Cryptography News

Coindoo

262

Image Credit: Coindoo

Chainlink Could Dominate Stablecoin Infrastructure, Says Co-Founder

- Sergey Nazarov highlighted the importance of platforms enabling proof of reserves and cross-chain connectivity for stablecoin adoption.

- Chainlink, according to Nazarov, is the only system currently offering both proof of reserves and cross-chain communication in a unified platform.

- Nazarov believes that Chainlink's capabilities position it as core infrastructure for stablecoin adoption, especially amid increasing global regulatory demands for transparency and interoperability.

- As stablecoins evolve into compliant financial instruments, platforms must also address on-chain identity, payment friction, and regulatory standards.

- Nazarov noted that Chainlink can provide proof of reserves, cross-chain messaging, and identity/compliance support within a single system.

- Chainlink is seen as a unified framework for handling complex blockchain transactions as blockchain operations become more sophisticated.

- Nazarov emphasized the need for a unified transactional framework to manage the increasing complexity of blockchain transactions, data layers, regulations, and cross-chain requirements.

- Chainlink's architecture allows users to configure and deploy services using a single piece of Chainlink Runtime Environment (CRE) code, streamlining processes such as proving reserves, managing compliance, and bridging networks.

- Sergey Nazarov highlighted that Chainlink simplifies users' access to necessary services by providing them with all the tools they need in one system.

- Chainlink is positioned to dominate stablecoin infrastructure due to its ability to address key industry challenges and offer a comprehensive solution for proof of reserves, compliance management, and cross-chain communication.

- The platform's unified approach to complex blockchain transactions makes it a preferred choice as blockchain operations continue to evolve.

- Chainlink simplifies the deployment of various services through a single piece of code, enhancing efficiency and reducing operational complexities for users.

- Nazarov's statements underscore Chainlink's potential as foundational infrastructure for stablecoin adoption in the face of evolving regulatory requirements and the expansion of the tokenized economy.

- Chainlink's approach aligns with the growing need for platforms to integrate functions like identity verification, payment facilitation, and regulatory compliance seamlessly.

- The platform's focus on seamless integration of essential services positions it as a key player in driving the growth and adoption of stablecoins in the ever-changing financial landscape.

Read Full Article

15 Likes

Coindoo

364

Image Credit: Coindoo

Analysing Monero Price Prediction 2025 and the Strategic Rise of Qubetics

- Privacy coins and multi-chain infrastructure tools are gaining attention for their utility in decentralized finance and secure data exchange.

- The article analyzes Monero (XMR) and Qubetics, focusing on their contributions to privacy-preserving decentralized infrastructure.

- Monero's 2025 price prediction ranges from $300 to $500, driven by private digital payments demand and regulatory challenges.

- Monero's strengths include untraceable transactions with Ring Signatures and Stealth Addresses, attracting users needing financial confidentiality.

- Regulatory restrictions in some jurisdictions challenge Monero, but its activity remains robust on decentralized exchanges and through atomic swaps.

- Monero's forecast for 2025-2027 projects a price range of $800 to $950, supported by acceptance of privacy coins and technological advancements.

- Qubetics offers a non-custodial multi-chain wallet for secure asset management in the evolving Web3 ecosystem, catering to rising privacy and usability expectations.

- Qubetics' token presale performance signals strong investor confidence, with plans for integrations like a decentralised VPN and tokenised asset marketplace.

- Monero and Qubetics represent paths towards privacy and infrastructure in the digital asset landscape, catering to utility, resilience, and decentralization.

- Investors looking for utility-driven exposure are advised to consider both Monero and Qubetics for long-term potential.

Read Full Article

21 Likes

Coindoo

373

Image Credit: Coindoo

XRP Price Rejected After SEC Appeal Delay

- XRP faced a rejection as it neared a potential breakout, impacted by legal developments with the SEC.

- Ripple and the SEC jointly requested a delay in appeal proceedings, pushing a decision to August.

- Analyst EGRAG CRYPTO indicated the disruptive effect of this delay on XRP bulls, leading to a sharp price decline.

- The delay might be utilized by institutions to accumulate XRP as the price remains around the $2 zone, potentially resulting in a bullish outcome.

- Advising patience in light of regulatory delays in the XRP market, EGRAG emphasized the need to adapt to such situations.

- A chart shared by EGRAG shows XRP retesting key support levels post-failed breakout, with future movements dependent on legal clarity and market response.

Read Full Article

22 Likes

Coindoo

186

Image Credit: Coindoo

SEC Seeks Additional 60-Day Pause in Ripple Appeal, Next Update Due August 15

- The SEC has requested a 60-day extension in the Ripple appeal case, with the next update scheduled for August 15.

- Both parties previously agreed to a hold on appellate activity to seek an indicative ruling from the District Court.

- The SEC's filing aims to maintain the case in abeyance to allow time for finalizing a proposed resolution.

- The proposed resolution includes vacating the permanent injunction on Ripple's institutional sales and reducing the financial penalty from $125 million to $50 million.

- The Second Circuit is overseeing the case and required a progress update by June 16, leading to the current extension request.

- The outcome of the appeal hinges on whether the District Court supports the adjustments outlined in the agreement between the parties.

- If approved, the revised terms would significantly impact the long-standing legal battle between Ripple and the SEC.

- The Ripple case is closely monitored by the crypto community, including XRP holders, legal experts, and stakeholders, for insights into regulatory implications and precedent.

Read Full Article

11 Likes

Cryptoticker

297

Image Credit: Cryptoticker

Why Everyone’s Talking About Hyperliquid?

- Hyperliquid is a decentralized exchange on its Layer 1 blockchain, offering zero gas fees, deep liquidity, and up to 50x leverage.

- It combines centralized performance with blockchain transparency and features tools like copy trading and scale orders.

- Hyperliquid's HyperEVM chain ensures speed, scale, and seamless trading optimized for perpetual futures contracts.

- The platform uses HyperBFT consensus, supports rapid transaction finality, and offers cross-margin trading.

- Key features include on-chain order book, no gas fees, high leverage, and one-click trading.

- Hyperliquid stands out with its infrastructure, high order processing capabilities, and non-custodial model.

- The platform supports market, limit, stop market, stop limit, scale, and TWAP order types.

- It lists over 130 assets, including major coins and stablecoins, and features the HYPE token for governance and rewards.

- Trading fees include maker fee of 0.01% and taker fee of 0.035%, with no gas fees for trading.

- Hyperliquid provides vaults for users to earn from trading strategies and ensures security with HyperBFT consensus and encryption protocols.

Read Full Article

17 Likes

Coindoo

106

Image Credit: Coindoo

South Korean Court Acquits Haru Invest CEO of Fraud in $650M Case

- The Seoul Southern District Court acquitted the Haru Invest CEO of fraud in a $650 million case.

- Prosecutors had sought a 23-year sentence, alleging the company misappropriated $650 million from around 6,000 individuals.

- The court cited external factors, like the FTX collapse, contributing to Haru's liquidity crisis and emphasized the company's genuine profit generation model.

- While acknowledging management negligence, the court found no sufficient evidence of criminal intent or deception.

- Lee survived a stabbing attack during his trial, and the assailant was sentenced to five years in prison.

- The verdict raises questions about investor compensation and the collapse of South Korea's yield platform sector.

Read Full Article

6 Likes

Coindoo

35

Image Credit: Coindoo

FloppyPepe’s Momentum Is Getting Dangerous – Why Early Backers Say It Will Rally 40,000%

- FloppyPepe (FPPE) is a new AI coin causing a stir in the crypto market, with a presale already raising $2.4 million and predictions of a 40,000% rally fueled by its AI technology and community support.

- The significant early-stage investment and unique features like a strong holder base, zero-tax structure, redistribution rewards, and token burns create an ideal environment for price growth.

- Investors can benefit from an 80% token bonus in the ongoing presale, potentially leading to substantial ROI, especially if the projected 40,000% rally materializes.

- FloppyPepe (FPPE) stands out with AI tools like Meme-o-Matic and FloppyX, enabling users to generate engaging content and memes that drive participation and growth.

- The referral system acts as a liquidity loop, expanding the holder base and ecosystem activity, while influencers endorsing FloppyPepe (FPPE) further increase project exposure and demand.

- FloppyPepe.ai has already launched functional products, providing market insights, content creation tools, and meme generators, emphasizing immediate value and community engagement.

- With a focus on security, token burns, and holder rewards, FloppyPepe (FPPE) aims to build lasting trust while maintaining hype and potentially triggering a significant price increase post-launch.

- The project's strategic approach, combined with the ongoing presale offering and upcoming listings, positions it as a promising investment opportunity with potential for significant gains.

- Investors can join the presale to access exclusive benefits and participate in the vibrant FloppyPepe (FPPE) community as the project aims for a landmark rally.

- FloppyPepe's momentum and unique features make it a compelling investment choice, with the potential for substantial returns and community-driven growth.

Read Full Article

2 Likes

Cryptopotato

182

Image Credit: Cryptopotato

WhiteBIT Coin (WBT) Defies Altcoins’ Crash, Bitcoin (BTC) Stopped at $109K: Market Watch

- Bitcoin faced volatility in the market due to Middle East tensions, dropping to under $103,000 before recovering to around $107,000 but then dipping after political events.

- Altcoins generally saw a decline, except for WBT which surged over 30% to surpass $50 amidst a market cap decrease to $3.440 trillion.

- BTC's dominance over altcoins increased slightly to 61.6%, while other top cryptocurrencies like XRP, BNB, TRX, and BCH saw gains.

- High-flyer altcoins suffered losses such as HYPE, PEPE, PI, TAO, ONDO, ICP, and KAS, with some drops exceeding 5%.

- Despite the market downturn, WBT stood out with significant gains, reaching a new peak above $50 while most other altcoins experienced declines.

Read Full Article

10 Likes

Coinjournal

320

Image Credit: Coinjournal

Best crypto presales to buy as JP Morgan reportedly files trademark application for JPMD

- Bitcoin Pepe presale raises over $14.6 million with BPEP token priced at $0.0416.

- JP Morgan reportedly files trademark application for JPMD, hinting at potential stablecoin launch.

- Bitcoin price rises amidst mixed performance in broader crypto markets and global tensions.

- Stocks and cryptocurrencies dropped sharply following Israeli strikes, with sentiment recovering on Monday.

- US index futures slip and crypto prices show mixed action on Tuesday.

- Bitcoin Pepe project attracts strong investor interest despite market volatility.

- JP Morgan's trademark application covers services in digital asset trading, exchange, and payment functions.

- The filing hints at potential use cases in blockchain-based asset issuance, brokerage, and electronic fund transfers.

- Bitcoin Pepe aims to merge meme culture with a credible Layer 2 blockchain proposition.

- The project positions itself with an infrastructure vision to combine Bitcoin's security with Solana's scalability.

- Bitcoin Pepe raises over $14.6 million in presale funding, preparing for a listing announcement.

- The accelerating adoption of Bitcoin and digital assets by traditional finance boosts sentiment in the crypto market.

- Investors seek outsized returns in a risk-friendly environment, rotating back into speculative plays.

- Bitcoin Pepe gains traction as a technically grounded project, distinct from typical meme tokens.

- With strong investor interest, Bitcoin Pepe aims to capitalize on the speculative momentum during its token sale.

- Eligible for Web Story as it covers cryptocurrency market trends, project updates, and a notable trademark filing.

Read Full Article

19 Likes

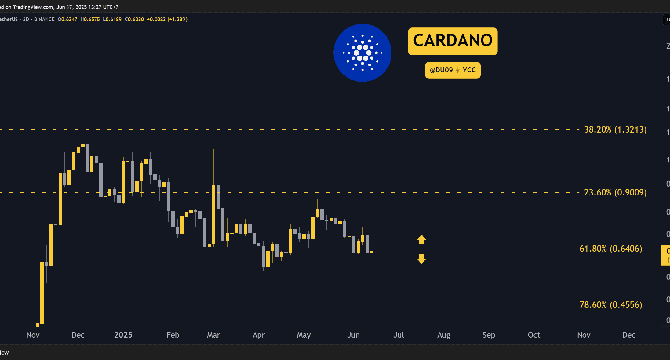

Cryptopotato

4

Image Credit: Cryptopotato

Cardano (ADA) Price Predictions for This Week

- ADA struggles to maintain its support at $0.64, facing pressure to stay above this level.

- Key support levels for ADA are at $0.64 and $0.45, while key resistance levels are at $0.90 and $1.30.

- Buyers are under pressure as another weekly candle closed in the red, potentially leading ADA to $0.55 if the week does not close positively.

- Interest in Cardano is low, and without current buyers, ADA may trend lower until interest returns, possibly dropping to $0.55.

- The falling daily volume suggests a lack of conviction among sellers, potentially paving the way for buyers to return later.

- The article discusses price predictions for ADA in the current week, showing concerns about the cryptocurrency's performance.

Read Full Article

Like

Coindoo

305

Image Credit: Coindoo

Canada Approves First Spot XRP ETF, Launching June 18 on TSX

- Canada has approved its first spot XRP ETF, which will start trading on the Toronto Stock Exchange (TSX) on June 18, 2025, providing regulated access to Ripple's digital asset.

- The Purpose XRP ETF will have three variations for different investor needs: XRPP (CAD-hedged), XRPP.B (Unhedged CAD), and XRPP.U (USD-denominated), offering direct exposure to XRP without the need for managing private keys or wallets.

- The ETF is eligible for Canadian registered accounts, such as TFSAs and RRSPs, potentially providing tax advantages to investors.

- Purpose Investments views the approval as a testament to Canada's advancement in supporting institutional-grade crypto infrastructure.

- The XRP ETF is based on the XRP Ledger, known for its efficient and rapid cross-border settlement capabilities.

- Vlad Tasevski, Purpose's Chief Innovation Officer, sees the approval as a confirmation of Canada's development in establishing a regulated environment for digital assets.

- Purpose's XRP ETF launch follows previous Bitcoin and Ethereum ETF introductions, showcasing Canada's progressiveness in offering crypto-backed financial products.

- The approval reflects Canada's significant role in creating a regulated blockchain ecosystem.

- The Purpose XRP ETF opens up opportunities for investors to engage in XRP's price movements within a regulated framework.

- The ETF launch is part of a broader trend in Canada towards embracing digital asset investment products.

- The XRP ETF enhances the accessibility of XRP to a wider investor base.

- Canada continues to position itself as a leader in the digital asset space with the introduction of the XRP ETF.

- Investors can benefit from the ETF's structure that eliminates the need for directly handling private keys or wallets.

- The XRP ETF launch on TSX reflects the growing acceptance of digital assets in traditional financial markets.

- The ETF's availability in different formats caters to diverse investor preferences and needs.

- Canada's move to approve the XRP ETF reinforces its reputation as a progressive jurisdiction for crypto-related financial products.

Read Full Article

18 Likes

Cryptopotato

31

Image Credit: Cryptopotato

Bitnovo Celebrates 10 Years

- Bitnovo, a Spanish company, celebrates its 10th anniversary with the launch of a gift card mall enabling users to pay with cryptocurrencies at brands in Spain and Italy.

- The company has focused on making cryptocurrency use accessible without requiring expert knowledge.

- Users can purchase gift cards and products directly with crypto through the Bitnovo platform.

- Bitnovo emphasizes self-custody, allowing users control over their assets.

- The gift card mall enables quick purchases from Bitnovo's non-custodial wallet, offering cashback on select brands with no need for intermediaries.

- Available brands include Carrefour, Cepsa, IKEA, Repsol, Atrapalo, and Smartbox in Spain, and additional brands in Italy and globally.

- Bitnovo was among the first to enable Bitcoin purchases with cash at physical stores and continues to make crypto accessible through various payment methods.

- The launch of the marketplace aims to simplify crypto usage for all users while maintaining control and security.

- Bitnovo offers services like buying cryptocurrencies with cash at physical locations, a self-custody wallet, and a B2B payment gateway for businesses.

- The company's commitment to self-custody and accessibility has been a key aspect of its operations over the past decade.

Read Full Article

1 Like

Cryptopotato

287

Image Credit: Cryptopotato

Crypto Shows Immunity as Bitcoin Quickly Recovers From Tehran Tensions

- Total crypto market capitalization dropped around $80 billion as Middle East tensions escalated.

- Bitcoin dipped by over $2,000 to around $106,500 but quickly recovered, reaching $107,000.

- US President Trump's call for Tehran evacuation caused the market dip.

- Trump left G7 early, citing the need to return for undisclosed reasons.

- China and Russia urged citizens to evacuate Tel Aviv amid military action escalation.

- There's a surge in odds (67%) on the US taking military action against Iran soon.

- Crypto markets seem less affected by geopolitical turmoil, showing resilience.

- Bitcoin and Ethereum prices remain stable despite the geopolitical tensions.

Read Full Article

18 Likes

Coindoo

222

Image Credit: Coindoo

Eric Trump Denies Involvement in Tron Public Listing Deal

- Eric Trump denied any involvement in Tron's rumored plan to go public, calling the claims inaccurate.

- Despite distancing himself, Eric Trump acknowledged Justin Sun's contributions to the digital asset industry and praised his support for Trump-aligned crypto initiatives.

- Justin Sun has aligned his efforts with Trump-led financial and blockchain ventures, boosting visibility and adoption in pro-crypto circles.

- Tron has seen renewed U.S. momentum as the SEC and Sun agreed to pause the ongoing lawsuit, hinting at a shift in the government's stance.

- Eric Trump's denial of ties to Tron-related listings contrasts with the close relationship between Sun and Trump-affiliated initiatives.

- The denied involvement comes as Eric Trump respects Sun's efforts in the crypto space.

- Eric Trump's post on social media emphasized the inaccurate nature of the circulating claims.

- Sun's alignment with Trump-led ventures has contributed to increased visibility and adoption for Tron in pro-crypto circles.

- Tron's resurgence in the U.S. market is partly attributed to the legal pause in the SEC lawsuit in partnership with Sun.

- The joint motion filed by the SEC and Justin Sun to pause the lawsuit suggests a potential regulatory shift in Tron's favor.

- The relationship between Sun and Trump-related initiatives continues to influence Tron's U.S. market momentum.

- Eric Trump, in his denial, acknowledged the value of Sun's contributions to the digital asset industry.

- Sun's support for Trump-aligned crypto projects has contributed to visibility and acceptance within pro-crypto communities.

- Tron's recent resurgence in the U.S. market is accompanied by a legal pause in the ongoing SEC lawsuit, indicating a possible change in regulatory dynamics.

- The association between Sun and Trump-linked ventures plays a role in shaping Tron's growing momentum in the U.S. financial space.

Read Full Article

13 Likes

Coindoo

377

Image Credit: Coindoo

Bitcoin Nears Critical MVRV Resistance—Cycle Peak or Breakout Ahead?

- Bitcoin's MVRV Z-Score is approaching a crucial resistance trendline, historically indicating cycle tops.

- The MVRV Z-Score measures BTC's market value deviation from realized value, guiding market overheating and undervaluation.

- Historically, the MVRV Z-Score has been reliable in identifying market tops and bottoms.

- Bitcoin is nearing a key resistance level that could determine the rest of the 2025 cycle.

- Previous cycles saw Bitcoin either breaking through or getting capped by this resistance level.

- A breakout above the MVRV trendline could signal strong cycle strength, while a rejection may indicate exhaustion.

- Alphractal advises vigilance as this moment could define Bitcoin's trajectory in the coming weeks.

Read Full Article

22 Likes

For uninterrupted reading, download the app