Startup News

Economic Times

389

Image Credit: Economic Times

VCs sniff opportunity as petcare expands beyond food

- Pet adoption surge during the Covid-19 pandemic has led to increased interest from investors in the petcare startup space.

- Nestlé SA invested in Drools, making it a unicorn, while Supertails and Heads Up For Tails are also seeking funding rounds.

- Vetic secured a $26 million funding round, showcasing growing interest in veterinary care startups.

- The petcare market in India, valued at $3.5 billion, is expected to reach $7–7.5 billion by 2028, with various companies entering the space.

Read Full Article

23 Likes

Economic Times

201

Image Credit: Economic Times

Dhan soon to turn unicorn with $200 million fundraise from ChrysCapital, Alpha Wave, MUFG

- Online stock trading platform Dhan is set to become a unicorn with a $190-200 million fundraise led by ChrysCapital, with Alpha Wave and MUFG participating.

- The funding round will value Dhan at $1.1 billion, making it the fifth unicorn of the year, including investors like Harsh Jain and the family office of Sunil Mittal.

- Google and Amazon may also invest in Dhan through a follow-on round, along with existing investors like Beenext and Mirae Asset Venture Investments.

- The fundraise will involve primary capital and secondary sales and is expected to close soon, after considering Sebi's regulatory changes on stock brokers.

- Dhan offers stock trading services to high-frequency traders, turning profitable in FY24 with significant revenue growth.

- Founded in 2021, Dhan saw substantial growth in active users, while its rival Groww is gearing up for a $1 billion IPO and a $200 million pre-IPO fundraise.

- The capital raise comes amidst regulatory changes affecting stock brokers, particularly in the futures and options segment, impacting revenue for many players.

- Dhan's focus on high-frequency traders and profitable business model have positioned it well in the competitive stock broking market.

- The increasing number of retail investors in India, driven by tech-savvy platforms like Dhan, Groww, and Zerodha, has reshaped the stock broking industry.

- Discount brokers like Dhan and Groww have disrupted traditional brokers' business models, capturing a substantial market share through their tech-driven approach.

Read Full Article

12 Likes

Economic Times

0

Image Credit: Economic Times

Dhan closes in on $200 million fundraise from ChrysCap, Alpha Wave, MUFG

- Online stock trading and investment platform Dhan is closing a $190-200 million round, led by ChrysCapital and joined by Alpha Wave and MUFG.

- The funding includes a mix of primary capital and secondary sales, valuing Dhan at $1.1 billion, the fifth unicorn of the year in India.

- Tech giants Google and Amazon are considering investments in Dhan through a follow-on round, along with existing investors like Beenext and Mirae Asset Venture Investments.

- Dhan offers stock trading services to high-frequency and professional traders, with a significant user base and turning profitable in FY24.

- Founded in 2021 by Pravin Jadhav, Dhan has shown significant growth and aims to benchmark itself along public markets with the latest funding round.

- Competitors like Groww and Angel One are also making moves in the market with IPO plans and fundraise activities.

- The capital raise for Dhan comes amidst regulatory changes impacting the stock broking industry, with a focus on high-frequency users and a profitable business model.

- Industry experts highlight the growth of demat accounts in India and the increasing dominance of discount brokers like Dhan, Groww, and Zerodha in the space.

- Regulators are cautious about the rise in retail money in futures and options trading, prompting interventions to safeguard individual traders from losses.

- The stock broking industry in India is undergoing rapid evolution, driven by digital trends, regulatory changes, and the influx of new investors.

Read Full Article

Like

Economic Times

275

Image Credit: Economic Times

Zetwerk sharpens focus on capital goods equipment business

- Zetwerk is focusing on manufacturing equipment and capital goods under the Zetwerk Electronics team to support process equipment and strengthen capabilities.

- In the next 12-18 months, Zetwerk expects 'meaningful traction' in the capital goods team with equipment for internal use initially, aiming at external business opportunities eventually.

- The company plans to develop, design, manufacture, and support capital goods such as jigs and fixtures, simple automation equipment, and test instrumentation for both internal and external customers.

- Foulger emphasized on building capabilities in-house to enhance production efficiency and serve customers better, focusing on tools like jigs and fixtures, automation equipment, and test solutions.

Read Full Article

16 Likes

Economic Times

302

Image Credit: Economic Times

Buy-now-pay-later offerings wane as fintechs pivot to EMI loans, consumer credit

- Buy now, pay later (BNPL) services in the consumer fintech space are decreasing in popularity due to regulatory tightening and credit quality concerns.

- Fintech companies are shifting from BNPL models to equated monthly installment (EMI) lending to adhere to regulations and manage risks.

- Major players like PayU's LazyPay have transitioned to KYC-compliant EMI solutions, abandoning the previous BNPL model.

- Companies like Paytm and Mobikwik have discontinued their BNPL offerings and are focusing on transitioning users to longer-term EMI products for better risk management.

- Simpl is one of the few remaining players in the BNPL space, avoiding regulatory issues by not offering loans and focusing on trust-based payment models.

- Banks and NBFCs have also scaled back on BNPL services due to macroeconomic risks and growing unsecured lending portfolios.

- While the narrative of unsecured consumer credit growth in India prevails, the focus is shifting towards EMI-based products with robust risk management and full KYC compliance.

- The RBI is tightening regulatory oversight on fintech lending, urging a shift towards compliant and sustainable embedded finance solutions.

- "Pure-play BNPL without proper credit assessment or regulatory partnership is effectively dead", says a fintech founder who transitioned to EMI loans.

- The next phase of growth in India's consumer credit landscape is expected to be more regulated, measured, and tenure-driven.

Read Full Article

18 Likes

Siliconangle

377

Image Credit: Siliconangle

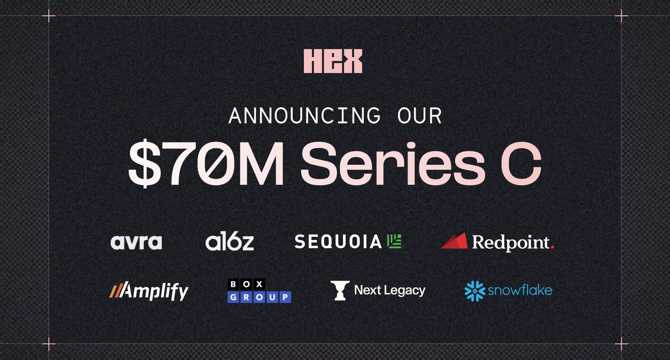

Hex raises $70M to expand AI-powered data analytics platform

- Hex Technologies Inc. raises $70 million in new funding to expand operations and enhance its AI-powered data analytics platform.

- Founded in 2020 by former Palantir Inc. employees, Hex offers a collaborative data workspace aimed at improving data utilization in organizations.

- Hex's platform features a notebook-based interface supporting SQL, Python, and no-code inputs, along with an App Builder for creating interactive data applications without additional coding.

- The new funding, totaling $70 million, brings Hex's total raised amount to $172 million, with notable customers including Reddit, Cisco, NBA, and others.

Read Full Article

22 Likes

TechCrunch

431

Image Credit: TechCrunch

Security startup Horizon3.ai is raising $100M in new round

- Cybersecurity startup Horizon3.ai aims to raise $100 million in a new funding round, having secured at least $73 million according to an SEC filing.

- NEA leads the funding round, with Horizon3.ai potentially being valued at over $750 million. The startup is said to generate around $30 million in annual recurring revenue.

- This marks NEA's second significant investment in a cybersecurity startup within a month, following a $108 million funding round for Veza.

- Founded in 2019, Horizon3.ai is known for its AI-powered autonomous threat detection tools and recently received FedRAMP authorization to sell to federal agencies, reporting impressive revenue growth.

Read Full Article

25 Likes

Gritdaily

362

Image Credit: Gritdaily

Epic Events and Pet Health Breakthroughs: Go Fund Yourself Season 2 Blasts Off with Purpose and Personality

- Season 2 of Go Fund Yourself has returned with a bang, featuring dynamic companies Bash Community and PawPro showcasing innovation and impact.

- Hosted by Rory Cutaia, David Meltzer, and Jayson Waller, the show blends entertainment with investment opportunities, mentorship, and visibility.

- Bash Community offers an event-planning platform for unforgettable moments, while PawPro focuses on revolutionizing animal wellness with a bacteria-based pet supplement line.

- The show emphasizes community, mentorship, and building lasting brands, showcasing the potential for growth and success for innovative startups.

Read Full Article

21 Likes

Pymnts

394

Image Credit: Pymnts

Global Payments Divests Payroll Unit to Acrisure for $1.1 Billion

- Global Payments is divesting its payroll business for $1.1 billion to Acrisure, a Michigan-based FinTech company.

- The divestiture of Global Payments' payroll business is part of the company's strategy to simplify its operations and focus on being a leading commerce solutions provider.

- As part of the deal, Global Payments will maintain a commercial partnership with Acrisure to continue offering human capital management and payroll services to its merchant customers.

- Proceeds from the divestiture will be used to return capital to shareholders, with the deal expected to close in the second half of the year.

Read Full Article

23 Likes

TechCrunch

13

Image Credit: TechCrunch

Karat Financial is bringing business banking to creators

- Karat Financial, known for its credit cards for creators, is launching a creator-focused business banking product with Grasshopper.

- Creators face challenges with traditional banks when applying for business credit cards or opening accounts; Karat aims to address this issue.

- Karat has extended $1.5 billion in credit to creators, offering two tiers of business banking services including a free checking account with tax planning and a premium account with 2-3% APY.

- In the future, Karat plans to expand its services to provide insurance options for creators, aiming to enhance the financial safety net for self-employed individuals.

Read Full Article

Like

Startup Pedia

298

Image Credit: Startup Pedia

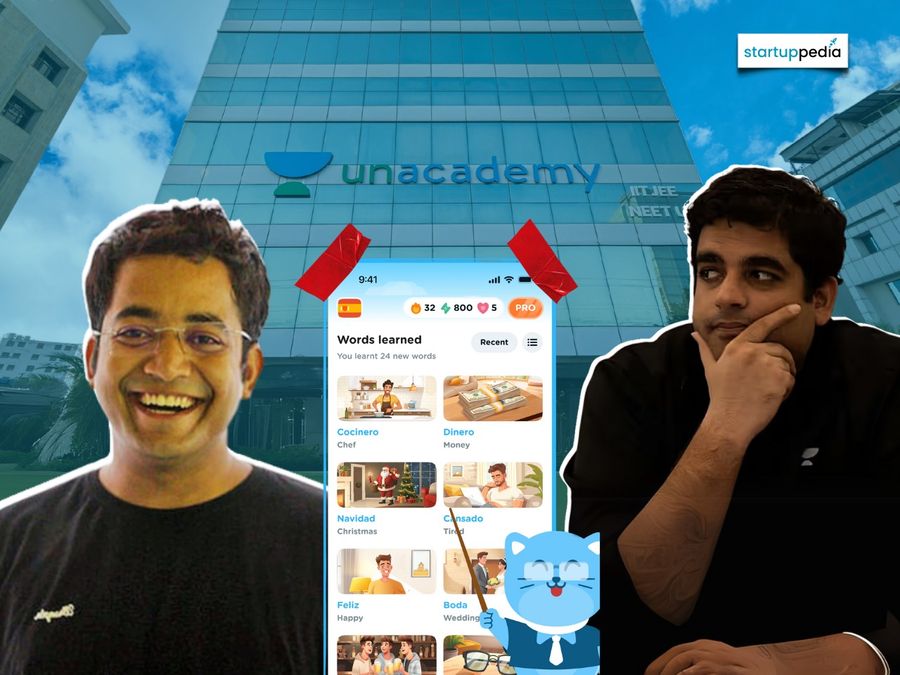

Unacademy founders Gaurav Munjal and Roman Saini to exit company, in talks to spin off Airlearn as new venture

- Unacademy co-founders Gaurav Munjal and Roman Saini are set to exit the company within the next 2-3 months.

- They are in talks with the board and investors to spin off Airlearn, Unacademy's language learning app, as a separate entity.

- Sumit Jain, co-founder of Unacademy's subsidiary Graphy, will take over as CEO of Unacademy.

- Unacademy plans for a succession strategy as Munjal and Saini are expected to leave post Airlearn spin-off, with a focus on reducing cash burn and improving financial performance.

Read Full Article

17 Likes

Hitconsultant

101

AssistIQ Secures $11.5M to Transform Hospital Supply Chains with AI

- AssistIQ, an AI company, secures $11.5M in Series A funding round led by Battery Ventures to revolutionize hospitals' supply chains with AI.

- The platform captures every item used in operating and procedural rooms, helping healthcare facilities recover revenue, streamline operations, and enhance staff satisfaction.

- Using AI-powered computer vision technology, AssistIQ provides real-time visibility into surgical supply usage, reducing costs and enabling hospitals to recover missed revenue.

- Health systems like Northwell Health and Owensboro Health Regional Hospital are partnering with AssistIQ, reporting high charge capture rates and operational efficiencies.

Read Full Article

6 Likes

Medium

293

Advanced Prompt Engineering Strategies to Grow Your AI-Powered Business in 2025

- Advanced prompt engineering involves strategic design of input instructions for generating consistent and actionable outputs from AI systems.

- Key strategies include chaining prompts for better control, using dynamic templates with variables, defining role-based prompts, and building AI-as-a-Service workflows.

- It is essential to simulate memory, test and debug prompts like a developer, inject commercial intent, and create/sell prompt libraries as digital products for monetization.

- AI prompt engineering is crucial for creating automated income systems, scalable content engines, and virtual workers tailored to specific needs, providing a competitive edge in various fields.

Read Full Article

17 Likes

Gritdaily

59

Image Credit: Gritdaily

Redefining Presence with Sonant Voice AI: How Independent Insurance Agents Can Reclaim Time Without Losing Touch

- Independent insurance agents are reevaluating the concept of 'being there' with the help of Sonant, a voice AI platform designed for agencies.

- Constant availability and responsiveness can hinder rather than help agencies, leading to a focus on more meaningful interactions over constant availability.

- Tools like Sonant aim to automate routine tasks to allow agents to focus on client relationships, strategic thinking, and efficient time management.

- The use of AI in the insurance industry is seen as a way to protect agents' time, improve efficiency, and create space for more valuable interactions, moving from burnout to balance.

Read Full Article

3 Likes

Unboxing Startups

353

Image Credit: Unboxing Startups

Wall Mount Sign Holder: Boost Startup Branding & Efficiency

- Using wall mount sign holders can help startups make a strong first impression and improve branding and efficiency.

- They aid in displaying logos, slogans, and organizing information, enhancing visibility and professionalism.

- Wall mount sign holders are versatile tools for communication and branding efforts in businesses.

- Acrylic wall mount sign holders are durable, aesthetically appealing, flexible, and offer clarity for effective communication.

- Choosing the right size and style, like 8.5 x 11 sign holders, is crucial for visibility and adaptability.

- Vertical sign holders can creatively serve purposes like directional signage, menu displays, event promotions, and artistic displays.

- Strategic placement and consistent messaging with sign holders can significantly boost brand visibility for startups.

- Implementing wall mount sign holders can enhance branding and operational efficiency for startups, creating a more professional business environment.

- Overall, these holders offer valuable assets for startup branding and organization of important information.

- Consider incorporating wall mount sign holders to elevate branding efforts and create a cohesive brand experience for customers.

Read Full Article

21 Likes

For uninterrupted reading, download the app