DeFi News

99Bitcoins

8

Is Jupiter (JUP) DEX On Solana Ready For a 100% Surge After Key Breakout?

- Jupiter (JUP) DEX on Solana is trending and could surge 100%, retesting 2024 highs and rewarding token holders.

- Solana has proven its strength over the past three years, rising in prominence and hosting top cryptocurrencies.

- Jupiter enables traders to find the best token prices within its ecosystem, distinguished by standout projects like Raydium and Orca.

- Jupiter's expansion with Jupiter Lend and Universal Send feature aims to solidify its DeFi presence and drive crypto adoption.

Read Full Article

Like

Medium

103

Reconstructing Identity Verification: A Decentralized Framework to Protect Privacy Without…

- The article introduces the Decentralized Identity Token Framework (DITF) as a privacy-preserving identity architecture to protect user privacy.

- It addresses the issues with centralized identifiers and the lack of meaningful user consent in online platforms.

- DITF aims to decouple identity from surveillance and provides rapid-response tools for account access control.

- The framework operates on a dual structure, supports structured user rights and appeal processes, and emphasizes decentralized accountability.

Read Full Article

6 Likes

TheNewsCrypto

305

Jupiter (JUP) Jumps 15% After Launching High-LTV DeFi Lending Protocol

- Jupiter (JUP) price surged 15.45% to $0.6109 following the launch of Jupiter Lend, introducing 90% LTV and 0.1% fees in DeFi.

- Market cap and trading volume increased by 15.44% and 254.44% respectively, pushing Jupiter's valuation to $1.77 billion with a total volume of $179.65 million.

- JUP has 2.89 billion tokens in circulation out of 6.99 billion total, with a max supply of 10 billion; the price spike followed the Jupiter Lend announcement at the Solana Accelerate conference.

- Technical analysis suggests a bullish continuation for JUP as RSI nears overbought territory, forming a golden cross at $0.5732 and potential short-term targets at $0.650 or $0.540.

Read Full Article

18 Likes

Hackernoon

300

Image Credit: Hackernoon

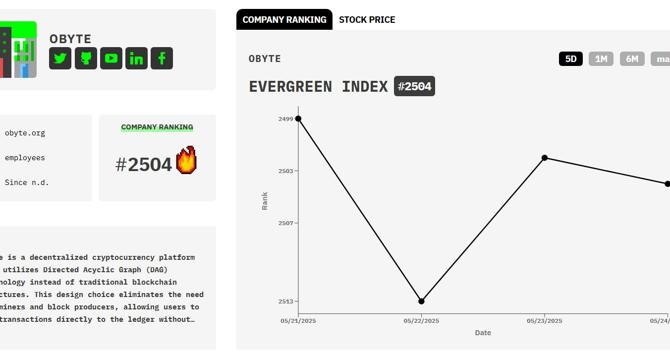

Meet Obyte: HackerNoon Company of the Week

- Obyte is the HackerNoon Company of the Week, known for its decentralized cryptocurrency platform using Directed Acyclic Graph (DAG) technology.

- Obyte offers features like programmable smart contracts, self-sovereign identity, Blackbytes currency, and textcoins for easy crypto transactions.

- The partnership between Obyte and HackerNoon includes educational content on open banking and crypto-related topics.

- HackerNoon's Business Blogging Program allows brands to publish content on HackerNoon for backlinks, SEO authority, and global reach.

Read Full Article

18 Likes

Medium

273

Image Credit: Medium

Cypherpunks: The Crypto Rebels Behind Bitcoin and Digital Freedom

- Alan Turing's contributions to cryptography, particularly in breaking the German Enigma, are believed to have shortened World War II and saved many lives.

- Diffie and Hellman introduced public key cryptography in 1967, revolutionizing the field of cryptography.

- The Cypherpunks, influenced by figures like Timothy May and Eric Hughes, advocated for privacy rights and developed cryptographic software for public distribution.

- The emergence of Bitcoin in 2008, following unsuccessful attempts at digital cash within the Cypherpunk community, marked a significant moment in the movement.

- Bitcoin's creation by Satoshi Nakamoto exemplifies Cypherpunk ideals of decentralized currency and resistance to central control.

- While Bitcoin provides tools for economic sovereignty and privacy, concerns arise about its evolution and potential divergence from Cypherpunk principles.

- The ongoing debate within the Bitcoin community, involving figures like Jack Dorsey and Amir Taaki, reflects a tension between institutional adoption and its revolutionary roots.

- Modern-day Cypherpunks like Edward Snowden and Moxie Marlinspike continue to champion privacy and decentralized technologies in the face of surveillance.

- The Cypherpunk movement's ideals, focused on digital resistance and privacy rights, remain pertinent in current discussions on data control and internet freedom.

- Privacy, a core Cypherpunk value, continues to be a crucial battleground in the digital age, with advancements and challenges shaping its future.

Read Full Article

16 Likes

Medium

215

Image Credit: Medium

AI, DeFi, and the Path to Decentralised Intelligence

- Decentralised Finance (DeFi) offers high-yield opportunities, with $35.2 billion TVL, and strategies like yield farming.

- AI tokens and DeFi are merging to create a new frontier for investors, combining technology and financial innovation.

- The growth of AI tokens and projects driving decentralised AI are enhancing DeFi through automation, analytics, and scalability.

- AI is revolutionising the crypto landscape by enabling scalable solutions, real-time data processing, and advanced algorithms.

- AI spending is projected to reach $300 billion in 2025, highlighting the demand for transparent and accessible AI ecosystems.

- AI tokens reflect robust growth, with a market cap growing from $2.7 billion in 2023 to $39 billion in 2025.

- Their volatility, with reported 10–20% daily swings, makes holding risky, but DeFi's protocols offer a solution for passive income.

- Technological breakthroughs, economic incentives, and cultural shifts have driven the rise of AI tokens, making them a focal point of crypto enthusiasm.

- AI tokens revolutionise DeFi through automated trading, predictive analytics, governance optimization, and yield farming strategies.

- Integration of AI tokens into DeFi introduces risks due to substantial price fluctuations, regulatory concerns, and market uncertainties.

Read Full Article

12 Likes

Medium

35

Image Credit: Medium

Reclaiming Digital Privacy: How MaskNumber Is Reinventing SMS Verification for the Crypto Era

- MaskNumber is a privacy-first platform offering temporary phone numbers for SMS verification using cryptocurrency, aiming to protect users' anonymity and control.

- Users can access MaskNumber through a Telegram bot or a browser-based dApp without the need for KYC, identity verification, or personal data.

- The platform addresses the issue of centralized platforms compromising privacy for services like SMS verifications and enables users to stay anonymous while accessing online accounts.

- MaskNumber incorporates a community-focused revenue model, allocating half of the platform revenue to eligible token holders, promoting sustainability and rewarding supporters.

Read Full Article

2 Likes

Global Fintech Series

273

Image Credit: Global Fintech Series

Blockchain Is Revolutionizing Cross-Border Payments for Enterprises

- Cross-border payments play a crucial role in international commerce, but are often complex and costly for businesses due to multiple factors such as currency conversion and regulatory compliance.

- The cross-border payments market is projected to reach $290 trillion by 2030, prompting the adoption of blockchain-based solutions by enterprises to streamline global money movement.

- Blockchain technology offers faster, cheaper, and more transparent payment options through its decentralized nature and near-instant settlement capabilities.

- Blockchain redefines cross-border payments by enabling direct transactions between parties, reducing operational costs, and accelerating settlement times to seconds.

- Permissioned decentralized finance (DeFi) models could lower transaction costs by up to 80% compared to conventional methods, enhancing efficiency in cross-border transactions.

- Major organizations like Visa, Shopify, and PayPal are leveraging blockchain and stablecoins to facilitate cross-border transactions, signaling mainstream acceptance of these technologies.

- Different types of blockchain solutions, including public, private, consortium, and hybrid blockchains, address various challenges in cross-border payments with distinct features and benefits.

- Blockchain enhances security, data integrity, cost efficiency, rapid settlements, transparency, and auditability in cross-border transactions, reshaping the future of payment systems.

- The adoption of blockchain technology in cross-border payments is gaining momentum, with financial institutions, FinTechs, and central banks exploring its scalability and operational advantages.

- Central banks are increasingly considering launching central bank digital currencies (CBDCs) within the next five years, underscoring the confidence in blockchain's role in modernizing cross-border transactions.

Read Full Article

16 Likes

TechBullion

242

Image Credit: TechBullion

The Convergence of Traditional Finance and Blockchain: What Developers Need to Know

- The convergence of traditional finance and blockchain technology is creating opportunities for developers to bridge the old and the new in the financial services industry.

- Blockchain technology, with its decentralized and secure nature, is reshaping financial market infrastructure and services, enabling innovation in sectors like decentralized finance (DeFi).

- DeFi, operating without intermediaries, offers various financial services like lending, derivatives, payments, and asset management through smart contracts, presenting opportunities for developers to explore.

- Major banks are recognizing the significance of blockchain and digital assets, investing in custody solutions, retail crypto offerings, institutional tools, tokenization platforms, and CBDC development.

- Developers play a crucial role in creating infrastructure for secure storage, transaction monitoring, governance support, compliance tools, and integration between old and new systems.

- Tokenization of assets on the blockchain opens up liquidity for traditionally illiquid assets, allowing fractional ownership, automation, and global secondary markets.

- Blockchain is revolutionizing payment rails and clearing systems to enable faster, cheaper, and more accessible value transfers across borders, with opportunities for developers to enhance financial transmission.

- Understandably complex regulations around crypto and decentralized technologies require developers to stay updated and ensure compliance while identifying areas for innovation and growth.

- The intersection of blockchain and traditional finance presents numerous opportunities for developers to bridge gaps, create innovative solutions, and pursue successful careers in fintech.

- By mastering blockchain fundamentals, gaining financial services domain knowledge, and staying informed about regulatory developments, developers can capitalize on the evolving landscape of financial technology.

Read Full Article

14 Likes

Medium

4

Image Credit: Medium

Smart Privacy: Balancing Blockchain Transparency with Data Protection through Oasis Protocol

- The pressing need for solutions that balance blockchain transparency with data protection has led to the emergence of Oasis Protocol as a leader in smart privacy.

- Smart privacy, championed by Oasis, allows for customizable levels of confidentiality within blockchain ecosystems, catering to diverse use cases in Web3 applications.

- Unchecked blockchain transparency poses risks such as exposing user transaction history, trading strategies in DeFi, and leaking sensitive data in healthcare.

- Oasis Protocol integrates Sapphire, OPL, and ROFL to deliver smart privacy, enabling developers to build secure, user-centric dApps across Web3 and AI applications.

- Sapphire, as the confidential Ethereum Virtual Machine, empowers developers to build EVM-based dApps with inherent privacy features, enhancing security on public blockchains.

- OPL acts as a bridge to extend Sapphire's privacy features to other EVM-compatible blockchains, ensuring cross-chain compatibility without compromising confidentiality.

- ROFL enables off-chain execution of complex computations like AI workloads in trusted environments, enhancing scalability and privacy for resource-intensive applications.

- Oasis Protocol's smart privacy framework addresses the blockchain privacy paradox by offering a scalable, flexible, and developer-friendly solution, attracting enterprises and developers demanding security and usability.

- By fostering innovation and offering grants for privacy-focused dApps, Oasis Protocol encourages developers to explore novel use cases, expanding the Web3 ecosystem.

- In summary, Oasis Protocol's smart privacy framework sets a new standard for data protection in Web3, emphasizing the importance of balancing confidentiality with blockchain's transparent nature.

Read Full Article

Like

Dev

22

Image Credit: Dev

Discover Trending Crypto Tokens with GMGN.AI API: A Complete Developer Guide

- The GMGN.AI API offers access to trending token data across major blockchains like Ethereum, Solana, Base, BSC, and Tron with a focus on smart money tracking and safety filters.

- Developers need to implement appropriate request handling solutions for network protection as the API is secured with advanced measures like Cloudflare protection.

- Key features include multi-chain support, various sorting criteria, safety filters for honeypot detection, flexible time periods for trending data, and insights on smart money activities.

- Basic parameters for the API include supported chains, time periods, sorting criteria, and direction for data ordering.

- Real-world examples showcase token discovery, high-volume token scanning, smart money analytics, and an enterprise-grade API client for production use.

- Best practices cover robust error handling, request rate limiting, and data caching strategies for efficient API utilization.

- The GMGN.AI API's versatility in providing real-time data facilitates the building of trading tools, portfolio trackers, and market analysis applications in the cryptocurrency space.

- Developers are advised to leverage safety filters, smart money metrics, error handling, rate limiting, and multiple sorting criteria when utilizing the API for comprehensive analysis.

- Overall, the GMGN.AI API serves as a valuable resource for those looking to stay informed and capitalize on trends in the dynamic crypto market.

- Utilizing the API for various applications such as trading bots, portfolio management, and market analysis can enhance decision-making and performance in the cryptocurrency space.

- Share your experiences and use cases of the GMGN.AI API to enhance collaboration and insights in cryptocurrency development and trading.

Read Full Article

1 Like

Coinpedia

112

Polkadot Price Prediction 2025, 2026 – 2030: Will DOT Price Cross $10?

- Polkadot price is currently at $4.57 with a potential to reach $10.40 in 2025 and $78.98 by 2030.

- Recent upgrades and staking yield have boosted Polkadot's price, aiming for $10 milestone with a move above $8.5.

- The integration of Lido for liquid staking on Moonbeam and Moonriver platforms could influence Polkadot's trajectory over the next few years.

- By 2026, Polkadot's price is projected to range between $5.20 and $15.60, with an average of $10.40.

- The Polkadot ecosystem developments and increased parachain rollouts are expected to drive the token price to $23.40 by 2028.

- Various market analysis firms predict different average targets for Polkadot, with potential highs up to $58.88 by 2030.

- CoinPedia's Polkadot price prediction anticipates a price range of $3.47 to $10.40 in 2025, influenced by new parachains and investor sentiments.

- Polkadot is not an ERC-20 token but a digital asset built on the Polkadot blockchain, offering profit-making potential in the long term.

- DOT can be traded on various exchanges like Binance, FTX, Huobi, and Kraken for interested investors.

- Overall, the future of Polkadot seems promising with potential growth driven by ecosystem enhancements and market trends.

Read Full Article

6 Likes

Cryptopotato

130

Image Credit: Cryptopotato

OKX Launches xBTC on Aptos Blockchain to Enhance Bitcoin-Backed DeFi

- OKX is launching xBTC, a wrapped version of Bitcoin on the Aptos blockchain, allowing users to access wrapped BTC without minting or redemption fees.

- xBTC is backed 1:1 by bitcoins held in OKX's custody, offering users the ability to mint xBTC on OKX, deposit, or withdraw to the blockchain starting May 22.

- The launch of xBTC aims to enhance Bitcoin and Aptos DeFi utilities, leveraging the $1 billion TVL DeFi ecosystem on the Aptos chain.

- OKX plans to start a special campaign for xBTC on May 23 to enable deeper integrations across the Aptos ecosystem, partnering with various decentralized platforms.

Read Full Article

7 Likes

Cryptonews

4

Pantera’s Santori Hails DeFi-Driven Solana Strategy as Superior to ETFs

- Pantera Capital's Marco Santori praises DeFi Development Corp's Solana strategy for engaging in staking, DeFi, and liquidity provision, offering a dynamic alternative to traditional ETFs.

- DeFi Dev Corp can generate returns through DeFi participation, unlike ETFs that are restricted from staking in the US.

- Pantera invested US$9.6M (AU$14.6M) in Solana, holding over 400,000 SOL, with a focus on active participation in on-chain activities.

- Solana's recent Alpenglow upgrade and positive price performance, with SOL trading at US$179.05 (AU$279), further highlight the significance of DeFi-driven strategies.

Read Full Article

Like

99Bitcoins

76

Cetus Protocol on Sui Network Hacked and Prices Tank: Everything You Need To Know

- Cetus Protocol, a DEX on the Sui Network, was hacked, losing over $230 million.

- Hackers targeted SUI-denominated liquidity pools, causing CETUS and SUI prices to drop significantly.

- Approximately $160 million of the stolen funds has been reportedly recovered and frozen by Cetus Protocol.

- Team and community are investigating the incident, and Cetus Protocol has frozen its contracts to prevent further losses.

Read Full Article

4 Likes

For uninterrupted reading, download the app