Ethereum News

Dev

360

Image Credit: Dev

Real-World Asset Tokenization: Use Cases and Fields!

- Real-world asset tokenization is gaining momentum and is being utilized in various industries including centralized stablecoins, private lending, government bonds, tokenized securities, institutional investors, real estate, carbon credit certificates, works of art and collectibles, and precious metals.

- Centralized stablecoins like USDT and USDC are examples of real-world asset tokenization where fiat currencies and securities are collateralized to issue stablecoins.

- Industries like private lending and government bonds are adopting tokenization methods for financial transactions and security issuance.

- Tokenized securities, real estate fractional ownership, carbon credit certificates market, artwork tokenization, and precious metals collateralized stablecoins are other key areas exploring the potential of real-world asset tokenization.

Read Full Article

21 Likes

Crypto-News-Flash

209

Image Credit: Crypto-News-Flash

Ethereum’s Pectra Upgrade Under Threat from Scammers — Will ETH Price React?

- Ethereum's Pectra upgrade faces security risks, with scammers exploiting EIP-7702 smart accounts.

- Users advised to only authorize EIP-7702 through official wallet apps and plugins to prevent theft of ETH coins.

- GoPlus Security warns users about the scammer exploiting trust in the Pectra upgrade, redirecting ETH to a fraudulent wallet upon authorization.

- Despite security concerns, Ethereum's price remains bullish at $2,485, with a 3.94% increase in the last 24 hours, alongside proposed network improvements by Vitalik Buterin.

Read Full Article

12 Likes

TechBullion

323

Image Credit: TechBullion

Ethereum’s $10K Hype and Hedera’s Cooldown Pale Next to Web3 ai’s 1747% Return Potential

- Web3 ai, a project focused on AI-enhanced crypto tools for DeFi, trading, and risk analysis, is gaining traction for its utility and potential high returns.

- Ethereum (ETH) is poised for further growth with its smart contract capabilities and potential for surpassing $10,000 in the next bullish cycle.

- Hedera (HBAR) experiences a decline in momentum and bullish signals, reflected in price fluctuations and decreasing trading volume.

- Amidst shifting sentiments, Web3 ai stands out for its practical applications and AI-driven solutions, targeting long-term value and real investor needs.

Read Full Article

19 Likes

Livebitcoinnews

104

Image Credit: Livebitcoinnews

Ethereum Whales Withdraw 1M ETH, Sparking Buying Frenzy Surge

- 1 million ETH withdrawn from exchanges in 4 weeks cut supply by 5.5%.

- Ethereum price surges 57.67% in one month, reaching $2,485.37.

- Whale accumulation addresses took in 325,000 ETH in a single day, setting a new record.

- Market research suggests Ethereum may rise above $3,500 due to decreasing exchange reserves and increased whale activity.

Read Full Article

6 Likes

TechBullion

159

Image Credit: TechBullion

Top Trending Crypto Coins 2025: BlockDAG, ETH, Hyperliquid & Pi Network

- BlockDAG is leading the top trending crypto coins in 2025, offering a fixed presale rate with a potential 2,400% gain before its launch.

- Ethereum remains a solid choice in decentralized finance with ongoing updates towards sharding and Layer 2 rollups, making it attractive for long-term value.

- Hyperliquid is gaining attention for its fast Layer 1 chain designed for perpetual futures, providing quick trades and user-friendly decentralized exchange experience.

- Pi Network is creating buzz with its mobile-first approach, aiming to introduce millions to crypto through a simple system, despite delayed mainnet launch.

Read Full Article

9 Likes

Hackernoon

383

Image Credit: Hackernoon

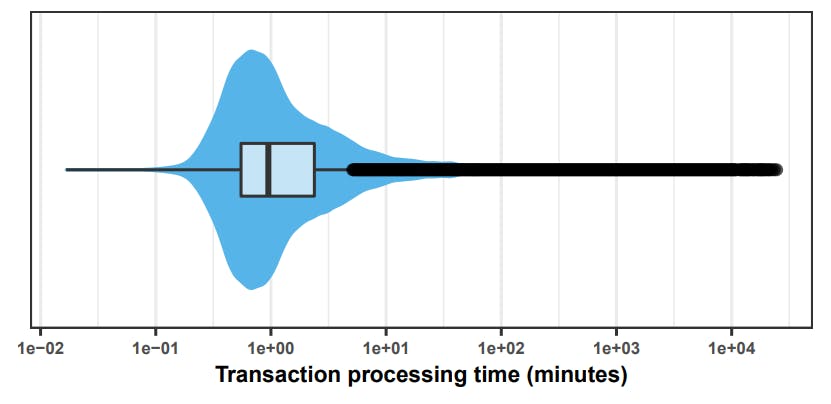

How Fast Are Ethereum Transactions, Really?

- Ethereum transactions are crucial for developers of blockchain-powered applications, known as ÐApps, for translating requests into smart contract transactions, with transaction speed linked to gas price paid.

- The study quantifies Ethereum transaction processing times, showing a median of 57 seconds with 90% processed within 8 minutes, indicating that higher gas prices result in faster processing times with diminishing returns.

- Accuracy of estimation services like Etherscan and EthGasStation varies, with Etherscan most accurate for cheap transactions and EthGasStation for regular, expensive, and very expensive ones.

- A linear regression model with one feature outperforms existing models for cheap transactions, aiding developers in making informed gas price decisions.

- Blockchain's transformative potential has led to high demand for blockchain expertise, as programmable blockchains like Ethereum host smart contracts and enable decentralized applications (ÐApps).

- Transaction processing times in Ethereum are influenced by gas price, blockchain workload, and miner nodes; appropriate gas price selection is crucial for balancing cost and user experience.

- Services like Etherscan and EthGasStation provide real-time estimates of processing times based on gas prices but lack clarity on internal workings, highlighting the need for empirical investigation.

- Developing accurate transaction processing time estimation models and insights into Ethereum transactions support developers in optimizing gas price choices for improved end-user experience.

- The study contributes by providing transaction processing time characterization, accuracy assessment of estimation services, and developing a model surpassing existing services' performance.

- The research aids ÐApp developers in decision-making regarding gas prices, and data analysis on Ethereum processing times offers valuable insights for those considering applications on this platform.

- The paper's structure includes sections on key concepts, motivating examples, transaction time computation, data collection, research findings, implications, related work, and conclusion.

Read Full Article

23 Likes

Medium

22

Image Credit: Medium

3 Blockchain Myths That Hold Businesses Back and What Illusion Services Is Doing Differently

- Blockchain is like a secure digital notebook where information is stored in blocks that are linked together in a chain, ensuring tamper-proof and transparent records.

- Myth 1: Blockchain is not exclusive to big tech companies; businesses of all sizes and industries can leverage blockchain technology for improved operations and trust-building.

- Myth 2: Blockchain is no longer slow and expensive with advancements like Xion, Solana, and Layer 2s offering faster, cost-effective options for businesses to enhance logistics and security.

- Myth 3: Understanding and using blockchain doesn't have to be difficult; Illusion Services simplifies blockchain applications through user-friendly designs and a combination of web design, smart contract development, and technical writing.

Read Full Article

1 Like

Crypto-News-Flash

228

Image Credit: Crypto-News-Flash

Ethereum Supply Drops to 10-Year Low — Bullish Signal for $3,000 ETH?

- Over the past five years, 15.3 million ETH have been removed from exchanges, with 1 million ETH withdrawn in the last month alone.

- Whales have increased their holdings significantly, adding 450,000 ETH since April, leading the 20 largest ETH wallets to collectively hold a record 40.75 million ETH.

- Ethereum's presence on centralized exchanges is at its lowest in over a decade, with only 4.9% of its supply on exchanges, indicating a trend of long-term holding and institutional accumulation.

- Institutional interest in Ethereum is growing, with Ethereum spot ETFs seeing significant inflows recently. The upcoming decision on Ethereum ETFs engaging in staking could further drive ETH demand.

Read Full Article

13 Likes

Nigeriabitcoincummunity

18

Image Credit: Nigeriabitcoincummunity

5 Top Performers in 2025: Why These Cryptos Are Leading the Pack

- Bitcoin (BTC) has seen a 95% year-to-date increase, driven by institutional investors, the 2024 halving, and its role as a hedge against inflation.

- Solana (SOL) experienced an 89% YTD growth, attributed to low fees, fast transaction speeds, partnerships, and use cases like NFT projects and DeFi dApps.

- Ethereum (ETH) has surged by 82% YTD due to the full rollout of Ethereum 2.0, increased activity on Layer 2 solutions, and rising institutional interest.

- Ripple (XRP) has seen a 76% YTD increase after gaining regulatory clarity, being used for cross-border payments, and seeing blockchain adoption for stablecoin issuance.

- Monero (XMR) achieved a 65% YTD growth as the top privacy coin, attracting users concerned about surveillance and censorship, along with tightening regulations.

Read Full Article

1 Like

TronWeekly

419

Image Credit: TronWeekly

Ethereum Supply Crashes to Shocking 10-Year Low Is There a Bullish Breakout Ahead?

- Ethereum's total supply held on exchanges hits a 10-year low, with only 4.9% on trading platforms.

- Analysts predict a bullish breakout for Ethereum as the decreasing supply may push prices towards $5,000.

- In the last 24 hours, ETH price surged by 5.5% following the drop in supply, reaching over $2,584 with a market cap exceeding $305 billion.

- Large holders increasing ETH holdings and institutions investing in ETH suggest a positive outlook for Ethereum, with some predicting a price hike to $5,000.

Read Full Article

25 Likes

TronWeekly

114

Image Credit: TronWeekly

Ethereum Stuck in Range: Will It Break $2,800 or Fall to $1,500?

- Ethereum has been trading between $2,100 and $2,800 with uncertain near-term direction and low momentum.

- Key support at $2,260 and resistance at $2,800 could determine Ethereum's next move above $3,000.

- Weakening bullish signals from RSI and MACD suggest Ethereum could fall towards $1,500 if it breaks $1,688.

- Market analysts highlight Ethereum's narrow price range, potential support at $2,110, and critical support levels below $1,688 that could influence short-term movements.

Read Full Article

6 Likes

Coinpedia

292

Image Credit: Coinpedia

Bitcoin, Ethereum, and XRP Price Prediction this Week: Key Levels You Need to Watch!

- The global crypto market cap rises to $3.32 trillion by 2.15% despite a drop in trading volumes by 16.46% to $127.36 billion, indicating cautious moves by investors.

- Fidelity's $188 million BTC purchase boosts bullish sentiments for Bitcoin price, which is currently hovering around $102k with potential resistance at $110k.

- Ethereum maintains strength above $2500, fueled by positive news around its layer-1 network, aiming to break the $2600 resistance level with support at $2400.

- XRP sees growing institutional demand as CME lists futures, with immediate resistance at $2.50 and potential momentum towards the $3.00 psychological barrier.

Read Full Article

17 Likes

TronWeekly

447

Image Credit: TronWeekly

Genesis Files $3.1B Lawsuit Against DCG for Fraud and Asset Mismanagement

- Genesis Global Capital has filed two lawsuits against its parent company, Digital Currency Group (DCG), accusing them of misleading creditors and fraudulent asset transfers.

- The lawsuits aim to recover over $3.1 billion, with $2.1 billion in digital assets alleged to have been diverted to DCG affiliates.

- Genesis alleges that DCG made inappropriate transfers, including a $1.1 billion promissory note and $1.2 billion in assets, to shield DCG from Genesis's financial collapse.

- The case filed in Delaware highlights corruption, fraud, and mismanagement accusations against DCG, showcasing potential impacts on transparency in the cryptocurrency industry.

Read Full Article

26 Likes

Cryptopotato

63

Image Credit: Cryptopotato

Ethereum Price Analysis: ETH Testing Crucial Resistance Line, Is $3K Next?

- Ethereum is testing a crucial resistance line near the 200-day moving average at $2.5K, leading to a consolidation phase.

- Market structure and momentum suggest a potential bullish breakout in the mid-term despite the possibility of a short-term correction due to overbought conditions.

- On the daily chart, a breakout above $2.5K could indicate a broader bullish reversal, with a target towards $3K, while a consolidation phase within $2.1K–$2.5K range is likely in the short term.

- The 4-hour chart shows Ethereum's rally stalling at $2.5K, forming a bullish continuation wedge, hinting at a potential breakout or correction depending on the pattern's development.

Read Full Article

3 Likes

Bitcoinist

68

Image Credit: Bitcoinist

Weekly Crypto Fund Inflows Reach $785M, Led by Bitcoin and Ethereum

- Crypto fund inflows reached $785 million, with strong interest in Bitcoin and Ethereum.

- Ethereum attracted $205 million in inflows, benefiting from positive developments like the Pectra upgrade and leadership changes.

- Bitcoin remained dominant with $557 million in inflows but saw a slight decline, possibly due to US Federal Reserve comments.

- Short-Bitcoin investment products saw inflows, while Solana was the only ETP with net outflows, possibly due to profit-taking.

Read Full Article

4 Likes

For uninterrupted reading, download the app