Medium

1M

321

Image Credit: Medium

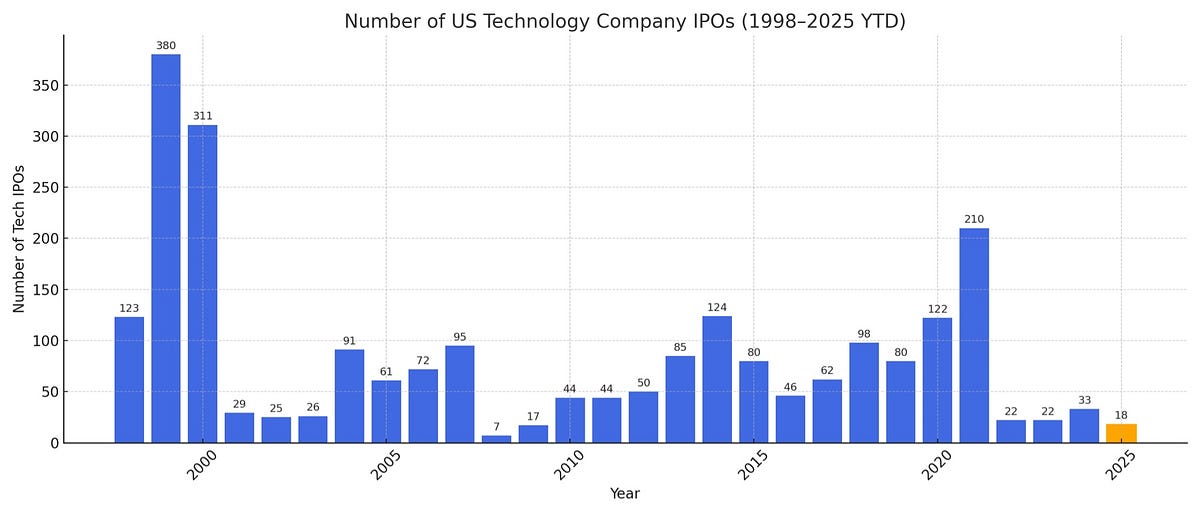

No, This Isn’t 2000 Again: Why the Real Problem Is a Liquidity Crisis, Not a Bubble

- The current market situation is not a bubble like 2000, as shown by the low number of tech IPOs compared to that era.

- It is more of a liquidity crisis where there is a lack of access to public markets for capital, hindering innovation and growth.

- The importance of functioning public markets is emphasized for AI companies with significant upfront costs and infrastructure needs.

- The focus should be on revitalizing well-regulated capital markets to unlock the potential of growth companies and ensure innovation continues to thrive.

Read Full Article

19 Likes

For uninterrupted reading, download the app