Medium

2M

427

Image Credit: Medium

From Networks to Data: An Anthropologist’s Journey into the Culture of Venture Capital

- Anthropology researcher Emily Tao delves deep into Venture Capital (VC) to understand its culture and practices.

- VCs largely rely on networking to create deal flow, whereby investors get around 75% of their investments from network-driven sources.

- Robust networks with domain-specific operators, investors and experts become crucial during the due diligence stage.

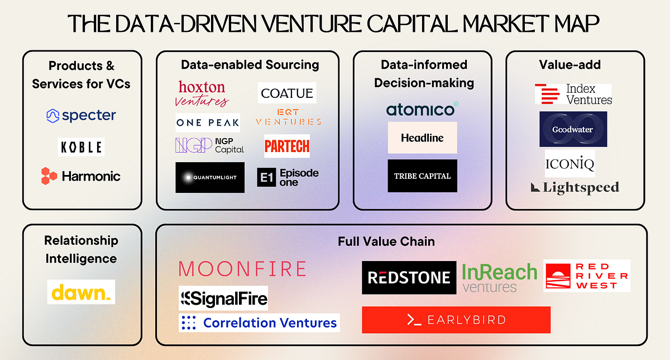

- Data-driven venture capital (DDVC) is an emerging practice reshaping the VC landscape.

- DDVC firms integrate data and machine learning into every aspect of their business.

- VC traditionally thrives on secret information, but DDVCs aims to change that by unlocking the black box with data.

- Diversity is still an issue in the VC industry, and data and AI exhibit bias. For instance, data's created by humans and algorithms mirror historical biases.

- DDVC is not a panacea for the human issues within VC, but it represents a cultural transformation.

- DDVC is not the only answer for the VC industry and is one that's still in its early stages.

- Interviewees such as Jenny Tooth, Rob Kniaz and John Spindler provided essential insights into the VC industry.

Read Full Article

25 Likes

For uninterrupted reading, download the app