Business News

HinduBusinessLine

100

Image Credit: HinduBusinessLine

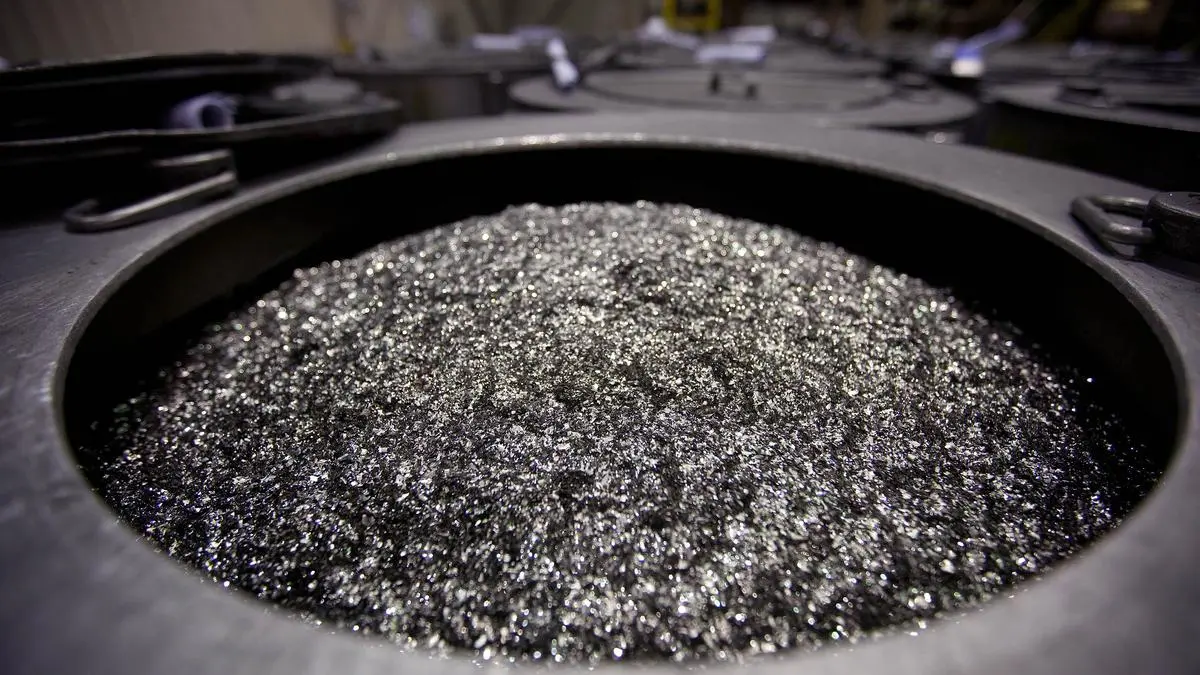

Draft guidelines to incentivise domestic production of rare earth minerals on anvil

- Ministries of Heavy Industries and Mines in India are working on a scheme to boost domestic production of rare earth magnets and minerals, including for private sector and PSUs.

- China, the world's primary exporter of rare earth magnets, imposed restrictions on shipments earlier this year, affecting global supply.

- India, heavily reliant on Chinese imports for over 80% of its 540 tonnes of magnet imports, has felt the impact and aims to increase domestic production.

- Rare earth minerals like samarium, gadolinium, and dysprosium are crucial for various technologies such as electric motors, smartphones, and missile systems.

Read Full Article

6 Likes

HinduBusinessLine

422

Image Credit: HinduBusinessLine

India's iron ore pellet makers seek curbs on Iranian imports via Oman

- Indian iron ore pellet makers have seen a surge in imports from Iran via Oman this year, with around 800,000 metric tons being imported so far, as opposed to negligible imports in previous years.

- The increase in imports is attributed to higher domestic pellet prices and the availability of cheaper, high-quality Iranian pellets, causing domestic producers to operate at only 69% capacity.

- The Pellet Manufacturers Association of India has raised concerns about the actual country of origin for these pellets coming through Oman, prompting the Ministry of Steel to examine the issue following a petition from domestic pellet manufacturers.

- The surge in demand for pellets in India is driven by robust steel production fueled by growth in infrastructure, construction, and the automotive sector, leading to increased steel consumption and crude steel output in the country.

Read Full Article

25 Likes

HinduBusinessLine

331

Image Credit: HinduBusinessLine

Stakeholders to urge govt to declare 2026 as ‘Year of Soy’

- Stakeholders in the soyabean value chain, backed by various associations, are urging the government to declare 2026 as the 'Year of Soy' to boost consumption and address nutrition concerns.

- A national consultation in New Delhi on July 12 aims to present a white paper advocating for the mainstreaming of soybean-based food products, recommending their inclusion in mass feeding programs and distribution to improve food security.

- The white paper emphasizes the nutritional benefits of soya products, their potential to bridge supply-demand gaps in pulses, reduce imports, and enhance health security. It also highlights the cost-effectiveness of soya protein compared to other sources.

- The initiative seeks to combat malnutrition, boost farmer income, promote entrepreneurship, enhance public health, and drive exports of high-value soya products. Recommendations from the consultation will be presented to key ministries for future policy guidance.

Read Full Article

19 Likes

TechBullion

342

Image Credit: TechBullion

Entrepreneurship Without the Noise: Why Focus Matters More Than Talent

- Amidst the loud entrepreneurship culture, focus trumps talent for enduring success.

- Talent gives a head start, but consistent focus drives real, lasting businesses.

- Clear direction, relentless focus, and disciplined effort differentiate enduring entrepreneurs from burnouts.

Read Full Article

20 Likes

Forbes

178

Image Credit: Forbes

It’s About To Get Harder To Pay Off Your Student Loans—Here’s What Changed

- President Trump signed a bill making it harder to pay off student loans.

- The bill replaces income-based repayment plans with less equitable options.

- Borrowers will face higher monthly payments and restricted loan forgiveness options.

- Current income-based plans are replaced with less forgiving repayment plans.

Read Full Article

10 Likes

Forbes

305

Image Credit: Forbes

Homeownership Just Got Easier For Millions With Limited Credit History—Here’s Why

- A new rule introduced by Fannie Mae and Freddie Mac allows the use of VantageScore 4.0, a more flexible credit scoring model, enabling millions with limited credit history to qualify for mortgages.

- VantageScore 4.0 requires as little as one account, like a credit card or a collection, to generate a score, making it beneficial for first-time buyers and individuals who primarily pay in cash.

- This change aims to reduce closing costs and expand homeownership access for groups like rural residents, renters, and young buyers with unconventional credit histories.

- VantageScore 4.0 considers nontraditional data like rent and utility payments, excluding medical debt and paid collections, potentially opening up mortgage opportunities for more individuals.

Read Full Article

18 Likes

Baystreet

152

Image Credit: Baystreet

Markets Tick Higher Amid Tariff Updates

- Futures linked to Canada's main stock index edged higher as investors awaited trade and tariff updates.

- President Trump announced copper tariffs and threatened levies on semiconductors and pharmaceuticals, expanding the trade war.

- Nissan halted production of three models for Canada due to mutual U.S.-Canada auto export tariffs.

- Stock futures in the U.S. rose slightly, with investors monitoring tariff updates and awaiting the release of the Federal Open Market Committee’s minutes.

Read Full Article

9 Likes

HinduBusinessLine

90

Image Credit: HinduBusinessLine

Musk's Starlink receives final regulatory nod for launch in India, sources say

- Elon Musk's Starlink has received final regulatory approval to launch in India.

- Starlink has been awaiting regulatory clearance since 2022 and recently received a key license from India's Telecom Ministry.

- Once Starlink secures spectrum, sets up ground infrastructure, and meets security regulations, it will enter the Indian market as the third company after OneWeb and Reliance Jio.

- Starlink's approval comes after a spectrum allocation dispute between Elon Musk's company and Mukesh Ambani's Jio was resolved by India's government.

Read Full Article

1 Like

HinduBusinessLine

78

Image Credit: HinduBusinessLine

Broker’s call: Adani Power (Buy)

- Adani Power (APL) is poised for strong capacity addition with a reduced risk profile and profitable PPAs in place. Recent payments from Bangladesh ease investor concerns.

- Management expects APL's earnings volatility to decrease as merchant capacity drops to 10-12% by FY30E compared to the current 18%.

- APL is a pure play on India's thermal energy sector, with a focus on peak power containment. The company is valued at a 36% premium to NTPC based on a 15x EV/EBITDA multiple.

- The article discusses the strong position of Adani Power in India's thermal energy landscape, its valuation compared to NTPC, and potential risks such as PPA issues and merchant realisations. The analysis was published on July 9, 2025.

Read Full Article

4 Likes

HinduBusinessLine

379

Image Credit: HinduBusinessLine

MF equity inflows jump 24 per cent in June despite market volatility

- Equity inflows increased by 24% in June despite market volatility, with flexi and small-cap funds receiving the highest inflows.

- Total equity assets reached ₹33.47 lakh crore with a mark-to-market gain of ₹1.18 lakh crore, indicating investor confidence in mutual funds.

- The rebound in equity inflows is seen as a resurgence in investor confidence, driven by strong market performances, especially in mid- and small-cap segments.

- Inflows through SIP hit a new high of ₹27,269 crore, with strong interest in arbitrage funds while sectors like gold ETFs saw significant inflows amid global uncertainties.

Read Full Article

22 Likes

Coinpedia

191

Image Credit: Coinpedia

Forget the Shiba Inu (SHIB) Noise: These 4 Tokens Are the True Millionaire-Makers in 2025

- Analysts suggest shifting attention from Shiba Inu to upcoming millionaire-maker tokens.

- Little Pepe (LILPEPE) stands out as a meme coin with real utility.

- XRP battles resistance, Cardano sees positive trends, Dogecoin eyes bullish breakout.

- 2025's millionaire-makers focus on narrative, technical strength, and ecosystem potential.

Read Full Article

11 Likes

Baystreet

318

Image Credit: Baystreet

Pentagon Shifts Stance on Ukraine Military Aid

- US President Trump announced sending more weapons to Ukraine for defense against Russian attacks.

- Pentagon stated they will send primarily defensive weapons to Ukraine at Trump's direction.

- Ukraine has been asking for Patriot missiles to defend against Russian air strikes.

- Trump discussed increasing Ukraine's defense capability with Zelenskyy amidst escalating Russian attacks.

Read Full Article

19 Likes

Bloomberg Quint

13

Image Credit: Bloomberg Quint

LTIMindtree, eClerx, Oracle Financial Services — Dolat Capital's Preferred Pick In IT, Internet, Software, KPO

- Dolat Capital's preferred picks in IT, Internet, Software, and KPO sectors include LTIMindtree, eClerx, and Oracle Financial Services.

- For Q1, Dolat Capital anticipates tier-1 companies to report negative to low single digit growth in CC terms, while tier-2 companies may see negative to high single digit growth in CC terms.

- Q1 FY26 is expected to see strong cross-currency tailwinds, with gains ranging from 60 bps to 340 bps, especially for companies with a significant presence in the UK/Europe.

- Potential downward pressure post-Q1 earnings is predicted for companies like Tech Mahindra, KPIT, Newgen, and Eternal due to recent stock price increases.

Read Full Article

Like

Baystreet

235

Image Credit: Baystreet

Asia Mixed as Trump Nixes Extensions

- Asia-Pacific markets traded mixed following Trump's decision to not extend tariffs deadline set for August 1st.

- Nikkei 225 in Japan gained 0.3%, while Hang Seng in Hong Kong decreased by 1.1%.

- Trump announced a 50% levy on copper imports and hinted at more sector-specific tariffs; threatened tariffs on pharmaceutical exports.

- Various other markets in the region experienced mixed movements.

Read Full Article

14 Likes

HinduBusinessLine

75

Image Credit: HinduBusinessLine

Temasek’s portfolio rises to new high; India exposure up at 8%

- Temasek's net portfolio value reached S$434 billion by March 2025, with an 8% exposure to India and decreased exposure to China.

- Chief Investment Officer Rohit Sipahimalani attributed the portfolio growth to investments in China, the US, and India, supported by macroeconomic conditions and long-term prospects.

- Temasek plans to continue investing in key markets and explore new ones. It expects India's growth to be driven by capex growth and domestic consumption recovery.

- In FY25, Temasek made a net investment of S$10 billion, indicating a shift from the previous year's divestment, expressing optimism about a potential US-India trade deal and other free trade agreements.

Read Full Article

3 Likes

For uninterrupted reading, download the app