Startup News

TechBullion

306

Image Credit: TechBullion

The Hidden ROI of PR: Why Your Startup Can’t Afford to Stay Invisible

- Invisible startups miss opportunities, investments, and recognition in crowded markets.

- PR is essential for startups to build trust, credibility, and connections with stakeholders.

- Strategic media coverage can change startup perception, attract talent, and open doors.

- Being proactive with PR early on is crucial for long-term success and visibility.

Read Full Article

18 Likes

TechCrunch

340

Image Credit: TechCrunch

From $5 to financial empowerment: Why Stash co-founder Brandon Krieg is a must-see at TechCrunch All Stage 2025

- TechCrunch All Stage 2025 aims to provide founders with tools, tactics, and insights for success in the startup world.

- Brandon Krieg, co-founder of Stash, will speak at the event on July 15, discussing how technology has made investing accessible to everyone.

- Krieg will share insights on Stash's innovations like StashWorks and the AI Money Coach, as well as his journey in building a mission-driven fintech startup.

- TechCrunch All Stage offers valuable sessions for founders to learn from experienced individuals like Krieg, with discounted tickets available for a limited time.

Read Full Article

20 Likes

Inc42

204

Image Credit: Inc42

Karnataka HC Stays AAR’s Plans To Revoke Tax Exemption For Namma Yatri

- The Karnataka High Court has stayed the notice issued by the state authority for advance ruling to revoke the tax exemption granted to ride-hailing platform Namma Yatri.

- The notice to revoke the tax reprieve stemmed from Namma Yatri (operated by Juspay), being hived off as Moving Tech Innovations, leading to questions about GST collection on fares.

- The HC directed the AAR to justify invoking Section 104 of the CGST Act against Namma Yatri, noting the lack of specific allegations of suppression or misrepresentation in the show cause notice.

- The move by Karnataka HC occurs amid a changing landscape where competitors like Ola and Uber transition to subscription models, potentially impacting tax implications for companies adopting similar models.

Read Full Article

12 Likes

TechCrunch

353

Image Credit: TechCrunch

Tailor, a ‘headless’ ERP startup, raises $22M Series A

- Tailor, a San Francisco- and Tokyo-based headless ERP startup, secured $22 million in a Series A funding round with investors ANRI, JIC VGI, NEA, Spiral Capital, and Y Combinator.

- Headless ERP systems, like Tailor's Omakase, separate the front end from the back end, allowing for customization options. This approach enables AI agents to automate tasks and provides flexibility for businesses.

- Tailor's diversified service offerings initially focused on retail and e-commerce but are now expanding to B2B sectors due to rising complexities in the operational side of businesses.

- The company plans to utilize the funding for U.S. expansion, product development, and strengthening operations in Japan. Tailor aims to offer a modular, API-first ERP platform to cater to diverse customer needs.

Read Full Article

21 Likes

Startup Pedia

63

Image Credit: Startup Pedia

Instamart, Zepto, Blinkit to introduce new charges for orders that do not meet specified MOV: Report

- Indian quick commerce platforms like Instamart, Zepto, and Blinkit have introduced new charges and handling fees for orders that do not meet a specified minimum order value (MOV), including basket size levies, small-order surcharges, and weather-related fees.

- The move aims to improve unit-level profitability, with Instamart setting a new MOV at Rs 99, Zepto implementing a handling fee for orders below Rs 175, and Blinkit charging extra for bulk orders and discounted purchases.

- Analysts suggest that these additional charges and policy adjustments could enhance platform take rates, representing the revenue ratio to the total gross order value, and may impact how quick commerce companies manage their earnings and last-mile delivery costs.

- Quick commerce leaders like Blinkit, Instamart, and Zepto account for a significant portion of India's quick commerce market, with Blinkit reporting an operational loss of Rs 178 crore in the January-March quarter.

Read Full Article

3 Likes

Insider

418

Image Credit: Insider

Mira Murati's startup is dangling $500,000 salaries to win the AI arms race

- Former OpenAI CTO Mira Murati's startup, Thinking Machines Lab, is paying top dollar for technical talent, offering salaries of up to $500,000 to its staff.

- The startup paid two technical staff members $450,000 each, while another received $500,000, according to federal data obtained by Business Insider.

- The salary data, sourced from H-1B visa filings, reveals that Thinking Machines Lab's compensation for technical hires far exceeds that of competitors like OpenAI and Anthropic.

- The startup, founded earlier this year, includes former OpenAI personnel and has garnered attention for its high salaries in the competitive AI talent market.

Read Full Article

25 Likes

TechCrunch

582

Image Credit: TechCrunch

A comprehensive list of 2025 tech layoffs

- The tech industry saw over 22,000 layoffs in 2025, with 16,084 in February.

- Top companies like Google, Microsoft, and Amazon were among those cutting jobs.

- Layoffs ranged from 5% to over 40% of workforce, totaling thousands of job cuts.

- Major layoffs affected industries like tech, gaming, and cybersecurity globally.

- The list is updated frequently, tracking layoffs across the tech sector in 2025.

Read Full Article

19 Likes

TechBullion

17

Image Credit: TechBullion

Canadian-Founded Blockchain Project, ZDKL, Could Revolutionize Peace Through Trade for Businesses and Content Creators

- Decentralized transactions offer a way to bypass traditional financial regulations for businesses.

- ZDKL, a Canadian-founded blockchain project, aims to combine compliance with decentralized infrastructure.

- ZDKL-PTT coin drives the digital economy by benefiting various individuals and institutions.

- Focused on regulatory compliance and empowering underserved communities in the digital economy.

- Promotes economic sovereignty by equipping small businesses and content creators with on-chain tools.

Read Full Article

1 Like

ISN

276

Image Credit: ISN

B2B marketplace Jumbotail becomes India's newest unicorn startup after raising over Rs 1,000 crore

- B2B marketplace Jumbotail has become India's newest unicorn startup after raising over Rs 1,000 crore ($120 million) in a funding round led by SC Ventures and Artal Asia.

- Jumbotail's valuation was estimated to reach around $900 million before this funding round.

- The funding round follows the startup's acquisition of Solv and the approval from the Competition Commission of India in May, allowing Jumbotail to extend its services tailored for India’s small and medium enterprises.

- The combined Jumbotail and Solv platform will focus on empowering India's small retailers and MSMEs through a tech-driven B2B ecommerce ecosystem, with plans to expand its offerings and workforce.

Read Full Article

16 Likes

Andrew Chen

172

Image Credit: Andrew Chen

Corpospeak: Why you still sound like a faceless corporate entity

- Marketing teams still use corpospeak despite the shift towards authenticity in communication.

- The trend of faceless, wooden corporate communication is highlighted with examples and implications.

- A call to move away from traditional marketing strategies and embrace real, relatable interactions.

- The importance of founders and builders engaging directly with customers in a genuine manner.

- Suggestions on how companies can humanize their communication and connect effectively with audiences.

Read Full Article

9 Likes

Startup Story

417

Image Credit: Startup Story

Jumbotail Becomes India’s Newest Unicorn with $120 Mn Funding

- Bengaluru-based B2B ecommerce platform Jumbotail becomes India's newest unicorn after securing $120 million in a Series D funding round led by SC Ventures and Artal Asia.

- Jumbotail's post-money valuation surpasses $1 billion with this funding, making it the fifth Indian startup in 2025 to achieve unicorn status.

- The company, founded in 2015, focuses on groceries and food, connecting over 500,000 small retailers in 400+ Indian cities through a B2B marketplace.

- Jumbotail's acquisition of Solv India, a B2B marketplace incubated by SC Ventures, allows it to expand into non-grocery categories and strengthen its B2B offerings, despite some concerns raised due to Solv's financial performance and leadership exit.

Read Full Article

25 Likes

Pymnts

286

Image Credit: Pymnts

Home Depot Hopes to Build Up Pro Segment With GMS Acquisition

- Home Depot acquired SRS Distribution last year, a distributor for roofing firms and construction projects.

- SRS Distribution is now acquiring specialty building products distributor GMS to expand its 'Pro' customer base.

- The acquisition of GMS will create a network of over 1,200 locations and 8,000 trucks for job site deliveries.

- Home Depot's focus on growing its Pro segment includes digital upgrades and trade finance initiatives to support contractors.

Read Full Article

17 Likes

Inc42

157

Image Credit: Inc42

EV 2-Wheeler Registrations: TVS, Bajaj Retain Top 2 Spots In June, Ather’s Market Share Grows

- TVS Motor and Bajaj Auto continue dominating June's electric two-wheeler market.

- Despite a decline in overall EV sales in India, TVS and Bajaj maintain top positions.

- Ather Energy's market share grows as it witnesses a rise in registrations.

- EV market experiences decline, while EV companies like Ather Energy show growth.

Read Full Article

9 Likes

TechCrunch

163

Image Credit: TechCrunch

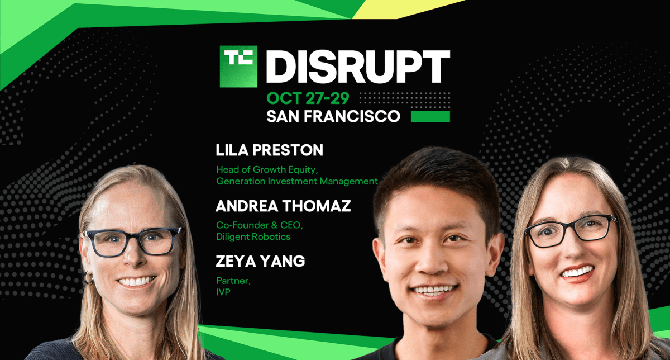

Three powerhouses cover how to prepare now for your later-stage raise at TechCrunch Disrupt 2025

- TechCrunch Disrupt 2025 will feature a session on preparing for later-stage raises, focusing on strategies for founders aiming for significant funding.

- The panel on October 29 will address the importance of building relationships, tracking metrics, and telling the right story for successful late-stage capital raises.

- Experts like Zeya Yang from IVP, Lila Preston from Generation Investment Management, and Andrea Thomaz from Diligent Robotics will share insights on navigating the funding landscape.

- The event aims to provide founders with valuable advice to secure meaningful funding, offering a platform for networking and learning opportunities.

Read Full Article

9 Likes

Eu-Startups

191

French startup Cosma raises €2.5 million for underwater imaging technology for marine biodiversity

- Nice-based startup Cosma raises €2.5 million to industrialize its drone fleet used for mapping deep-sea ecosystems.

- The funding round was led by WIND and Ternel, with support from other investors, including 50 Partners, Caisse d’Épargne Côte d’Azur, and IFREMER.

- Cosma's technology involves autonomous underwater robots collecting images to generate photographic seabed models and locate protected species, contributing to ocean biodiversity preservation.

- The funding will enable Cosma to expand its drone fleet for deep-sea operations, enhance its software platform, and cater to public and private clients at a European level.

Read Full Article

11 Likes

For uninterrupted reading, download the app