Funding News

Bloomberg Quint

372

Image Credit: Bloomberg Quint

Who Is Sanjog Gupta? Former Journalist Now Appointed As ICC CEO

- Sanjog Gupta has been appointed as the new Chief Executive Officer of the International Cricket Council, succeeding Geoff Allardice.

- Gupta, currently the CEO of Sports and Live Experiences at JioStar, will bring over two decades of experience in sports strategy, media, and fan engagement to his new role.

- His appointment follows a global recruitment process and he was selected from over 2,500 applicants from 25 countries.

- Gupta began his career as a journalist and has held various key roles in the media industry, eventually becoming the CEO of JioStar Sports in November 2024.

Read Full Article

22 Likes

Bloomberg Quint

182

Image Credit: Bloomberg Quint

'If India-US Trade Deal Kicks In, Diversify Away From India': Saurabh Mukherjea's BIG Warning For Investors

- Saurabh Mukherjea of Marcellus Investment Managers advises diversifying away from Indian markets if the India-US trade deal materializes.

- Mukherjea warns of the Indian market being expensive and the economy slowing down, suggesting risks are heightened in the domestic space.

- He recommends investing in American and European midcaps over large caps post the trade deal, emphasizing the attractiveness of US small caps compared to Indian small caps.

- The India-US trade deal's potential impact on markets and the need for portfolio diversification are key points discussed by Mukherjea in light of current market conditions.

Read Full Article

9 Likes

Bloomberg Quint

450

Image Credit: Bloomberg Quint

Crude Oil Prices To Stabilise Around $65-$70 Per Barrel: Indian Oil Chairman

- Crude oil prices are forecasted to stabilize around $65 to $70 per barrel for the remainder of the financial year, with potential for a decrease to below $65.

- Russian crude, constituting 30-35% of the industry's imports, is predominantly driven by commercial considerations rather than geographical factors.

- Indian Oil Chairman emphasized making procurement decisions solely on economic and commercial grounds, focusing on the best delta offered by crude sources.

- Indian Oil plans significant capital expenditure in petrochemicals post-refinery expansions, leveraging an integrated model for cost efficiency.

Read Full Article

24 Likes

Bloomberg Quint

2.5k

Image Credit: Bloomberg Quint

Capgemini To Buy IT Firm WNS For $3.3 Billion To Boost AI

- Capgemini plans to acquire IT outsourcing firm WNS Holdings Ltd. for $3.3 billion, aiming to boost its AI operations.

- The acquisition is valued at $76.50 per share, representing a premium of about 28% to WNS's average price over the past 90 days.

- Capgemini anticipates the deal to increase its earnings per share by approximately 4% on a normalized basis in 2026.

- The move highlights the trend of IT services companies investing in artificial intelligence to meet the evolving needs of businesses for efficiency gains.

Read Full Article

25 Likes

Bloomberg Quint

455

Image Credit: Bloomberg Quint

Travel Food Services IPO Subscribed 5% On Day 1 So Far — Check GMP

- Travel Food Services IPO, an offer for sale worth up to Rs 2,000 crore, is open for subscription from July 7 to July 9 at a price band of Rs 1,045 to Rs 1,100 per share.

- Investors can bid for a minimum of 13 shares, and then in multiples thereof; the IPO has no fresh issue component.

- As of day one, the IPO has been subscribed 5%, with the grey market premium at Rs 30 indicating a potential listing at a premium.

- The book-running lead managers include Kotak Mahindra Capital, HSBC Securities, ICICI Securities, and Batlivala & Karani Securities; tentative listing date is July 14.

Read Full Article

19 Likes

Bloomberg Quint

395

Image Credit: Bloomberg Quint

Fine Organics, PCBL — PL Capital's Top Stock Picks In Chemical Sector

- Chinese companies pose a significant competitive threat to Indian chemical manufacturers, as per PL Capital.

- Margins for agrochemical-focused companies are expected to remain under pressure due to subdued demand and weak realizations.

- The potential imposition of anti-dumping duties could benefit Indian chemical companies, with NOCIL standing to gain significantly.

Read Full Article

Like

Eu-Startups

107

“From Poland to Portugal”: Amsterdam-based Perry raises €1.6 million to empower technicians across Europe with work instructions

- Dutch AI startup Perry has raised €1.6 million in an investment round to provide AI-powered work instructions for technicians in Europe.

- The funding round was led by Revent and included angel investors from companies like Google and OpenAI.

- Perry's technology aims to address the shortage of technical personnel in Europe by offering visual instructions that adapt to work situations using AI.

- The company plans to expand its team and software development with the investment, aiming to scale rapidly into Germany, France, and the United Kingdom.

Read Full Article

6 Likes

Bloomberg Quint

359

Image Credit: Bloomberg Quint

Water Level In Mumbai Lakes Rises To Nearly 68%; IMD Predicts More Rainfall Till July 10

- The water level in Mumbai lakes has reached nearly 68% of their total capacity, with 9,82,413 million liters of water present out of a total capacity of 14,47,363 million liters.

- The seven main lakes supplying water to Mumbai are experiencing a surge in storage levels due to heavy rainfall, with Middle Vaitarna and Modak Sagar lakes at the highest capacities.

- IMD has issued a yellow alert for Mumbai till July 10, with expectations of moderate to heavy rainfall and some areas likely to experience heavy to very heavy rainfall on July 8 and 9.

- With more rainfall predicted, the water levels in the lakes are anticipated to rise further in the upcoming days.

Read Full Article

21 Likes

Medium

183

Image Credit: Medium

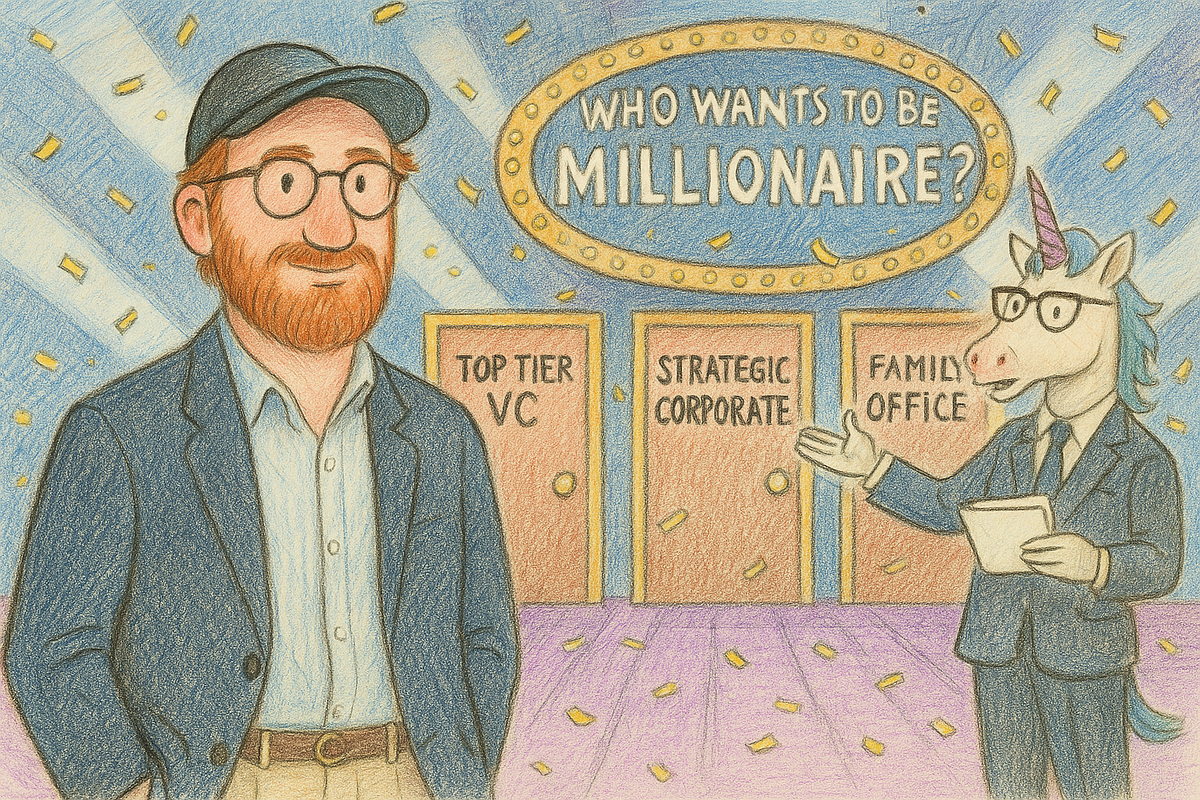

Fit First, Money Second: The Unpopular Truth About Picking Investors

- Choose investors wisely, as wrong investors can harm businesses by overpromising or controlling too much.

- For businesses truly needing venture funding, selecting the right investors is crucial for success.

- Different types of investors exist: institutional, emerging managers, government grants, family offices, and corporates.

- Due diligence is key: investors should have a proven track record, be responsive, and offer support.

Read Full Article

8 Likes

Bloomberg Quint

209

Image Credit: Bloomberg Quint

SEBI To Upgrade Market Surveillance After Jane Street Action

- SEBI to upgrade market surveillance measures to safeguard markets from malpractices after the Jane Street incident.

- SEBI Chairman Tuhin Kanta Pandey mentioned a forthcoming white paper with three-month data and detailed analysis of weekly expiry contracts.

- The capital markets regulator will launch a theme-based investor awareness campaign to strengthen surveillance at both SEBI and exchange levels.

Read Full Article

12 Likes

Bloomberg Quint

1.4k

Image Credit: Bloomberg Quint

Stock Market Live: Gift Nifty Trading Over 25,500 Points; Jubilant Foodworks, IndusInd Bank Stocks In Focus

- Benchmark indices broke a two-day losing streak to settle higher on Friday.

- The GIFT Nifty was trading near 25,529 points early Monday, indicating a positive start for the Indian markets.

- Global markets showed mixed movements with US stocks gaining on strong US jobs data and Asian shares awaiting progress on trade deals with the US.

- Jubilant Foodworks and IndusInd Bank stocks are in focus as trading continues.

Read Full Article

22 Likes

Bloomberg Quint

4.8k

Image Credit: Bloomberg Quint

Work-Life Balance In Focus As Infosys, TCS, Genpact Revise Workplace Policies

- Major Indian IT companies like Infosys, Genpact, and TCS are revising their workplace policies to address work-life balance concerns among employees.

- Infosys has implemented a system to track remote working hours to support work-life balance, with employees receiving notifications if they exceed prescribed work hours.

- Genpact faced backlash over increased work hours with employees expressing concerns about the impact on workplace culture.

- TCS introduced a new policy requiring a minimum of 225 billed business days annually per employee, facing criticism for reducing bench time and making physical office presence mandatory.

Read Full Article

33 Likes

Bloomberg Quint

81

Image Credit: Bloomberg Quint

Automobile Retail Sales Grow 4.84% In June 2025: FADA

- Overall automobile retail sales in India grew 4.84% year-on-year in June 2025 to 20,03,873 units, driven by festival and marriage-season demand.

- Two-wheelers saw a 4.73% gain on a year-on-year basis, despite a 12.48% month-on-month decline, influenced by factors like financing constraints, intermittent variant shortages, early monsoon rains, and rising EV penetration.

- Passenger vehicle retails slipped 1.49% month-on-month but exhibited a 2.45% year-on-year uplift, with challenges such as heavy rains, tight market liquidity, and compulsory billing procedures affecting sales.

- Commercial vehicle (CV) retails declined 2.97% month-on-month, yet achieved a robust 6.6% year-on-year expansion. Factors impacting CV sales included new taxation, mandatory air-conditioned cabins, muted infrastructure demand, and softening economy.

Read Full Article

4 Likes

Bloomberg Quint

431

Image Credit: Bloomberg Quint

IPO-Bound Smartworks FY25 Loss Widens, Revenue Up 32%

- Smartworks, a co-working operator planning to launch its IPO, reported an increased net loss of Rs 63.17 crore for the fiscal year 2024-25 despite a growth in revenue from operations.

- The company aims to boost revenue levels, reduce expenses, and achieve profitability in the future.

- Smartworks will reduce its IPO size and utilize the proceeds for capital expenditure, loan repayment, and general corporate purposes.

- With 48 operational centers and 1.9 lakh seating capacities, Smartworks holds a significant market presence in the co-working sector by sub-leasing office spaces to corporates.

Read Full Article

5 Likes

Bloomberg Quint

372

Image Credit: Bloomberg Quint

New Samsung Galaxy Z Fold 7 Video Shows Light, Easy To Operate Device

- A leaked video by tipster @iceuniverse showcases the Samsung Galaxy Z Fold 7's expanded display and improved one-handed usability.

- The Samsung Z Fold 7 is slimmer and lighter compared to the Fold 6, with a larger and more enriching display.

- Expected specs for the Z Fold 7 include a Snapdragon 8 Elite chipset, an improved 200MP primary camera, and various storage options.

- The device is expected to feature an outer display of 8 inches, an inner display of 6.5 inches, and come with powerful Galaxy AI features.

Read Full Article

22 Likes

For uninterrupted reading, download the app