Solana News

Newsbtc

150

Image Credit: Newsbtc

Solana Approaches Critical Support Amid Middle East Conflicts – Can Demand Hold?

- Solana (SOL) is facing selling pressure amid rising global uncertainty, triggered by Middle East conflicts and market-wide volatility.

- The altcoin market, including SOL, remains vulnerable to downside as macro risks rise, with SOL now approaching a critical technical level.

- Top analyst Cheds highlighted SOL re-testing a key daily demand zone around $145, a level crucial for maintaining bullish momentum.

- If SOL fails to hold above $145, it could signal further losses, especially if global tensions persist, impacting the broader altcoin market sentiment.

- Traders are closely watching for buyer support near $145 to determine if SOL can bounce back or if the market downturn will intensify further.

- Solana had briefly consolidated below $170 but faced resistance and dropped amidst escalating global tensions, finding itself at a critical support zone.

- Bulls are cautiously optimistic, hoping for a bounce back, but the overall market uncertainty and geopolitical risks have dampened altcoin momentum.

- Solana is currently trading at $145.24 after breaking below key moving averages, with the $145 zone crucial for potential recovery or further retracement.

- A failure to hold $145 could lead to a deeper retracement towards $130, while reclaiming the 100 SMA at $157.46 might indicate renewed bullish momentum.

- Momentum indicators suggest oversold conditions, and traders are advised to stay cautious amid high volatility and macroeconomic uncertainty.

Read Full Article

9 Likes

Blockonomi

251

Image Credit: Blockonomi

DeFi Development Corp. Raises $5B to Buy More Solana: Details

- DeFi Development Corp. secures $5 billion equity line to boost Solana holdings and expand its SPS-focused treasury.

- New capital strategy aims to enhance validator yield and shareholder value without dilution.

- Despite a 7% drop in Solana price, trading volume surges by 64% due to institutional accumulation.

- The SPS model connects public equity performance directly to Solana treasury growth and staking rewards.

- The $5 billion equity deal allows incremental share issuance, avoiding price slippage in volatile markets.

- CEO Joseph Onorati highlights the flexibility to drive SOL per share growth and validator yield.

- DeFi Dev files Form S-1 with the SEC for regulatory clearance to access the equity line.

- The company's strategic shift reflects the need for adaptable capital structures in the evolving crypto landscape.

- DeFi Dev's $5 billion plan showcases its strong confidence in the long-term potential of the Solana ecosystem.

- Solana's recent price decline contrasts with a substantial increase in trading volume, indicating heightened market interest.

- DeFi Dev's unique SPS model intertwines shareholder performance with Solana treasury growth and capital appreciation.

- The equity line signifies a significant evolution in how firms leverage capital raises tied to digital assets.

- DeFi Dev emerges as a pioneer in linking shareholder value directly to Solana, setting a new standard in funding strategies.

Read Full Article

15 Likes

TheNewsCrypto

128

Beyond the Hype— Neo Pepe’s Initial Surge of Authentic Community Growth Outshines Solaxy’s

- In the world of cryptocurrency, Solaxy and Neo Pepe showcase contrasting growth trajectories based on community engagement.

- Solaxy initially experienced significant hype with promises of solving Solana's network issues but faced challenges based on potential over performance.

- Common pitfalls observed in projects like Solaxy include hype-driven narratives and vulnerability to momentum loss.

- The broader landscape of Solana meme coins reveals issues such as lack of utility, insider trading risks, and superficial community engagement.

- Neo Pepe focuses on authentic community growth, organic expansion, and a decentralized governance model, setting itself apart from hype-driven projects.

- Key strengths of Neo Pepe include transparent communication, practical utility features, and a structured presale mechanism for stability.

- Neo Pepe aims to redefine meme coins by blending humor, utility, and governance to create lasting impact and sustained growth.

- Projects like Neo Pepe prioritize technology, transparent governance, and community engagement for long-term success in the evolving cryptocurrency market.

- Investors interested in sustainable growth and community-driven projects can explore Neo Pepe's unconventional approach to meme coin development.

- Disclaimer: The article provides insights into Solaxy and Neo Pepe's growth strategies based on community engagement, highlighting the importance of authenticity and sustainable development in the cryptocurrency space.

Read Full Article

7 Likes

TronWeekly

22

Image Credit: TronWeekly

BlackRock Eyes XRP and Solana ETFs Amid Explosive Altcoin Momentum

- BlackRock faces mounting pressure to enter the XRP and Solana ETF race amid increasing excitement in the crypto investment space.

- ETF Store President Nate Geraci believes it's not a matter of if but when BlackRock will expand beyond Bitcoin and Ethereum into altcoin ETFs.

- XRP gains momentum following CME's launch of regulated futures, positioning it well for a potential spot ETF filing.

- Geraci suggests BlackRock, already a leader in Bitcoin and Ethereum ETFs, won't overlook the opportunity to extend dominance to altcoin ETFs like XRP.

- There are speculations that BlackRock might convert Grayscale's Digital Large Cap Fund, which includes XRP, into a standalone ETF for quicker market penetration.

- Market sentiment reflects strong investor expectations with a high probability of approval for a Solana ETF and XRP ETF.

- Bloomberg's Eric Balchunas hints at an 'Altcoin ETF Summer,' with Solana potentially leading the charge in the next wave of ETF approvals.

- Even with the buzz around altcoin ETFs, BlackRock remains focused on Bitcoin and Ethereum due to liquidity and maturity criteria.

- Various asset managers have submitted spot XRP ETF proposals, including Bitwise, 21Shares, WisdomTree, Grayscale, and Franklin Templeton.

- Approval for these proposals faces hurdles, with the SEC extending review timelines and requesting public comments on concerns around market manipulation.

- Internationally, offerings like Switzerland's AXRP ETP and the first spot XRP ETF approval in Brazil highlight XRP's global institutional appeal.

- As competitors progress and optimism grows, all eyes are on BlackRock to see if it will lead the charge into altcoin ETFs or risk falling behind.

- The evolving legal status of XRP and its expanding derivatives market could influence BlackRock's assessment of entering the altcoin ETF space.

- BlackRock's potential move into XRP and Solana ETFs comes as rival filings surge, hinting at a new phase in digital asset ETFs.

- Amid the growing interest in altcoin ETFs, the question remains whether BlackRock will make a strategic entry into this space to maintain its leadership position.

- BlackRock's decision to join the XRP and Solana ETF competition will be closely watched as the crypto investment landscape continues to evolve.

Read Full Article

1 Like

TheNewsCrypto

300

How to Escape the Solana Rollercoaster and Ride Neo Pepe’s Blissful Surge

- The crypto market in 2025 presents opportunities and challenges amidst macroeconomic factors, regulatory uncertainties, and technological advancements.

- Innovative projects like DePINs and intent-based architecture in DeFi are shaping the decentralized technology landscape.

- Neo Pepe ($NEOP) stands out with its decentralized DeFi governance and unique tokenomics, offering a fresh approach to decentralized finance.

- Neo Pepe's governance model empowers token holders through community-driven decision-making processes.

- The project focuses on utility, humor, and decentralization, providing long-term stability and value to investors.

- Investors are advised to focus on projects with strong fundamentals, community engagement, and transparent governance structures.

- Staying informed, engaging with communities, and evaluating projects based on merit are crucial for success in the crypto market.

- Joining Neo Pepe involves holding $NEOP tokens, tracking proposals, voting, and actively participating in the community's governance.

- The shift towards community-controlled treasuries and transparent decision-making processes marks a positive evolution in the crypto space.

- Investors are encouraged to prioritize informed participation over blind speculation, aligning with the ethos of decentralization and sustainable value.

Read Full Article

18 Likes

Zycrypto

358

Image Credit: Zycrypto

Bitcoin Dips To $103K But Ethereum, Solana, And DOGE Fall Harder As Israel Launches Major Strike On Iran

- Bitcoin and other risk assets dropped as US President Trump threatened renewed tariff measures.

- Bitcoin fell over 3.7% in a 24-hour period as Israel launched strikes on Iran's key military sites.

- Israeli Prime Minister Netanyahu described Iran's nuclear ambitions as a clear danger, leading to preemptive strikes.

- Bitcoin hit lows of $103,081 amidst escalating tensions in the Middle East, down from a 24-hour high of $108,369.

- Ethereum, the second-largest cryptocurrency, declined by 9.8%, while ETH ETFs attracted $240 million in investments.

- Crypto assets like Solana's SOL and Dogecoin (DOGE) also experienced drops of around 10.3% and 10% respectively in the last 24 hours.

- Bitcoin usually sees short-term price drops during geopolitical turmoil but historically rebounds quickly due to increased digital store of value adoption.

- President Trump criticized Fed Chairman Powell, calling him a 'numbskull' and threatening to force changes in interest rates.

Read Full Article

21 Likes

TheNewsCrypto

437

Solsniper Closes NFT Services After 3.5 Years on Solana

- Solsniper, an analytics and trading tool on Solana, is closing its NFT-related products after operating for 3.5 years.

- The platform shut down NFT-related services, delisted NFTs, eliminated bids, and refunded users' balances.

- Solsniper will keep rewards leaderboard data for future use and continues other operations like Telegram trading bot, web trading terminal, and AI trading assistant for memecoins.

- The CEO clarified that while closing NFT-related products, Solsniper is not shutting down completely.

- The closure of NFT services may lead to a temporary dip in NFT trading volume as users seek alternatives.

- Bybit and X2Y2, two prominent NFT marketplaces, recently announced closures due to declining NFT interest and trading volume.

- Bybit suffered a significant loss to North Korean hackers before closing, but the impact on overall NFT market growth was minimal.

- DappRadar data indicates a 63% decrease in NFT trading volumes since December 2024, suggesting a slowdown in NFT momentum.

- Crypto Market recently reacted to the Israel-Iran conflict with a 4% drop in BTC.

Read Full Article

26 Likes

Crypto-News-Flash

411

Image Credit: Crypto-News-Flash

Solana News: $5B War Chest Secured by DeFi Development to Accumulate More SOL

- DeFi Development Corp secures a $5 billion war chest to accumulate and stake SOL.

- The goal is to position the company as a major long-term backer of the Solana ecosystem.

- The partnership between BONK and DeFi Development Corp aims to power Solana.

- On June 12, 2025, DeFi Development Corp announced a $5 billion equity line of credit deal with RK Capital Management.

- DeFi Development Corp holds over 609,000 SOL, worth approximately $88 million.

- The company uses SOL to earn more SOL through its own validator nodes on the Solana blockchain.

- SOL's price experienced an 8.09% dip in the last 24 hours.

- Despite short-term price fluctuations, Solana's growing validator infrastructure and institutional alignment show strong long-term support.

- DeFi Development Corp's strategy of buying SOL, staking it, earning more SOL, and reinvesting rewards aims to increase total SOL holdings over time.

- Solana (SOL) is currently trading at $146.29, showing a slight decrease of 0.98% over the past week.

Read Full Article

24 Likes

Pymnts

150

Image Credit: Pymnts

DeFi Development Gains $5 Billion Line of Credit to Accumulate Digital Assets

- DeFi Development Corp. secured a $5 billion equity line of credit to accumulate and compound Solana digital assets.

- The company, formerly known as Janover, signed a share purchase agreement with RK Capital Management.

- The equity line of credit allows DeFi Development to gradually raise capital as needed.

- Proceeds from the credit will be utilized to continue acquiring SOL and boost growth.

- DeFi Development aims to enhance SOL per share and compound validator yield with this funding.

- The company's CEO, Joseph Onorati, highlighted the strategic opportunity provided by the new credit line.

- Janover rebranded as DeFi Development, focusing on digital assets and bridging TradFi with DeFi.

- The company raised $42 million in convertible notes and warrants previously to assist in the acquisition of digital assets.

- DeFi Development formed a partnership with Amber International Holding to collaborate on SOL-denominated treasury acquisition and other financial services.

- Amber Premium may act as a broker for DeFi Development Corp.'s treasury acquisitions.

- The alliance aims to strengthen offerings in structured products, staking, and validator aggregation for digital assets.

- The developments aim to support DeFi Development's growth strategies in the realm of digital assets.

- These initiatives suggest a focused effort by DeFi Development to advance in the decentralized finance sector.

- The company's forward-looking approach indicates a focus on expansion and innovation within the cryptocurrency market.

- DeFi Development's recent financial maneuvers reflect its commitment to leveraging opportunities in digital asset accumulation.

- The company's strategic partnerships and funding endeavors position it for significant advancement in the DeFi landscape.

Read Full Article

9 Likes

Newsbtc

265

Image Credit: Newsbtc

Solana-Linked $1 Billion DeFi Dream Crushed By SEC Intervention

- The US Securities and Exchange Commission blocked DeFi Development Corp.'s $1 billion registration filing due to a missing internal controls report linked to its Form 10-K.

- DeFi Development, formerly known as Janover, withdrew the filing and plans to rectify the paperwork before reapplying.

- The company intended to use the funds to purchase Solana tokens, the sixth-largest cryptocurrency by market cap.

- Staking rewards and token purchases were part of the intended use of the $1 billion, posing risks if Solana's value fluctuates.

- No securities were issued during this halted process, and the company aims to resubmit the filing once the controls report requirement is fulfilled.

- DeFi Development must adhere to regulatory standards like any other public issuer, highlighting the importance of meeting all necessary requirements.

- Traders speculated that a billion-dollar purchase of Solana tokens could affect prices, but with the filing delayed, market reactions are uncertain.

- Investors will monitor the company's next steps, including the selection of experienced underwriters or auditors to prevent future compliance issues.

- The future actions of DeFi Development will demonstrate its ability to navigate between blockchain aspirations and regulatory compliance.

- The pause on the token-buy plan underscores the need for crypto firms to prioritize compliance and regulatory procedures to avoid setbacks.

Read Full Article

15 Likes

Zycrypto

243

Image Credit: Zycrypto

ETF With XRP, Cardano Exposure To Win SEC Approval Next Before Solana Funds, Expert Points Out

- Nate Geraci, president of The ETF Store, predicts the next crypto ETF approved by the SEC could focus on XRP and Cardano before Solana.

- Grayscale's Digital Large Cap Fund, holding Bitcoin, Ether, XRP, Cardano, and Solana, might be approved first, according to Geraci.

- The fund has a significant BTC weighting with smaller allocations to other cryptocurrencies like XRP, SOL, and ADA.

- Grayscale's Digital Large Cap Fund has around $796 million in AUM and is only accessible to accredited investors.

- Approval might be likely as it contains a small portion of altcoins with lower liquidity, making it less risky.

- ETF issuers such as VanEck and Grayscale have shown interest in spot ETFs for Solana, showcasing demand for regulated SOL investment vehicles.

- Bloomberg's senior ETF analyst anticipates a high chance of approval for Solana and staking ETF filings, potentially unlocking institutional capital for SOL.

- Approval of these ETFs could increase demand for SOL and drive prices higher, with some analysts even setting targets at $500.

Read Full Article

14 Likes

TronWeekly

22

Image Credit: TronWeekly

PayPal Upgrades PYUSD with Stellar for Global Payment Expansion

- PayPal integrates PYUSD with Stellar blockchain for real-world payments, commerce, and microfinancing, expanding beyond Ethereum and Solana.

- The launch of PayFi offers instant PYUSD loans to small businesses via Stellar wallets, addressing cash flow delays.

- Stellar's global reach enables low-cost, near-instant remittances in over 170 countries, particularly benefiting underserved markets.

- The upgrade of PayPal's stablecoin, PYUSD, on the Stellar network signifies a shift in stablecoin strategy.

- Stellar's fast, low-cost, and scalable network aligns with PayPal's goal to bring stablecoin payments to the masses and emerging markets.

- PayPal introduces PayFi for small and medium-sized businesses, providing instant working capital loans in PYUSD.

- The partnership aims to solve delayed receivables and pre-funding challenges for businesses through blockchain technology.

- PYUSD integration on Stellar unlocks new opportunities for developers and businesses in a more inclusive financial ecosystem.

- PayPal collaborates with regional fintech partners in Africa and Asia to expand PYUSD remittance services, tapping into over 28,000 cash-in/cash-out locations.

- Regulatory hurdles, including scrutiny by the New York Department of Financial Services, may pose challenges for PYUSD's expansion.

- Competition from established stablecoins like USDC and USDT presents challenges for PYUSD's market entry and adoption.

- Financial analyst Jim Cramer views PayPal's PYUSD initiative as a high-risk, high-reward venture with potential market impact.

- If approved and embraced by SMBs, PayPal's PYUSD expansion could lead to significant growth in shares.

- Market observers closely monitor the rollout of PYUSD on Stellar to assess its performance in the competitive stablecoin landscape.

Read Full Article

1 Like

Newsbtc

898

Image Credit: Newsbtc

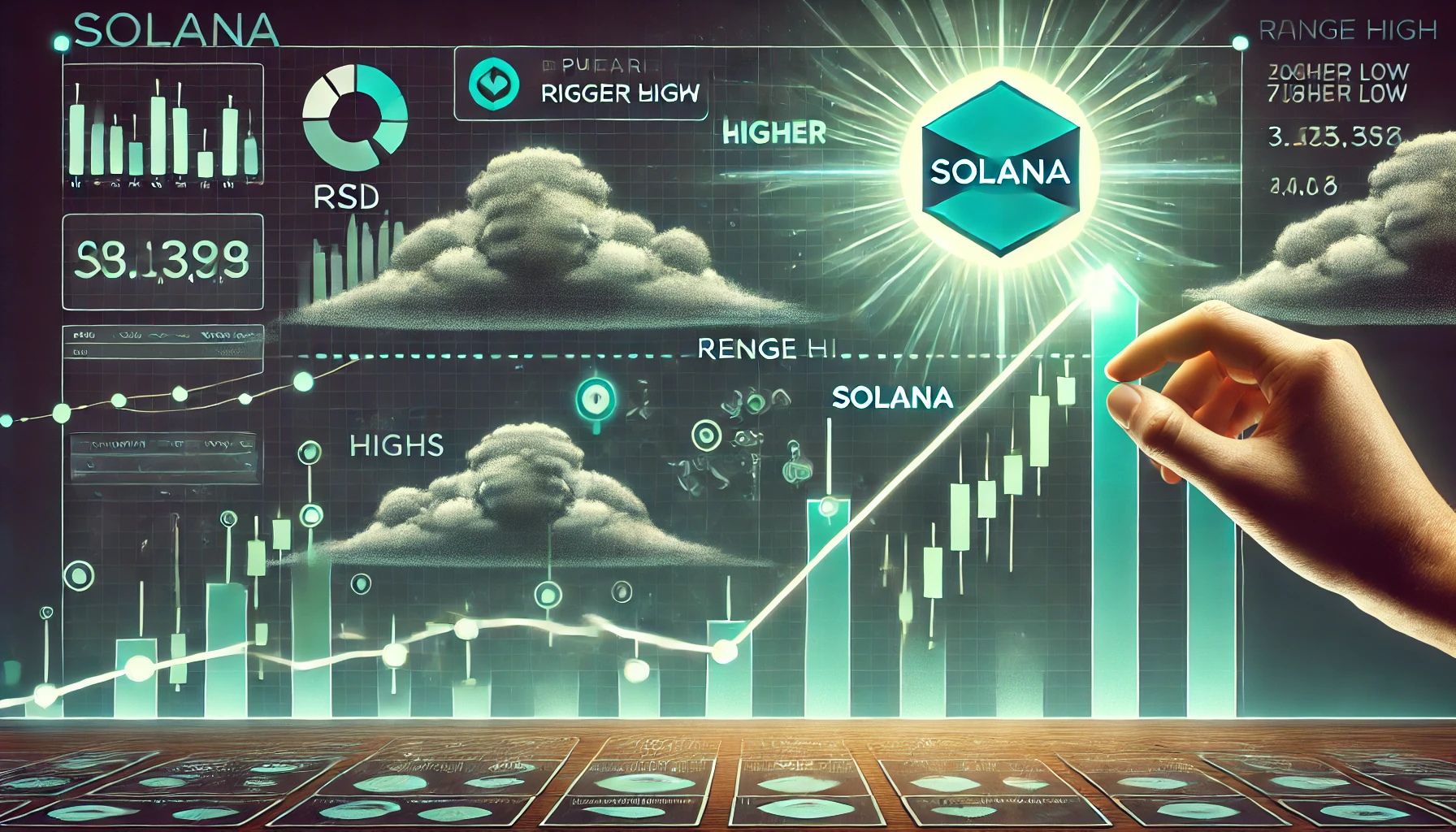

Solana Forms Higher Low: Charging Toward Range Highs?

- Solana is holding above $150 amid bullish momentum in the crypto market, following Bitcoin and Ethereum's upward movement.

- Analyst Jelle noted Solana forming a higher low, a positive sign suggesting increased strength.

- The $150 level serves as short-term support, with potential for a breakout if major cryptocurrencies continue their upward trend.

- Solana faces resistance near $175, but a breakout above $185 could lead to new all-time highs.

- Flipping the $175-$185 zone into support is crucial for a sustained upward move.

- Currently trading at $165.80, Solana reclaimed the 50-day SMA and eyes the 100-day SMA at $175.70.

- A breakout above $175 may target the $190-$200 range, while a failure could lead to a pullback towards $155-$160.

- Increasing volume supports the current price rise, with the crossover of the 50-day and 100-day SMAs reinforcing bullish momentum.

Read Full Article

7 Likes

TechBullion

110

Image Credit: TechBullion

Beer 2.0: The Meme Coin That is Brewing Something Bigger on Solana

- Beer 2.0 is a meme coin on Solana aiming to blend nostalgia with meme culture, community power, and real utility.

- Over 10,000 people have shown interest in the Beer 2.0 presale within 48 hours of the official announcement, indicating high anticipation and traction.

- Beer 2.0 plans to integrate NFTs, gaming, and future DApps to bring tangible use cases while leveraging Solana's fast transactions and low fees.

- The tokenomics structure includes a total supply of 888.8 billion tokens with a 20% public allocation through a 48-hour presale starting May 21, 2025.

- Early supporters of the presale can receive tiered bonuses in the first 30 minutes, emphasizing the importance of timing.

- Interested participants need to set up a Solana wallet, buy SOL, and send it to the verified Presale address within the 48-hour window to receive BEER 2.0 tokens.

- Beer 2.0's roadmap consists of four phases focused on global visibility, community empowerment, and real-world interactions.

- The project promotes positivity and community engagement through giveaways, competitions, and a $30,000 Brewmobile grand prize.

- Users are advised to conduct their research and invest wisely, as with any crypto project.

- Beer 2.0 marks a new era in meme coin evolution by combining community strength with on-chain interaction and plans for further integrations.

- The project emphasizes culture and technology, catering to investors interested in both aspects.

Read Full Article

6 Likes

TheNewsCrypto

270

SEC Halts DeFi Development’s $1B Solana-Focused Fundraising

- The Securities and Exchange Commission (SEC) has halted DeFi Development Corp's $1 billion fundraising for investing in the Solana blockchain due to missing documentation.

- The SEC found that the necessary internal controls report in the Form 10-K was missing, leading to the withdrawal of the filing by the firm.

- DeFi Development Corp, formerly known as Janover, aimed to raise funds to buy Solana tokens for general corporate purposes.

- The firm plans to refile in the future after addressing the compliance issues raised by the SEC. No securities were issued during this process.

- The investment was focused on Solana due to its strong position in the crypto industry, aiming to benefit from potential staking rewards.

- Solana tokens were intended to be purchased, with the expectation of generating returns from staking activities.

- The future of this investment plan is now uncertain due to the SEC's intervention.

Read Full Article

16 Likes

For uninterrupted reading, download the app