The Beautiful Mess

3M

327

Image Credit: The Beautiful Mess

TBM 301: How to Reconcile Prioritization and $/Time Allocation

- Many companies express their strategies (or plans) using % allocations to different investment buckets.

- The percentage in question is typically some combination of $, 'heads,' or time.

- The problem with this approach is that, in many cases, % allocations mask actual priorities, fail to capture the current blockers and inefficiencies related to that proposed investment, obscure the overall investment required, and mask implicit expectations around the outcomes expected from these investment allocations.

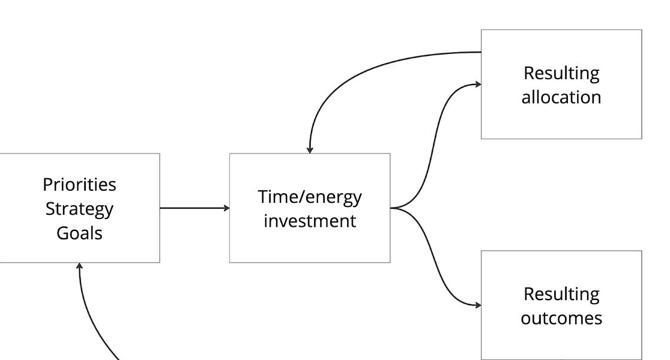

- Instead of using allocations as the input for controlling the mechanism, it is important to see them as an output of priorities, strategy, goals, etc. They are something to monitor and may influence how we course correct.

- To prioritize investments using value and urgency, companies can use Value/Urgency Buckets.

- The five buckets that a company can prioritize investments in include the mission-critical category, dilemma category, optimizer category, future seeds category, and mop up slack category.

- Allocations should be considered a hypothesis instead of the driver of a strategy and priorities.

- Allocations fail to capture the mix of urgency and value critical for prioritization.

- It is better to talk about budgets when discussing funding and resource allocation.

Read Full Article

18 Likes

For uninterrupted reading, download the app