Medium

2M

335

Image Credit: Medium

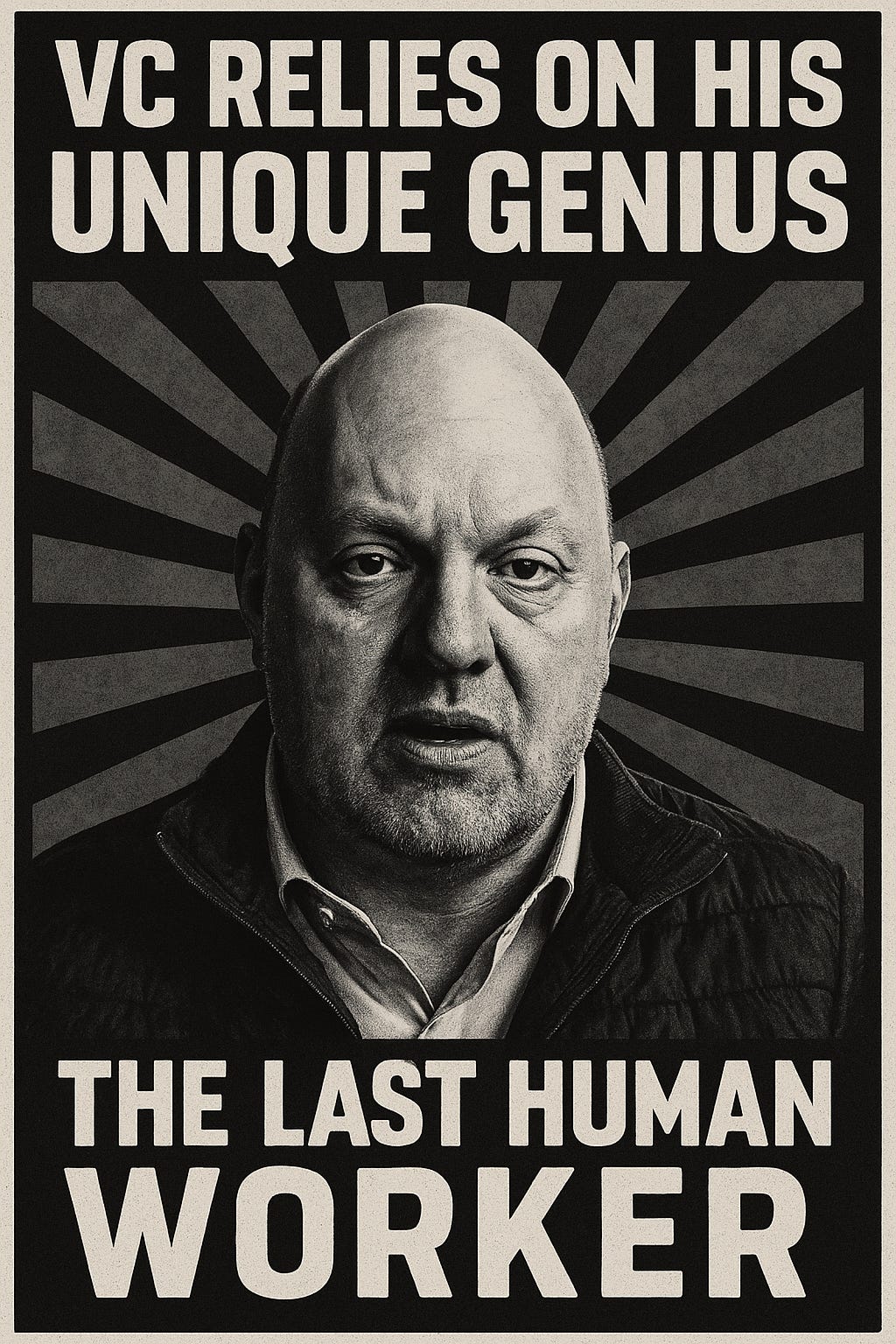

Obsolete by Design: Venture Capital’s AI Paradox.

- Venture capital has played a significant role in financing the development of AI but faces the risk of being replaced by AI itself.

- The venture capital industry is undergoing a transformation as tasks traditionally done by humans are now being automated.

- The reliance on agentic tooling in venture capital is leading to a decrease in learning opportunities for junior investors.

- Access, a key aspect of venture capital, is being redefined as founders no longer depend solely on closed networks.

- Founders are increasingly utilizing internal tools for support, challenging the traditional value proposition of post-investment assistance by investors.

- Venture firms risk losing institutional memory as apprenticeship models fade and the firm structure becomes tool-centric.

- Limited partners are reevaluating their investments in venture capital as tools play a larger role in decision-making.

- The future of venture capital lies in becoming system designers and focusing on clear architecture and value proposition.

- The enduring firms in the industry will be those with clear intent, transparent function, and adaptable architecture.

- Venture capital must evolve to remain relevant by being discoverable, testable, and compatible with the systems used by founders.

Read Full Article

20 Likes

For uninterrupted reading, download the app