Cryptography News

Coindoo

159

Image Credit: Coindoo

Robert Kiyosaki Warns of Historic Crash, Urges Shift Toward Gold, Bitcoin

- Robert Kiyosaki warned of an impending historic crash, citing predictions from his 2013 book.

- He expressed frustration at financial influencers claiming credit for his forecasts.

- AI job losses and inflation are among his top concerns for the global economy.

- Kiyosaki criticized conventional education and advised self-education and investing in gold, silver, and Bitcoin.

- He cautioned followers against false financial prophets and emphasized choosing mentors wisely.

- Kiyosaki mentioned the year 2925 as significant for a major financial change.

- He encouraged people to prepare for global financial transformation and strive for wealth.

- Despite the challenging outlook, Kiyosaki ended on a motivational note.

- Kiyosaki's message highlights the importance of prudent financial decisions and education.

- He advocates a shift towards investments like gold and Bitcoin to hedge against uncertainty.

Read Full Article

9 Likes

Coindoo

75

Image Credit: Coindoo

Long Liquidations Mount at $104K—Is Bitcoin Ready to Climb?

- Bitcoin's spot price has been hovering around $104,000 while open interest on Binance has been declining, suggesting a market-wide deleveraging.

- Despite consistent price stability around $104,000, open interest has been decreasing, indicating unwinding of leveraged positions.

- Many long positions were liquidated at the $104,000 level, implying traders entering late were forced out by liquidation events.

- Short liquidations were minimal, highlighting that the correction mostly impacted overly aggressive longs.

- CryptoQuant analysts see the combination of price stability, decreasing open interest, and liquidation exhaustion as a potentially bullish signal.

- The recent derivatives market reset coincided with the Fed's rate pause, historically favorable for risk-on assets like Bitcoin.

- CryptoQuant suggests that with stabilizing market conditions and reduced leverage, Bitcoin might have a bullish outlook.

- Bitcoin's price stability around $104,000 and decreasing open interest hint at a potential upward trend in the market.

- The recent liquidations at $104,000 level and minimal short liquidations signal a correction mainly targeting aggressive long positions.

- Analysts interpret the current market conditions as potentially bullish for Bitcoin due to decreasing leverage and price stability.

- The recent Fed rate pause aligns with a historically supportive macro backdrop for Bitcoin as a risk-on asset.

- The combination of factors like declining open interest and liquidation exhaustion point towards a potentially bullish scenario for Bitcoin.

- The market resetting in derivatives alongside the Fed's rate pause could pave the way for a positive trend in Bitcoin's price.

- With the clearing of late leverage and stabilizing market conditions, Bitcoin's path of least resistance could be upwards.

- Bitcoin's recent trading patterns and decreasing open interest suggest a possible bullish momentum for the cryptocurrency.

Read Full Article

4 Likes

Coinjournal

282

Image Credit: Coinjournal

Raydium price forecast after the Upbit listing

- Upbit has listed KRW and USDT trading pairs for Raydium (RAY) cryptocurrency.

- The listing on Upbit caused a surge in interest, speculation, and price increase for RAY.

- Key resistance levels for Raydium lie at $2.52–$3.12 for a potential breakout continuation.

- The listing announcement sparked a significant price rally, with RAY climbing nearly 45% to $2.64.

- While the initial breakout was short-lived, market interest remains strong post-listing.

- Raydium's strong fundamentals, including TVL, revenue, and staking metrics, support its recent price momentum.

- Trading volume surged by over 600%, reaching $401.19 million, indicating short-term strength.

- Technical indicators show a mixed outlook, with support near $2 and potential resistance at $2.96 and $3.40.

- A double-bottom pattern, RSI, and MACD signals suggest further gains, with caution near the $2.90–$3.12 range.

Read Full Article

17 Likes

Coinjournal

132

Image Credit: Coinjournal

AERO price jumps 20% as it defies crypto downturn

- Aerodrome Finance's native token, $AERO, has surged by 20%, reaching $0.96 despite a broader crypto market downturn.

- The recent Coinbase integration appears to be a key driver of AERO's price surge.

- Tensions in the Middle East have contributed to market uncertainty, but $AERO remains resilient.

- Investors are cautious amid geopolitical risks impacting global markets.

- AERO is on the cusp of surpassing $1, a level not seen since early 2024.

- The token has outperformed Bitcoin and many altcoins, climbing 20% in a single day and 74% over the past week.

- $AERO's price surge is attributed to Coinbase's integration of Aerodrome Finance, the second-largest DEX on Base.

- A 1.3× boosted airdrop for Coinbase One users and new token launch fees for stakers have fueled investor enthusiasm.

- Analysts predict $AERO could reach $1.50 in the near term, with long-term potential to hit $2 by year-end.

- AERO's ties to Coinbase and dominance on Base position it as a leader in the DEX space.

- With over 1 million tokens locked for governance and public goods, the protocol's fundamentals remain robust.

- Despite potential market volatility, $AERO's unique catalysts suggest continued outperformance.

- The token's recent price surge is supported by strong community sentiment and increased platform visibility.

- Aerodrome Finance holds the 2nd highest score in @Blockworks_ new Token Transparency Framework, fostering trust in crypto.

- The next resistance for $AERO lies at $1.04, potentially propelling the token towards $1.50.

- Market fluctuations, including potential pullbacks to $0.70 or $0.60, could impact $AERO's trajectory.

Read Full Article

7 Likes

Cryptopotato

326

Image Credit: Cryptopotato

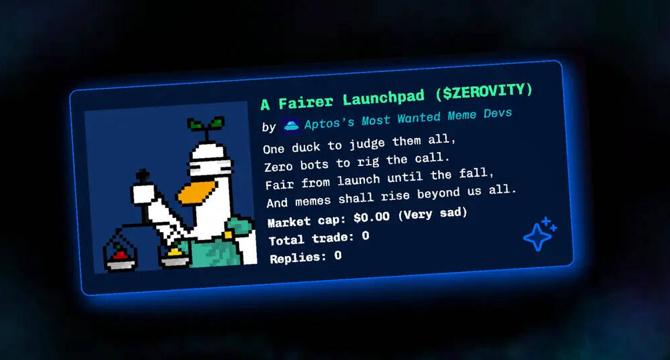

Zerovity Launches to Redefine Memecoin Fairness and Stop Bot-Dominated Launches

- Zerovity aims to redefine fairness in memecoin launches by addressing issues like bot dominance and unfair practices.

- They have developed a launchpad focused on fairness, blocking bot entry and ensuring transparency for all users.

- Zerovity tackles problems like bot control of initial moves, unfair launches, baiting through liquidity pools, and chaos profiteering by DEXs.

- They implement measures such as blocking early entries, conducting a graduation phase before trading starts, and delaying LP activation until after public token graduation.

- The platform limits bot pathways, increases visibility, and prioritizes human users over automated farms.

- Zerovity is an independent team dedicated to creating a cleaner memecoin launch process on the Aptos blockchain.

- Their focus is on enhancing fairness, transparency, and user participation while preventing harmful aspects of volatility.

- Zerovity's ultimate goal is to revolutionize how meme tokens are launched and experienced.

- The platform is live with a commitment to providing real users with a genuine opportunity in memecoin launches.

Read Full Article

19 Likes

Cryptopotato

229

Image Credit: Cryptopotato

Meet altFINS AI Copilot: A Smart Crypto Trading Assistant

- altFINS has launched AI Copilot, a feature to support efficient crypto trading by helping users discover trade opportunities easily.

- AI Copilot uses over 120 trade analytics, chart patterns, and candlestick patterns across different time intervals.

- Richard Fetyko, altFINS CEO, emphasized the simplicity of trade idea discovery, catering to both new and experienced traders.

- Users can input plain language descriptions like 'assets in a strong uptrend' to receive custom market scans without manual filters.

- The AI Copilot feature supports multiple languages for broader accessibility.

- It allows users to adjust scan results, save scans, set alerts, export data, and create watchlists.

- The current focus is on market scans using altFINS' Crypto Screener, with plans to expand to include on-chain data and news.

- altFINS is an analytics platform offering insights to active traders based on off-chain and on-chain data.

- The AI Copilot aims to transform market noise into actionable market insights for users.

- Users can begin exploring the AI Copilot now for enhanced trading support.

Read Full Article

13 Likes

Coindoo

101

Image Credit: Coindoo

Arthur Hayes Predicts $250,000 for BTC by Year-End: Here is Why

- Arthur Hayes predicts BTC could reach $250,000 by year-end due to expected $9 trillion liquidity injection into the U.S. economy.

- Hayes anticipates traditional sectors will receive liquidity first before it flows into risk assets like Bitcoin.

- Recent regulatory changes allowing banks more lending flexibility will enhance credit availability.

- Increased lending may benefit manufacturing firms and eventually the cryptocurrency market.

- Hayes expects broader risk assets, including crypto, to be supported by increased credit and economic activity.

- Hayes sets a long-term target of $1 million for BTC by 2028 if monetary expansion continues as predicted.

- Bitcoin's fixed supply and small market cap make it more reactive to capital inflows compared to traditional assets.

- Assets with limited supply like Bitcoin are likely to appreciate faster as liquidity increases.

- Hayes highlights Bitcoin's consistent outperformance of other assets over the past 15 years due to its unique monetary structure.

- Global financial institutions injecting liquidity could benefit Bitcoin in the next phase of monetary expansion.

Read Full Article

6 Likes

Cryptopotato

136

Image Credit: Cryptopotato

Are Altseason Expectations Wishful Thinking? This Metric Hints So

- Analysts have been predicting the start of the altcoin season based on Bitcoin and Ether's price performance.

- CryptoQuant analysts suggest that expectations of an altseason in this cycle may be wishful thinking.

- Altcoins have been underperforming despite Bitcoin rallies and price spikes.

- The 1-Year Cumulative Buy/Sell Quote Volume Difference for Altcoins needs to turn positive for the altseason narrative to change.

- Currently, the metric is at -$36 billion, indicating a lack of altcoin investor activity.

- Altcoins are struggling even as Bitcoin consolidates around $104,000.

- Experts believe there is still hope for altcoins, with some pointing to Ether's potential breakout triggering an altseason.

- Some analysts see aligning altseason indicators and expect another leg up for Bitcoin.

- CryptoQuant founder anticipates only select altcoins rallying if an altseason occurs in this cycle.

- The dynamic of this bull season is viewed as different from past cycles.

- Analysts remain optimistic despite the current lackluster performance of altcoins.

- The 1-Year Cumulative Buy/Sell Quote Volume Difference for Altcoins remains a key metric to watch for altcoin market activity.

- Expectations for a full altseason or FOMO among altcoin investors may be premature without this metric turning positive.

- The fate of the altcoin market is closely tied to the performance of Bitcoin and Ether.

- Hope persists that altcoins could still see a significant rally in the future.

- The assessment questions the widespread expectation of an imminent altseason during this particular market cycle.

- Crypto market participants continue to monitor various indicators and metrics to gauge the potential for an altseason.

Read Full Article

8 Likes

Coindoo

44

Image Credit: Coindoo

Whale Transactions Spike Over 400% on Top Gainers, According to Santiment

- Whale transactions on top gaining projects surged over 400% in the past 30 days, as per Santiment data.

- Top 5 altcoins with highest increases in $100K+ whale transactions include Render (RNDR), SPX6900 (SPX), Sky (SKY), BitDAO (BIT), and UNUS SED LEO (LEO).

- Notable gainers also include stablecoins Dai (DAI) and USDC on Optimism, along with Optimism (OP) and Aave (AAVE) showcasing interest in Layer-2 and DeFi platforms.

- The spike in whale activity coincides with market ranging conditions, suggesting strategic accumulation by large holders.

- Historically, sharp rises in whale transactions may indicate position accumulation before significant price movements or reallocation during low volatility periods.

- Traders are advised to monitor tokens like Render and SPX6900 for potential breakout momentum once broader market trends become clear.

Read Full Article

2 Likes

Coindoo

353

Image Credit: Coindoo

Iran Imposes Crypto Curfew After $90M Hack Amid Rising Cyber Threats

- Iran imposes a crypto curfew following a $90 million hack on Nobitex, Iran's largest crypto exchange.

- The hack is believed to be linked to Gonjeshke Darande, a pro-Israel hacking group known for cyber operations against Iranian infrastructure.

- The curfew is seen as a cybersecurity measure to reduce exposure during off-peak hours when foreign attacks are more likely.

- Authorities hope to enhance oversight and lower systemic risk by restricting trading to standard business hours.

- This policy contrasts with global norms of decentralized and round-the-clock crypto trading.

- Critics view the curfew as regressive in terms of market openness and technological advancement.

- The restrictions in Iran could have significant impacts on both retail and institutional traders, raising concerns about cybersecurity weaknesses and state control.

- User trust in local platforms may decline due to reduced access windows compared to international exchanges.

- The situation highlights the intersection of geopolitics, cybersecurity, and financial innovation in the digital age.

- Iran's move underlines the delicate balance between risk mitigation and market freedom.

- The article discusses the impact and implications of the crypto curfew in Iran after the Nobitex hack.

- It also mentions concerns about how state controls could affect crypto adoption and user trust.

- The cybersecurity measure is aimed at mitigating cyber threats during vulnerable off-peak hours.

- The curfew is a departure from the decentralized nature of the global crypto market.

- Authorities emphasize the need for greater protection in the crypto sector.

- The story highlights the interconnected nature of geopolitics, cybersecurity, and financial innovation.

Read Full Article

21 Likes

Coindoo

406

Image Credit: Coindoo

Top Crypto Presale Alert: Qubetics Enters Final Presale Stage While GateToken, and Bitget Hold Steady

- Qubetics, GateToken, and Bitget Token are key players in June 2025 as investors seek new opportunities in the crypto market.

- Qubetics introduces cross-chain interoperability and is in its final presale stage, offering a unique value proposition.

- GateToken experiences a 3.82% price drop, presenting a potential entry point for investors looking for exchange-centric assets.

- Bitget Token registers a 2.64% decline following a strategic token burn, enhancing its long-term value.

- Despite the recent dips, GateToken and Bitget Token offer utility-driven models and benefits akin to presale tokens.

- Investors can capitalize on the opportunities presented by Qubetics, GateToken, and Bitget Token based on their risk profiles and investment strategies.

- Qubetics' interoperability solution, GateToken's exchange stability, and Bitget Token's deflationary economics cater to diverse investor preferences.

- Each token provides a distinct path for investors, with Qubetics being highlighted as the top crypto presale project amidst the three.

- The tokens offer varied growth prospects, ranging from potential exponential returns with Qubetics to stability and utility with GateToken and Bitget Token.

- Combining investments in Qubetics, GateToken, and Bitget Token offers diversification and exposure to different sectors within the crypto market.

Read Full Article

24 Likes

Coinjournal

4

Image Credit: Coinjournal

Tron price forecast: TRX defies market conditions, up 1%

- Tron's TRX is the best performer among the top 10 cryptocurrencies, up 1% in the last 24 hours.

- TRX could surge towards $0.29 on strong technicals.

- TRX defies broader crypto market conditions.

- TRX, the native coin of the Tron ecosystem, is the best performer among the top 10 cryptocurrencies this week.

- Other cryptos are down while TRX added 1% in value.

- Tron reveals plans to go public in the U.S. via a reverse merger led by a Trump-linked bank.

- SRM Entertainment to raise $100 million to buy TRON tokens.

- Technical indicators suggest TRX could rally towards the $0.2924 resistance level.

- TRX's MACD indicator is positive, RSI shows bullish strength.

- TRX's price above 50-day and 100-day EMAs, indicating buyer control.

- TRX forms a cup-and-handle pattern on daily chart, signaling bullish continuation.

- TRX could see excellent gains in the near to medium term.

- Tron price forecast discussed in a post on CoinJournal.

Read Full Article

Like

Coinjournal

159

Image Credit: Coinjournal

Bitcoin Pepe price outlook as stablecoin companies gain after US Senate passed GENIUS act

- The US Senate passing the GENIUS Act resulted in stock price surges for Coinbase and Circle, with Circle's shares rising over 33% and Coinbase's shares gaining 16%.

- The passage of the stablecoin bill is expected to increase the legitimacy of stablecoins and benefit early-stage tokens like Bitcoin Pepe in the market.

- Coinbase and Circle, major cryptocurrency firms, have shown significant growth following the Senate's approval of the GENIUS Act.

- Coinbase shares surged 16%, making it the top gainer among S&P 500 stocks, while Circle's shares jumped sixfold since its IPO.

- Circle, the issuer of USDC stablecoin, has seen stablecoin-related revenue play a significant role in earnings growth for Coinbase.

- Bitcoin Pepe, a new cryptocurrency project combining Bitcoin's security with Solana's speed, has raised over $15 million and announced a 30% token bonus for current investors.

- The GENIUS Act passed by the Senate establishes a framework for private entities to issue stablecoins under strict oversight and regulations.

- Bitcoin Pepe continues to gain attention during its presale, with plans for listing on MEXC and BitMart exchanges to enhance market visibility and liquidity.

- The project team is set to make a major listing announcement on June 30, further boosting investor interest.

Read Full Article

9 Likes

Coinjournal

141

Image Credit: Coinjournal

Best crypto presales to buy as BTC ETFs continue hot streak

- Bitcoin Pepe project's presale has raised over $15 million, with the BPEP token priced at $0.0416.

- BTC and other major altcoins saw modest price movements as the market stayed steady after the Fed's decision to maintain interest rates.

- Federal Reserve commits to achieving maximum employment and 2% inflation target in its policy statement.

- The Fed projects two rate cuts totaling 50 basis points by year-end.

- BTC ETFs recorded $388.3 million in inflows, with BlackRock’s iShares Bitcoin Trust leading with $278.9 million.

- Bitcoin ETF inflows show continued institutional interest in Bitcoin, trading near $104,777.

- Bitcoin Pepe aims to combine meme culture with a credible Layer 2 infrastructure narrative and has seen significant interest in its presale.

- The PEP-20 token standard allows permissionless minting and trading on Bitcoin for Bitcoin Pepe.

- The project plans to list its native BPEP token on centralized exchanges MEXC and BitMart.

- A major listing announcement for Bitcoin Pepe is scheduled for June 30, heightening investor anticipation.

Read Full Article

8 Likes

Coindoo

225

Image Credit: Coindoo

Retail Sentiment for Bitcoin Hits Most Bearish Level Since April, Typically a Bullish Signal

- Retail sentiment for Bitcoin has reached its most bearish level since April, with just 1.03 bullish comments for every 1 bearish comment on social platforms.

- This ratio indicates high levels of impatience and pessimism among traders, reminiscent of the period preceding a strong price recovery in April.

- Historically, such extreme bearish sentiments have often preceded upward momentum in Bitcoin's price.

- Current social sentiment divergence, with low positive and negative commentary while Bitcoin was trading at $105,000, suggests a contrarian bullish indicator.

- If historical patterns repeat, the current retail capitulation could set the stage for Bitcoin's next upward movement.

Read Full Article

13 Likes

For uninterrupted reading, download the app