Cryptography News

Zycrypto

442

Image Credit: Zycrypto

BlockDAG Stuns With Record $299M Presale & 2,660% ROI

- The cryptocurrency project BlockDAG impresses the market with a record $299 million presale and a potential 2,660% return on investment (ROI).

- BlockDAG stands out with its user-friendly testnet, $299M presale, and solid community support.

- The project offers a hybrid DAG-Proof-of-Work architecture with EVM compatibility for seamless smart contract deployment.

- Over 1.5 million users are already mining BDAG through the X1 mobile app, showing mass adoption potential.

- BlockDAG aims to redefine crypto adoption with its scale, speed, and visibility.

- Ethereum remains a top choice for its established utility as the foundation for decentralized applications.

- Despite high gas fees, Ethereum's upgrades enhance scalability and environmental sustainability.

- Developers continue building on Ethereum due to its mature ecosystem and community support across various sectors like DeFi and NFTs.

- Solana shines with its transaction speed, low fees, and appeal to developers creating scalable dApps, particularly in gaming and NFTs.

- Solana has shown resilience and growth, attracting major projects to its ecosystem.

- Each coin - BlockDAG, Ethereum, and Solana - offers a different value proposition, ranging from early growth potential to established infrastructure and performance.

- Readers are advised to conduct independent research before making any investment decisions in cryptocurrencies due to market volatility and risks involved.

Read Full Article

26 Likes

Bitcoinmagazine

438

JPMorgan Reports Record Profits for Bitcoin Miners in Q1

- Bitcoin mining companies in the U.S. posted record profits in Q1 2025, marking one of the best quarters on record.

- Four out of five tracked operators reported record revenue and profits.

- U.S.-listed miners generated $2.0 billion in gross profit, with average gross margins at 53%.

- MARA Holdings led in Bitcoin production but had the highest cost per coin at $72,600.

- IREN emerged as the top performer in gross profit with the lowest all-in cash cost per Bitcoin at $36,400.

- CleanSpark opted for capital discipline by not raising equity in Q1, contrasting with its peers.

- Total equity raised by the five tracked miners in Q1 dropped significantly to $310 million.

- Miners' power expenses increased to $1.8 billion, highlighting the energy-intensive nature of mining.

- JPMorgan remains optimistic, maintaining overweight ratings for CleanSpark, IREN, and Riot Platforms.

- The bank assigns neutral ratings to Cipher Mining and MARA among the tracked firms.

- The surge in profitability and controlled spending in 2025 marks a potential turning point for mining economics.

- 2025 could be significant for companies focusing on cost discipline and scaling production in the mining industry.

Read Full Article

26 Likes

Coindoo

357

Image Credit: Coindoo

Bitcoin’s Critical Support Level: What Happens If Price Falls Below $100K?

- BTC is testing the upper boundary of a long-standing price channel, with $100,000 as a critical support level.

- A move above $100,000 could signal further upside potential, while failure to hold this level might lead to a deeper correction.

- Analyst warns that if Bitcoin drops below $100,000, the likelihood of a downswing significantly increases with a potential retracement towards $78,500.

- Bitcoin has faced strong resistance near $110,000 but finds support around $100,000.

- A chart signals a looming risk, indicating a multi-month ascending pattern with $100,000 as a critical mid-range support.

- In case $100,000 breaks, the next significant support zone is much lower, posing a potential 20% downside risk.

- Bitcoin's volatile situation is influenced by geopolitical tensions, macroeconomic uncertainty, and mixed ETF inflows.

- Traders are monitoring for institutional support to stabilize price action amidst market uncertainty.

- The $100,000 level plays a crucial role in determining Bitcoin's short- to mid-term direction.

Read Full Article

21 Likes

Coindoo

143

Image Credit: Coindoo

Cardano and PEPE Signal Breakouts, While BlockDAG’s $299M Presale and Web3 Ecosystem Take the Lead

- Cardano (ADA) and PEPE coins are showing signs of potential breakouts, with ADA targeting $5.35 and PEPE approaching $0.000013 resistance level.

- BlockDAG has already raised $299 million and sold over 22.4 billion coins, demonstrating early strength with a mobile-first platform attracting 1.5 million users globally.

- ADA's chart indicates a possible 660% rise to $5.35, but its ecosystem development, particularly in DeFi protocols, remains slow, hindering broader adoption.

- PEPE is gaining momentum as whale wallets become more active and excitement grows, yet its value primarily relies on community support and lacks long-term utility.

- PEPE offers short-term trading appeal, while BlockDAG, powered by a Directed Acyclic Graph structure, delivers scalability in processing and is already in use with a mobile app.

- BlockDAG's presale success, raising $299 million with a current price of $0.0276 and supporting Ethereum-based dApps, showcases its strong financial traction.

- BlockDAG's X1 Miner app provides easy access to BDAG coins, boasting over 1.5 million users across 100 countries, demonstrating real-world usage and growth.

- While ADA and PEPE gear up for potential breakouts, BlockDAG is already leading with tangible products, global adoption, and financial success.

- BlockDAG's blend of usability, financial traction, and early execution sets it apart as a Web3 leader, poised to continue its growth and adoption.

- BlockDAG is ahead of the curve, delivering where others are still planning, making it a standout in the current crypto landscape.

Read Full Article

8 Likes

Cryptoticker

366

Image Credit: Cryptoticker

XRP Price Prediction: Can $2 Hold or Is More Downside Coming?

- XRP is currently trading around $2.15 and is showing signs of a potential rebound after testing the critical $2.00 support level.

- The $2.00 support has been tested three times in the past two weeks, forming bullish reversal patterns and indicating strong buying interest in that area.

- On the 2-hour chart, XRP is forming a triple bottom pattern around the $2.10–$2.00 range, accompanied by oversold indicators like the Relative Strength Index (RSI).

- The 200 EMA at approximately $2.24 is acting as a significant dynamic resistance, with immediate resistance levels at $2.25 and $2.30 if XRP breaks above the EMA.

- Failure to surpass the 200 EMA could lead XRP back towards $2.00 for a retest of the support level.

- If the $2.00 support holds, XRP might aim for $2.24–$2.30 in the short term, possibly offering a 7–10% upside.

- A breakout above the 200 EMA could signal a bullish continuation pattern and a retest of previous highs above $2.35.

- On the downside, if $2.00 breaks convincingly, XRP could face increased bearish pressure with potential downside targets near $1.85–$1.78 based on prior price consolidation.

Read Full Article

22 Likes

Coindoo

397

Image Credit: Coindoo

Gaming Company Makes History Investing $463M in Ethereum, Becomes Largest Publicly-Traded ETH Holder

- Gaming company SharpLink has invested $463 million in Ethereum at an average price of $2,626 per ETH.

- This investment makes SharpLink the second-largest publicly-traded ETH holder, behind only the Ethereum Foundation.

- SharpLink's CEO, Rob Phythian, views Ethereum as the core infrastructure for future digital commerce and decentralized applications.

- Over 95% of SharpLink's ETH holdings are actively staked or deployed in liquid staking protocols, contributing to Ethereum's network security and earning native yield.

- The company raised approximately $79 million through its $1 billion equity program, with the majority used for ETH purchases.

- Ethereum co-founder Joseph Lubin, also SharpLink's chairman, praised the institutional commitment to Ethereum, highlighting its importance in advancing digital asset legislation.

- SharpLink's aggressive ETH positioning aims to provide shareholders economic exposure to Ethereum and promote institutional focus on ETH-based yield strategies.

- Since their token accumulation, SharpLink's ETH-per-share metric has grown by 11.8%, indicating positive growth.

- As regulatory clarity increases and more institutions explore blockchain integration, SharpLink's move may set a precedent for public companies in digital asset allocation.

Read Full Article

23 Likes

Zycrypto

156

Image Credit: Zycrypto

Walmart, Amazon Consider Issuing Their Own Dollar-Pegged Digital Tokens As Stablecoin Mania Envelopes Big Tech

- Walmart and Amazon are exploring the idea of issuing their own US dollar-pegged stablecoins amid rising institutional adoption of stablecoins in the US.

- These stablecoins could help reduce merchant fees, as companies currently pay significant fees for credit card transactions to networks like Visa and Mastercard.

- Stablecoins could potentially save financial technology firms billions in fees associated with card payments, disrupting traditional financial institutions' dominance.

- One major advantage of stablecoin transactions is faster payment settlements compared to traditional card payments that take 1-3 business days.

- Both Walmart and Amazon are in the early stages of considering private coins or partnerships with third-party stablecoin providers for their stablecoin plans.

- The potential launch of stablecoins by these tech giants may hinge on the progress of the GENIUS Act, a legislation that aims to regulate stablecoin issuance in the US.

- If the GENIUS Act becomes law, it could set the stage for big companies like Walmart and Amazon to adopt stablecoins as an alternative to current payment systems.

Read Full Article

9 Likes

Coindoo

210

Image Credit: Coindoo

Bitcoin Trades Around All-Time Highs While Miner Revenues Lag Behind

- Bitcoin is trading around all-time highs, but miner revenues are not keeping pace.

- The Puell Multiple, a metric comparing miner revenue to the annual average, remains below 1.40, indicating potential undervaluation.

- Miners are not reaping proportional rewards from the price rally, suggesting external forces are at play.

- Institutional demand, spot Bitcoin ETFs, and reduced block rewards are impacting miner income and tight supply.

- Structural demand, not speculative hype, may be driving the current price rally.

- CryptoQuant's analysis indicates the current cycle could be only halfway through, with room for further expansion.

- If miner revenues rise in line with market demand, Bitcoin could reach new highs in the coming months.

- Bitcoin's near all-time high reflects strong momentum, but underlying fundamentals suggest more potential ahead.

Read Full Article

12 Likes

Coindoo

44

Image Credit: Coindoo

Peter Schiff Mocks Bitcoin After Israel-Iran Conflict Sends Gold Up and BTC Down

- Peter Schiff pointed out market reactions to Israel's military strike on Iran, highlighting gold's 0.85% climb as a safe-haven asset amid geopolitical risk.

- Bitcoin dropped by approximately 2% following the event, prompting Schiff to question its status as a digital version of gold.

- Schiff argues that Bitcoin lacks intrinsic value and historical reliability compared to gold during market stress, challenging popular crypto narratives.

- The contrasting price movements of gold and Bitcoin during crises intensify the debate over which asset provides better safe-haven protection.

- Bitcoin advocates believe in its limited supply and decentralized nature for long-term value, while Schiff emphasizes its volatility and speculative nature during crises.

- Schiff's criticism of Bitcoin's performance amidst the Israel-Iran conflict reflects the ongoing uncertainty in both crypto and traditional markets.

- Investors are swift to react to macro events, leading to significant price movements in various financial assets.

- The debate between gold and Bitcoin as safe-haven assets persists as market participants navigate through global economic and geopolitical uncertainties.

- Gold's stability and enduring status as a safe-haven asset receive renewed attention in times of global crisis such as the Israel-Iran conflict.

- Bitcoin's price volatility and correlation with market events have been subject to scrutiny by critics like Peter Schiff.

- Schiff's skepticism towards Bitcoin's comparison to gold stems from his belief in gold's superior qualities as a reliable store of value during turbulent times.

- Bitcoin's response to geopolitical events like the Israel-Iran conflict raises questions about its effectiveness as a hedge against market uncertainty.

- Bitcoin's advocates emphasize its digital scarcity and cryptographic security as key attributes that differentiate it from traditional safe-haven assets like gold.

- The ongoing market dynamics between gold and Bitcoin highlight the diverging views on their roles as safe-haven investments in the face of global challenges.

- Schiff's comments on Bitcoin reflect the broader discussions surrounding the asset's utility and performance in comparison to established safe-haven assets like gold.

- The debate surrounding Bitcoin and gold's efficacy as safe havens intensifies as global events shape market sentiments and investment strategies.

Read Full Article

2 Likes

Coindoo

415

Image Credit: Coindoo

Pi Coin Lost 50% of Its Value in the Past Month – What to Watch Out For

- Pi Coin has experienced a 53% drop in value in the past month, with the majority of the decline occurring in the first two weeks followed by stabilization.

- After reaching a peak of $1.11 in mid-May, Pi Coin quickly fell below $0.70, settling around $0.55 by the end of May with minor fluctuations since then.

- Despite showing signs of stability, the lack of upward movement indicates ongoing market uncertainty, with occasional volume spikes not enough to counter broader selling pressure.

- Key points to monitor going forward include the stability of the support zone at $0.52-$0.55, breakout attempts above $0.60 with strong volume, and potential external catalysts like listings or ecosystem expansion.

- Pi Coin's recent monthly loss highlights profit-taking and decreasing investor confidence, nearing a potential support level but requiring sustained support and positive market developments for confirmation.

Read Full Article

25 Likes

Cryptoticker

250

Image Credit: Cryptoticker

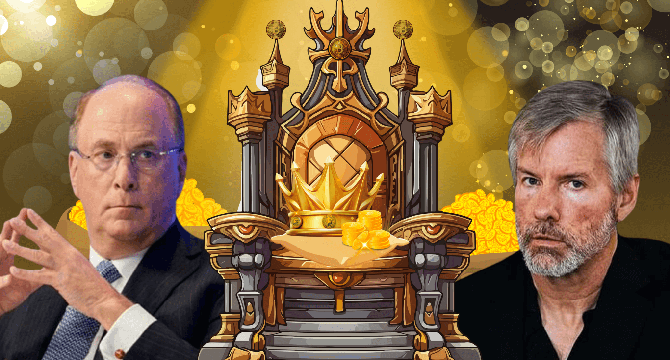

BlackRock Goes All In: From Anti-Crypto to Competing for Bitcoin Supremacy

- BlackRock and Strategy Inc. are in a race to become the world's largest corporate holder of Bitcoin.

- BlackRock, previously a skeptic, is now competing with Strategy Inc. for dominance in the crypto space.

- Both companies hold over half a million BTC each, raising the question of who will claim the crypto crown first.

- BlackRock's CEO, Larry Fink, made a significant pivot from dismissing Bitcoin to managing the iShares Bitcoin Trust (IBIT).

- Key milestones in BlackRock's crypto journey include filing for a spot Bitcoin ETF, approval of IBIT, and surpassing $70 billion in AUM with around 667,000 BTC holdings.

- BlackRock aims to become the top crypto asset manager worldwide by 2030.

- Strategy Inc., led by Michael Saylor, remains a strong player with approximately 582,000 BTC held on its balance sheet.

- Strategy Inc. was the first corporate buyer of BTC, converted its treasury into Bitcoin, and rebranded from MicroStrategy to Strategy Inc.

- In June 2025, Strategy launched a BTC-backed preferred stock offering to raise nearly $1 billion for further Bitcoin purchases.

- The competition and approaches differ between BlackRock through regulated ETFs and Strategy Inc. with a maximalist balance sheet strategy.

- The race between BlackRock and Strategy Inc. is crucial for the mainstream legitimacy of crypto and the perception of Bitcoin as a strategic asset rather than speculation.

- BlackRock contributes regulatory credibility and institutional capital, while Strategy Inc. brings conviction and a bold balance sheet approach to Bitcoin.

- The outcome of this competition could influence how corporations, ETFs, and nations adopt Bitcoin as a strategic reserve asset.

- This race signifies the institutionalization of Bitcoin, reshaping the future of digital finance and benefiting the entire ecosystem.

- The crypto market is evolving significantly, with a focus on strategic Bitcoin holdings and mainstream acceptance.

Read Full Article

15 Likes

Bitcoinmagazine

165

Where Could Bitcoin Peak This Cycle?

- Bitcoin's potential peak in this market cycle is analyzed using various on-chain valuation models and cycle timing tools.

- Price Forecast Tools like Top Cap, Delta Top, and Terminal Price project peak valuations ranging from $80k to over $250k.

- The MVRV ratio suggests room for significant upside as it nears 3.5, historically peaking close to a value of 4 in major cycles.

- Analysis of BTC Growth Since Cycle Lows indicates a potential peak in about 130 days, estimating a $78k realized price.

- Combining a projected $78k realized price with a conservative MVRV target of 3.5 leads to a potential Bitcoin peak of $273,000.

- Historical data and on-chain evidence suggest that a peak between $150k to $200k is realistic, but $273,000 is within the realm of possibility.

- Forecasting Bitcoin's exact peak remains uncertain, emphasizing the importance of reacting to data and using on-chain tools to inform decisions.

- The article advises against rigid price level predictions and recommends staying flexible to take profits based on broader ecosystem signals.

- Information in the article is for informational purposes only and does not constitute financial advice; it encourages conducting individual research before investment decisions.

- For more in-depth analysis, technical indicators, real-time alerts, and community access, you can visit BitcoinMagazinePro.com.

Read Full Article

9 Likes

Coindoo

330

Image Credit: Coindoo

Coinbase Lists Fartcoin and Two Other Popular Altcoins

- Coinbase has listed PancakeSwap (CAKE), Subsquid (SQD), and Fartcoin (FARTCOIN) on its platform.

- The new tokens can be bought, sold, converted, sent, received, or held on Coinbase.

- CAKE is an ERC-20 token on Ethereum, SQD runs on Arbitrum - an Ethereum Layer 2 solution, and FARTCOIN is based on the Solana blockchain as an SPL token.

- Coinbase enabled perpetual futures trading for Fartcoin on both Coinbase International Exchange and Coinbase Advanced.

- The exchange updated its asset roadmap to potentially include Sonic (S) as a new listing in the future.

- Worldcoin (WLD) support for send/receive features on Ethereum, Optimism, and the World Chain network was expanded by Coinbase.

- Coinbase aims to cater to market demand by offering a wider range of tokens across major blockchain networks.

- Coinbase's listing of Fartcoin indicates growing interest in memecoins among derivatives traders.

- Overall, Coinbase is expanding its ecosystem to provide access to a broader selection of tokens.

- The newly added assets are live on Coinbase's platform, including mobile apps for iOS and Android.

Read Full Article

19 Likes

Zycrypto

245

Image Credit: Zycrypto

The Launch of SoloChain: The World’s First Blockchain Specifically Designed for Agentic Transactions and DePIN Mining

- SoloChain is launched as the world's first blockchain designed for agentic transactions and DePIN mining.

- It focuses on real-world asset integration, equitable token distribution, and smart automation.

- The platform is built on three pillars: Transaction Mining, DePIN Mining, and Agentic AI Automation.

- Transaction Mining on SoloChain offers equitable rewards without the need for expensive hardware, making token distribution more democratic.

- Users receive $SOLO tokens for engaging in the network, emphasizing fairness and transparency.

- DePIN Mining enables the tokenization of decentralized physical infrastructure assets like GPUs and weather sensors on SoloChain.

- SoloChain differentiates itself by supercharging DePIN assets with a native execution layer that rewards engagement and fosters real-world use.

- Agentic AI on SoloChain aims to automate network operations such as reallocating assets for optimal yield and expanding the ecosystem.

- SoloChain is designed for scalable deployment, offering an execution layer for decentralized physical infrastructure like IoT devices.

- The platform highlights a total DePIN market cap exceeding $50 billion and over 13 million connected devices.

- Mining.fun, SoloChain's testnet, allows users to create tokens through transaction mining, emphasizing fairness and sustainability over speculative behavior.

- Mining.fun prioritizes long-term community participation and discourages predatory practices, providing a platform for memecoins and utility tokens to thrive.

Read Full Article

14 Likes

Zycrypto

317

Image Credit: Zycrypto

Bitcoin Solaris Emerges as the Ultimate ‘Second Chance’ for Missed Millionaires

- Bitcoin's recent rally following Donald Trump's support has reignited interest in cryptocurrency.

- Bitcoin Solaris (BTC-S) offers a 'second chance' for missed opportunities in the crypto market.

- BTC-S is a modern blockchain optimized for speed, accessibility, and scalability.

- It utilizes a dual-consensus mechanism, dynamic block sizes, and smart contract support.

- BTC-S is energy-efficient and allows mining through smartphones with upcoming Solaris Nova app.

- The ongoing presale of BTC-S has seen significant momentum and raised funds.

- The network rewards contributors based on device efficiency and network demand.

- BTC-S has undergone audits and prioritizes transparency.

- Bitcoin Solaris presents a unique opportunity for wealth-building in the crypto space.

- Readers are advised to conduct independent research before engaging in any investment activities related to BTC-S.

Read Full Article

19 Likes

For uninterrupted reading, download the app