Cryptography News

Coindoo

139

Image Credit: Coindoo

Kaspersky Uncovers New Malware Stealing Crypto Wallets via Mobile Photos

- Kaspersky uncovered a new malware called SparkKitty that steals crypto wallets via mobile photos.

- The malware scans photo albums in smartphones for wallet recovery phrases.

- It looks for screenshots of 12- or 24-word seed phrases used to back up wallets.

- Once detected, SparkKitty can extract and transmit these credentials to attackers.

- The malware spreads by masquerading as legitimate mobile apps like '币 coin' and 'SOEX'.

- '币 coin' was on the Apple App Store, while 'SOEX' was on Google Play.

- Kaspersky notified Google and Apple, leading to the removal of the malicious apps.

- SparkKitty is linked to SparkCat and has been targeting users since early 2024.

- It mainly affects users in China and Southeast Asia but poses a global threat.

- Kaspersky advises crypto users not to store sensitive data in unencrypted photo albums.

- Users should be cautious of apps with unclear origins, even on official app stores.

Read Full Article

8 Likes

Coindoo

305

Image Credit: Coindoo

Ledger Launches ‘Recovery Key’ to Simplify Crypto Wallet Access and Backup

- Ledger has launched a 'Recovery Key' to improve user experience in crypto wallet access and backup.

- The new feature is designed for Ledger's Flex and Stax devices, allowing users to recover wallet access quickly by tapping the Recovery Key card and entering a PIN.

- The technology uses secure element infrastructure and connects via offline NFC for enhanced security.

- As global crypto adoption grows, Ledger believes traditional seed phrase recovery methods are becoming less practical, leading to the introduction of the Recovery Key.

- Users can generate secure backup keys in addition to their original seed phrases, ensuring offline, PIN-protected storage on durable hardware.

- The Recovery Key creation is optional, manually approved on Ledger devices, allowing flexibility in managing access and redundancy.

- Ledger's initiative aligns with the industry's focus on user-friendly yet secure self-custody solutions, bridging decentralization and convenience.

- Ledger aims to enhance security as the crypto ecosystem evolves.

- The Recovery Key is a step towards improving user experience while maintaining self-custody.

- The technology is available for Ledger's Flex and Stax devices, which feature e-ink touchscreens for easy recovery.

- Users can create backup keys in addition to seed phrases for enhanced security and redundancy.

- Recovery Key creation is optional, allowing flexibility in managing access.

- Ledger's move reflects the industry trend towards secure self-custody solutions.

- The Recovery Key simplifies crypto wallet access and backup procedures.

- Ledger's innovation addresses the need for improved security in the evolving crypto landscape.

Read Full Article

18 Likes

Coindoo

327

Image Credit: Coindoo

Digital Asset Secures $135M to Expand Privacy-Focused Canton Blockchain for Institutions

- Digital Asset has secured $135 million in funding led by DRW Venture Capital and Tradeweb Markets, with participation from key players in traditional finance and crypto.

- Participants in the funding round included BNP Paribas, Circle Ventures, Citadel Securities, DTCC, Virtu Financial, and Paxos.

- The funding reinforces Digital Asset's position in the intersection of capital markets and Web3 innovation.

- Digital Asset's ecosystem centers around the Canton Network, a blockchain platform with configurable privacy for enterprise use.

- Institutions like Goldman Sachs and BNY Mellon are already exploring tokenizing real-world assets on the Canton Network.

- The funding milestone validates the vision of a privacy-enabled public blockchain for institutional adoption, according to CEO Yuval Rooz.

- Canton supports various asset classes and will leverage the funding to onboard more institutions and tokenized products.

- Digital Asset's focus on enterprise-grade privacy and compliance-ready infrastructure could drive mainstream financial integration of blockchain technology.

Read Full Article

19 Likes

Zycrypto

135

Image Credit: Zycrypto

Stably Unveils Stablecoin Development & Advisory Services for Institutions & Enterprises

- Stably, a stablecoin development and advisory firm, is offering services to help institutions and enterprises create their own branded stablecoins.

- The company has been involved in stablecoin issuance and SCaaS since 2018, specializing in Stablecoin-as-a-Service solutions.

- Stably collaborated to introduce the world's first subsidized stablecoin with dTRINITY, aimed at transforming credit markets with interest rebates for stablecoin borrowers.

- They provide SCaaS solutions, including custom development, advisory services, and integration with partners like Bridge and Frax.

- Major companies like Amazon, Walmart, and JD.com have shown interest in developing private stablecoins to tap into the growing stablecoin market, projected to reach $3.7 trillion by 2030.

- Stablecoins are favored for reducing payment friction, enabling faster, cheaper, and borderless transactions, increasing global market access and opportunities.

- Stably leverages its experience to support compliant, fiat-backed stablecoin launches with services spanning issuance, orchestration, DeFi integrations, and more.

- The company offers chain-agnostic issuance, traditional orchestration, fiat on/off-ramps, and various business supports for stablecoin issuers.

- Stably caters to a wide range of potential stablecoin issuers, from financial institutions to non-financial enterprises like retailers, F&B chains, and telecoms.

- Stably's CEO highlighted key considerations for businesses entering the Stablecoin Age to determine readiness for stablecoin adoption.

- The company works with regulated partners to enable rapid branded stablecoin launches and offers infrastructure solutions for in-house stablecoin development.

- Stably provides stablecoin advisory services for clients at various stages, from exploration to market execution.

Read Full Article

8 Likes

Coinjournal

104

Image Credit: Coinjournal

DOGE surges 5.5%. Will it flip Tron’s TRX soon?

- Tron’s TRX recently overtook Dogecoin to become the 8th-largest cryptocurrency by market cap.

- Dogecoin (DOGE) surged 5.5% in the last 24 hours, aiming to overtake TRX after hitting a two-month low.

- DOGE's market cap is $24.3 billion, slightly below TRX's $25.6 billion, indicating a potential flip in rankings.

- DOGE could retest resistance levels at $0.17-$0.18 and potentially reach $0.20 in the near term.

- Technical indicators suggest a bullish trend for Dogecoin, with RSI at 56 and MACD lines showing bullish momentum.

Read Full Article

6 Likes

Coindoo

270

Image Credit: Coindoo

U.S. Spot Ethereum ETFs Surpass $4 Billion in Cumulative Inflows

- U.S. Spot Ethereum ETFs have exceeded $4 billion in total inflows, just eleven months after their launch in July 2024.

- Data from Farside reveals that the Ethereum ETFs saw a significant increase of $100.7 million in inflows on June 23, representing the highest daily inflow in a week.

- This remarkable growth occurred despite ongoing geopolitical tensions in the Middle East, indicating sustained investor confidence in the digital asset.

- Fidelity's FETH fund attracted the most inflows on that day, with $60.5 million, surpassing BlackRock's ETHA fund which brought in $25.8 million.

- Grayscale's ETHE and ETH products also made positive contributions, adding $9 million and $5.4 million, respectively.

- Other Ethereum-based funds did not record any inflows for the day.

- The consistent increase in inflows reflects a rising investor interest in regulated access to Ethereum.

- The news was originally reported by Coindoo.

- ETFs have been successful in attracting significant investments in Ethereum, signaling a growing trend in the digital asset market.

Read Full Article

16 Likes

Coindoo

21

Image Credit: Coindoo

BlockDAG Raises $320M as Pi Network Price Holds $0.50 Before June 28 & Chainlink (LINK) Technical Setup Tests $12.70 Level

- Pi network price faces uncertainty as it dropped to $0.50 amidst a 35% decline this month.

- Chainlink (LINK) technical setup nears a critical $12.70 support level, with mixed signals indicating potential for a bounce or deeper pullback.

- BlockDAG secures $320 million in investment, with its price set to increase from $0.0020 to $0.0030 on June 24, offering a substantial upside potential.

- Over 23.2 billion BDAG coins have been sold, highlighting significant investor interest in the project.

- BlockDAG's engagement is impressive, with over 2 million users mining through mobile apps and upcoming miner deliveries, making it a potential 100x crypto by 2025.

- A major sponsorship announcement for BlockDAG is scheduled for June 30, adding to its growing visibility.

- Chainlink (LINK) faces uncertainty as it hovers around $11.80, with the $12.70 level crucial for determining future price action.

- Pi network price decline is attributed to market selling pressure, with anticipation building for the June 28 Pi Day 2 event and potential updates.

- Both Chainlink (LINK) and Pi network prices are under observation for clearer entry points while BlockDAG emerges as a promising investment opportunity.

Read Full Article

1 Like

Cryptonewsz

322

Image Credit: Cryptonewsz

Senator Proposes Bill to Ban Presidential Crypto Involvement

- Senator Adam Schiff introduces the COIN Act to ban presidential involvement in crypto promotions and profits.

- The bill targets Trump's $57 million earnings from a DeFi project and aims to prevent officials from leveraging their positions for personal crypto gains.

- The COIN Act proposes a ban on presidents, vice presidents, and their families from endorsing or profiting from crypto while in office.

- It requires disclosure of digital asset sales exceeding $1,000 and includes penalties such as profit forfeiture and up to five years in prison for violators.

- The legislation applies to senior executive officials, members of Congress, and their families.

- Schiff argues that Trump's crypto dealings raise ethical concerns regarding the misuse of presidential influence for personal gain.

- The bill comes after Trump's reported earnings from crypto projects, including a $2.5 billion Bitcoin treasury for Trump Media & Technology Group.

- Critics note Schiff's support for the GENIUS Act, which excluded the president and vice president, as potentially inconsistent.

- Trump's public promotion of crypto ventures has sparked the COIN Act proposal to prevent conflicts of interest in the crypto space.

- The bill prohibits officials from involvement in crypto for 180 days before and two years after leaving office to uphold integrity and faith in the presidency.

- Although the COIN Act is not expected to become law soon, it reflects increasing legislative concern over political interference in the crypto sector.

Read Full Article

19 Likes

Coinjournal

249

Image Credit: Coinjournal

Where is Bitcoin Pepe price headed as crypto markets register major regulatory win?

- The cryptocurrency market surged with total market capitalization rising by 4.4% to $3.26 trillion.

- Bitcoin (BTC) rose to $106,000 before stabilizing around $105,208.

- Ethereum (ETH) surpassed $2,400, while XRP, Solana, and Dogecoin saw significant gains.

- The regulatory front saw a major development, with the US Federal Reserve removing 'reputational risk' from its bank examination framework.

- The move aims to enhance transparency and consistency in supervisory practices.

- The change could impact the crypto industry, especially regarding 'debanking' issues for US-based digital asset firms.

- Bitcoin Pepe, a meme-centric Layer 2 solution on the Bitcoin network, may benefit from the improving regulatory environment.

- The ongoing Bitcoin Pepe presale has raised over $15.4 million, with plans for listings on MEXC and BitMart exchanges to enhance credibility.

- Bitcoin Pepe seeks to blend meme culture with blockchain utility, offering innovation alongside sentiment in the digital asset space.

Read Full Article

14 Likes

Coinjournal

231

Image Credit: Coinjournal

XRP price prediction: What next for XRP after breaking above the $2.15 resistance?

- Ripple’s XRP has surged nearly 8% in the last 24 hours, trading above $2.18.

- XRP could potentially rally towards $2.33 after surpassing the $2.15 resistance level.

- XRP is performing well due to strong market conditions and technical indicators.

- The coin's recent rally is attributed to President Trump's ceasefire announcement between Israel and Iran.

- Analysts are optimistic about XRP reaching new highs.

- XRP's 4-hour chart shows bullish signs with the MACD and RSI indicators indicating buying pressure.

- The next resistance level for XRP is at $2.33.

- If the bullish trend continues, XRP could target $3.0064 and potentially reach $3.2.

- The future price movement of XRP is heavily influenced by events in the Middle East.

- A sustained ceasefire could lead to further XRP gains, while reversals in events might trigger corrections.

- XRP's performance will depend on ongoing developments in the region.

Read Full Article

13 Likes

Coinjournal

109

Image Credit: Coinjournal

Best crypto presales to buy as major fund reportedly eyes crypto investments

- Bitcoin Pepe, an emerging crypto asset, has seen significant gains, with a presale raising over $15.4 million and listings on MEXC and BitMart.

- The crypto market saw a 4.4% increase to $3.26 trillion in total market capitalisation as geopolitical tensions eased.

- Bitcoin and Ethereum rebounded following a ceasefire announcement in the Middle East.

- Institutional adoption of crypto is increasing, with firms like VMS Group planning to invest $10 million in crypto strategies managed by Re7 Capital.

- Bitcoin Pepe is gaining attention from risk-oriented investors, benefiting from the market's momentum.

- VMS Group's shift to crypto investments represents a strategic move as Hong Kong's regulations attract more investors to digital assets.

- Bitcoin Pepe, a meme coin, is blending meme appeal with Layer 2 infrastructure on the Bitcoin network.

- The ongoing presale for Bitcoin Pepe has raised over $15.3 million, with expectations for a price increase once it hits $15.54 million.

- An additional listing announcement for Bitcoin Pepe is anticipated on June 30, generating further investor interest.

Read Full Article

6 Likes

Cryptopotato

231

Image Credit: Cryptopotato

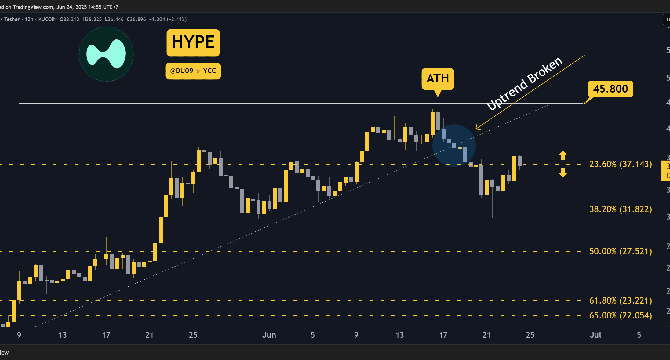

3 Things to Watch in Hyperliquid’s Price Today

- Hyperliquid's price found support at $32, but sellers are active.

- Key support levels are at $35 and $32, while key resistance levels are at $37, $42, and $46.

- The price had a strong bounce off the key support level at $32, with buyers trying to confirm $37 as a new support.

- If $37 support is lost, buyers might retreat to $35 and $32.

- The correction in price may not be over if sellers manage to halt the price at $37, indicating a potential downtrend continuation.

- Buyers need to defend $32 and create a higher low to facilitate a major price reversal.

- Buyers are showing signs of returning as the daily MACD histogram is making higher lows, suggesting potential buyer momentum.

- However, it is still early to confirm a price reversal as the MACD moving averages remain bearish.

- It is best to allow more time for the price to establish a bottom in the current conditions.

Read Full Article

13 Likes

Cryptopotato

379

Image Credit: Cryptopotato

Discover How Coinzilla Powered Bitget’s Performance in Web3

- Bitget partnered with Coinzilla to boost platform activity by 120% in just one month through targeted placements and real-time optimization.

- Coinzilla helped Bitget accelerate market expansion by providing a performance-first strategy focused on scaling fast and reaching the right audiences.

- Coinzilla leveraged its premium network of over 2,000 crypto publishers to ensure maximum relevance and engagement while implementing full-funnel targeting.

- The campaign was managed end-to-end by Coinzilla, with continuous optimization and adjustments to maximize efficiency and impact.

- Results included 75+ million targeted impressions, 120% surge in traffic, and an average CPM of €2.30 being 61% below the finance sector benchmark.

- Bitget scaled across international markets like Spain, France, Italy, Japan, Brazil, and Canada, tailored to regional trends and user behavior.

- The partnership demonstrates how targeted advertising, premium network access, and expert campaign management can drive growth in the crypto industry.

- By February 2025, Bitget saw significant traffic spikes and engagement, showcasing the scalability and success of the campaign.

- The complete Bitget case study detailing the partnership with Coinzilla can be found on Coinzilla's official website.

- Readers are encouraged to follow Coinzilla on Twitter and LinkedIn for updates on trends and success stories in the industry.

Read Full Article

22 Likes

Coindoo

292

Image Credit: Coindoo

US Housing Agency Eyes Crypto Holdings for Mortgages

- FHFA Director Bill Pulte announced a potential shift in how crypto holdings are treated in the traditional housing finance system.

- The review will explore incorporating cryptocurrencies into asset evaluations for federally backed mortgages, impacting Fannie Mae, Freddie Mac, and the Federal Home Loan Banks.

- As Bitcoin reaches over $105,000, the proposal marks a milestone in integrating crypto into mainstream financial assessments.

- Mortgage applicants with significant digital holdings could gain better access to federally backed home financing if the proposal succeeds.

- This move reflects the growing recognition of crypto as a legitimate store of value.

- Details on the timeline, scope, and specific digital assets to be included in the evaluation remain undisclosed by FHFA Director Pulte.

- The impact of crypto volatility and custodianship on mortgage underwriting is yet to be clarified.

- The study's outcome could reshape how homeownership is financed in a digitizing economy.

Read Full Article

17 Likes

Coindoo

309

Image Credit: Coindoo

Analytics Firm Issues Whale Activity Warning as Crypto Recovers from Geopolitical Jolt

- On-chain analytics firm Santiment warns of potential price swings for altcoins despite the recent relief rally.

- Santiment has flagged over $1 million whale transfers to exchanges for tokens like PAX Gold, Space ID, Gala, Aethir, and Pendle.

- Large whale transactions to centralized exchanges may indicate preparation for sell-offs or rebalancing of holdings.

- Historically, such movements precede short-term price volatility.

- Santiment advises traders to monitor PAXG, ID, GALA, ATH, and PENDLE closely for near-term selling pressure.

- Altcoins face short-term risks as large-scale wallet movements signal potential repositioning by major holders.

- Bitcoin and Ethereum are showing signs of stabilization, but certain altcoins may still experience turbulence.

- Tracking wallet movements remains crucial during geopolitical and macroeconomic uncertainties.

- Santiment's alert emphasizes the need to monitor whale activity for informed trading decisions.

- The warning comes as the crypto market recovers from recent geopolitical tensions.

- Analysis of on-chain data can provide insights into potential market trends and movements.

- Whale activity in altcoins could lead to increased volatility in the short term.

- The importance of vigilant monitoring during periods of uncertainty is highlighted by Santiment's observations.

- The post was originally published on Coindoo, focusing on the implications of whale activity amid the crypto market recovery.

- Crypto investors are advised to stay cautious and informed given the potential risks highlighted by Santiment.

- Be prepared for potential price fluctuations as major holders make significant transfers to exchanges.

Read Full Article

18 Likes

For uninterrupted reading, download the app