AR News

Digit

332

Image Credit: Digit

Best gaming PC build under ₹95,000 in July 2025

- Article showcases a gaming PC build under ₹95,000 for July 2025.

- Featuring components like AMD Ryzen 5 9600X, NVIDIA RTX 5060, and 32GB DDR5 RAM.

- Designed for gaming, creative workloads, and balanced performance with modern features.

- Upgrade-friendly with future GPU and SSD upgrades, fast DDR5 memory, and responsive build.

Read Full Article

19 Likes

TechDigest

309

Image Credit: TechDigest

Nvidia becomes world’s first $4 trillion company

- Nvidia has achieved a market valuation of $4 trillion, making it the first company globally to do so.

- The chip-maker's shares surged by 2.4% to $164 on Wednesday, driven by high demand for AI technology.

- Nvidia's growth trajectory has been remarkable, with its value less than 1% of its current price just eight years ago.

- The company's expansion was initially fueled by competition in graphics card development, and more recently, by demand for chips essential to generative AI models.

Read Full Article

17 Likes

Digit

837

Image Credit: Digit

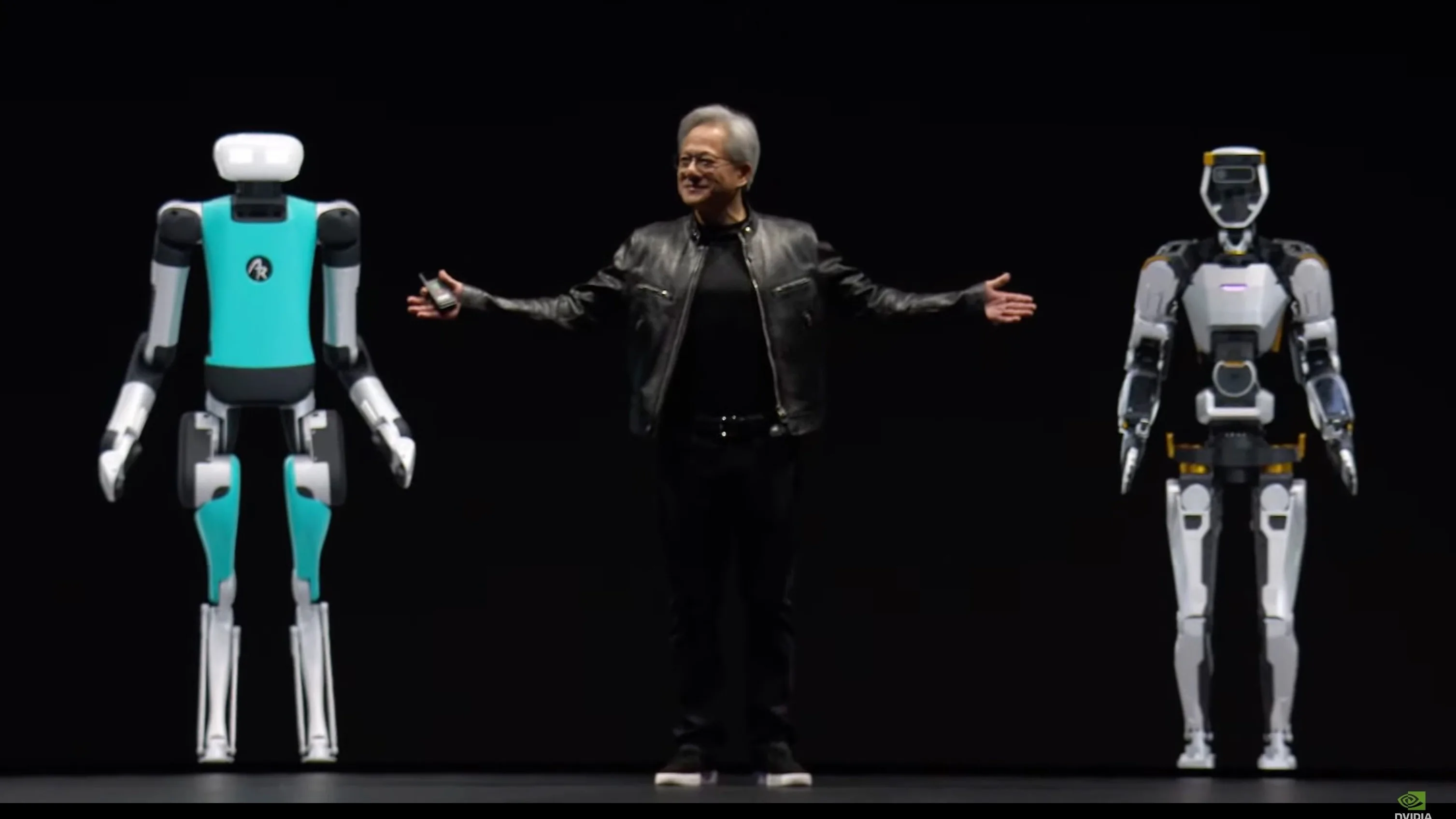

NVIDIA becomes first company ever to hit $4 trillion mark, spurred by AI

- NVIDIA becomes the first company to hit a $4 trillion market capitalization on July 9, 2025, driven by its dominance in artificial intelligence (AI) technology.

- The company's success is attributed to the widespread adoption of NVIDIA's GPUs in AI applications, ranging from large language models to autonomous vehicles and scientific simulations.

- NVIDIA's strategic shift from gaming hardware to AI infrastructure, led by CEO Jensen Huang, has positioned it as a key player in the AI revolution, with a near-monopoly in the AI hardware market.

- Despite its milestone achievement, NVIDIA faces challenges such as overvaluation risks, regulatory scrutiny due to its near-monopoly status in AI chips, and the need to sustain its lead amidst competition and evolving market dynamics.

Read Full Article

23 Likes

Fourweekmba

287

Image Credit: Fourweekmba

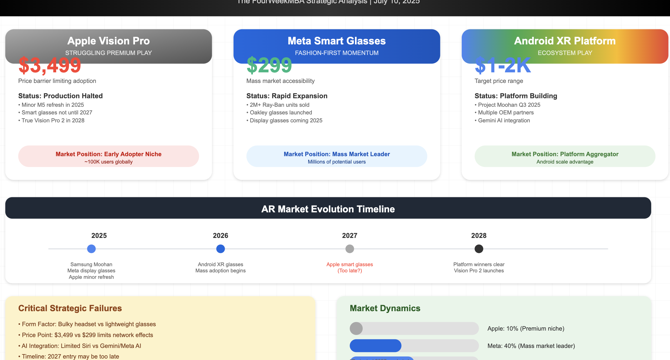

The AR Wars: Apple Vision Pro’s Struggle as Meta and Google Race Ahead

- Apple plans to upgrade Vision Pro headset as competitors Meta and Google advance.

- Apple's premium AR glasses strategy faces challenges against lightweight, AI-powered competitors.

- AR landscape shifting towards smart glasses, leaving Apple's premium approach vulnerable.

- Meta and Google aggressively advancing with affordable AR glasses, putting pressure on Apple.

Read Full Article

17 Likes

Fourweekmba

323

Image Credit: Fourweekmba

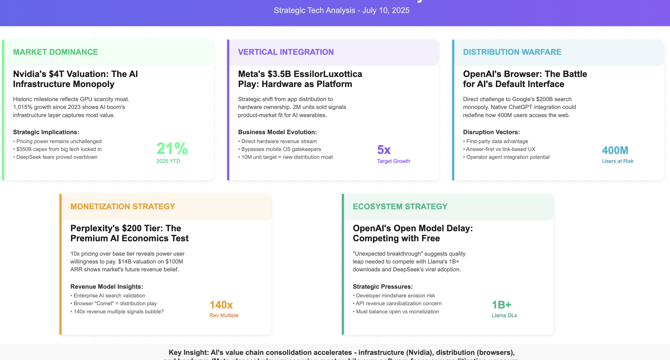

The Great AI Consolidation: From Chips to Interfaces, the Moat Wars Begin

- Nvidia reaches $4 trillion market valuation, showcasing AI infrastructure monopoly confirmation.

- Meta invests $3.5 billion in EssilorLuxottica, shifting focus to hardware-software integration.

- OpenAI challenges Google Chrome by launching AI-powered web browser for enhanced user experience.

- Perplexity tests AI's pricing ceiling with $200 premium tier subscription plan.

- OpenAI faces delay in open model release, risking developer ecosystem loss.

Read Full Article

5 Likes

Moneyweb

1.1k

Testing ChatGPT to pick shares

- Debates about AI impacting jobs, industries, including financial services, are ongoing.

- AI shows potential to improve financial services efficiency but lacks human experience.

- AI's limitations include being reactive, not proactive, and risk of industry manipulation.

- ChatGPT advice on JSE stock portfolio showcased benefits but also included critical errors.

Read Full Article

11 Likes

Siliconangle

153

Image Credit: Siliconangle

Hybrid cloud emerges as cornerstone of enterprise AI strategy

- Hybrid cloud is foundational for enterprise reinvention, offering versatility and control.

- It enables seamless orchestration across edge, core, and cloud for legacy and new apps.

- Hybrid cloud platforms support AI-driven use cases while maintaining security and performance.

- Nutanix's collaboration with AWS highlights the importance of dual-platform strategy for enterprises.

Read Full Article

9 Likes

Insider

95

Image Credit: Insider

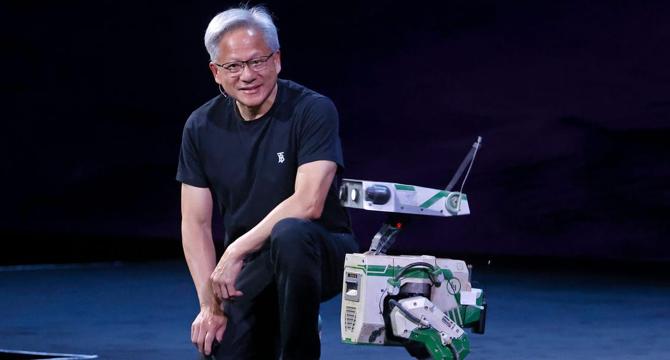

How much do you know about the world's largest company? Take our quiz about Nvidia!

- Nvidia briefly crossed a $4 trillion valuation, becoming the first company to hit this milestone.

- CEO Jensen Huang transformed Nvidia from a gaming hardware maker into a premier AI tech company over the last 33 years.

- Nvidia dominates the AI chip market with GPUs necessary for training large language models.

- The company was founded in 1993 by Huang and his co-founders in a Denny's restaurant; it nearly went bankrupt in 1996 before a recovery.

Read Full Article

5 Likes

Pymnts

135

Image Credit: Pymnts

Nvidia Achieves Record $4 Trillion Market Capitalization

- Nvidia has become the world’s first $4 trillion public company, exceeding market caps of competitors like Microsoft.

- The chip designer's market cap briefly reached $3.9 trillion and hit a record high share price of $164 on a surge in demand for AI technologies.

- Despite facing U.S. export controls limiting access to the Chinese market, Nvidia continues to expand AI infrastructure projects internationally.

- The company's value tripled to over $1 trillion in just a year, positioning it alongside Microsoft and Apple as one of the few American companies with over $3 trillion market value.

Read Full Article

7 Likes

Macdailynews

125

Image Credit: Macdailynews

Nvidia, not Apple, first to historic $4 trillion market value

- Nvidia became the first public company to reach a $4 trillion market cap, surpassing Apple, driven by strong demand for AI technologies.

- Nvidia's market value growth reflects Wall Street's confidence in AI advancements, with its high-performance chips at the forefront of this sector.

- Nvidia's market value tripled in a year, faster than Apple and Microsoft, positioning it as an early AI winner and the largest tech weight on the S&P 500.

- Nvidia's market value exceeds that of Apple and Microsoft, worth more than the Canadian and Mexican stock markets combined, and surpassing the total value of all publicly listed companies in the UK.

Read Full Article

7 Likes

Insider

329

Image Credit: Insider

Nvidia's AI-powered rise to a $4 trillion market cap, in 3 charts

- Nvidia has become the first $4 trillion company following its surge driven by the AI boom since ChatGPT appeared in late 2022.

- Shares of Nvidia have risen more than eightfold since November 2022, outperforming the broader market significantly.

- Nvidia's GPUs powering large language models have led to its dominance in AI over competitors like AMD and Intel.

- Nvidia's revenue has seen substantial growth, with $44.1 billion in the first quarter of this year, mainly driven by its data center unit.

Read Full Article

19 Likes

Ars Technica

167

Image Credit: Ars Technica

AI mania pushes Nvidia to record $4 trillion valuation

- Nvidia achieved a historic $4 trillion market valuation, making it the first company to reach this milestone.

- The company's stock has surged by 22% in 2025 driven by high demand for AI hardware following ChatGPT's launch.

- Nvidia's success is attributed to its GPUs excelling in running AI models efficiently, with its data center GPUs being crucial for AI applications.

- Despite facing challenges such as export controls and market volatility, Nvidia's future success hinges on the growth of the AI industry's sustainability.

Read Full Article

Like

Insider

74

Image Credit: Insider

Nvidia: A complete guide to the hardware company behind the AI boom

- Nvidia is at the forefront of the AI boom, hitting $4 trillion in market cap.

- The company's success is attributed to CEO Jensen Huang's leadership and innovative products.

- Nvidia, founded in 1993, became a household name in recent years with GPUs for AI.

- Its history, leadership, products, and financials contribute to Nvidia's global prominence.

- The article delves into Nvidia's journey, successes, challenges, and impact on AI technology.

Read Full Article

4 Likes

Rockpapershotgun

133

Image Credit: Rockpapershotgun

You'll have to move quickly to save a third on this HP Omen 35L with an RTX 4080 Super

- HP is offering a 32% discount on a build-to-order PC with an NVIDIA RTX 4080 Super GPU, bringing the price from $2,180 to $1,464 using a voucher code.

- There is also a 30% discount on an HP Omen 35L with an RTX 5070 Ti, available for $1,648.

- To avail of the deals, customers need to customize and buy the PC with specific components and use the voucher code 'LEVELUP20' for an extra 20% off the price.

- For those interested in the RTX 5070 Ti rig, selecting certain components and applying the same discount code will result in a final price of $1,648 with free shipping.

Read Full Article

8 Likes

Johndcook

358

Experiences with Nvidia

- Started working with Nvidia in early 2009 at the beginning of the ORNL Titan project, found their technical stance on issues to be reasonable.

- Nvidia made good strategic decisions, formed partnerships to stay competitive, captured market share dominance with CUDA over Intel Xeon Phi.

- Nvidia went all-in on CUDA in the early 2000s; some disregarded it at first due to it being nonstandard, but many have since turned back on this decision.

- Nvidia made prescient decisions to focus on AI, develop software libraries for new markets, but faces criticism for high prices and confusing marketing claims.

Read Full Article

21 Likes

For uninterrupted reading, download the app