DeFi News

TronWeekly

335

Image Credit: TronWeekly

Nasdaq-Listed VivoPower Sets XRP Treasury Plan with $121M Raise Led by Saudi Prince

- VivoPower raised $121M led by Saudi Prince Abdulaziz to fund its XRP treasury plan.

- The company will buy XRP and build XRPL infrastructure after issuing 20M shares at $6.05.

- Former Ripple Asia executive Adam Traidman joins VivoPower as chairman of its advisory board.

- VivoPower aims to become the first publicly traded firm to structure its corporate treasury around XRP.

Read Full Article

20 Likes

Tokenhell

290

Image Credit: Tokenhell

How to Spot and Avoid Fake Crypto Airdrops – A Comprehensive Guide

- Crypto airdrops are a way for Web3 projects to gain users but fake airdrops can be conducted by scammers to drain wallets.

- Key red flags for spotting fake airdrops include no announcement from official channels, requests for seed phrases or private keys, upfront fee payments, suspicious websites, urgent language and poor grammar, and fake social proof.

- To avoid falling victim to fake airdrops, always confirm legitimacy from official project channels, never share seed phrases or private keys, ignore requests for upfront payments, verify website URLs, be cautious of urgent language and poor grammar, and do independent research on social proof.

- Being cautious and verifying the legitimacy of crypto airdrops is crucial to avoid falling prey to scammers in the crypto space.

Read Full Article

17 Likes

Bitcoinsensus

349

Image Credit: Bitcoinsensus

BlackRock Aims for 10% of Circle: USDC, Stablecoins, and the DeFi Power Shift

- BlackRock is considering a $600 million investment to acquire a 10% stake in USDC issuer Circle.

- The move signifies increasing institutional interest in stablecoins driven by factors like bond yields and regulatory clarity.

- BlackRock already manages the reserves for USDC and the potential investment could lead to a shift from manager to owner.

- This investment by BlackRock aligns with a larger trend of traditional finance seeking ownership in stablecoin infrastructures, indicating a shift in the DeFi landscape.

Read Full Article

20 Likes

Dev

187

Image Credit: Dev

🥇 XBANKING — The World’s #1 DeFi Aggregator Chosen by Users

- XBANKING is a leading DeFi aggregator that simplifies yield opportunities by providing a streamlined interface.

- It aggregates data from 300+ protocols across 40+ blockchains, showcasing the most profitable liquidity pools.

- Users can connect their wallets, choose assets, explore top yield pools, deposit assets, and track performance via XBANKING.

- XBANKING offers security features, automated strategies, and maximizes user profits through rebalancing, AI-powered selection, and cross-chain optimization.

Read Full Article

11 Likes

Cryptonews

353

VivoPower Nets $121M, Led by Saudi Prince, to Pioneer First XRP Treasury Model

- VivoPower raises US$121 million to launch the world’s first corporate treasury model anchored on XRP cryptocurrency.

- Strategic investment led by Saudi Prince aims to accelerate blockchain innovation and strengthen VivoPower’s XRP-focused initiatives.

- Funds will support DeFi development on the XRP Ledger, repay debt, and spin off non-core business units.

- VivoPower plans to establish a digital asset treasury anchored on XRP, develop a DeFi team focused on the XRP Ledger, pay off existing debt, and spin off non-core units.

Read Full Article

21 Likes

TronWeekly

241

Image Credit: TronWeekly

Grayscale launches AI crypto sector with 20 tokens, promising disruption

- Grayscale has launched the Artificial Intelligence Crypto Sector, marking a significant development in the world of digital assets.

- The new sector includes 20 tokens with a total market capitalization of $21 billion and covers a wide range of AI-specific subsectors.

- Decentralized AI development aims to counterbalance centralized control, offering potential solutions to concerns over bias and censorship.

- By introducing this new sector, Grayscale provides investors with a fresh framework to monitor and analyze prospects for AI-driven blockchains, signaling long-term growth potential.

Read Full Article

14 Likes

Medium

331

Image Credit: Medium

Mastering Concentrated Liquidity Arbitrage

- Concentrated liquidity pools in DeFi, like Uniswap V3, present challenges beyond constant product AMMs.

- Navigating concentrated liquidity demands sophisticated algorithms due to the sparse distribution of liquidity.

- Arbitrader framework supports concentrated liquidity by developing new mathematical models.

- Iterative algorithms are crucial for navigating complex liquidity landscapes efficiently and profitably.

- Arbitrader architected as a framework for handling various AMM types, including concentrated liquidity pools.

- Concentrated liquidity alters the arbitrage calculation paradigm by fragmenting liquidity into discrete ranges.

- Challenges include non-uniform liquidity distribution, dynamic range boundaries, gas optimization, and precision preservation.

- Efficient tick discovery and relationship analysis between pools play key roles in arbitrage algorithms.

- Optimal arbitrage in concentrated liquidity involves iterative price convergence rather than direct mathematical calculations.

- Arbitrader's systematic approach integrates concentrated liquidity trade evaluation with specialized systems for DeFi trading.

Read Full Article

19 Likes

Kotaku

35

Image Credit: Kotaku

GameStop Just Bought Half A Billion Dollars Worth Of Bitcoin

- GameStop has purchased over 4,500 Bitcoin, estimated to be at least $500 million, causing a drop in stock prices.

- Earlier this year, GameStop announced plans to invest $1.3 billion in cryptocurrency and added Bitcoin as a treasury reserve asset.

- The announcement received mixed reactions with confusion and bemusement from the public.

- Analysts critique GameStop's strategies, mentioning accelerated store closures and lack of specificity in plans.

Read Full Article

2 Likes

TheNewsCrypto

102

Martini Market Is Redefining DeFi Forecasting on the XRP Ledger

- XRPL is evolving into a hub for DeFi innovation, with Martini Market leading the way as the first decentralized prediction market protocol on XRPL.

- Martini Market enables users to speculate on real-world events in a secure and fast environment, leveraging XRP Ledger's speed, low fees, and liquidity.

- The platform is community-focused, allowing users to create or participate in prediction markets using XRP or other XRPL-based assets, powered by its utility token $MRT.

- With XRPL's growth and Martini Market's milestones, the protocol aims to revolutionize prediction markets on the network, offering utility to XRP holders and DeFi users alike.

Read Full Article

6 Likes

Cryptoticker

210

Image Credit: Cryptoticker

Cardano News Today: XRP DeFi on Cardano? Hoskinson Teases Game-Changing Move

- Cardano founder Charles Hoskinson sparked speculation about a possible partnership between Cardano and XRP Ledger for XRP DeFi integration.

- The integration could bring XRP's liquidity and user base to Cardano's smart contract ecosystem, potentially unlocking up to $140 billion in value.

- Cardano is set to integrate Ripple's upcoming stablecoin RLUSD on its privacy-focused sidechain Midnight, enhancing Cardano's DeFi infrastructure.

- This cross-chain initiative may impact Cardano's price positively, with short-term targets between $0.60-$0.75 and a long-term bullish outlook if it becomes a leading DeFi Layer 1 platform.

Read Full Article

12 Likes

Medium

31

Image Credit: Medium

Signal on Swarm

- Signal, despite secure message content, exposes messaging activity metadata, posing risks for journalists and users due to central server reliance.

- Swarm introduces a new messaging model by storing encrypted messages anonymously across a decentralized network.

- Messages in Swarm are broken into indistinguishable chunks for secure, private communication without revealing metadata.

- Swarm's Trojan Chunks allow for asynchronous, real-time messaging without leakage of any metadata or identification.

- Trojan Chunks disguise private messages as regular network data, ensuring secure communication without visibility.

- Swarm uses decentralized storage and encryption protocols for forwarding secrecy, mutual authentication, and deniability.

- Swarm's Double Ratchet mode ensures encrypted messages with unique keys for forward and future secrecy.

- Swarm's decentralized outbox feeds enable posting and retrieval of encrypted messages with randomized indexing for privacy.

- Swarm's architecture combines cryptographic security with decentralized infrastructure for end-to-end encryption and leakage-proof messaging.

- This privacy-focused system allows for instant, censorship-resistant, and leak-proof messaging while preserving user anonymity.

Read Full Article

1 Like

Bitcoinsensus

313

Image Credit: Bitcoinsensus

XRP DeFi Could Launch on Cardano, Says Hoskinson | Cardano DeFi News

- Cardano plans to integrate DeFi capabilities into the XRP Ledger via a computational layer.

- The integration could unlock over $140 billion in dormant value across XRP and Bitcoin ecosystems.

- Cardano and Ripple are showing signs of warming up to a strategic collaboration after years of tension.

- The potential multi-billion-dollar integration could revolutionize the DeFi space by bridging networks and introducing new functionalities.

Read Full Article

18 Likes

Cryptopotato

304

Image Credit: Cryptopotato

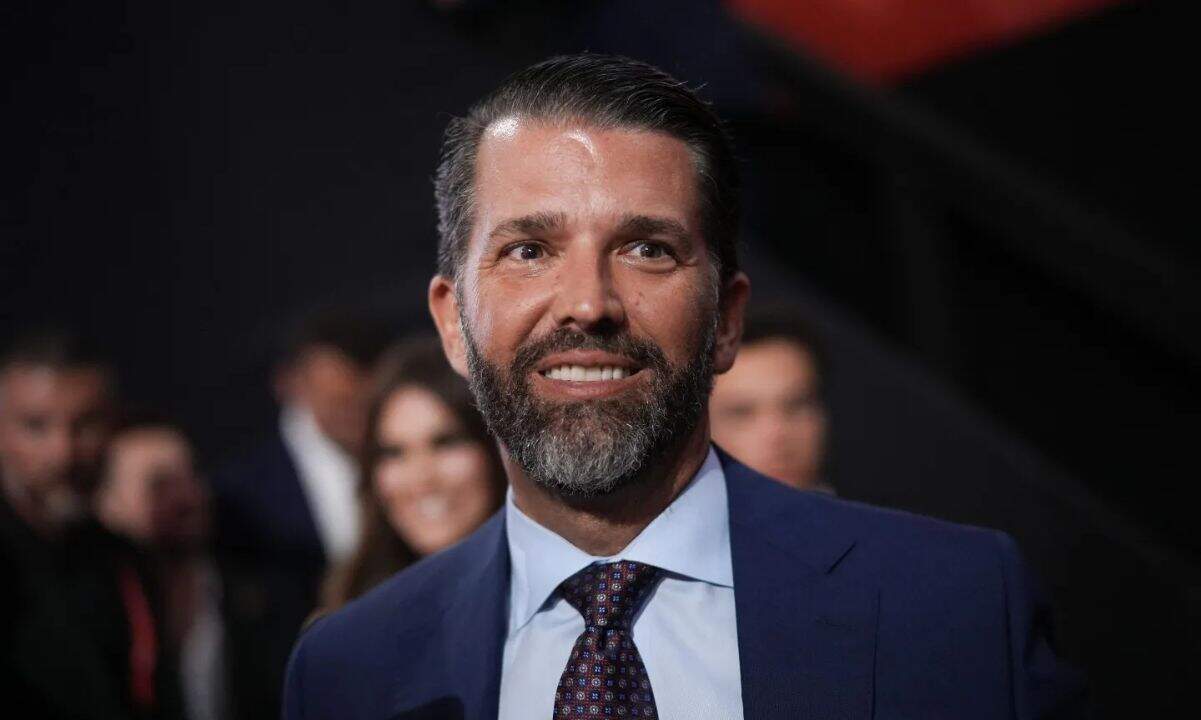

Donald Trump Jr. Unveils $2.5B Bitcoin Moon Shot at Vegas Conference

- Donald Trump Jr. expressed bullish sentiments on Bitcoin and crypto at the Bitcoin 2025 conference in Las Vegas.

- He announced the creation of a $2.5 billion Bitcoin treasury through the Trump media group, TMGT.

- Senator Cynthia Lummis mentioned Trump's support for the Bitcoin Act, which aims to acquire 1 million BTC over five years for a strategic reserve.

- David Sacks, the White House AI and crypto czar, emphasized Bitcoin as the 'financial system of the future' during the conference.

Read Full Article

18 Likes

TheNewsCrypto

354

Bitget Launches BGUSD Stablecoin Offering, Bridges DeFi and TradFi

- Bitget has launched a new stablecoin called BGUSD, backed by real-world assets, offering up to 5% APY with an early bird promo of 5% yield for 30 days.

- Users can access BGUSD using stablecoins like USDC or USDT, swap back 1:1 for USDC, and earn passive income without locking up their funds.

- Bitget aims to bridge the gap between traditional finance and the crypto world by providing tools that are fresh but based on solid financial fundamentals.

- In addition to BGUSD, Bitget introduced a 1 million BGB staking pool offering a 5% APY with a 90-day lock-up period, limiting 2,000 BGB per user and providing access to airdrops.

Read Full Article

21 Likes

Changelly

98

Image Credit: Changelly

What Is DeFi 2.0 and Why It Matters

- DeFi 2.0 aims to address the flaws of DeFi 1.0 by improving liquidity management, reducing risk, and introducing more sustainable models.

- It focuses on protocols owning their liquidity, introducing bonding mechanisms, self-repaying loans, and more efficient treasury management.

- DeFi 2.0 aims to create a more sustainable and efficient decentralized finance ecosystem by reducing dependence on external rewards.

- Key innovations in DeFi 2.0 include improved scalability, enhanced security, DAO governance, cross-chain interoperability, and better user experience.

- Projects like OlympusDAO, Tokemak, Alchemix, and Abracadabra Money are implementing concepts of DeFi 2.0 such as protocol-owned liquidity and self-repaying loans.

- DeFi 3.0 is expected to address gaps in DeFi 2.0, such as real-world asset tokenization, AI-driven protocols, better cross-chain tools, regulations, and innovative liquidity provision models.

- DeFi 3.0 will build on the advances of DeFi 2.0, offering smarter automation, increased access to markets, and improved risk management tools while maintaining decentralization.

- It is important for users to stay informed about the evolving DeFi landscape, potential risks, and regulatory developments to make informed decisions in the crypto space.

- Disclaimer: The information provided is the author's opinion and not financial advice. Investors should conduct thorough research and consider various viewpoints before making investment decisions.

Read Full Article

5 Likes

For uninterrupted reading, download the app