Cryptography News

Zycrypto

165

Image Credit: Zycrypto

SharpLink Gaming Boosts Crypto Treasury To 188,478 ETH, Becomes Largest Publicly Traded Ether Holder

- SharpLink Gaming added over $30 million in ETH to its treasury, boosting its holdings to 188,478 Ether.

- The acquisition was funded by a $27.7 million net proceeds raised through an at-the-market offering, making SharpLink the largest publicly traded holder of Ether globally.

- SharpLink is the first Nasdaq-listed company to adopt ETH as its core treasury reserve asset, staking all its crypto cache and earning 120 ETH in rewards.

- While SharpLink holds the title for the largest publicly traded Ether holder, the Ethereum Foundation and some ETF issuers have substantially larger ETH holdings.

Read Full Article

9 Likes

Zycrypto

417

Image Credit: Zycrypto

Deep Sea Mining Company Buys First 4 BTC for its $1.2 Billion Bitcoin Treasury Strategy

- Green Minerals (GEM), a deep-sea mining company, purchased 4 BTC as part of its $1.2 billion Bitcoin treasury strategy to hedge against inflation and embrace decentralization.

- Green Minerals plans to adopt blockchain technologies to modernize operations, enhance transparency, and maintain a strong balance sheet amidst economic disruptions.

- The company aims to acquire $1.2 billion worth of Bitcoin using a BTC/share metric, integrate blockchain innovations, and improve technological efficiency in sustainable mining operations.

- Green Minerals is part of a growing trend as 245+ companies hold around $88 billion in Bitcoin on balance sheets, aiming to add value to the digital asset despite a 20% stock price drop post-announcement.

Read Full Article

25 Likes

Coindoo

60

Image Credit: Coindoo

Little Pepe Meme Coin Growth Forecast: Why LILPEPE Might be the Surprise Winner of 2025

- Little Pepe (LILPEPE) is gaining attention for its potential growth in 2025 as a meme-focused Layer-2 blockchain with innovative features and community support.

- The project's presale progress, reaching over $1.8 million in cumulative funds, indicates strong demand and confidence in its roadmap leading up to the public launch in June.

- Little Pepe's roadmap includes stages such as presale launches, public listings on DEXs and CEXs, a memes launchpad, staking, rewards, and DApp integration to attract users and strengthen community belief.

- With a promising mainnet debut and scarcity factor, Little Pepe has the potential to achieve significant returns, with forecasts suggesting a price increase from $0.0012 to $0.10, offering a potential 8,000% return for early investors.

Read Full Article

3 Likes

Cryptopotato

1.4k

Image Credit: Cryptopotato

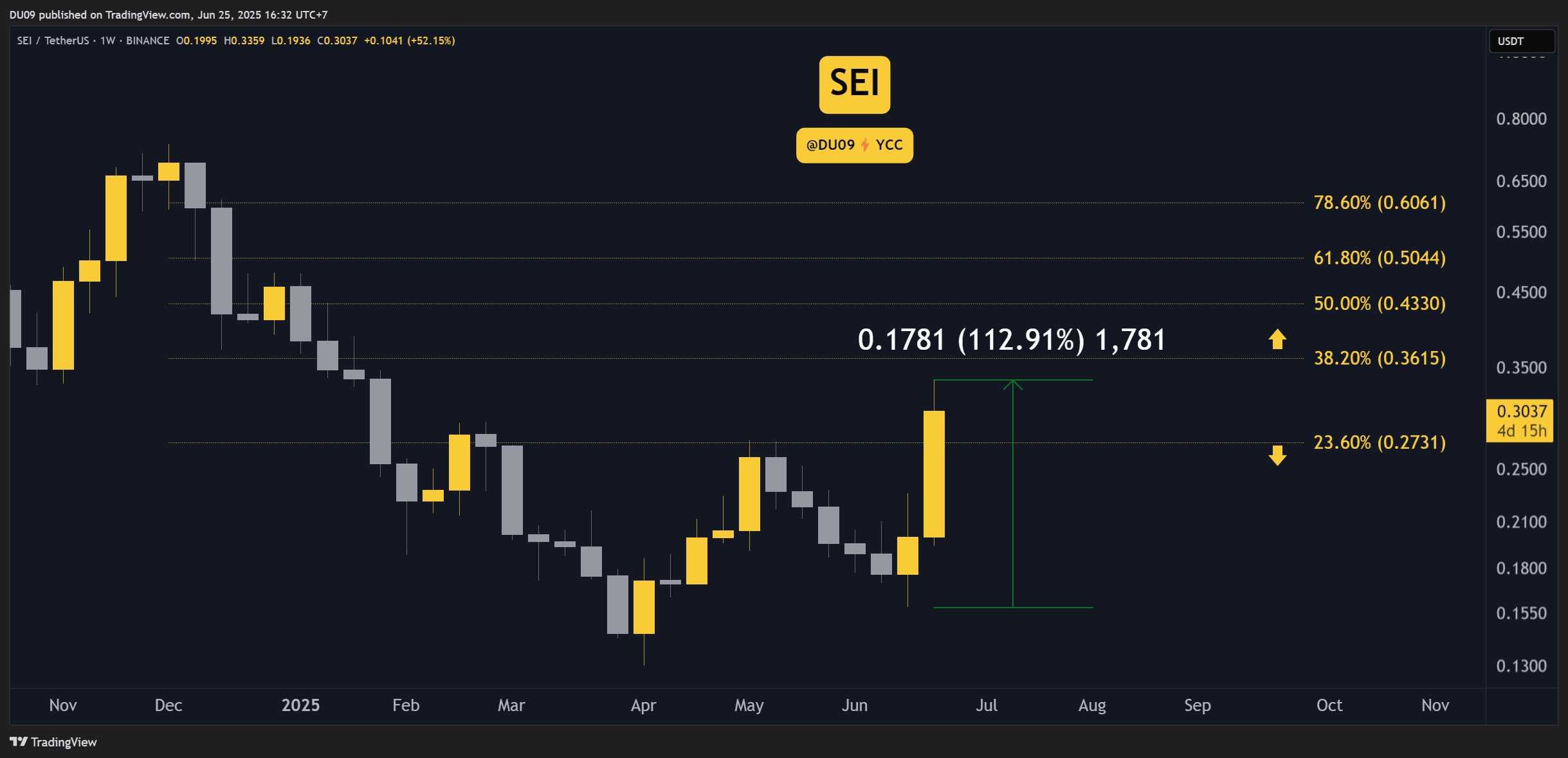

Why is the SEI Price Up Today

- SEI buy volume exploded leading to a quick increase in price.

- Key support level is at $0.27 and key resistance level is at $0.36.

- SEI has rallied over 100% in two weeks, reaching 30 cents.

- The daily RSI is above 70 points, indicating overbought conditions.

- Historically, such high RSI levels have led to corrections.

- Current bullish momentum may indicate a potential pullback.

- Buy volume for SEI hasn risen significantly, last seen at this level in November 2024.

- The price also made a higher high, suggesting a possible continuation of the rally.

- Confirmation of the rally's sustainability would require breaking the resistance at 36 cents.

Read Full Article

17 Likes

Coindoo

165

Image Credit: Coindoo

Bitcoin Rises Above $107,000 as ETF Inflows and Corporate Buying Fuel Rally

- Bitcoin rose above $107,000, driven by institutional demand, corporate adoption, and a technical breakout, signaling confidence in its positive trajectory.

- Record spot Bitcoin ETF inflows totaling $588.6 million on June 24 strengthened the correlation between institutional demand and price gains.

- Corporate treasuries like Aurora Mobile and The Blockchain Group allocating funds to Bitcoin, along with regulatory support from Hong Kong, fueled bullish sentiment.

- Bitcoin's technical breakout above $104,515 and the alignment of macro factors suggest a sustained uptrend, potentially leading to further gains as new capital enters the market.

Read Full Article

8 Likes

Coindoo

226

Image Credit: Coindoo

Best Cryptos to Buy in 2025: Ethereum, XRP, Pi Network, ADA & Angry Pepe Fork Dominate Investor Watchlists

- Ethereum, XRP, Pi Network, ADA, and Angry Pepe Fork are top potential cryptocurrencies.

- Ethereum's upgrades and market movement make it a safe investment choice.

- XRP's stablecoin launch and price surge position it as a strong contender.

- Cardano's research focus and ADA's growth make it a preferred long-term investment.

- Pi Network's community and Angry Pepe Fork's unique features create investor interest.

Read Full Article

13 Likes

Cryptoticker

335

Image Credit: Cryptoticker

Did Jerome Powell Just Spark the Next Bitcoin Bull Run?

- Federal Reserve Chair Jerome Powell confirmed U.S. banks can provide services to crypto firms with proper risk management, seen as a regulatory greenlight.

- Institutional investors poured over $588 million into Bitcoin and $71 million into Ethereum ETFs after Powell's statement, propelling Bitcoin past $105,000.

- Jerome Powell also supported upcoming stablecoin legislation, like the GENIUS Act, crucial for regulating stablecoins powering the crypto economy.

- Market speculates if this Fed-driven momentum will launch a parabolic Bitcoin rally, citing institutional capital flows, regulatory clarity, and stablecoin framework.

Read Full Article

20 Likes

Zycrypto

395

Image Credit: Zycrypto

Why Pepe Dollar’s Pay-Fi Economy Beats Brett coins One-Trick Pony, Pepe Dollar’s Launchpad Improves On Brettcoin’s Founder Dump

- Pepe Dollar (PEPD) is surpassing Brettcoin (BRETT) in the meme coin space by offering diversified utility and innovation over mere hype.

- Pepe Dollar's Pay-Fi economy integrates payment solutions, tipping, and micro-payments, leveraging Ethereum Layer-2 scalability for real-world usability.

- Pepe Dollar's launchpad addresses issues like founder token dumps seen in Brettcoin, promoting fairness in token launches and sustainability.

- Traders are favoring Pepe Dollar (PEPD) due to its multi-faceted ecosystem, capped supply, transparent governance, and growing community, as opposed to Brettcoin's single-utility model.

Read Full Article

23 Likes

Zycrypto

343

Image Credit: Zycrypto

Pepecoin Millionaires Move to Pepe Dollar, Why Successful Traders Are Betting Big On Utility-Based Memes

- The crypto landscape is experiencing a shift as early Pepecoin millionaires are moving their gains into a new contender, Pepe Dollar (PEPD), driven by the rise of utility-based memes.

- Pepe Dollar (PEPD) stands out with a fixed supply, real utility, and DeFi capabilities, offering features like on-chain minting tools, staking, GameFi integration, and transparent governance.

- Pepe Dollar (PEPD) is attracting former Pepecoin (PEPE) whales due to its stronger fundamentals, including fixed supply, integrated DeFi tools, and infrastructure for long-term growth.

- The shift towards utility-based meme coins like Pepe Dollar (PEPD) signifies a move towards lasting value and community growth, offering features appealing to experienced traders seeking sustainable investments.

Read Full Article

20 Likes

Coindoo

343

Image Credit: Coindoo

Metaplanet Raises $515M on First Day of $5.4B Bitcoin Plan

- Metaplanet raised $515 million on the first day of its $5.4 billion Bitcoin plan through a stock issuance.

- EVO Fund exercised 540,000 stock acquisition rights, resulting in the issuance of 54 million new shares.

- The program aims to issue a total of 555 million new shares, equaling approximately 92% of Metaplanet's total outstanding shares.

- Metaplanet's goal is to acquire 1% of Bitcoin’s fixed 21 million supply, positioning itself as a major corporate BTC accumulator.

Read Full Article

20 Likes

Coindoo

256

Image Credit: Coindoo

Baanx Adds BNB Support to Crypto Payment Card

- Baanx integrates BNB support into its Crypto Life Card, allowing users to spend the token at over 100 million merchants globally accepting Mastercard and Visa.

- Rollout of the feature is planned for the UK, EU, and LATAM regions in June, with U.S. availability to follow, as Baanx already partners with Mastercard, Visa, and Circle.

- Simon Jones, Chief Commercial Officer at Baanx, emphasized the tangible approach of connecting digital and traditional finance with practical products.

- This move strengthens the BNB Chain ecosystem, enhancing utility for users in various payment scenarios and highlighting the increasing role of blockchain tokens in everyday financial transactions.

Read Full Article

15 Likes

Coindoo

234

Image Credit: Coindoo

Litecoin Price Prediction 2026 Eyes $150 Target While Qubetics Presale Draws Early Adopters in Final Stage

- Litecoin price may hit $150 by 2026 as analysts track performance.

- Litecoin features quicker transactions, lower fees, MWEB privacy upgrades, and institutional interest.

- Qubetics presale attracts early adopters aiming for blockchain interoperability and potential ROI.

- Both Litecoin and Qubetics offer unique value propositions in the evolving crypto market.

Read Full Article

14 Likes

Coinjournal

134

Image Credit: Coinjournal

SYRUP, MOVE, DEXE among top gainers as cryptocurrencies eye fresh gains

- Maple Finance's SYRUP token surged 19%, hitting $0.62, with strong market confidence and increasing institutional interest due to its transition to a leading on-chain asset manager.

- Movement's MOVE token rose 17% to $0.19, driven by a buyback initiative, with gains exceeding 42% in the past week.

- DeXe's DEXE token jumped 10% to $9.10, supported by a governance model strengthening community trust, after a rebound from $5.30.

- The surge in these altcoins comes as broader cryptocurrencies aim for gains, with Bitcoin holding above $106k amidst positive market sentiments.

Read Full Article

8 Likes

Coindoo

211

Image Credit: Coindoo

Aurora Mobile Approves Crypto Investment Plan, Will Allocate Up to 20% of Cash Reserves

- Aurora Mobile plans to invest up to 20% of its cash reserves in cryptocurrencies and digital assets like Bitcoin and Ethereum to enhance asset value and support partnerships and market reach.

- The move aims to diversify treasury management practices and align with the changing global financial landscape, according to Chairman and CEO Weidong Luo.

- The company assures that this crypto investment plan will not impact core business operations, liquidity needs, or funds allocated for growth initiatives.

- Aurora Mobile reaffirms its commitment to AI integration and global expansion under its "dual-engine" business model despite the crypto investment.

- The decision to allocate funds to crypto reflects a broader trend among public companies for long-term value preservation and innovation.

- This strategic move places Aurora Mobile at the convergence of fintech and enterprise technology, showcasing the increasing institutional acceptance of cryptocurrencies for treasury purposes.

Read Full Article

12 Likes

Coinjournal

191

Image Credit: Coinjournal

Bitcoin Cash resumes rally after testing $430 support, eyes $550

- Bitcoin Cash (BCH) is up 4.5% in the last 24 hours and could rally higher amid technical and fundamental support.

- BCH reclaims $450 after testing support at $430 and could potentially reach $550 with strong bullish momentum.

- The bullish performance comes after BCH created a low of $437 over the weekend but has now recovered to $478.

- Technical indicators suggest a potential surge towards $550, supported by positive market sentiment and buying pressure.

Read Full Article

11 Likes

For uninterrupted reading, download the app