Fintechnews

3w

282

Image Credit: Fintechnews

Sumsub Leverages Device Intelligence to Monitor Fraud Activity in Real Time

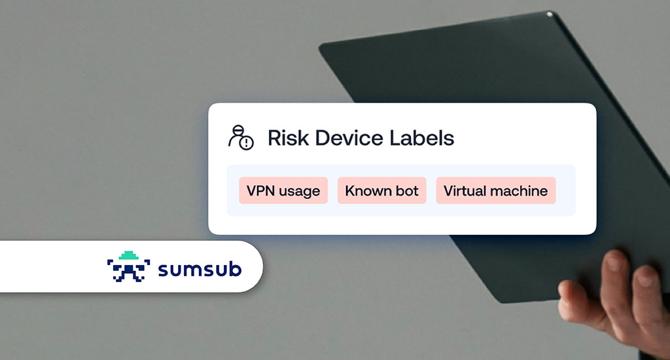

- Sumsub has integrated advanced device intelligence from Fingerprint to enhance fraud prevention capabilities.

- The update helps businesses detect suspicious behavior early in the customer journey, especially post-onboarding, a common target for fraud.

- Technical parameters like browser type, operating system, VPN usage are analyzed to identify threats such as bot activity and account takeovers.

- The solution by Fingerprint also spots incognito mode and developer tool usage as potential red flags.

- Sumsub's integration aims to cut unnecessary KYC costs and improve fraud detection without user disruption.

- The tool is beneficial for high-risk industries like crypto, fintech, and e-commerce, aiding in early threat detection.

- Sumsub emphasizes the solution's role in reducing false positives and enhancing fraud detection through various user interactions.

- Sumsub's CPO, Andrew Novoselsky, highlights the collaboration for a comprehensive fraud prevention system.

- This integration enables real-time fraud prevention to mitigate financial losses and operational disruptions.

- Sumsub's platform, combining device intelligence with identity verification solutions, aims to enhance user insights and streamline onboarding experiences.

- Shaun Per from Fingerprint emphasizes the joint effort to reduce fraud and offer smooth onboarding experiences through real-time signals.

- The collaboration benefits businesses by improving fraud prevention accuracy and operational efficiency.

- Overall, the integration of device intelligence enhances Sumsub's fraud monitoring capabilities.

- The expansion aims to provide a more robust fraud prevention system without requiring coding on the clients' end.

- Sumsub and Fingerprint together aim to deliver more effective fraud prevention measures.

- The article was originally published on Fintech Singapore.

- The companies believe the collaboration will help businesses combat fraud effectively.

Read Full Article

16 Likes

For uninterrupted reading, download the app