AR News

NullTX

222

Image Credit: NullTX

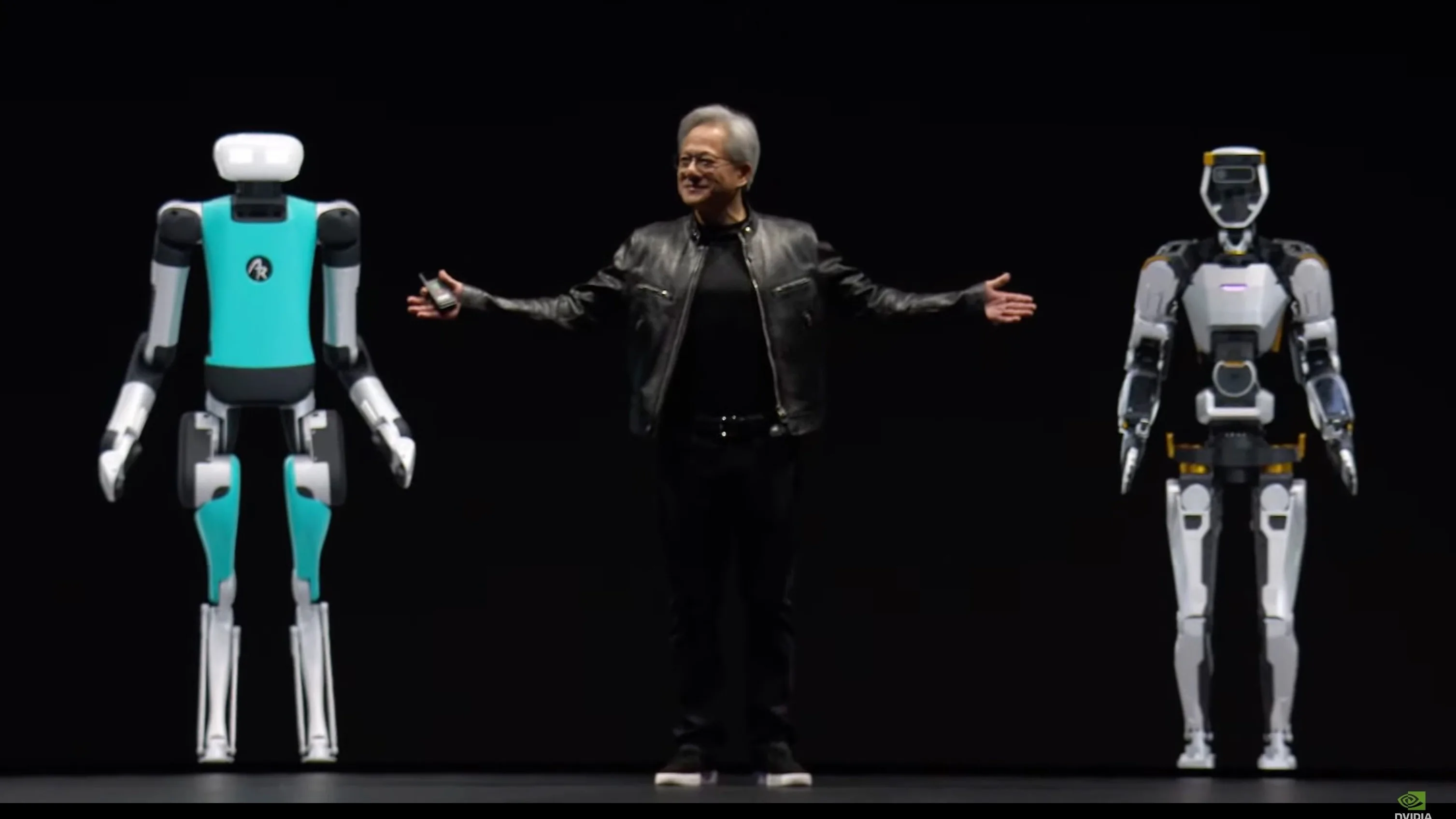

NVIDIA Overtakes Microsoft as World’s Most Valuable Company Amid Explosive AI Growth

- NVIDIA has surpassed Microsoft to become the world's most valuable publicly traded company with a market cap of $3.4 trillion, driven by the growth in artificial intelligence (AI) sector.

- The demand for NVIDIA's AI-focused GPUs has led to its valuation surge over the past year, with major tech companies relying on its chips for various machine learning applications.

- NVIDIA's revenue growth is fueled by its AI-related business, as the company invests heavily in full-stack AI computing platforms and ecosystems.

- The shift in market leadership towards AI and infrastructure signifies a generational inflection, marking the transition to the AI age as a tangible reality.

- Aside from traditional markets, NVIDIA's influence is also impacting the digital asset space, with AI-inspired cryptocurrencies like Kibshi gaining momentum.

- AI memecoins like Kibshi are riding the thematic wave of AI association, attracting investors looking to capitalize on the AI trend in the crypto market.

- NVIDIA's position as a market leader indicates the profound impact of AI on the global marketplace, ushering in a new era of revolutionary technological advancements.

- Investors are recognizing AI as a defining force of the decade, with capital flow increasing into AI-related investments across stocks, ecosystem players, and speculative crypto bets.

- The economic value generated by AI innovations suggests that NVIDIA's current $3.4 trillion valuation could pale in comparison to the future potential of the AI industry.

- The surge in NVIDIA's market value and the resurgence of AI-related tokens like Kibshi reflect the significant influence of AI growth on both traditional and crypto markets.

- The rise of NVIDIA as the top company globally and the focus on AI highlights a monumental shift in the tech landscape, underscoring the transformative power of AI as a key driver of future economic growth.

Read Full Article

12 Likes

Siliconangle

135

Image Credit: Siliconangle

Meta and Anduril partner to develop wearables for the US military

- Meta Platforms Inc. and Anduril Industries Inc. are collaborating to develop wearable devices for the U.S. military.

- Anduril, a defense technology startup, received a $14 billion valuation in its recent funding round.

- The partnership aims to create a line of wearables called EagleEye, including helmets, glasses, and other devices with virtual reality and mixed reality features.

- The devices are designed to enhance hearing and vision, enable remote control of autonomous systems, and will incorporate advanced technologies like Meta's Llama algorithms and Anduril's Lattice OS and networking engine.

Read Full Article

8 Likes

Insider

153

Image Credit: Insider

Trump tariffs are still a risk: 4 experts explain what could derail a stock market just 4% from record highs

- Trump's tariffs have been blocked and reinstated in less than 24 hours, indicating ongoing trade war risks.

- Even if tariffs are defanged, Trump has other options to continue the trade war.

- The trade developments highlight potential market volatility and the need for investors to be cautious.

- Experts suggest that Trump could still pursue his trade policies through alternative means, leading to potential market uncertainty.

Read Full Article

9 Likes

TechDigest

293

Image Credit: TechDigest

UK’s first flying taxi takes off, Game cancels Nintendo Switch pre-orders

- Britain's first-ever flying taxi, the prototype VX4 electric aircraft, completes its first journey with plans to introduce the service by 2028.

- Technology shares rise after strong results from Nvidia, Dutch semiconductor maker ASML rallies.

- UK military to invest over £1 billion in artificial intelligence and hacking attack team for offensive operations against hostile states.

- UK chain Game apologizes for cancelling pre-orders of Nintendo Switch 2, disappointing eager gamers awaiting the release.

Read Full Article

17 Likes

Cgmagonline

379

Image Credit: Cgmagonline

GeForce NOW on Steam Deck – Playing With The Power Of The Cloud

- GeForce NOW, after years of development, has become a powerful cloud gaming service offering users access to advanced GeForce RTX GPU through streaming.

- The new GeForce NOW Steam Deck app brings high-performance cloud gaming to the mobile platform, allowing easy integration with Steam Game Library.

- Users can link various accounts like Xbox Game Pass Ultimate, GOG.com, Steam, and Epic Games to expand their game library on GeForce NOW.

- GeForce NOW on Steam Deck leverages NVIDIA GeForce RTX GPU from the cloud, providing better performance compared to using native hardware.

- The service includes access to upgraded RTX 4080 SuperPODS with 64 TFLOPS of performance, enhancing gaming experiences on devices like Steam Deck.

- GeForce NOW allows for monitoring performance stats and offers capabilities to enhance visuals, but some options like 4K and HDR may vary on the Steam Deck's display.

- Users can seamlessly play games from where they left off on different devices, offering a convenient and versatile gaming experience.

- By utilizing GeForce NOW on the Steam Deck, users can access higher visual fidelity options like HDR10, Ultrawide, and 4K on compatible displays.

- GeForce NOW proves to be more battery efficient on the Steam Deck compared to relying solely on the device's native hardware for gaming.

- The service enables playing a variety of games without the need for downloads, reducing loading times and storage space requirements, but it relies heavily on a stable internet connection.

Read Full Article

22 Likes

The Verge

266

Image Credit: The Verge

Tested: Nvidia’s GeForce Now just breathed new life into my Steam Deck

- Nvidia's GeForce Now offers a game streaming service for $20 a month, appealing to Steam Deck users.

- GeForce Now allows remote-controlling an RTX 4080-powered gaming rig in a server farm to access games from platforms like Steam, Epic, Ubisoft, Xbox, and Battle.net.

- The service has free and Performance tiers, with the paid option offering better gaming experience with features like ray tracing.

- The author expresses reluctance towards more streaming subscriptions but finds GeForce Now a perfect fit for long-term gaming enjoyment.

Read Full Article

16 Likes

Guardian

405

Image Credit: Guardian

Tech shares climb after strong Nvidia results despite warning over rise of Chinese rivals

- Technology shares climbed on Thursday following strong results from Nvidia, despite concerns over the rise of Chinese competitors.

- Nvidia's financial report led to a 0.8% rise in the Stoxx Europe tech index and a 2% increase in Nasdaq futures.

- Nvidia's CEO, Jensen Huang, warned about the advancements of Chinese rivals benefitting from the void created by US trade restrictions.

- Tech investors were optimistic after a US trade court ruling against sweeping tariffs, while shares in Tesla rose following Elon Musk confirming his departure from the Trump administration.

Read Full Article

24 Likes

Analyticsindiamag

321

Image Credit: Analyticsindiamag

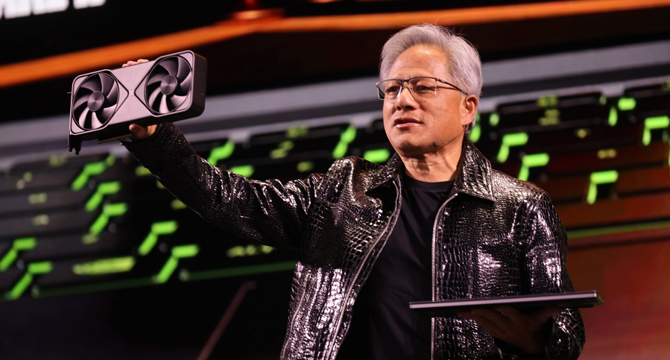

The $50 Billion Market That’s Haunting NVIDIA

- NVIDIA's CEO is concerned about missing out on China's $50 billion AI market opportunity, as export restrictions hinder its business prospects in the country.

- Despite holding a 90% share in the global GPU market, NVIDIA faces potential revenue loss of around $8 billion, causing strategic concerns.

- US export restrictions on chips have fueled China's innovation in the semiconductor industry, as stated by NVIDIA's CEO Jensen Huang.

- NVIDIA incurred a $4.5 billion charge due to export licensing requirements for its products in China, impacting its revenue projections.

- Both NVIDIA and AMD are preparing to launch new AI GPUs tailored for the Chinese market to comply with US export rules on advanced semiconductor tech.

- Huawei is making strides in the AI chip market, introducing upgraded chips like Ascend 910C and 920, posing potential competition to NVIDIA.

- NVIDIA reported $44.1 billion in revenue despite challenges in China, and is expanding its AI initiatives globally by partnering with various entities.

- The AI race extends beyond chips, encompassing infrastructure leadership in technologies like 6G and quantum, highlighting the importance of US platforms.

- Huang emphasizes the significance of US institutions in AI development and global collaborations, even amidst concerns about China's rising influence in AI.

- The article raises the key question of whether China will establish its own AI capabilities and chip dominance or continue relying on American technology infrastructure.

Read Full Article

19 Likes

TechDigest

447

Image Credit: TechDigest

Nvidia sales exceed expectations despite tariff uncertainty

- Nvidia reported a stellar first quarter with revenue and profit exceeding forecasts, driven by strong global demand for its AI infrastructure.

- The company's stock surged by around 6% in extended trading following the announcement, reaching its highest point in four months.

- Nvidia posted adjusted earnings per share of 96 cents on revenue of $44.06 billion, exceeding analyst expectations.

- Despite facing tariff uncertainties and export restrictions, Nvidia plans to increase manufacturing in the U.S. and remains dominant in the AI sector.

Read Full Article

26 Likes

TechCrunch

0

Image Credit: TechCrunch

NVIDIA, AMD may soon start selling new AI chips in China to comply with US restrictions

- NVIDIA and AMD are set to begin selling new AI chips in China to comply with US restrictions on exporting advanced semiconductor technology to the country.

- NVIDIA will introduce a stripped-down AI GPU called 'B20', while AMD plans to target AI workload needs with its new Radeon AI PRO R9700 workstation GPU in China starting from July.

- NVIDIA is working on a budget AI chip based on its Blackwell architecture for China, priced at $6,500-$8,000, whereas its H20 GPUs are sold for $10,000-$12,000 each.

- In Q1, NVIDIA incurred a $4.5 billion charge due to licensing requirements hindering the sale of its H20 AI chip in China. The company anticipates an $8 billion revenue impact in Q2 from licensing restrictions.

Read Full Article

Like

Insider

275

Image Credit: Insider

The 3 biggest takeaways from Nvidia's Q1 earnings call: China, China, China

- Nvidia CEO Jensen Huang criticized US export controls on chips to China during Q1 earnings call.

- Despite China restrictions, Nvidia's Q1 revenue exceeded expectations, but faced a significant impact.

- Huang expressed concerns about losing the Chinese market but commended some of Trump's policies.

- Nvidia reported $44.06 billion in revenue for Q1, beating Wall Street expectations.

- The company faced a $4.5 billion write-down due to restrictions with an anticipated $8 billion revenue loss for the next quarter.

- Huang emphasized the importance of the China market for AI competitiveness and global leadership.

- Nvidia's core segments, like data centers, showed strength despite challenges in China market.

- Huang criticized the export controls' impact on US platforms and global AI talent distribution.

- While critical of China restrictions, Huang praised Trump's initiatives for US tech advancement.

- Huang indicated Nvidia's exploration of other markets apart from China, aiming for sovereign AI development.

Read Full Article

16 Likes

Pymnts

122

Image Credit: Pymnts

Nvidia Takes $4.5B Inventory Charge Due to Chip Trade Policy

- Nvidia CEO Jensen Huang announced a $4.5 billion inventory charge due to recent U.S. export-control changes affecting its growth plans in China.

- The new rules require licenses for U.S. chipmakers to ship advanced devices to China, impacting Nvidia's H20 processor.

- Nvidia cannot sell or repurpose the inventory of H20 chips, designed to meet earlier compliance thresholds.

- Despite Chinese firms continuing to build AI capabilities, Nvidia faces challenges due to export controls and market closure in China.

- Nvidia is engaged with policymakers and customers to navigate compliance issues and find paths forward in AI infrastructure projects worldwide.

- The company is focusing on AI initiatives globally, including projects in Saudi Arabia, UAE, Taiwan, Japan, and partnering with TSMC and Foxconn for chip manufacturing.

- Nvidia aims to have chips and systems built in America within a year, emphasizing investments in advanced manufacturing.

- AI demand is soaring, with Nvidia expanding its portfolio across cloud, enterprise, humanoid robots, gaming, quantum, and 6G sectors.

- In its fiscal first quarter, Nvidia reported strong financial results with net income of $18.77 billion and revenue of $44.06 billion, exceeding Wall Street's expectations.

- Nations are investing in AI infrastructure, signaling a significant growth opportunity for Nvidia in AI sectors like enterprise and industrial AI.

Read Full Article

7 Likes

99Bitcoins

81

Crypto Market Down Today: Bitcoin Faced $110k Resistance

- Bitcoin failed to retake the $110k mark, resulting in a significant selloff in the crypto market.

- One of the reasons for the selloff was the Fed's decision not to cut rates as expected, leading to profit-taking and risk deleveraging among traders.

- Uncertainty stemming from President Trump's tariffs on imports has also impacted the crypto market, with a trade war dynamic causing disruptions.

- Technically, Bitcoin's behavior aligns with the market conditions, with the potential for a reversal if it does not reclaim the $110k region, alongside bearish signs in technical indicators like RSI.

Read Full Article

4 Likes

Siliconangle

389

Image Credit: Siliconangle

Nvidia delivers another earnings and revenue beat on rampant data center growth

- Nvidia's shares rose 5% after reporting better-than-expected earnings and revenue, with a 73% growth in data center business.

- The company beat analyst forecasts with earnings of 96 cents per share and revenue of $44.06 billion.

- Despite falling short on guidance, Nvidia attributed it to the impact of U.S. export restrictions on advanced chips selling to China.

- The export restrictions led Nvidia to write off $4.5 billion in inventory and forfeit $15 billion in planned sales.

- Nvidia's gross margin was affected, but the company is still aggressively growing in the AI infrastructure space globally.

- Despite challenges in China, Nvidia's data center division showed a 73% increase, accounting for 88% of total revenue.

- Sales of Nvidia's gaming division increased by 42%, while its automotive and robotics chip sales grew by 72%.

- Nvidia's stock, fueled by its data center and gaming divisions, remains stable in the market, near its record high.

- The company's continued growth outlook remains strong, with a focus on AI, gaming, automotive, and robotics applications.

- Despite geopolitical challenges, Nvidia's performance and revenue forecast demonstrate resilience and growth potential.

Read Full Article

23 Likes

Guardian

420

Image Credit: Guardian

Nvidia beats Wall Street expectations even as Trump tamps down China sales

- Nvidia exceeded Wall Street expectations with $44.1bn revenue, up 69% from the previous year, and $39.1bn in data center revenue, up 73%.

- CEO Jensen Huang highlighted global demand for Nvidia's AI infrastructure and the company expects $45bn in the next quarter.

- Geopolitical challenges include Trump's restrictions on China sales, potentially leading to $8bn revenue loss in the second quarter.

- Despite US-China tensions, Huang remains optimistic about potential market opportunities in China's AI sector.

- Nvidia faced charges estimated at $5.5bn due to changes in its business strategy, impacting revenue and tax implications.

- The company navigated challenges by managing data-center supply-demand effectively and adapting to market conditions.

- Analysts are encouraged by Nvidia's resilience and believe negotiations between the US and China could benefit the company.

- Nvidia's business in Saudi Arabia and the UAE shows promise, with sales of AI chips expected to increase following commitments from Saudi Arabia.

- Trump's tightening rules on chip exports to China reflect broader tensions, affecting Nvidia's operations in a key market.

- Although facing challenges, Nvidia's position as a leader in AI technology remains strong, according to industry analysts.

Read Full Article

25 Likes

For uninterrupted reading, download the app