Blockchain News

TechBullion

391

Image Credit: TechBullion

8 Unmissable Signals Shaping Crypto Market’s Next Moves in July 2025

- The article discusses eight crucial signals shaping the crypto market in July 2025, emphasizing the importance of understanding underlying trends for investors.

- Factors like global regulations, economic conditions, blockchain upgrades, institutional involvement, geopolitical events, market narratives, exchange listings, and the positioning of projects impact market dynamics.

- It highlights the significance of tracking legislative movements, inflation reports, network upgrades, institutional investments, global events, emerging trends, exchange actions, and regulatory pressures.

- The article specifically mentions Neo Pepe as a project challenging traditional regulatory controls through decentralized governance and community-driven initiatives.

- Neo Pepe's features include a fixed token supply, transparent treasury management, immutable design, appeal to both retail and sophisticated investors, and resilience to political pressures.

- Its strategic roadmap, focus on meme culture and DeFi governance, auto-liquidity mechanism, and community-centric approach position it as a promising project for long-term growth.

- The article encourages participation in Neo Pepe's presale as a means to engage in decentralized finance and influence the future of crypto through community-driven governance.

- The fascinating dichotomy of meme culture and serious DeFi governance in Neo Pepe presents a unique value proposition, attracting diverse investor profiles and capital.

- With a secure architecture, resilient decentralized structure, and clear market strategy, Neo Pepe aims to navigate market volatility and evolve as a significant player in the crypto space.

- Overall, Neo Pepe stands out as a project with long-term potential, offering a blend of cultural appeal, community control, and strategic growth opportunities amidst a dynamic crypto landscape.

- Neo Pepe's commitment to decentralization and empowering token holders positions it as an innovative force in reshaping financial paradigms and fostering a more democratic crypto ecosystem.

Read Full Article

23 Likes

TheNewsCrypto

391

Dogecoin Price Prediction? How to Spot When Dogecoin is Building Up for Price Jump

- Dogecoin has cemented its status as one of the most talked-about cryptocurrencies, showing signs of recovery with a 1-3% gain over the past week.

- Factors like Elon Musk's potential integration of Dogecoin into X, meme coin surges, community-driven campaigns, and broader market optimism could propel Dogecoin's price higher.

- Upside potential suggests Dogecoin soaring to $0.25 - $0.35 over the next 30 days, with a possibility of challenging the $0.50 benchmark.

- Risks for Dogecoin include scenarios like Elon Musk's silence, market-wide pullbacks, profit-taking, and limited utility growth, which could lead to price consolidation or dips.

- A potential downside target for Dogecoin is a retracement to $0.17 - $0.15 without compelling catalysts.

- The emergence of Neo Pepe, a memecoin with community-driven governance and transparency, offers an alternative opportunity in the crypto space.

- Investors are advised to closely monitor Dogecoin's price actions and narratives, especially with critical catalysts on the horizon.

- The month ahead promises an exciting journey in the crypto world, with possibilities of higher price movements and the rise of innovative projects like Neo Pepe.

Read Full Article

23 Likes

101Blockchains

894

Image Credit: 101Blockchains

Introducing 101 Crypto: Your One-Stop Destination for Everything Bitcoin, Blockchain & Beyond

- 101 Crypto is an emerging platform providing comprehensive information on Bitcoin, blockchain, and cryptocurrencies, tailored for beginners and professionals.

- With a special emphasis on education, 101 Crypto aims to transform complex concepts into concise articles for easy understanding.

- The platform covers topics beyond Bitcoin, such as DeFi, NFTs, DAOs, and web3, offering a wide range of educational resources.

- 101 Crypto offers a productive learning experience through structured blogs, real-world case studies, and supporting resources like free courses and eBooks.

- It provides insights on the latest trends in the crypto industry, making it a valuable source for staying informed about market developments.

- The platform caters to curious beginners, tech enthusiasts, aspiring traders and investors, as well as professionals looking to understand and engage with cryptocurrencies.

- From foundational crypto knowledge to specialized insights on DeFi, NFTs, and web3, 101 Crypto ensures a holistic understanding of the crypto landscape.

- Overall, 101 Crypto by 101 Blockchains is a reliable destination for individuals seeking to enhance their crypto skills and stay updated with the latest industry trends.

Read Full Article

9 Likes

TronWeekly

320

Image Credit: TronWeekly

Breakthrough Moment: PYUSD Joins Stellar to Disrupt Legacy Payment Systems

- PayPal is planning to bring its PYUSD stablecoin to the Stellar network, pending approval from NYDFS.

- The integration with Stellar aims to improve global payments, financing, and liquidity solutions for real-world commerce.

- The move will place PYUSD alongside Ethereum and Solana for cross-border transactions.

- PayPal intends to expand PYUSD onto the Stellar blockchain to enhance global payment services.

- The announcement was scheduled for June 11, 2025, pending approval from the NYDFS.

- Stellar's integration can offer wider adoption for PYUSD with its global network accessibility.

- Access to more than 170 countries through Stellar can facilitate various services like payments, remittances, and financing.

- Stellar provides a cost-efficient and fast settlement mechanism suitable for cross-border remittances and real-time payments.

- The move to Stellar aligns with PayPal's strategy to offer more efficient and accessible stablecoin services.

- Integration with Stellar can present developers with a viable alternative to Ethereum and Solana due to low fees and seamless operations.

- PYUSD on Stellar can support innovative financial solutions like payment financing and real-time working capital for businesses.

- This integration could improve global financial efficiency by reducing settlement delays and automating expense reconciliations.

Read Full Article

19 Likes

TheNewsCrypto

173

Is Rexas Finance (RXS) Going to Flip Ripple (XRP) Before Solana (SOL)? Cheap Crypto Set to Grow Your Wealth 18,000% in 4 Months

- Rexas Finance (RXS) is positioned for significant growth with a projected 18,000% increase in value within four months.

- Rexas Finance focuses on tokenization of real-world assets, bringing financial assets onchain to enhance DeFi space.

- RXS raised over $49.35 million during presale and received a Certik security audit, enhancing investor confidence.

- Comparing RXS to Ripple (XRP), Rexas Finance aims for disruptive growth in the real-world asset market.

- Solana (SOL) faces competition from Rexas Finance targeting the real-world asset market with potential for significant growth.

- Distinct elements like innovative use case, strong community, security, upcoming exchange listing, and strategic positioning contribute to RXS potential returns.

- Rexas Finance presents a unique opportunity for investors to capitalize on real-world asset tokenization and potential for rapid growth.

- The article discusses the potential of RXS surpassing XRP and outperforming SOL in the market within a few months.

- Rexas Finance offers a compelling investment narrative with a focus on real-world assets, backed by viral community support and upcoming exchange listing.

- For investors seeking to benefit from crypto innovation, Rexas Finance could offer substantial growth opportunities by 2025.

Read Full Article

10 Likes

Global Fintech Series

2.1k

Image Credit: Global Fintech Series

Implementing AI-Powered Policy Verification Systems in FinTech

- AI-powered policy verification systems are transforming how FinTech companies interpret and enforce regulatory frameworks, enhancing operational accuracy and compliance.

- FinTech operates in a shifting regulatory landscape with challenges like AML, KYC, and GDPR, making automated policy verification crucial.

- AI systems use NLP, machine learning, and rule-based algorithms to understand and validate policies in real time.

- They ingest, interpret, and map policies against internal operations, continuously monitor compliance, and learn and adapt over time.

- Benefits include increased accuracy, operational efficiency, real-time compliance insights, scalability, and audit readiness.

- Use cases span digital banking, InsurTech, Crypto, Blockchain, and lending platforms within the FinTech sector.

- Challenges involve data privacy, regulatory ambiguity, integration complexity, and ethical AI decision-making.

- The future of AI in FinTech compliance points towards more intuitive systems automating regulatory reporting and predicting compliance risks.

- Implementing AI-powered policy verification systems in FinTech enhances operational resilience and regulatory alignment, paving the way for seamless compliance.

- Overall, AI systems play a vital role in ensuring FinTech compliance keeps pace with regulatory changes efficiently and accurately.

Read Full Article

24 Likes

TronWeekly

208

Image Credit: TronWeekly

Ethereum Fusaka Upgrade Kicks Off with 8 Game-Changing EIPs

- Ethereum's Fusaka upgrade progresses to Devnet-1 phase with 8 key EIPs focusing on scalability, security, and data efficiency.

- Devnet-2 will follow with 3 additional improvements to support Ethereum's modular vision.

- Protocol Guild members are actively driving Ethereum's advancement in research, execution, and usability fields.

- The Fusaka upgrade introduces EIPs like PeerDAS for secure data sampling, optimizing gas usage, and capping transaction limits.

- EIP-7918 adjusts Ether's base fee logic for better fee forecasting, while EIP-7917 enhances block producer coordination.

- Pending Devnet-1's success, Devnet-2 will bring enhancements like a cryptographic curve precompile and code size limit expansion.

- Ethereum developers confirm finalizing EIPs for Fusaka to prevent network overload.

- Protocol Guild members make key contributions in Ethereum's core development, focusing on scaling, usability, and performance improvements.

Read Full Article

12 Likes

TechBullion

22

Image Credit: TechBullion

Did You Miss Litecoin at $0.30? Qubetics May Be One Of the Top Altcoins to Buy in 2025

- Litecoin ($LTC) started at $0.30 in 2011 and has grown to over $480 with real-world use cases, making early adopters significant profits.

- Qubetics ($TICS) emerges as a top altcoin for 2025, focusing on cross-border finance and Web3 infrastructure.

- Qubetics offers seamless interoperability, low-cost cross-border payments, and native support for Bitcoin and Ethereum chains.

- It aims to improve global payments by streamlining transactions through smart routing and compliance-layer integration.

- Qubetics tackles high fees, settlement delays, and reliance on intermediaries in cross-border transactions, particularly benefiting emerging markets.

- Qubetics has raised over $17.9 million in its presale, with significant growth potential and final stages of the public sale expected to yield high ROI.

- The project slashes token supply for sustainability, addressing global cross-border transaction inefficiencies left unsolved by Litecoin.

- Litecoin's advancements in accessibility and privacy are noted, but structural gaps remain in areas like smart contract support and enterprise-grade tooling.

- Qubetics aims to solve Litecoin's unresolved issues with infrastructure tailored for global payments and complete financial interoperability.

- Analysts project significant post-mainnet valuations for Qubetics, positioning it as a top altcoin with clear long-term value and practical application.

- Qubetics offers a presale opportunity for potential investors seeking to capitalize on its utility-focused innovation and real-world solutions.

Read Full Article

1 Like

Fintechnews

271

Image Credit: Fintechnews

FINMA Reduces Response Time for Fintech Authorisation Enquiries

- FINMA has improved efficiency in handling authorisation enquiries related to DLT and blockchain.

- They average time to respond has been reduced from 141 days to 25 days, an 82% decrease over three years.

- Despite increasing complexity, FINMA's experience in the field has helped reduce processing times.

- Procedural changes and an electronic survey platform have been introduced to streamline authorisation enquiries.

- A quick guide for the electronic submission process is available on FINMA's website.

- FINMA differentiates between DLT and blockchain authorisation enquiries and fintech license applications.

- For fintech license applications, a preliminary enquiry is recommended for a more efficient assessment.

- This allows FINMA to provide valuable feedback on licensing obstacles or important issues.

- Authorisation enquiries can now be submitted through an electronic survey platform.

- FINMA has reduced the average processing time from 141 days to 25 days.

- There are around 100 DLT and blockchain related enquiries received annually by FINMA.

- The improved efficiency is attributed to both experience in the field and procedural changes.

- FINMA recommends preliminary enquiries for fintech license applications to assess them more efficiently.

- By submitting a preliminary enquiry, project initiators receive regulatory assessment feedback.

- The initiative aims to provide valuable feedback on obstacles to licensing or other critical issues.

- FINMA's quick guide for electronic submission of enquiries is accessible on its website.

Read Full Article

16 Likes

TechBullion

160

Image Credit: TechBullion

What Separates These From the Rest? The 8 Best Cryptos to Watch Now

- Identifying high-impact crypto tokens early can create significant opportunities in the rapidly evolving blockchain space.

- Qubetics is reshaping global asset ownership through foundational changes in tokenization, making headlines for its utility-focused blockchain protocols.

- The article discusses eight standout tokens, including Aptos, Cardano, Arbitrum, and Render, showcasing strong fundamentals with a focus on real-world use cases.

- Qubetics facilitates seamless access to tokenized physical and digital assets, offering transparency, high liquidity, and user governance.

- The Qubetics presale, currently in its final stage, presents strong entry conditions and potential ROI for investors.

- Monero is highlighted for its unparalleled focus on on-chain privacy, making it a foundational layer for users valuing autonomy and confidentiality.

- VeChain is revolutionizing supply chain systems with transparent, immutable tracking, aiming to combat counterfeits and verify carbon outputs.

- The Artificial Super Intelligence Alliance merges blockchain and AI, with the potential to revolutionize machine learning capabilities across diverse sectors.

- Aptos prioritizes smart contract performance optimization for developers, ensuring high scalability and security without compromising speed.

- Cardano's research-based development, sustainable governance model, and Hydra scaling protocol position it as a key player for future-governed systems.

Read Full Article

9 Likes

TronWeekly

249

Image Credit: TronWeekly

Chainlink, JPMorgan’s Kinexys, and Ondo Complete First Cross-Chain DvP Settlement

- Chainlink, Kinexys by JPMorgan, and Ondo Finance completed the first cross-chain DvP settlement.

- The transaction was facilitated by Chainlink's CRE, integrating traditional and decentralized finance.

- OUSG, tokenized US Treasuries fund issued by Ondo, was involved in the DvP transaction.

- Chainlink's solution ensured secure atomic asset and payment transfers, reducing risks.

- Chainlink's CRE managed the DvP workflow across different blockchains and finance systems.

- CRE provides automated and verifiable workflows with reduced settlement risk for financial institutions.

- Tokenized RWA market exceeded $23 billion in 2025, led by US Treasury debt and private credit.

- OUSG fund by Ondo holds over $692 million TVL across multiple networks.

- Chainlink's partnership with Kinexys offers a scalable model for future cross-chain settlements.

Read Full Article

14 Likes

Medium

404

Image Credit: Medium

Planetary Chain of Custody: Securing Martian Mining Data with Blockchain

- Humanity is moving towards interplanetary resource extraction, focusing on securing extraterrestrial data integrity and ownership.

- Off-Earth mining of resources like helium-3, Martian ice, and asteroid materials is becoming crucial.

- The vulnerability of space data, including mineral reports and resource claims, is a significant concern.

- Blockchain technology is proposed as a solution to safeguard extraterrestrial data.

- Decentralized consensus through Blockchain is essential for ensuring data trustworthiness in space.

- A Planetary Chain of Custody using Blockchain ensures the immutability and integrity of space data.

- Blockchain enables auditable processes like extracting water ice from beneath the Martian surface.

- Blockchain offers immutability, decentralization, and verifiable consensus for space data.

- The next cyber frontier involves securing data integrity in interplanetary missions.

- It is crucial to future-proof the integrity of interplanetary civilization's data.

- Efforts are focused on building truth systems for interplanetary data security.

- Collaboration opportunities are encouraged for space data infrastructure, cross-chain interoperability, and legal-tech frameworks for planetary claims.

- Ensuring that data integrity matches human vision upon returning from Mars is highlighted.

- The article emphasizes the importance of securing data integrity for future space missions.

- Blockchain technology is positioned as a key tool for ensuring trustworthiness in extraterrestrial data management.

Read Full Article

24 Likes

Dev

364

Image Credit: Dev

Top Solidity Development Companies to Watch in 2025: A Comprehensive Guide

- Solidity is crucial for smart contract development on the Ethereum blockchain, leading to high demand for skilled developers.

- The article explores top Solidity development companies in 2025, emphasizing their expertise and unique offerings.

- Key factors for selecting a Solidity development company include blockchain expertise, track record, security focus, innovation, and client support.

- Leading companies like LBM Solution, Blockchain App Factory, LimeChain, OpenZeppelin, Altoros, and ConsenSys are highlighted with their core services and reasons for selection.

- Emerging trends in Solidity development include Ethereum 2.0, Layer 2 solutions, cross-chain interoperability, DeFi, and security audits.

- Choosing the right Solidity development partner involves evaluating technical expertise, portfolio, security practices, and communication.

- Companies mentioned in the article offer innovative solutions, expertise in Ethereum, smart contract development, and emphasize security and scalability.

- Partnering with top Solidity development firms ensures secure, scalable, and future-ready blockchain solutions in 2025 and beyond.

Read Full Article

21 Likes

Dev

262

Image Credit: Dev

🔗 From Trust Problems to Trustless Technology: How Blockchain Is Changing Web Development

- Legacy web applications face trust issues due to data privacy concerns and centralized servers.

- Blockchain offers solutions to enhance security, transparency, and decentralization in web development.

- Key benefits of blockchain for web apps include trustless transactions, immutable data storage, smart contracts, and user sovereignty.

- Tools for blockchain-powered web applications include wallet integration, Web3 libraries, smart contracts using Solidity, and decentralized hosting on IPFS.

- A use case of a voting app demonstrates blockchain's advantages in terms of security and immutability.

- Blockchain technology can be applied to various sectors like e-commerce, digital identity verification, royalties, and supply chain tracking.

- SEO keywords related to blockchain for web developers are highlighted for better content visibility.

- Web developers are encouraged to start integrating blockchain features gradually to stay relevant in the evolving Web3 environment.

Read Full Article

15 Likes

Fintechnews

374

Image Credit: Fintechnews

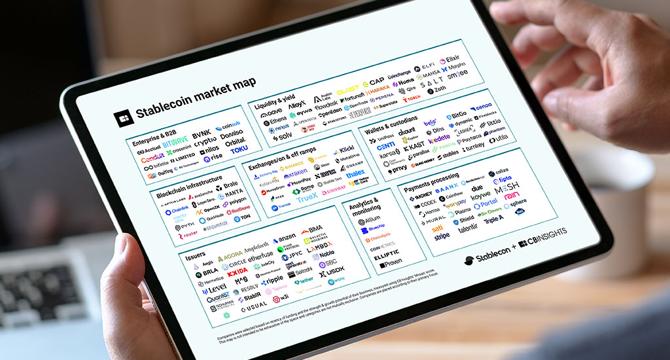

Stablecoins Gain Ground in Finance, Key Trends Include Yield Products, Cross-Border Payments

- Stablecoins are becoming integral to the global financial system, attracting traditional financial institutions due to their stability and blockchain advantages.

- Key trends in stablecoins include traditional banks issuing their own stablecoins and companies like Mastercard and Visa supporting stablecoin transactions.

- Stablecoins are expanding beyond safety features to include yield products like Paxos' Lift Dollar and payment capabilities for Stripe's USDB stablecoin.

- Stablecoins are increasingly used for cross-border payments, offering affordable alternatives in emerging markets and specialized options in developed nations.

- The stablecoin market landscape includes 172 players categorized based on business focus, with stablecoin issuers leading in numbers and attracting potential consolidation.

- Liquidity and yield-focused firms have garnered the most funding over the last year, with StakeStone and Flowdesk prominent in this space.

- Wallets and custodians for stablecoins have shown significant headcount growth, with Kast from Hong Kong expanding its services.

- Payments processing companies, like Rain and Mesh, are expected to see substantial funding growth, with predictions of a tenfold increase in 2025.

- The stablecoin market, valued at approximately US$255 billion, could grow to US$2 trillion by 2028 with the anticipated regulatory framework through acts like the GENIUS Act.

- US legislation, such as the GENIUS Act, aims to provide regulatory clarity for stablecoins, potentially propelling the market's value to US$2 trillion by 2028.

Read Full Article

22 Likes

For uninterrupted reading, download the app