Startup News

TechCrunch

201

Image Credit: TechCrunch

Elon dips from DOGE, and Silicon Valley enters the ‘find out’ stage

- Elon Musk steps down as a U.S. special government employee and the head of the Department of Government Efficiency (DOGE).

- Despite his departure, Musk emphasized that DOGE's mission will continue, having already made significant budget cuts and controversial decisions.

- TechCrunch's Equity podcast discussed the departures from DOGE and highlighted Silicon Valley's evolving relationship with politics.

- Other tech headlines covered in the podcast include GameStop's bitcoin purchase, Neuralink's funding raise, The New York Times and Amazon's AI licensing deal, and Nvidia's recent earnings.

Read Full Article

9 Likes

Insider

398

Image Credit: Insider

Brian Chesky reveals what he learned from a brutal early rejection email

- Brian Chesky learned a key lesson about entrepreneurship from a rejection email in 2008 when he was trying to raise money for Airbnb.

- The rejection was one of many Chesky received while building Airbnb, which now has a market cap of nearly $80 billion.

- Chesky highlighted the importance of believing in a different world than the current one and mentioned that most people have the skills to be entrepreneurs.

- This lesson from the rejection email comes at a time when the job market, especially in the tech sector, remains challenging for young people.

Read Full Article

23 Likes

ISN

430

Image Credit: ISN

KiranaPro acquires AR startup Likeo to integrate immersive trial room features into BLACK

- KiranaPro acquires augmented reality startup Likeo in an all-stock transaction valued at $1 million to enhance its fashion-focused app BLACK with virtual try-on capabilities.

- Likeo's visual computing and AI-led trial room experience will be integrated into the BLACK app interface, making it the first in India to offer AI-powered virtual fittings.

- The acquisition aims to blend visual discovery with personalization to reduce product returns and increase customer satisfaction, with Likeo's founder Saurav Kumar joining KiranaPro to lead initiatives in AI and visual computing.

- KiranaPro, known for its no-commission, ad-led model and 10-minute delivery services to kirana stores, is focusing on enhancing user experience by leveraging Likeo's technology to redefine online shopping for Gen Z consumers.

Read Full Article

25 Likes

Siliconangle

119

Image Credit: Siliconangle

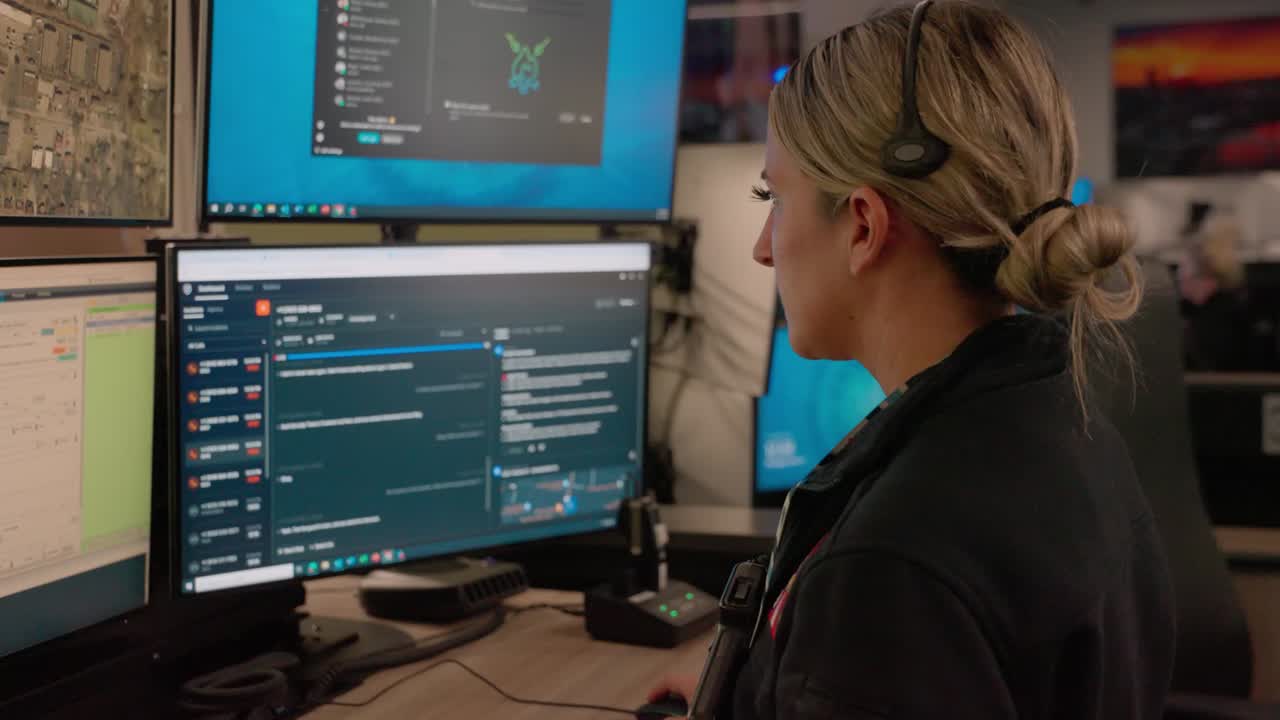

Prepared raises $80M to expand AI-powered emergency response platform

- Prepared, a startup specializing in AI-powered emergency response solutions, has secured $80 million in new funding to enhance its assistive AI platform.

- The funding will be utilized to expand the platform's features such as real-time translation, automated call triage, and quality assurance tools, and to extend its services to more public safety agencies.

- Prepared's AI technology aims to modernize emergency response systems in the U.S. by collaborating with over 1,000 public safety agencies to serve nearly 100 million people.

- The Series C funding round was led by General Catalyst Group Management, with existing investors Andreessen Horowitz and First Round Capital LP, along with new investor Radical Ventures LP, participating.

Read Full Article

7 Likes

Gritdaily

407

Image Credit: Gritdaily

Wealth Protocol: Where Bitcoin Meets Black Luxury

- LaQuida Landford founded AfroVillage PDX in Portland, focusing on community wellness and addressing racial disparities.

- AfroVillage led an initiative to provide wifi access to underserved communities and transform public transportation trains into a hub for the Black community.

- LaQuida launched Wealth Protocol, a fashion line blending luxury fashion with blockchain technology, featuring Bitcoin-inspired garments.

- Wealth Protocol's collection, displayed at MACQ in Cancun, aims to redefine luxury as a tool for empowerment and financial sovereignty for people of color.

Read Full Article

24 Likes

Startup Pedia

357

Image Credit: Startup Pedia

India's 1st bullet train production to start at BEML’s Bengaluru plant, 280 kmph trainset to roll out on MAHSR corridor by 2026

- BEML, a Bengaluru-based state-owned defence PSU, will manufacture India’s first bullet train at its facility, starting with the prototype in September 2025.

- The first bullet train is expected to be rolled out for testing on the Mumbai-Ahmedabad High-Speed Rail corridor by December 2026.

- The trainsets will reach speeds of up to 280 kmph, designed with domestically sourced products and components to keep costs lower than competitors.

- Japan International Cooperation Agency (JICA) is financing a majority of the MAHSR project, with the first bullet train prototypes set to undergo testing in early 2026.

Read Full Article

21 Likes

Economic Times

137

Image Credit: Economic Times

ETtech Deals Digest: Startups raise $1.06 billion in May, up 12% on-year

- Startups raised $1.06 billion in funding in May, marking a 12% increase from last year.

- Startups secured funding through 79 rounds, primarily in early and late stages.

- Top deals of the month include PB Healthcare Services raising $218 million, Porter raising $200 million, and Euler Motors raising around $75 million.

- Other significant funding rounds include Citykart raising $63 million and Routematic raising $40 million in May.

Read Full Article

8 Likes

AllTopStartups

311

Image Credit: AllTopStartups

From Price to Features: 2025 Ford Bronco Sport Review

- Henry Ford revolutionized the automotive industry with innovations like the assembly line and mass production.

- Ford, a well-known global automaker, has produced popular models like the Taurus, Mustang, and F-Series trucks.

- The Ford Bronco, introduced in 1966, made a notable impact in the SUV market.

- The 2025 Ford Bronco Sport offers a base model starting at $33,000 with various trim levels available.

- The design of the 2025 Bronco Sport reflects the classic rugged Bronco appearance with modern touches.

- The Bronco Sport is equipped for off-roading with high ground clearance and exterior cladding for protection.

- Inside, the cabin of the Bronco Sport offers a blend of ruggedness and comfort with tech features like Apple CarPlay and SYNC 4.

- The Bronco Sport provides ample cargo space with 32.5 cubic feet behind the rear seats, expandable to 65 cubic feet.

- Engine options for the Bronco Sport include a 1.5-liter three-cylinder EcoBoost and a 2.0-liter four-cylinder EcoBoost.

- The Bronco Sport's fuel economy is commendable, offering around 25 mpg in the city and 30 mpg on the highway with the 1.5-liter engine.

Read Full Article

18 Likes

Eu-Startups

45

British startup Assisterr raises €2.8 million to enable users to create and monetise AI agents – without having to write code

- London-based Assisterr raised €2.4 million in funding to empower users to create and monetise AI agents without writing code.

- The funding round included investors like Google for Startups, Outlier Ventures, and others.

- Assisterr, founded in 2023, is a platform focused on Small Language Models (SLMs) for decentralised AI creation, deployment, and monetisation.

- The company aims to revolutionize the AI industry by providing easy access, clear monetization pathways, and a DeAI economy with $ASRR token rewards.

Read Full Article

2 Likes

Eu-Startups

137

From tracking to coaching: The rise of smarter fitness tech

- AI is reshaping how we take care of ourselves by incorporating real-time analysis, adaptive training plans, and virtual coaches into everyday fitness tech.

- The focus now is on building systems that genuinely support individuals in their daily routines and help them stay engaged in reaching their goals.

- AI-powered tools assist in making healthy choices easier by analyzing data like sleep patterns and metabolic information to provide personalized recommendations.

- Fitness platforms are utilizing AI to encourage healthy habits through gentle nudges without pressure or judgement, known as ethical AI nudging.

- AI coaches are evolving to be sentiment-aware, adapting communication based on the user's tone or energy levels for a more personalized coaching experience.

- AI is improving support after injury by integrating injury history and rehab progress into personalized training plans, aiding in a smoother transition back to regular training.

- Immersive technologies like AR and VR, combined with AI, are transforming workouts into interactive experiences with evolving storylines and adjustable difficulty levels.

- AI is seen as a partner in daily wellness, providing emotional support, recovery assistance, and personalized experiences to enhance overall human health.

- The trend in fitness tech is towards realistic and adaptable solutions that fit into people's real lives and offer rewarding experiences that are sustainable over time.

Read Full Article

8 Likes

TechCrunch

32

Image Credit: TechCrunch

Your last opportunity to vote on the TechCrunch Disrupt 2025 agenda lineup

- TechCrunch Disrupt 2025 received an overwhelming response for speakers at the upcoming event in San Francisco.

- 20 finalists have been selected for breakout sessions and roundtables, and audience choice voting is open until 11:59 p.m. PT tonight.

- The top 5 sessions in each category as voted by the audience will join the official Disrupt 2025 lineup.

- Finalists include sessions on AI automation, national security strategies, scaling startups, space economy, and more.

Read Full Article

1 Like

Eu-Startups

155

Brussels-based FinTech startup Husk raises €1 million to help startups optimise costs and manage their cash flow

- Brussels-based FinTech startup Husk raises €1 million in pre-Seed funding round to assist startups in optimizing and managing rising costs.

- Support from Techstars, Birdhouse Ventures, NewSchool.vc, Stripe, and Mastercard contributed to Husk's growth.

- Husk offers startups instant access to corporate cards with credit limits, real-time financial monitoring, and a dynamic risk model for financial health insights.

- With strategic partnerships with Stripe and Mastercard, Husk aims to provide flexible payment solutions, enhanced liquidity, real-time spending control, and higher payment limits for startups.

Read Full Article

9 Likes

TechCrunch

448

Image Credit: TechCrunch

TechCrunch Sessions: AI Trivia Countdown — Ready to test your AI knowledge?

- TechCrunch Sessions: AI Trivia Countdown offers a final chance to score a special deal before the event on June 5 at UC Berkeley’s Zellerbach Hall.

- Participants can answer AI-specific trivia questions to win two tickets for the price of one low rate before the trivia closes on June 4.

- The trivia quiz includes questions about AI industry facts and offers a chance to win a flat rate ticket for $200 along with a second ticket for free.

- Participants can save through June 4 for TechCrunch Sessions: AI event, featuring insights from leaders in the AI industry and networking opportunities.

Read Full Article

27 Likes

ISN

4

Image Credit: ISN

DiFACTO Robotics and Automation acquires RoboFinish division from Grind Master

- DiFACTO Robotics and Automation has acquired the RoboFinish division from Grind Master, gaining the Intellectual Property Rights (IPR) portfolio for RoboFinish operations.

- Grind Master, known for metal-finishing solutions, established the RoboFinish brand over 14 years, focusing on robotic grinding, deburring, and machining technologies deployed in over 150 installations worldwide.

- DiFACTO, founded in 2007, aims to scale up its automation capabilities with this acquisition, targeting clients in automotive, foundry, transportation, electrical machinery, and consumer goods sectors.

- The move comes at a time when Indian manufacturers are looking to modernize legacy systems through automation, positioning DiFACTO well to expand its client base both domestically and internationally.

Read Full Article

Like

TechCrunch

242

Image Credit: TechCrunch

Last Week: Few exhibit tables left to claim at TechCrunch All Stage

- Exhibit tables for TechCrunch All Stage on July 15 in Boston are almost sold out.

- Deadline to book an exhibit table is June 6, with only a few left.

- Benefits of exhibiting include showcasing solutions to decision-makers, enhancing brand status, and creating valuable connections.

- Exhibitor package includes a 6’ x 3’ exhibit table, brand exposure on-site and online, ticket bundle, and more.

Read Full Article

14 Likes

For uninterrupted reading, download the app