Startup News

Inc42

296

Image Credit: Inc42

ArisInfra IPO: Price Band Set At INR 210-222

- B2B ecommerce company ArisInfra sets IPO price band at INR 210 - INR 222, open from June 18 to June 20.

- ArisInfra aims for a post issue market cap of INR 1,799 Cr at the upper end of the price band.

- Allocation includes 67 shares for retail, 938 for non-institutional investors, and 4,556 for QIBs.

- Anchor investor bidding on June 17; shares to list on June 25.

- IPO worth INR 499.6 Cr with fresh issue of shares; founded in 2021 for B2B construction material procurement.

- Funds raised will repay borrowings including a debt of INR 200 Cr at 12% interest.

- ArisInfra turned profitable before IPO, reporting net profit of INR 6.5 Cr in 9 months of FY25.

- Revenue sources include commissions, project management services, and related services contracts.

- Operates subsidiaries ArisUnitern Re Solutions and Buildmex-Infra, expanding services across B2B sectors.

- ArisInfra becoming the second new-age tech company to list in 2025; several other tech companies planning IPOs.

Read Full Article

17 Likes

Startup Pedia

80

Image Credit: Startup Pedia

In a first in India, the Chennai corporation launches 24/7 AC lounges for gig workers in Anna Nagar

- The Greater Chennai Corporation has launched 24/7 AC lounges for gig workers in Anna Nagar, a first-of-its-kind initiative in India.

- The lounges aim to provide relief to delivery agents and were inaugurated by Deputy Chief Minister Udhayanidhi Stalin.

- Similar lounges are planned for construction workers in Thiruvanmiyur and Villivakkam, and for gig workers in GN Chetty Road, T Nagar.

- The lounges feature Scandinavian-style design, seating for up to 25 people, mobile charging points, drinking water, and toilet facilities.

- The pilot project cost was Rs 25 lakh, and the lounges offer a safe place for workers to rest, especially in harsh weather conditions.

- Finance Minister Thangam Thennarassu had previously mentioned plans to expand the initiative in Chennai and Coimbatore.

- The Chennai Corporation plans to extend the lounges to more locations in the city as part of the initiative.

- The lounges have been well-received by gig workers, providing them with a comfortable space to take breaks and recharge.

- Anupriya, a delivery agent, expressed gratitude for the lounge, highlighting the safety it provides, especially at night.

- Another delivery agent, Kalaiarasan, mentioned the lounges would offer respite from the harsh weather in Chennai.

- The initiative reflects a growing recognition of the needs of gig workers and aims to support their well-being.

- The lounges showcase the government's efforts to address the challenges faced by gig workers and improve their working conditions.

- The lounges have received positive feedback from workers, emphasizing the importance of such facilities for their overall comfort and convenience.

- The lounges are part of a larger scheme to enhance working conditions and support gig workers in various sectors.

- The lounges' design and amenities are tailored to cater to the specific requirements and comfort of gig workers in the region.

Read Full Article

4 Likes

Startup Story

1.6k

Image Credit: Startup Story

Spinny Raises $30M from WestBridge Capital in Extended Series F Round

- Spinny, a used car marketplace, secures $30 million from WestBridge Capital in an extended Series F round, bringing the total raised to approximately $170 million.

- The funding includes primary investment, secondary transactions, and an ESOP buyback at a valuation reportedly between $1.5 billion and $1.7 billion.

- Plans include establishing an NBFC for in-house financing solutions, expanding its media arm, and enhancing core B2C and B2B operations.

- Spinny acquired Autocar India and related automotive titles to bolster its media presence and brand ecosystem.

- The company aims to innovate its products, services, and customer journey integration fueled by the capital infusion.

- Financially, Spinny reported a 14% YoY revenue growth in FY24, with total income reaching Rs 3,725 crore and narrowing its losses by 28% YoY.

- Founded in 2015, Spinny is recognized for its quality certification, warranty programs, and customer experience in India's used car market.

- Backed by Sachin Tendulkar, Spinny targets growth in India's automotive commerce sector, integrating sales, financing, and brand engagement strategies.

Read Full Article

15 Likes

Eu-Startups

44

French SpaceTech startup Look Up lands €50 million to tackle space collisions with radar tech

- French SpaceTech startup Look Up raises €50 million to expand its radar network and space traffic management services globally.

- Funding includes equity, debt, and public grants exclusively from European financial players.

- The €24 million equity portion is led by ETF Partners with participation from Leadwind (KFund), the EU’s EIC Fund, and existing investors.

- The EU supports expansion with €15 million in funding, and banking institutions contribute through debt financing.

- Look Up aims to become a global player in space safety and operations.

- The startup was founded in 2022 by former head of the French Space Command and ex-Chief of Space Surveillance at CNES.

- Look Up is building a radar network—SORASYS—to monitor satellites and debris orbiting Earth.

- The team, currently with over 60 employees, plans to grow to 100 by year’s end.

- Look Up already operates a radar in France and plans to deploy two more in French Polynesia.

- Funding will be used for new radar units, a space operations centre, the company’s international push, and a Space-Operations-as-a-Service model.

- Look Up’s technology vision focuses on radar network coverage, real-time space domain analysis, and enabling safe space operations.

- The startup’s expansion points to Europe’s strategic ambitions in space surveillance.

- ETF Partners stresses Look Up's role in creating a secure orbital environment for a sustainable space economy.

- Look Up's full-stack solution includes ATLAS2, an EU-backed programme for low-Earth orbit safety.

- The company addresses the increasing risks of collisions and debris management in space.

Read Full Article

2 Likes

Silicon

409

Image Credit: Silicon

Meta Invests $14.3bn In AI Firm Scale, Poaches CEO

- Meta Platforms has made a $14.3 billion investment in the AI startup Scale AI, valuing the company at over $29 billion.

- Meta's investment in Scale AI is the company's largest-ever external AI investment, highlighting its focus on AI development.

- Along with the investment, Meta will hold a minority of Scale's outstanding equity.

- Meta has also poached Scale AI's founder and CEO, Alexandr Wang, and a few other staff members to join Meta's AI development team.

- Scale AI, founded in 2016, provides data-labelling services for machine-learning training, contributing to its revenue growth.

- Scale AI expects its revenue to more than double to $2 billion this year.

- Meta's Meta AI chatbot assistant has reached one billion monthly active users, and Meta is focusing on expanding its reach.

- Meta may explore monetization strategies for the Meta AI chatbot like paid recommendations or a subscription plan.

- Meta's investment in Scale AI contrasts with its past approach of developing AI technology internally.

- Other tech firms like Microsoft, Amazon, and Google have also made significant investments in AI technologies.

- Jason Droege has been appointed as Scale AI's Interim CEO following Alexandr Wang's departure to join Meta.

- Scale AI is committed to bridging the gap between human values and technology to unlock AI's full potential according to Alexandr Wang.

- Meta's investment and commercial agreement with Scale AI acknowledge Scale's accomplishments and future potential.

- Meta stated its commitment to AI technology, especially in expanding the reach of Meta AI.

- Meta is exploring various monetization options for its Meta AI chatbot assistant.

- Meta's investment in Scale AI is a significant move in the AI sector, mirroring the increasing competition in AI technology development.

Read Full Article

24 Likes

AllTopStartups

1.1k

Image Credit: AllTopStartups

Survey Suggests Over a Quarter of UK Consumers Are Open to AI-powered Payments

- A survey by SumUp in the UK reveals changing payment preferences, with 29% open to AI-powered payments.

- 62% prefer debit/credit cards, while 18% opt for mobile payment methods like Apple Pay/Google Pay.

- Younger generations show a greater acceptance of mobile payments.

- Shift towards digital wallets is making debit cards less essential for younger consumers.

- Only 11% prefer paying in cash, with emerging methods like Buy Now, Pay Later and cryptocurrency gaining traction.

- 51% of people changed their payment habits in the past year, with digital payments becoming more popular.

- Businesses not accepting digital payments frustrate 19% of consumers.

- 29% of UK consumers trust AI for small automated payments, driven by convenience.

- Londoners also embrace digital payments, with 66% changing payment methods in the past year.

- Marketing & Growth Lead at SumUp notes the shift towards digital wallets and evolving consumer preferences.

Read Full Article

7 Likes

Inc42

2.2k

Image Credit: Inc42

Fidelity Increases IPO-Bound LensKart Valuation By 21% To $6.1 Bn

- Fidelity Investments marks up LensKart valuation to $6.1 Bn, a 21% increase from previous assessment.

- Fidelity joined LensKart's cap table last year at a $5 Bn valuation.

- LensKart, a D2C eyewear startup, became a unicorn in 2019 after a SoftBank investment.

- LensKart aims to raise $700 Mn to $1 Bn in IPO with a target valuation of $7-8 Bn.

- LensKart preparing for IPO listing, appointed Kotak Mahindra Bank and Morgan Stanley as investment bankers.

- Startup showed an 84% decrease in net loss to INR 10 Cr in FY24.

- Operating revenue surged 43% to INR 5,427.7 Cr in FY24.

- 25 startups are progressing towards bourse listings; Ather has successfully completed its IPO.

- LensKart was founded in 2010, operates omnichannel retail in multiple countries with over 2,500 stores.

- LensKart board passed a special resolution to drop 'Private' from its name ahead of IPO.

- Fidelity's cross-over fund reviews portfolio performance based on financial statements and comparable growth.

- LensKart seeking pre-IPO funding round of $1 Bn.

- LensKart's IPO timeline for listing on bourses remains undisclosed.

- LensKart's founders are Piyush Bansal, Amit Chaudhury, and Sumeet Kapahi.

- As per Inc42's IPO tracker, few startups have SEBI's approval for red herring prospectus.

- LensKart's public offering plans come amidst a surge in new-age startups preparing for IPOs.

Read Full Article

24 Likes

Startup Pedia

2.7k

Image Credit: Startup Pedia

Haryana Engineer Quits Job To Start Vermicompost Biz; Clocks Rs 45 Lakh In FY25

- Sumit Giri, from Haryana, quit his marketing job due to health issues and started Urjaa Agro Farm, a vermicompost startup, in 2022.

- With approximately 160-170 beds, Urjaa Agro Farm produces 90-120 tonnes of vermicompost every 3-4 months, selling at Rs 6-7 per kilogram.

- Starting with 60-70 beds, Sumit faced setbacks like earthworm casualties but eventually generated revenue by selling 49 tonnes of vermicompost.

- Urjaa Agro Farm expanded to 100 beds in 2023, producing 70 tonnes per cycle, bringing in around Rs 4 lakh each time.

- Sumit aims to increase profit from Rs 20 lakh in FY25 to Rs 30 lakh by 2026, with revenue reaching Rs 45 lakh in FY25.

- Apart from selling vermicompost, Urjaa Agro Farm also sells earthworms and provides training in vermicomposting, expanding its customer base.

- Sumit focuses on quality control, proper training for laborers, and plans to expand his vermicompost business in North India.

- Urja Agro Farm's success story showcases the potential and demand in the vermicompost market for aspiring entrepreneurs.

Read Full Article

24 Likes

Inc42

382

Image Credit: Inc42

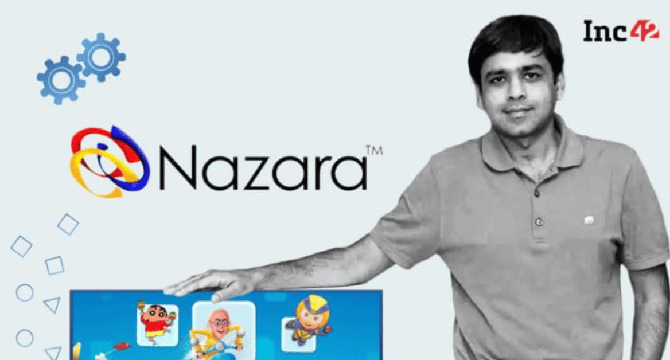

Nazara Completes Acquisition Of UK-Based Curve Games

- Nazara Technologies has completed the acquisition of UK-based video game publisher Curve Digital Entertainment Ltd for INR 247 Cr.

- Nazara's UK subsidiary completed the transaction, paying about INR 221 Cr to Curve Games.

- Curve Games, with casual gaming IPs like Fall Flat and For the King, was acquired to expand Nazara's gaming portfolio globally.

- Curve Games' publishing expertise was highlighted by Nazara's MD and CEO Nitish Mittersain.

- The acquisition involved payment of INR 248 Cr with Curve Games retaining its London office and team.

- Curve Games' studios in Brighton and Vancouver are also part of the acquisition agreement.

- Nazara has earmarked $100 Mn for mergers and acquisitions in the gaming segment.

- This is the second gaming studio Nazara has acquired internationally following Fusebox Games.

- Nazara has been active in various acquisitions, including Smaaash Entertainment and PokerBaazi parent.

- The acquisitions span across gaming, esports, and kids' entertainment, like Funky Monkeys.

- Nazara aims for organic growth by expanding publishing, game development, esports, and adtech divisions.

- Despite recent acquisitions affecting profitability, Nazara's CEO expects positive outcomes in the upcoming quarters.

- Shares of Nazara ended 6.5% higher at INR 1,328 on the BSE post the acquisition announcement.

Read Full Article

23 Likes

ISN

193

Image Credit: ISN

ArisInfra Solutions sets IPO price band at Rs 210-222 per share for Rs 500 crore offering

- Mumbai-based ArisInfra Solutions sets IPO price band at Rs 210-222 per share for Rs 500 crore offering.

- The IPO subscription will open on June 18 and close on June 20, with an anchor placement scheduled for June 17. Shares expected to list on BSE and NSE on June 25.

- The offer consists of a pure fresh issue of 2.25 crore equity shares with no offer-for-sale component, aimed at raising capital for various purposes like working capital and technology upgrades.

- The latest grey market premium suggests a potential listing price of Rs 262 per share, 18% above the upper price band.

- ArisInfra Solutions is a digital-first B2B startup targeting India's construction sector, offering a procurement and supply chain platform for bulk construction materials to clients like real estate developers and infrastructure firms.

- The company integrates warehousing, logistics, quality assurance, and just-in-time delivery through a digital interface to streamline processes and enhance efficiency in the construction supply chain.

- The IPO aims to raise Rs 499.59 crore for scaling operations, strengthening infrastructure, meeting working capital needs, and investing in subsidiaries for growth.

- The company plans to utilize IPO proceeds for working capital requirements, repayment of borrowings, investments in subsidiaries, general corporate purposes, and potential acquisitions.

- ArisInfra adjusted its IPO size to Rs 500 crore after a successful pre-IPO placement, managed by JM Financial, IIFL Capital Services, and Nuvama Wealth Management, with MUFG Intime India as the registrar.

- Minimum bid requirements for retail investors, small non-institutional investors, and large non-institutional investors are specified, catering to different investment levels.

- Siddharth Shah, co-founder of PharmEasy, backs ArisInfra Solutions, enhancing the company's investor appeal. The IPO comes during a favorable period for digitization and infrastructure investments.

Read Full Article

11 Likes

Economic Times

431

Image Credit: Economic Times

Chime, which almost sank in 2016, makes strong Wall Street debut; what changed?

- Chime Financial made a strong debut on the Nasdaq, rallying 37% on its first day after an $864 million IPO.

- The digital banking startup priced its shares at $27, opened above the announced range, and closed at $37.11 per share.

- Founded in 2012 by Britt and King, Chime offers online banking products and money management services through US national bank partnerships.

- Chime earns mainly from interchange fees, avoiding overdraft, service, and minimum balance fees, to provide affordable banking services.

- The company facilitated transactions worth $121 billion in the year ended March 31, 2025, serving 8.6 million customers.

- Investors such as DST Global, General Atlantic, and Iconiq are involved with Chime, reflecting the growth from past rejections to successful IPO.

- Chime's financial performance signals sustainable growth, as seen in its rising revenues and shrinking losses over recent years.

- Chime's listing rejuvenates the IPO market, potentially encouraging other fintech giants like Klarna, Gemini, and Medline to expedite their listing plans.

Read Full Article

25 Likes

Medium

166

4 Vs for Sustaining Startups

- Analyzing successful startups, a framework revolves around four key pillars: Vision, Values, Value, and Valuation.

- Vision is crucial, reflecting the founder’s passion for problem-solving and driving innovation.

- Values shape a startup's culture, decision-making, and long-term sustainability, intertwined with the founder's ethics.

- Value creation involves delivering benefits to customers that exceed costs, essential for sustainable growth.

- Valuation, often prioritized in startups, should not overshadow the core elements of vision, values, and value creation.

- A strong moral compass and focus on genuine value creation are vital for long-term success in startups.

- Focusing solely on valuation can lead to ethical conflicts, distorted priorities, and eventual organizational collapse.

- The framework highlights the importance of placing vision, values, and value creation above mere valuation in startup endeavors.

- The inverted focus on valuation over core startup elements poses a significant risk to sustainable business growth.

- Many startup failures can be attributed to prioritizing valuation over fundamental values, vision, and genuine value delivery.

- The article delves into the critical balance required between vision, values, value creation, and valuation for startup success.

Read Full Article

10 Likes

Inc42

94

Image Credit: Inc42

Gensol Insolvency: NCLT Admits IREDA’s Plea On INR 510 Cr Default

- The National Company Law Tribunal’s Ahmedabad bench has admitted Gensol Engineering Limited into insolvency on a plea by IREDA for a loan default of INR 510 Cr.

- IREDA's plea was heard by the bench of Shammi Khan and Sanjeev Kumar Sharma.

- The tribunal reserved its judgment as Gensol did not dispute the debt's existence.

- IREDA filed an insolvency petition against Gensol last month under the Insolvency and Bankruptcy Code (IBC).

- Gensol had borrowed INR 977.75 Cr from IREDA and PFC between FY22 and FY24.

- SEBI's interim order stated Gensol diverted funds for personal use and defaulted on debts from IREDA and PFC.

- Following SEBI's order, Gensol suspended operations, impacting over 10,000 drivers.

- NCLT issued directions to freeze assets of Gensol and associated entities.

- NCLAT rejected pleas by Gensol entities seeking a stay on asset freeze.

- Creditors have filed fresh insolvency petitions against BluSmart and Gensol for unpaid dues.

- Gensol Engineering allegedly owes Equentia Financial Services around INR 9 Cr.

- NCLT issued notices to BluSmart Mobility and Gensol Engineering on the insolvency petitions.

- Recent developments include ongoing insolvency proceedings and asset freezes related to Gensol and its entities.

- The case involves allegations of fund diversion, default on loans, and subsequent insolvency actions.

- Various legal actions and pleas have been filed by creditors and regulatory authorities against Gensol.

- The NCLT and NCLAT have been involved in adjudicating on the insolvency and asset freeze matters.

- The news article covers the complexities and legal actions surrounding Gensol Engineering Limited's insolvency case.

Read Full Article

5 Likes

Hackernoon

400

Image Credit: Hackernoon

Bedrock Security Cofounder and CEO on Why Security Must Start with Data Visibility

- Bedrock Security focuses on data security and management in a time of increased data growth, cloud modernization, and AI adoption.

- The team combines technical expertise with a bias for action to address complex data security challenges.

- Their metadata lake offers visibility and control to secure data and meet AI-driven operational demands.

- Bedrock Security helps enterprises discover, classify, and contextualize data, supporting various use cases including AI governance and compliance.

- The company aims to support the expanding use of enterprise data by autonomous systems and continuous data governance.

- Customer success stories include biotech companies using their platform to protect sensitive data like DNA sequences and intellectual property.

- Challenges include proving value in a crowded market where differentiation is essential, aiming to avoid customers getting stuck in siloed solutions.

- Key success metrics for the company include product market fit, pipeline growth, employee NPS, and talent retention.

- The CEO, Bruno Kurtic, values adaptability, learning from failures, and the team's ability to evolve in the fast-paced AI space.

- Bedrock Security's open and scalable approach addresses data risk visibility and management, providing a cohesive layer of context for policy enforcement and risk reduction.

Read Full Article

24 Likes

Inc42

309

Image Credit: Inc42

Exclusive: BRND.ME Sells MensXP To RPSG Group

- BRND.ME sells MensXP's parent entity to RPSG Group for around $9 Mn in an all-cash deal, an 85% drop in valuation.

- India Lifestyle Network (ILN), founded in 2017 by Anagad Bhatia, includes MensXP, iDiva, and HYPP.

- RPSG Group has integrated MensXP and iDiva into its online media platform, Hook.

- Bhatia moved out of MensXP to join Network18’s Firstpost and Creator18 as CEO.

- BRND.ME has been in talks to offload its stake in some acquired businesses to raise capital.

- BRND.ME, founded by Anath Narayanan, acquires digital-first startups and has raised over $300 Mn in funding.

- BRND.ME trimmed its consolidated net loss by 31% to INR 155.85 Cr in FY24 and saw an 11.6% increase in operating revenue.

Read Full Article

16 Likes

For uninterrupted reading, download the app