Cryptography News

Zycrypto

343

Image Credit: Zycrypto

Pepecoin Millionaires Move to Pepe Dollar, Why Successful Traders Are Betting Big On Utility-Based Memes

- The crypto landscape is experiencing a shift as early Pepecoin millionaires are moving their gains into a new contender, Pepe Dollar (PEPD), driven by the rise of utility-based memes.

- Pepe Dollar (PEPD) stands out with a fixed supply, real utility, and DeFi capabilities, offering features like on-chain minting tools, staking, GameFi integration, and transparent governance.

- Pepe Dollar (PEPD) is attracting former Pepecoin (PEPE) whales due to its stronger fundamentals, including fixed supply, integrated DeFi tools, and infrastructure for long-term growth.

- The shift towards utility-based meme coins like Pepe Dollar (PEPD) signifies a move towards lasting value and community growth, offering features appealing to experienced traders seeking sustainable investments.

Read Full Article

20 Likes

Coindoo

343

Image Credit: Coindoo

Metaplanet Raises $515M on First Day of $5.4B Bitcoin Plan

- Metaplanet raised $515 million on the first day of its $5.4 billion Bitcoin plan through a stock issuance.

- EVO Fund exercised 540,000 stock acquisition rights, resulting in the issuance of 54 million new shares.

- The program aims to issue a total of 555 million new shares, equaling approximately 92% of Metaplanet's total outstanding shares.

- Metaplanet's goal is to acquire 1% of Bitcoin’s fixed 21 million supply, positioning itself as a major corporate BTC accumulator.

Read Full Article

20 Likes

Coindoo

256

Image Credit: Coindoo

Baanx Adds BNB Support to Crypto Payment Card

- Baanx integrates BNB support into its Crypto Life Card, allowing users to spend the token at over 100 million merchants globally accepting Mastercard and Visa.

- Rollout of the feature is planned for the UK, EU, and LATAM regions in June, with U.S. availability to follow, as Baanx already partners with Mastercard, Visa, and Circle.

- Simon Jones, Chief Commercial Officer at Baanx, emphasized the tangible approach of connecting digital and traditional finance with practical products.

- This move strengthens the BNB Chain ecosystem, enhancing utility for users in various payment scenarios and highlighting the increasing role of blockchain tokens in everyday financial transactions.

Read Full Article

15 Likes

Coindoo

235

Image Credit: Coindoo

Litecoin Price Prediction 2026 Eyes $150 Target While Qubetics Presale Draws Early Adopters in Final Stage

- Litecoin price may hit $150 by 2026 as analysts track performance.

- Litecoin features quicker transactions, lower fees, MWEB privacy upgrades, and institutional interest.

- Qubetics presale attracts early adopters aiming for blockchain interoperability and potential ROI.

- Both Litecoin and Qubetics offer unique value propositions in the evolving crypto market.

Read Full Article

14 Likes

Coinjournal

134

Image Credit: Coinjournal

SYRUP, MOVE, DEXE among top gainers as cryptocurrencies eye fresh gains

- Maple Finance's SYRUP token surged 19%, hitting $0.62, with strong market confidence and increasing institutional interest due to its transition to a leading on-chain asset manager.

- Movement's MOVE token rose 17% to $0.19, driven by a buyback initiative, with gains exceeding 42% in the past week.

- DeXe's DEXE token jumped 10% to $9.10, supported by a governance model strengthening community trust, after a rebound from $5.30.

- The surge in these altcoins comes as broader cryptocurrencies aim for gains, with Bitcoin holding above $106k amidst positive market sentiments.

Read Full Article

8 Likes

Coindoo

211

Image Credit: Coindoo

Aurora Mobile Approves Crypto Investment Plan, Will Allocate Up to 20% of Cash Reserves

- Aurora Mobile plans to invest up to 20% of its cash reserves in cryptocurrencies and digital assets like Bitcoin and Ethereum to enhance asset value and support partnerships and market reach.

- The move aims to diversify treasury management practices and align with the changing global financial landscape, according to Chairman and CEO Weidong Luo.

- The company assures that this crypto investment plan will not impact core business operations, liquidity needs, or funds allocated for growth initiatives.

- Aurora Mobile reaffirms its commitment to AI integration and global expansion under its "dual-engine" business model despite the crypto investment.

- The decision to allocate funds to crypto reflects a broader trend among public companies for long-term value preservation and innovation.

- This strategic move places Aurora Mobile at the convergence of fintech and enterprise technology, showcasing the increasing institutional acceptance of cryptocurrencies for treasury purposes.

Read Full Article

12 Likes

Coinjournal

191

Image Credit: Coinjournal

Bitcoin Cash resumes rally after testing $430 support, eyes $550

- Bitcoin Cash (BCH) is up 4.5% in the last 24 hours and could rally higher amid technical and fundamental support.

- BCH reclaims $450 after testing support at $430 and could potentially reach $550 with strong bullish momentum.

- The bullish performance comes after BCH created a low of $437 over the weekend but has now recovered to $478.

- Technical indicators suggest a potential surge towards $550, supported by positive market sentiment and buying pressure.

Read Full Article

11 Likes

Coinjournal

182

Image Credit: Coinjournal

Fed could slash rates to 2.5% by 2026; crypto markets brace for impact

- Morgan Stanley forecasts that the US Federal Reserve will reduce interest rates seven times by the end of 2026, bringing the rate down to a target range of 2.5% to 2.75%.

- The first rate cut is expected in March 2026, later than initially projected, due to inflation risks from new US tariffs.

- The shift in Fed policy could benefit high-risk assets like cryptocurrencies, with historical trends showing that crypto markets tend to thrive in low-interest environments.

- While not confirmed by the Fed, market expectations are likely to adjust ahead of time, potentially impacting investor interest in digital assets.

Read Full Article

10 Likes

Coindoo

404

Image Credit: Coindoo

PEPE Price Prediction: The Bulls Are Back With Shiba Inu, PEPE and Angry Pepe Fork Leading The Way

- The meme coin market is rebounding with Shiba Inu, Pepe, and Angry Pepe Fork leading the way, with over 8% gains in the last 24 hours.

- Angry Pepe Fork introduces revenue-producing opportunities for investors through tiered rewards, CommunityFi incentives, and staking with up to 10,000% APY.

- The upcoming meme coin GambleFi platform by Angry Pepe Fork adds a fun and potentially profitable element to the project.

- Angry Pepe Fork ($APORK) offers tokens at $0.0269 during the presale with a fixed supply of 1.9 billion and planned token burning for scarcity.

- Shiba Inu faces the challenge of rebounding from an 18% crash but shows signs of a potential rally based on technical analysis.

- Pepe coin may experience an explosive breakout in July, supported by technical analysis suggesting a possible continuation of bullish momentum.

Read Full Article

24 Likes

Coindoo

4

Image Credit: Coindoo

Barclays Bans Credit Card Crypto Purchases Starting June 27

- Barclays will ban credit card purchases of cryptocurrencies starting June 27 for Barclaycard holders.

- The decision aims to protect customers from potential volatility and financial risks associated with crypto assets.

- Barclays stated that a decrease in crypto asset prices could lead customers into unaffordable debt.

- Crypto purchases are not covered by financial protection schemes like the Financial Ombudsman Service.

- Barclays had previously placed restrictions on payments to exchanges like Binance.

- The latest ban prohibits all crypto-related transactions using Barclays-issued credit cards.

- Barclays advises customers to visit the UK Financial Conduct Authority website to understand digital asset risks.

- This move aligns with the tightening crypto regulations in the UK and reflects a cautious stance by major financial institutions.

- The ban may increase challenges for retail users seeking convenient access to digital assets through traditional banking channels.

Read Full Article

Like

Coinjournal

256

Image Credit: Coinjournal

LINK price forecast: LINK could rally to $17 following Mastercard partnership

- Chainlink's LINK could rally towards the $17 resistance level following its partnership with Mastercard.

- Chainlink's LINK surged to $13 after the partnership announcement, marking an 11% increase in value.

- The positive performance is driven by strong fundamentals, including a partnership with Mastercard for onchain crypto purchases.

- LINK's technical indicators are bullish, with the RSI indicating buying pressure and MACD lines in positive territory.

- The LINK/USD pair might fill the fair value gap at $12.4 before potentially rallying higher towards $17.

Read Full Article

15 Likes

Coindoo

374

Image Credit: Coindoo

Altcoin Market Continues Downtrend Against Bitcoin

- The altcoin market continues to experience a downtrend against Bitcoin according to the TOTAL3/BTC weekly chart.

- Daan suggests that extreme macro conditions like mass money printing, quantitative easing, or significant interest rate cuts may be necessary to trigger a sustained turnaround.

- Daan expresses uncertainty about what would be needed to reverse the trend for more than a temporary bounce.

- Altcoin investors are advised to be selective and strategic as broad exposure to underperforming tokens can lead to significant losses compared to Bitcoin.

- The current market environment does not support a widespread altcoin rally similar to previous cycles like 2021.

- A descending wedge pattern is observed in the TOTAL3/BTC ratio chart, with the market testing the lower boundary near historical support.

- Altcoins are cautioned to remain cautious relative to Bitcoin until a clear breakout or significant macro shifts occur.

Read Full Article

22 Likes

Cryptopotato

356

Image Credit: Cryptopotato

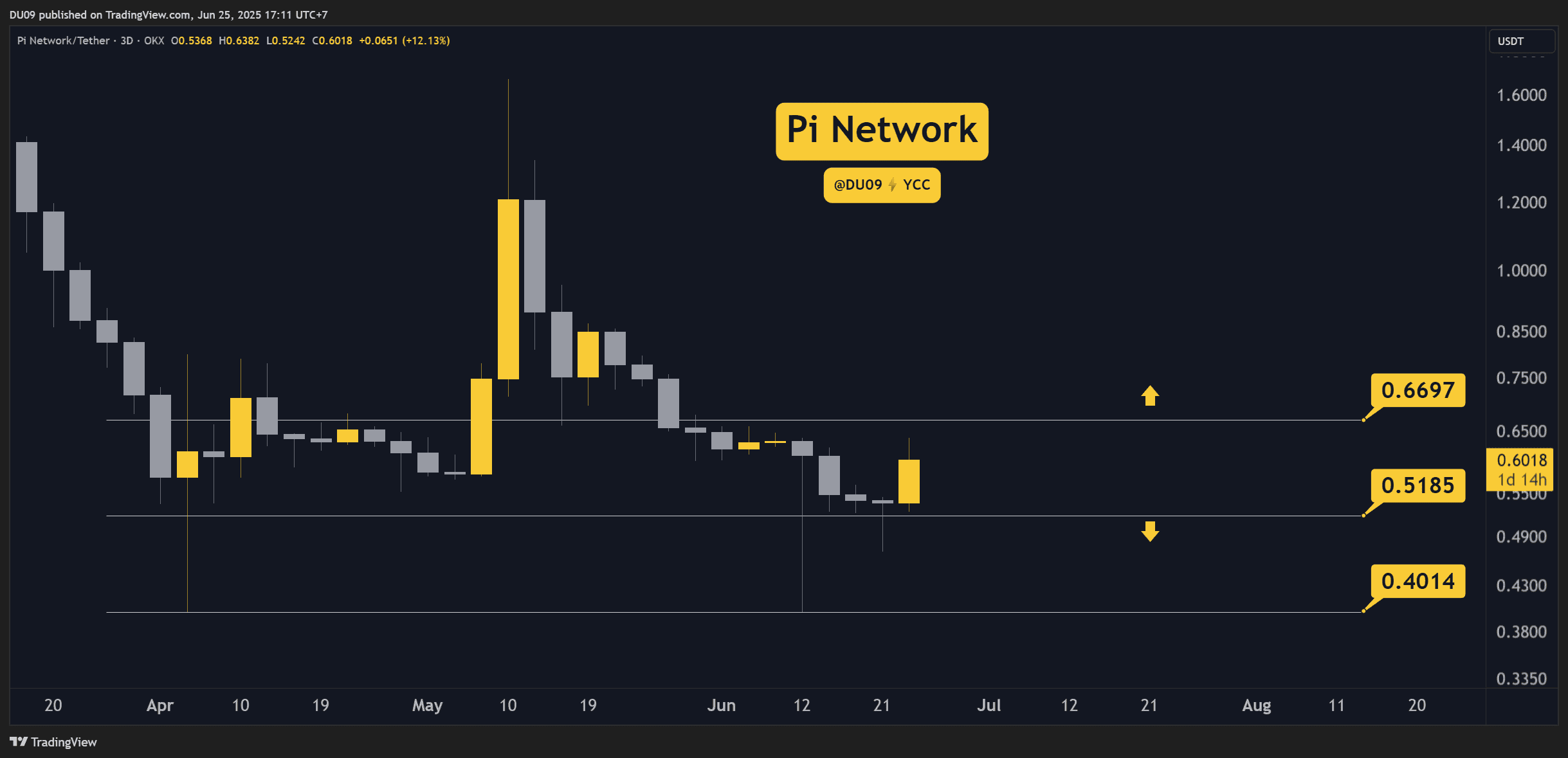

Pi Network (PI) Price Predictions for This Week

- Pi Coin price found strong support at $0.52 and rallied to $0.64 before encountering resistance at $0.67.

- Buy volume surged in the past three days, increasing the price by almost 30% and indicating a potential test of the key resistance ahead.

- A bullish cross on the daily MACD signals buyers' return and the need for Pi Network to sustain its current momentum.

Read Full Article

21 Likes

Coindoo

152

Image Credit: Coindoo

Pi Coin Surges 13%: Here is What’s Fueling the Rally

- Pi coin surges 13% fueled by speculation on major ecosystem updates and Pi2Day hype.

- Pi recently broke above $0.5868, the upper Bollinger Band, with an RSI of 80.38, signaling overbought conditions.

- Traders are monitoring the $0.65 Fibonacci extension level and the 50-day EMA at $0.66 for trend confirmation.

- On-chain data shows a 42% increase in non-exchange wallets and institutional participation in Pi Network.

- Banxa acquired 10 million PI tokens following KYC clearance, boosting confidence in the project.

- Pi traders anticipate upside potential as Pi2Day nears.

- Speculations on enhanced KYC processes, mainnet development, and AI integration are driving community interest.

- Pi2Day is seen as a catalyst event with protocol updates attracting retail and strategic investors.

- The rally is supported by technical breakout above key levels and indicators like the RSI.

- Institutional signals and retail interest contribute to the positive momentum in Pi coin's price.

- The news article discusses the increasing confidence in Pi Network’s infrastructure.

- Pi traders align with ecosystem expectations and technical trends for potential growth.

- Overall, the Pi coin rally is driven by market speculation, technical breakout, and ecosystem updates.

- The article highlights key factors influencing the recent surge in Pi coin's price.

Read Full Article

9 Likes

Coindoo

343

Image Credit: Coindoo

Hong Kong Approves First Broker to Buy and Sell Crypto

- The Hong Kong Securities and Futures Commission (SFC) granted approval to a broker for buying and selling cryptocurrency.

- The approval allows the firm to offer crypto trading services under an omnibus account arrangement.

- Guotai Junan Securities can now facilitate trading of major digital assets like Bitcoin and Ethereum for its clients.

- This approval is seen as a significant move to expand institutional access to regulated crypto markets.

- It positions Hong Kong as a key player in the adoption of digital assets in Asia.

- There is growing alignment between mainland Chinese financial institutions and Hong Kong's digital finance framework.

- The approval signifies a step towards integrating traditional financial services with digital assets.

- The broker's upgraded license allows for dealing in securities as well as offering crypto trading services.

- Hong Kong's initiative reflects the city's interest in fostering innovation in the crypto space.

- The milestone approval paves the way for more financial firms to enter the crypto trading space.

- The development highlights the increasing acceptance and integration of cryptocurrencies within mainstream financial services.

- The news showcases the ongoing evolution and legitimization of digital assets in established financial markets.

- The move could attract more institutional investors to participate in the cryptocurrency market.

- The approval sets a positive precedent for regulatory acceptance of cryptocurrency activities in financial markets.

- The expansion of services by Guotai Junan Securities indicates a growing interest in crypto investments among traditional brokerage firms.

Read Full Article

20 Likes

For uninterrupted reading, download the app