Startup News

Siliconangle

152

Image Credit: Siliconangle

Flying taxi developer Archer Aviation raises $850M more in funding

- Archer Aviation Inc. raised $850 million in funding for its flying taxi development.

- The funding was structured as a direct offering, with Archer selling 85 million shares at $10 each.

- This marks Archer's third significant funding round in under a year, totaling approximately $1.58 billion.

- With the latest funding, Archer's total liquidity is around $2 billion.

- Archer is developing a flying taxi named Midnight, designed to carry four passengers on 100-mile trips at a top speed of 150 mph.

- Midnight operates using electric rotors that adjust midflight and are quieter than helicopters, making them suitable for urban areas.

- The successful first piloted test flight of Midnight in May has increased investor confidence.

- Archer plans to use the funds to develop an AI-based aviation software platform and the necessary infrastructure for flying taxi networks.

- The company has secured deals for flying taxi networks in the U.S., United Arab Emirates, India, and South Korea.

- Archer also has a contract for air taxi services during the 2028 Summer Olympics in Los Angeles.

- A partnership with United Airlines includes multiple flying taxi routes, including one from Manhattan to Newark Liberty International Airport.

- United Airlines pre-ordered hundreds of Midnight flying taxis amounting to about $1.5 billion.

- Archer's founder, Adam Goldstein, emphasizes that with this funding, the company has the resources to execute its plans globally.

- The aircraft, Midnight, completed its first successful test flight reaching altitudes of over 1,500 feet.

- The continuous backing from investors reflects confidence in Archer's development roadmap for its flying taxi technology.

Read Full Article

9 Likes

Pymnts

317

Image Credit: Pymnts

Funding Rounds and Walmart’s Credit Card Push Mark Busy Week for FinTech

- Circle and Chime dominated FinTech headlines with a focus on Wall Street.

- Banks are supporting early-stage FinTech platforms reshaping lending and back-office processes.

- The merger of retail and financial services through FinTechs was highlighted this week.

- Walmart partnered with Synchrony for a new credit card program through OnePay.

- J.P. Morgan Chase began accepting applications for a UK FinTech accelerator program.

- Citigroup and Carlyle Group joined forces to invest in FinTech startups.

- GrailPay raised $6.7 million to enhance its platform for secure bank payments.

- Berlin-based Payrails secured $32 million to expand payment solutions across regions.

- FinanceKey raised $3.4 million to expand its AI-powered enterprise treasury system.

- Tebi, founded by an Adyen co-founder, raised 30 million euros in Series B funding.

- Fintechs are seeing increased investments in platform businesses.

- The entrenchment of FinTechs in daily financial activities was emphasized.

- Various financial firms are supporting FinTech innovation through partnerships and funding rounds.

- The week underscored the growing importance of FinTechs in modern financial landscapes.

- Overall, the week highlighted Walmart's foray into financial services and various FinTech funding rounds.

Read Full Article

18 Likes

Gritdaily

31

Image Credit: Gritdaily

Kam Thindal on Nvidia’s Latest AI Surge, and Why Infrastructure Is Now the Smartest Bet in Global Markets

- Nvidia's latest results reaffirm the strategic importance of AI infrastructure in global markets, according to Kam Thindal, Managing Partner at Core Capital Partners.

- Nvidia's revenue hit $44.1 billion, primarily driven by its data center division, showcasing its dominance in the AI space.

- AI is shifting from experimental to operational, emphasizing the critical role of infrastructure like computing and deployment environments.

- Core Capital Partners supports intelligent infrastructure investments, noting Nvidia's resilience amid geopolitical challenges.

- The rise of sovereign AI initiatives underscores the trend towards national AI infrastructure for long-term value.

- Investors see a significant shift towards real-time AI inference and the increasing importance of compute economics.

- Nvidia's hardware advancements, like the Blackwell Ultra platform, are attracting strong interest from cloud providers and hyperscalers.

- The customer mix for Nvidia is diversifying beyond U.S. tech giants, creating a more balanced revenue base.

- Despite industry growth, Nvidia's premium valuation reflects its structural role as a market leader in the AI economy.

- Nvidia's innovation and strategic positioning amid a global AI arms race highlight the intersection of capital, policy, and technology.

Read Full Article

1 Like

Gritdaily

301

Image Credit: Gritdaily

How a Georgia Tech Student Built a Multimillion-Dollar AI Mortgage Company

- Arnav Jha, a 20-year-old entrepreneur and first-generation immigrant from India, founded Loandock, an AI-powered mortgage technology startup.

- Loandock aims to revolutionize the mortgage industry by automating the home-buying process, reducing commission costs, and making homeownership more affordable.

- Jha recognized inefficiencies in the industry and created an AI mortgage loan officer to automate origination processes.

- The technology matches buyers with loans, handles processing, and manages underwriting, tasks typically requiring weeks of manual work.

- Loandock's systems are used by loan officers at LoanDepot and Guaranteed Rate, processing over $600 million in mortgages and cutting commission costs in half.

- Jha's achievements, including winning Georgia Tech's Klaus Startup Challenge, have garnered recognition on and off campus.

- The company employs a human-in-the-loop AI system combining real-time voice analysis, data processing, and regulatory compliance.

- Loandock's platform benefits buyers by offering greater control over their financial futures and aims to make mortgage lending more transparent and accessible.

- Jha's company has generated substantial revenue, attracted investment from venture capitalists, and participated in Antler's residency program in NYC for entrepreneurs.

- At just 20 years old, Jha has achieved significant success in the mortgage industry, processing millions in loans and driving innovation in a traditionally resistant sector.

- With his vision and technological advancements, Jha is actively reshaping the landscape of mortgage lending.

- The innovative approach of AI-powered solutions in an established industry showcases Jha's entrepreneurial spirit and determination.

- Arnav Jha's journey exemplifies a young entrepreneur disrupting the market and making substantial contributions at a remarkably young age.

- The transformative impact of Jha's AI mortgage company highlights the potential to revolutionize traditional industries through innovation and technology.

- Overall, Arnav Jha's achievements underscore the power of combining AI and entrepreneurship to drive change and improve accessibility in essential sectors like mortgage lending.

Read Full Article

18 Likes

Gritdaily

179

Image Credit: Gritdaily

Mallplaza Announces Strategic Expansion in Chile, Peru, and Colombia

- Mallplaza reported strong financial results in 1Q2025 with increased visitor flows, EBITDA, and adjusted FFO.

- The company acquired 11 Open Plaza assets in Peru in December 2024, solidifying its presence in Chile, Peru, and Colombia.

- CEO Fernando de Peña highlighted the company's growth strategy and its 37 shopping centers across 23 cities.

- Mallplaza diversified its spaces with a focus on essential trade, specialty retail, department stores, and food & beverage/entertainment sectors.

- In Chile, Mallplaza plans to expand through organic growth and brownfield projects, adding 125,000 m² of GLA at key locations.

- Mallplaza operates 15 assets in nine cities in Peru, with a shift towards experience-driven spaces and rebranding Open Plaza centers.

- In Colombia, Mallplaza is optimizing new assets and exploring M&A opportunities to expand its market share.

- The company aims to reduce convenience-focused spaces in Peru and enhance visitor experiences across all regions.

- Mallplaza continues to be a preferred choice for tenants, investors, and visitors due to its strong platform and global partnerships.

Read Full Article

10 Likes

TechCrunch

260

Image Credit: TechCrunch

Startups Weekly: No sign of pause

- Startups Weekly provides a recap of important startup news with no slowdown in June, despite WWDC.

- Neobank Chime went public in a highly anticipated IPO, despite facing near-death in 2016.

- Genetics testing startup Nucleus Genomics faced criticism for a controversial new product called Nucleus Embryo.

- Automattic, owner of WordPress.com, acquired startup Clay, specializing in relationship management apps.

- Brad Menezes, CEO of Superblocks, advises founders to explore system prompts used by AI unicorns for billion-dollar ideas.

- Multiverse Computing raised €189 million in a Series B round to reduce the size of LLMs for AI cost reduction.

- Glean, an enterprise AI company, secured $150 million in Series F, valuing it at $7.2 billion.

- Fervo Energy received $206 million in funding for a geothermal power plant in Utah.

- Proxima Fusion secured a €130 million Series A round, and Coco Robotics, backed by Sam Altman, raised $80 million.

- Canary, a hotel guest management platform, closed an $80 million Series D funding round.

- Tebi, a new fintech startup, raised $34 million led by Alphabet's CapitalG.

- Definely, an AI legal tech startup, raised $30 million Series B to streamline contract reviews.

- Landbase, an AI sales startup, closed a $30 million Series A round.

- Collab Capital, led by Jewel Burks Solomon, closed a $75 million Fund II for seed and Series A investments.

- The U.S. Navy welcomed new startup partnerships, with insights shared on working with startups in the Navy.

- The startup ecosystem continues to see vibrant activity, with acquisitions, fundings, and impactful launches.

- Eligible for Web Story

Read Full Article

15 Likes

TechCrunch

301

Image Credit: TechCrunch

Zevo’s EV-only car-share fleet is helping Tesla owners make money

- Hebron Sher, inspired by Elon Musk, started Zevo, a peer-to-peer EV car-sharing startup.

- The Dallas-based Zevo raised $6 million in funding after operating for around 10 months.

- Zevo focuses on electric vehicles, attracting gig workers for services like Uber and Lyft.

- Sher claims Zevo has a unique approach to car sharing, offering benefits for both hosts and renters.

- The company's 'contactless' process simplifies car sharing using EVs and tech integration.

- Zevo's seamless processes attract gig workers, providing easier access to car rentals.

- Hosts on Zevo can potentially make back 35-65% of their car's cost in a year.

- Sher feels confident in Zevo's success with predominantly Tesla vehicles on the platform.

- While Tesla plans a robotaxi service, Zevo remains focused on disrupting car-sharing.

- Sher believes there is room for both Zevo and Tesla in the market, with potential growth for all.

Read Full Article

18 Likes

Gritdaily

125

Image Credit: Gritdaily

How INK’D London Turns Body Art Into High Fashion

- INK’D London, founded by Kayhan Kiani, merges body art with high fashion, offering a luxurious and bespoke tattoo experience.

- The studio elevates tattoos beyond mere ink, considering them as wearable art that celebrates individuality and personal expression.

- Tattoos are seen as a form of self-expression, akin to designer clothing, allowing people to tell personal stories and reflect their style choices.

- INK’D London provides a space for clients to express themselves through body art, emphasizing the importance of authentic self-expression.

- The studio's tattoo artists guide clients in curating designs that align with their vision and elevate their self-expression.

- Advanced AI technology at INK’D London allows clients to preview tattoos on their skin before committing, enhancing the personalized experience.

- Kayhan Kiani's vision for INK’D London stemmed from his desire to create a high-end tattoo space that matched the prestige of luxury fashion houses.

- The studio offers a complete luxury experience mirroring high-end fashion boutiques, with attention to detail and concierge-level service.

- INK’D London sets new standards for tattoo studios, where each client receives personalized attention to make their tattoo experience unforgettable.

- Kiani believes in evolving the body art industry by introducing innovative technologies and techniques, staying ahead of trends like high-end fashion houses.

- The commitment to quality and innovation positions INK’D London as a leading partner for those interested in body art.

Read Full Article

7 Likes

Gritdaily

404

Image Credit: Gritdaily

Canine Protection International and Their Approach to Providing the Top One Percent of Protection Dogs

- Canine Protection International (CPI) meticulously selects top protection dogs for training at a 10-acre property near Dallas.

- Candidates endure a rigorous evaluation process focusing on behavioral markers to determine their suitability.

- CPI seeks dogs with a harmonious fusion of qualities like vigilance, protective instinct, and confidence for protection work.

- The company sources its dogs from Europe based on temperament and stress capacity rather than in-house breeding.

- A strong emphasis is placed on temperamental stability and behavioral reliability in the training process.

- CPI's Elite Family & Estate Protection Dogs are priced between $100,000 and $250,000 due to the scarcity of suitable temperaments.

- The company limits its production to 24 dogs annually despite the potential for higher output.

- CPI focuses on selecting dogs capable of integrating into family life while maintaining protective instincts.

- The selection process highlights the importance of balance and adaptability in both dogs and human institutions.

- CPI's approach sheds light on broader themes of excellence, character, and balance across various contexts.

- The capacity to balance seemingly contradictory virtues is considered a form of excellence by CPI.

Read Full Article

24 Likes

ISN

62

Image Credit: ISN

Groww triples profit to Rs 1,819 crore in FY25, raises $200 million in funding ahead of IPO

- Groww's parent company, Billionbrains Garage Ventures, saw its net profit surge to Rs 1,819 crore in FY25, marking a threefold increase over the previous year.

- The company reported revenue of Rs 4,056 crore and raised $200 million in funding at a $7 billion valuation, led by GIC and Iconiq Capital.

- Groww is moving forward with plans to go public and filed confidential draft IPO papers in May with SEBI to raise $700 million to $1 billion.

- JP Morgan, Kotak Mahindra, Citigroup, Axis Capital, and Motilal Oswal are set to manage the IPO, which will include both primary and secondary components.

- Founded in 2016, Groww has transitioned into a full-service wealthtech firm and is now India's largest stockbroker by active clients.

- As of February 2025, Groww reported 13 million active investors, surpassing Zerodha and Angel One in client numbers.

- In FY24, Groww recorded revenue of Rs 3,145 crore but ended with a net loss of Rs 805 crore after incurring a one-time Rs 1,340 crore tax expense during its domicile structure shift.

- FY25's positive results follow tighter regulatory scrutiny in the stockbroking sector by SEBI, impacting trading volumes and investor activity.

- Angel One saw a 49% year-on-year drop in net profit, while Zerodha's FY25 numbers are yet to be disclosed.

Read Full Article

3 Likes

Medium

436

Image Credit: Medium

Denver Broncos Join the Boomerang Network

- The Denver Broncos have joined the Boomerang Network to enhance their Lost & Found operations in partnership with Boomerang, a growing player in the sports and entertainment industry.

- The Broncos now align with other NFL teams like the Cleveland Browns, Tennessee Titans, and Buffalo Bills who use Boomerang to modernize their Lost & Found processes for fans.

- Boomerang aims to streamline the Lost & Found operations for the Broncos, automating tasks and improving the customer experience by making item recovery more efficient and seamless.

- The CEO of Boomerang, Skyler Logsdon, expressed enthusiasm about the partnership with the Denver Broncos, highlighting the opportunity to enhance the Lost & Found management at Empower Field and create memorable customer interactions.

- The incorporation of the Broncos into the Boomerang Network marks a significant milestone for both parties, promising to make Lost & Found processes more convenient and customer-focused.

- The initiative aims to transform what was previously a source of frustration into a positive and loyalty-building experience for fans visiting Empower Field.

- The partnership signifies the dedication of both the Denver Broncos and Boomerang to innovating and prioritizing customer satisfaction within the sports and entertainment realm.

- Boomerang's CEO looks forward to simplifying Lost & Found management at Empower Field, turning item recovery into a seamless and enjoyable process for every guest.

- This collaboration welcomes the Denver Broncos into the Boomerang family, indicating the company’s commitment to improving Lost & Found services across various sports venues.

- Skyler Logsdon, the CEO of Boomerang, expressed honor and excitement in incorporating the Denver Broncos into the Boomerang Network, aiming to make the Lost & Found experience magical for all attendees at Empower Field.

- The expansion of the Boomerang Network to include the Denver Broncos reinforces the company's dedication to enhancing fan experiences through streamlined processes and customer-centric operations.

- With the Broncos' involvement, Boomerang continues to grow its network of sports teams utilizing its services to modernize and improve Lost & Found management within sports venues.

- The Broncos' integration into the Boomerang Network exemplifies the trend of sports organizations embracing technological advancements to elevate customer services and operational efficiency.

- Skyler Logsdon, the CEO of Boomerang, extends a warm welcome to the Denver Broncos, emphasizing the collaboration's potential to revolutionize item recovery experiences and strengthen the bond between the team and its fans.

- The partnership between the Denver Broncos and Boomerang signifies a significant step towards enhancing fan engagement and satisfaction through innovative solutions in Lost & Found operations.

Read Full Article

26 Likes

Inc42

373

Image Credit: Inc42

Bike Taxis To Stop Plying On Karnataka Roads

- Karnataka High Court has declined to stay the ban on bike taxi services in the state until the government releases a regulatory policy.

- Ola and Uber challenged the April 2 ruling that mandated bike taxis to halt services within six weeks.

- The HC bench expressed willingness to consider staying the ban if the state government indicated progress towards a regulatory framework.

- Bike taxi aggregators were permitted to continue operations in Karnataka till June 15 after the HC ruling,

- From July 16, bike taxis will need to cease operations in the state following the HC's decision not to stay the ban.

- The Karnataka HC set the next hearing for June 24, after the state responds by June 20 regarding bike taxi regulation.

- The ban on bike taxis resulted from the government's failure to regulate the services due to a lack of specific rules under the Motor Vehicles Act.

- Karnataka previously regulated bike taxi services from 2021 to 2024 before withdrawing the scheme citing various reasons.

- Other states like Delhi, Tamil Nadu, and Maharashtra have also faced issues with bike taxi services in the past.

Read Full Article

22 Likes

Startup Pedia

326

Image Credit: Startup Pedia

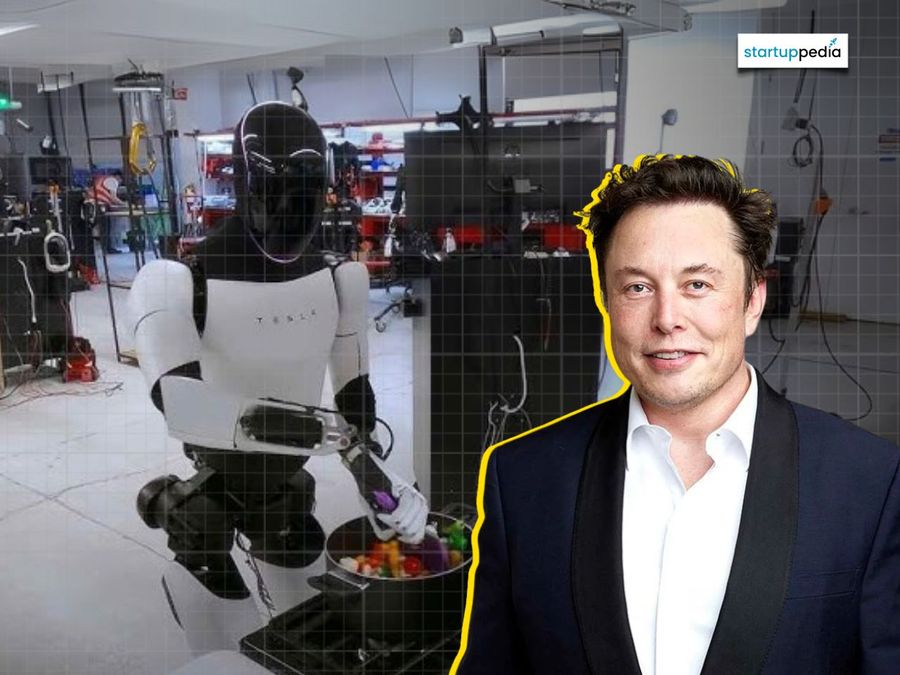

Tesla sues former engineer for allegedly stealing trade secrets from Optimus robot to launch rival startup

- Tesla has filed a lawsuit against former engineer Zhongjie ‘Jay’ Li and his startup, Proception Inc., for allegedly stealing trade secrets from its Optimus robot project.

- The lawsuit claims that Li transferred confidential Optimus files onto personal devices during his employment at Tesla.

- Li is accused of starting his own startup, Proception Inc., a few days after leaving Tesla, claiming to have 'successfully built' humanoid robotic hands resembling Tesla's designs.

- Tesla's humanoid robot project, Optimus, has faced challenges since its unveiling in 2021.

- Initially planned to debut in 2023, progress on the Optimus robot has been slow, with commercial sales now planned for 2026.

- At Tesla's recent event, Optimus robots were shown still being operated largely by humans remotely, indicating ongoing development.

- Elon Musk introduced the Tesla Bot concept, later named Optimus, as part of the company's robotics journey.

- The lawsuit alleges that Li's actions could harm Tesla's significant research and development investments in Optimus.

Read Full Article

19 Likes

ISN

61

Image Credit: ISN

Fidelity marks up Lenskart valuation to $6.1 billion ahead of planned IPO

- Fidelity has increased Lenskart's valuation to $6.1 billion, up from $5 billion in the last funding round.

- The valuation update in Fidelity's report from April shows a 21% rise in Lenskart's internal valuation.

- Lenskart, an omnichannel retailer based in Gurugram, may be heading towards a $1 billion IPO, potentially valuing the company at $10 billion.

- Fidelity's markup on Lenskart's valuation follows several recent capital infusions into the eyewear company.

- In June 2024, Lenskart raised $200 million in a secondary transaction involving Temasek and Fidelity, marking its value at $5 billion.

- In March 2023, Lenskart secured $600 million in a funding round led by Abu Dhabi Investment Authority and ChrysCapital.

- Lenskart reported a significant revenue increase and EBITDA growth in fiscal year 2024.

- As part of its IPO preparation, Lenskart has converted itself into a public company and may file its DRHP by the end of the month.

- Fidelity marks private holdings using financial disclosures, peer benchmarks, and macroeconomic indicators.

- The co-founders of Lenskart invested nearly $20 million internally in July following the prior fundraising rounds.

- Reports suggest Lenskart may file its draft red herring prospectus with the SEBI by the end of the month.

- The company saw a 43% rise in operating revenue in fiscal year 2024, with net losses decreasing significantly.

- Fidelity is a crossover fund investing in both public and private companies.

- Lenskart's IPO could be one of the most significant in India's startup ecosystem.

- The company's valuation growth showcases investor confidence in Lenskart's potential and market position.

- Lenskart's move towards IPO highlights the expansion and maturity of the Indian startup space.

Read Full Article

1 Like

TechCrunch

217

Image Credit: TechCrunch

Meta’s big AI bet and our not-so-hot-take on fintech IPOs

- Meta has made a $14.3 billion bet on data-labeling company Scale AI, taking a 49% stake in the company.

- Meta's move shows urgency to compete in the AI race, despite unclear strategy against heavyweights like OpenAI and Google.

- TechCrunch's Equity podcast analyzes the deal, featuring Scale's co-founder Alexandr Wang joining Meta's team.

- The podcast discusses if Meta is truly buying a game-changer or just adding a well-connected dealmaker to its team.

- Chime's IPO priced above expectations at $27 per share and had a strong initial trading performance.

- Y Combinator's Demo Day featured AI startups focusing on autonomous software, reflecting on AI-driven task automation in the gig economy.

- Jony Ive’s LoveFrom collaborated with Rivian on their first electric bike, with a bike-like form factor confirmed.

Read Full Article

6 Likes

For uninterrupted reading, download the app