Ethereum News

TronWeekly

431

Image Credit: TronWeekly

Ethereum (ETH) Buy-Sell Ratio Drops, Raising Odds of Near-Term Correction

- Ethereum's Taker Buy-Sell Ratio 14-day average has decreased, indicating increased selling activity.

- Key resistance for Ethereum remains at $2,700, while strong support is seen around $2,200 if selling pressure persists.

- Analyst Ted Pillows identifies a bullish pattern on the 12-hour chart, with a close above $2,700 potentially triggering a move towards $3,000.

- Market analysis reveals that Ethereum is trading under a strong resistance zone, with uncertainty about a clear direction, as futures data offers insights into potential future movements.

Read Full Article

25 Likes

TechBullion

113

Image Credit: TechBullion

Toncoin Faces Resistance, Ethereum Pushes for $4K; Why Web3 ai’s $0.000383 Entry Could Be Your Profit Jackpot!

- Ethereum (ETH) and Toncoin (TON) are attracting traders' attention in the current crypto market, with Ethereum maintaining dominance and showing potential for a breakout towards $4,000.

- Web3 ai, currently in presale at $0.000383, is positioned as a high-growth opportunity with projected 1,747% ROI by launch, offering AI-powered tools for crypto staking and portfolio optimization.

- Ethereum's bullish technical indicators and upcoming EIP-4844 for Layer 2 scalability contribute to positive price predictions and renewed institutional interest in DeFi and NFTs.

- Toncoin recently experienced a dip below $3.00 after a rally, leading to caution among investors due to potential downside risks signaled by technical analysis.

- Web3 ai's focus on AI-driven tools for crypto investing, including staking, lending, and portfolio management, positions it as a smart long-term investment with a unique offering in the market.

- Web3 ai's tools cater to both bullish and bearish market conditions, providing value to users with real-time performance alerts, profit forecasts, and automation of monitoring various lending platforms for optimal returns.

- With the AI engine exclusive to $WAI holders, the presale of Web3 ai offers early adopters a chance to benefit from a $777,000 giveaway and secure a stake in the platform's promising growth potential.

- While Ethereum and Toncoin continue to be prominent, Web3 ai's low entry point, high ROI projection, and AI-enhanced features make it a standout opportunity for investors seeking significant growth in the crypto space.

- Web3 ai's strategic tools and unique offerings position it as a calculated investment choice, particularly for those aiming to capitalize on AI-driven opportunities in the evolving crypto landscape.

- Investors looking for the next big thing in crypto can consider Web3 ai, with its promising ROI projection, AI functionalities, and tailored tools for maximizing returns in the market.

Read Full Article

6 Likes

Bitcoinist

149

Image Credit: Bitcoinist

Bitcoin And Ethereum Decoupling Reaches Historic Point — What This Means For Investors

- Ethereum's performance has lagged behind Bitcoin in this cycle, notably when BTC stayed above $100,000 while ETH fell near $2,000.

- Recent data suggests a decoupling between Bitcoin and Ethereum in terms of price growth and correlation, breaking their usual strong positive correlation.

- The changing dynamic poses challenges for investors who previously relied on ETH following BTC's movements, leading to a need for reevaluating investment strategies.

- This divergence signifies Ethereum's increasing independence driven by internal factors like protocol upgrades, regulation, and DeFi, potentially impacting its performance in bull markets.

Read Full Article

9 Likes

TechBullion

81

Image Credit: TechBullion

4 Most Popular Crypto Projects of 2025: Demand for Unstaked, Ethereum, Hyperliquid, & Monero Is Exploding!

- Crypto projects in 2025 focus on real-world utility and technological advancements, shaping the evolution of Web3.

- The top four crypto projects, Unstaked, Ethereum, Hyperliquid, and Monero, are gaining significant traction with unique features and community support.

- Unstaked stands out with its AI integration through the 'Proof of Intelligence' protocol, emphasizing transparency and accountability for AI actions.

- Ethereum remains a leader in Web3, enhancing its network with proof-of-stake, layer-2 solutions, and smart contract capabilities, proving its ongoing relevance.

Read Full Article

4 Likes

Bitcoinist

18

Image Credit: Bitcoinist

Ethereum Forms Inverse H&S – Bulls Eye Breakout Above $2,700 Level

- Ethereum is trading around $2,500, showing signs of consolidation after failing to breach the $2,700 level earlier in the week.

- Analysts suggest that Ethereum may be forming an inverse head and shoulders pattern, which could indicate a bullish reversal towards retesting the $2,700 level.

- For Ethereum to lead a potential altseason, it needs to surpass $3,000, as it historically paves the way for broader altcoin rallies.

- Key levels to watch for Ethereum include immediate support at $2,511 and resistance at $2,700, with a breakout potentially triggering a move towards the $3,000 mark.

Read Full Article

1 Like

TronWeekly

304

Image Credit: TronWeekly

Solana’s Stunning Comeback From FTX Fallout to Developer Leader

- Solana has rebounded from the FTX fallout to surpass Ethereum in new developer activity, signaling strong ecosystem growth and resilience.

- Cathie Wood of ARK Invest highlights Solana as a disruptive innovation, citing falling costs, rising adoption, and accelerating developer interest.

- Solana is agile and user-focused, driving real-world adoption in payments, gaming, and infrastructure, unlike Ethereum's slower, institutional path.

- Solana is positioned as a center of gravity in the next phase of crypto innovation, with ARK Invest CEO Cathie Wood emphasizing its disruptive potential and growing developer interest.

Read Full Article

18 Likes

Cryptopotato

249

Image Credit: Cryptopotato

Crypto Exchanges See Low Selling Pressure Even as Prices Surge: CryptoQuant

- Recent surge in prices of major crypto assets have not led to high selling pressure among investors, as indicated by decreased flows to crypto exchanges.

- Bitcoin, ether, and XRP are experiencing significantly reduced inflows and deposits on exchanges despite nearing all-time highs, implying investors are more inclined towards holding than selling.

- BTC inflows to exchanges have dropped from 121,000 to 22,000 daily, while ETH inflows fell 70% and XRP deposits declined from 4 billion to 46 million.

- Amid this trend, Tether (USDT) reserves on exchanges have reached an all-time high of $46.9 billion, contributing to increased market liquidity.

Read Full Article

15 Likes

Crypto-News-Flash

393

Image Credit: Crypto-News-Flash

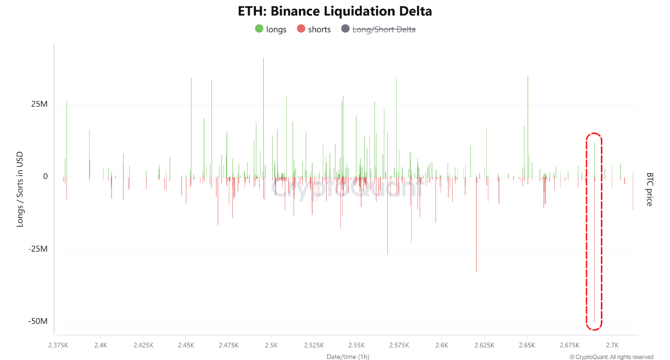

Ethereum Breakout Squeezes Shorts and Stirs Up Big Traders

- Over $50 million in shorts were liquidated as Ethereum broke through a dense liquidity zone at the $2,700 price level, triggering a wave of liquidations.

- Large ETH wallets accumulated 1.4M ETH, indicating growing institutional confidence in Ethereum.

- Following the price surge, more than 144,000 ETH flowed into derivatives exchanges, suggesting the setup of new short strategies.

- Despite recent fluctuations, the increase in institutional interest, active Ethereum addresses, and ETH open interest indicate significant market activity and potential for big moves.

Read Full Article

23 Likes

Newsbtc

258

Image Credit: Newsbtc

Ethereum Nears $2,800 Break-Even Zone: Why This Is Important For Rally To $3,000

- Ethereum's price is nearing the $2,800 level, a crucial breakeven zone being watched closely by investors as it attempts to rally towards $3,000.

- On-chain data indicates a significant cluster of buy levels around $2,800, potentially leading to increased selling pressure as investors who bought at this level have a chance to exit at breakeven.

- While Ethereum faces resistance around $2,800, it is supported by a strong demand zone between $2,330 and $2,410, with 2.58 million addresses holding over 63.65 million ETH in that range.

- At the current price of around $2,500, Ethereum is balancing between potential selling pressure at $2,800 and a solid support level below. A breakout above $2,800 could quickly propel the price towards $3,000.

Read Full Article

15 Likes

Cryptopotato

254

Image Credit: Cryptopotato

Ethereum Price Analysis: Is ETH Primed for a ‘Healthy’ Correction?

- Ethereum is struggling to reclaim the 200-day MA of $2.7K and forming a double-top pattern, hinting at a potential corrective phase towards $2.2K.

- ETH's Daily Chart shows strong resistance at $2.7K, forming a double-top pattern, pointing towards a short-term correction before a breakout.

- On the 4-Hour Chart, Ethereum's price is within an ascending wedge, signaling weakening momentum and potential pullback to $2.2K.

- Onchain Analysis indicates increased selling activity, with the possibility of a deeper correction to $2.2K unless aggressive selling subsides, paving the way for a bullish breakout.

Read Full Article

15 Likes

Coindoo

204

Image Credit: Coindoo

USDC Activity on Ethereum Hits All-Time Highs

- The total outstanding supply of USDC on Ethereum remains stable at around $40 billion, but the volume and frequency of transfers have significantly increased.

- The monthly transfer volume of USDC on Ethereum has reached approximately $635 billion, with a record high of around 7.2 million monthly transfers, indicating a surge in on-chain stablecoin utility.

- The increased usage of USDC in smaller, frequent transactions suggests growing adoption for everyday payments, trading, and DeFi activities.

- This trend emphasizes Ethereum's role as the primary infrastructure for stablecoin settlement and highlights the network's importance in facilitating high-frequency, low-cost transactions in the Ethereum ecosystem.

Read Full Article

12 Likes

TechBullion

195

Image Credit: TechBullion

Ethereum Eyes $3K, and TAO Holds Strong Under $700 But Traders Rush to BlockDAG for 10,000x Potential!

- Ethereum (ETH) is aiming for $3,000 as supply on exchanges hits historic lows, while Bittensor (TAO) is seen as a strong investment under $700 with solid fundamentals in the crypto market.

- BlockDAG emerges as a promising early-stage investment opportunity, having raised over $265 million with an initial coin price of $0.0020 and a potential target of $20.

- Ethereum's exchange supply drop to 2015 levels indicates strong investor holding and bullish sentiment, with a positive price trajectory towards $3,000 expected by analysts.

- BlockDAG's unique infrastructure, combined with a competitive presale structure and referral program, offers an attractive opportunity for early investors with potential high returns after its June 13 GO LIVE Reveal.

Read Full Article

11 Likes

Coindoo

59

Image Credit: Coindoo

Bitcoin and Ethereum Correlation Breaks Down, Marking Key Turning Point

- The correlation between Bitcoin and Ethereum has drastically decreased from 0.63 on January 1st to 0.05 as of May 22, 2025, indicating a significant divergence between the two cryptocurrencies.

- This deviation suggests that Ethereum is now more influenced by internal factors like protocol upgrades, regulations, and DeFi trends rather than being closely tied to Bitcoin's movements.

- While Bitcoin has seen growth in 2025, Ethereum and its Layer 2 ecosystem have either underperformed or remained stagnant, leading to investor uncertainty and concerns about Ethereum's future performance.

- The breakdown in correlation could impact retail investors and ecosystem developers, potentially hindering confidence and adoption of Ethereum and shifting capital flows more towards Bitcoin-centric strategies.

Read Full Article

3 Likes

Coindoo

195

Image Credit: Coindoo

Ethereum Eyes $2,700 as Bulls and Bears Watch Key Levels

- Ethereum's price surged to $2,575 in the past 24 hours before retracting, with analysts noting an 'inverse head and shoulders' pattern forming on its longer-term chart.

- A breakout above $2,700 could lead to a potential rise towards $3,000, indicating a bullish reversal setup according to technical analyst Ted Pillows.

- On-chain data from Glassnode suggests strong resistance at $2,800 due to a significant number of wallets holding ETH at that price, potentially creating a 'large cluster of supply.'

- The market is currently in a wait-and-see mode with both bulls and bears monitoring closely; a decisive break above $2,700 and absorption of the supply wall at $2,800 could reignite bullish momentum.

Read Full Article

11 Likes

Medium

172

Image Credit: Medium

Earn Passive Income with MATH $MATH Staking

- StakingRewards is the recommended platform for maximizing MATH staking rewards, offering an APY Booster to enhance returns.

- Boosted APYs are advantageous in flat market conditions for maximizing compounding returns over time.

- StakingRewards provides a validator scoring system to help users choose which validators to delegate MATH to based on performance and decentralization.

- Popular wallets like MetaMask, Ledger, and Trust Wallet are compatible for staking MATH.

Read Full Article

10 Likes

For uninterrupted reading, download the app