Funding News

Economic Times

111

Image Credit: Economic Times

Agritech startup Halter becomes New Zealand's latest unicorn in $100 million fundraise

- Agritech startup, Halter, raised $100 million at a $1 billion valuation, becoming one of New Zealand's unicorns.

- The Series D funding was led by Bond and joined by NewView, Bessemer Venture Partners, DCVC, Blackbird, Icehouse Ventures, and Promus Ventures.

- Halter focuses on cattle management for dairy farmers, using smart collars, connectivity towers, and a mobile app to enhance grazing efficiency and reduce environmental impact.

- The company plans to expand in the US, where it works with 150 ranchers in 18 states, addressing labor shortages and improving herd management efficiency.

- Halter's technology helps ranchers manage herds more efficiently with fewer staff, catering to the aging farmer population and labor shortages in rural areas.

- The US farm industry is experiencing staffing challenges due to recent deportations, impacting an industry traditionally reliant on immigrant labor.

Read Full Article

6 Likes

Economic Times

173

Image Credit: Economic Times

Customer service AI startup Decagon raises $131 million

- Decagon, a customer service AI startup, raised $131 million in a funding round that valued the company at $1.5 billion.

- The Series C round was led by Accel and Andreessen Horowitz, with participation from existing investors A*, Bain Capital Ventures, and BOND.

- Decagon's funding round comes less than a year after a Series B round where it raised $65 million at a $650 million valuation.

- The company competes with giants like Salesforce and startups like Sierra, led by OpenAI board chairman Bret Taylor.

- Sierra, a competitor, raised $175 million in a funding round with a $4.5 billion valuation in October.

- Decagon has caught investor interest since OpenAI's ChatGPT model, with a focus on AI applications that generate steady revenue.

- Decagon's clientele includes Hertz, Duolingo, Eventbrite, and Chime.

- Chime experienced a 60% reduction in contact center costs and a higher net promoter score using Decagon's services.

- Decagon offers text-based AI customer support like chat and email, as well as AI voice agents for customer support calls.

- The company's tools enable enterprises to build their AI customer support solutions.

Read Full Article

10 Likes

Pymnts

178

Image Credit: Pymnts

UBS Invests in Icon’s Payment Modernization Efforts

- UBS has made an equity investment in payments technology FinTech company Icon Solutions.

- The investment was announced on June 18 and follows additional funding from existing investors Citi and NatWest.

- UBS views Icon as a crucial partner in modernizing payment platforms with innovative infrastructure solutions.

- The investment solidifies the partnership between UBS and Icon to deliver faster and future-ready payment solutions.

- UBS, along with Citi and NatWest, will utilize Icon's Payments Framework (IPF) for their payments modernization programs.

- IPF allows banks to speed up the development, testing, and deployment of payment processing solutions while controlling costs and timelines.

- Icon's director and co-founder, Tom Kelleher, believes that banks should take the lead in their payments transformation, indicating confidence in IPF.

- PYMNTS highlights the increasing importance for banks to modernize in response to consumer preferences for instant payments and small businesses seeking faster access to funds.

- Research shows a growing preference for instant disbursements, with virtual accounts offering banks a competitive edge in meeting these evolving customer needs.

- Virtual accounts present an opportunity for banks to turn disbursements into customer-centric services that go beyond just transferring money.

Read Full Article

10 Likes

Pymnts

294

Image Credit: Pymnts

Investor Anthony Pompliano Launches $1 Billion Bitcoin Treasury Firm

- Investor Anthony Pompliano has launched a bitcoin treasury with $1 billion of the cryptocurrency.

- Pompliano's ProCap BTC entered a SPAC merger with Columbus Circle Capital Corp. to create ProCap Financial.

- The entities raised $516.5 million in equity and $235 million in convertible notes, marking the largest initial fundraise for a public bitcoin treasury company.

- ProCap Financial aims to provide bitcoin-native financial services to sophisticated investors, acquiring bitcoin and implementing risk-mitigated solutions.

- Many public companies are turning to bitcoin treasury strategies, inspired by the success of companies like Strategy.

- Bitcoin's increasing role in corporate treasuries reflects a re-evaluation of storing value, managing inflation risk, and allocating capital.

- Some CFOs may adopt a hybrid treasury model, balancing cash, fixed-income assets, and bitcoin to meet liquidity needs and long-term appreciation potential.

- Cryptocurrencies playing a larger role in lending pose risks due to their volatility, as stablecoins have deviated from their one-to-one relationship with the dollar.

- The Office of the Comptroller of the Currency's decision to permit digital holdings in secured lending activities is set to accelerate cryptocurrency lending.

- The announcement reflects the growing trend of bitcoin adoption in traditional financial systems and the importance of regulatory clarity.

- Bitcoin's rise in corporate treasuries could lead to a more diversified approach among companies looking to balance risks and potential gains.

- Investments in bitcoin treasuries and financial services showcase the evolving landscape of digital assets within established financial frameworks.

- Corporate bitcoin holdings highlight a shift in how businesses view asset storage, risk management, and capital allocation.

- The news underscores the increasing acceptance and integration of cryptocurrencies like bitcoin into mainstream financial practices.

- Anthony Pompliano's bitcoin treasury venture exemplifies the ongoing evolution of digital asset investments within traditional financial structures.

Read Full Article

17 Likes

Medium

258

Image Credit: Medium

Inside My Investment Committee Mindset — What We Look For Beyond the Deck

- Investors focus on factors beyond the standard pitch deck when evaluating startups.

- Key aspects include deep industry insights, evidence of problem understanding, and relentless drive to solve issues.

- Demonstrating thorough research and maintaining a sense of urgency are essential.

- Clear articulation of unit economics and financial realities is crucial.

- Long-term partnerships and transparent, collaborative relationships are valued.

- Startups must be able to survive various challenges and adapt to unforeseen circumstances.

- Investors look for multiple sustainable pathways and stress-testing resilience.

- Fatal single points of failure can swiftly derail investment prospects.

- The importance of strong partnerships and trust in investment decisions is highlighted.

- Investors consider long-term potential and the ability of startups to navigate uncertainties.

- A real-world example demonstrates how critical factors beyond the deck can influence investment outcomes.

- Final decisions often rely on invisible filters that go beyond initial presentations.

- Transparency, scrutiny, and readiness for detailed discussions are encouraged for founders.

- Investors prioritize robustness, sustainability, and adaptability in their evaluations.

- The article emphasizes the importance of deep understanding and preparedness for rigorous scrutiny.

- Investors seek startups with the ability to weather various challenges and pivot when necessary.

Read Full Article

15 Likes

TechCrunch

201

Image Credit: TechCrunch

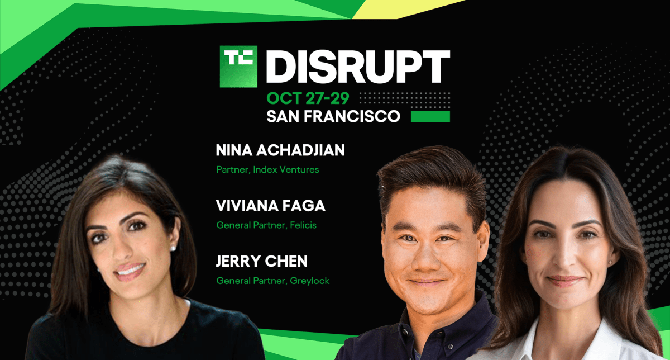

Want to know where VCs are investing next? Be in the room at TechCrunch Disrupt 2025

- TechCrunch Disrupt 2025 event on Oct 27 at 1:00 pm features VCs sharing their 2026 investment priorities.

- Nina Achadjian from Index Ventures focuses on automating 'forgotten' functions and industries.

- Jerry Chen of Greylock invests in product-driven founders across AI, Cloud, and Data.

- Viviana Faga of Felicis specializes in architecting brand categories and scaling go-to-market for cloud/SaaS.

- Event offers low pricing for attendees registering early, with up to $675 off tickets.

Read Full Article

11 Likes

Eu-Startups

191

Italian EdTech startup Wibo raises €500k for its upskilling and leadership programmes

- Turin-based EdTech startup Wibo has secured a €500k funding round to enhance its upskilling and leadership training programs in Italy.

- The funding round was led by a group of notable business leaders and supported by Talent Garden and VC fund Techstars.

- Wibo aims to combine human and tech skills through live sessions, exercises, and practical tools in its training model.

- The startup plans to expand its team, focus on AI training areas, and develop proprietary technology with the new funding.

- Founded in 2019, Wibo transitioned from a quiz app to a live quiz platform before pivoting to HR and Learning & Development training.

- Its model integrates human skills like leadership and communication with AI practical use, partnering with over 150 corporates and training 14,500+ individuals.

- Wibo's programs are designed to be immediately applicable to everyday work, aiming to create a memorable and practical learning experience.

- The startup addresses the perceived ineffectiveness of traditional corporate training by providing business-oriented, experiential programs led by industry executives.

- With insights from executives of major companies like Nike, Amazon, and Google, Wibo's training includes simulations, role-playing, and actionable steps for participants to implement.

- Wibo emphasizes bridging the gap between human and AI skills to drive business success by leveraging real-world experiences in its training.

- The startup plans to hire 5 new team members in product, tech, and customer success areas, aiming for continued growth and impact.

- Wibo has launched a pre-registration list for its Wibo Humans+AI Mini-Academy, offering free access to interested individuals.

Read Full Article

11 Likes

Economic Times

303

Image Credit: Economic Times

EV infrastructure startup Kazam raises $6.2 million in round led by International Finance Corporation

- EV infrastructure startup Kazam raises $6.2 million in a funding round led by International Finance Corporation (IFC), with participation from existing investors.

- This brings Kazam's total funding to $19.2 million, focusing on expanding its presence in domestic and international markets.

- Kazam provides software and hardware solutions for EV charging and battery swapping operators.

- The company plans to use the funds to scale its digital infrastructure for EVs toward clean mobility transition.

- Kazam, founded in 2020, helps manage and optimize charging assets, enabling over five million charging sessions so far.

- The platform has onboarded 68,000 chargers, facilitating 45 gigawatt hours of energy and reducing 46,000 tons of carbon emissions.

- Kazam's revenue surged from $1.5 million in FY24 to $6 million in FY25, targeting $12 million in revenue this fiscal.

- The company's platform operates in 80 cities across 10 countries, aiding in 25 million electric kilometres in a month.

- IFC's investment in Kazam supports the growth of electric mobility, especially in developing economies lacking EV charging infrastructure.

- The backing from IFC signals confidence in Kazam's potential to contribute to decarbonizing transport, especially in emerging markets.

Read Full Article

18 Likes

Medium

316

Image Credit: Medium

Why Most Product Launches Fail: The Missing Bridge Between Features & Personal Stakes

- The article discusses the common reasons for product launch failures in B2B marketing.

- It highlights the importance of understanding the personal stakes behind user decisions for successful adoption.

- The author shares a case study of launching an AI-powered accounting solution during lockdown in France.

- The focus was shifted from product features to addressing personal struggles and fears of the target users.

- The Bridge Builder Framework is introduced as a systematic way to identify personal stakes driving behavior change.

- The importance of addressing underlying personal stakes rather than just solving the business problem is emphasized.

- Creating smart constraints to drive action and commitments to ensure meaningful adoption is recommended.

- A case study of AMI Compta illustrates the effectiveness of setting high standards for adoption rather than offering free trials.

- The article suggests that people adopt new behaviors, not just products, and behavior change occurs when personal stakes are understood.

- The article concludes by emphasizing the importance of creating a bridge between user reality and business ambition for successful product launches.

- The author advises focusing on how the product improves the user's daily life rather than just the features.

Read Full Article

19 Likes

Siliconangle

57

Image Credit: Siliconangle

Qualytics gets $10M to use AI to monitor the data for AI

- Qualytics Inc. secures a $10 million Series A funding round to utilize AI in monitoring data for AI models' access to high-quality data, backed by investors like BMW i Ventures, Conductive Ventures, and Firebrand Ventures.

- The company aims to address the increasing importance of accurate and reliable data for AI-powered automation and data-driven operations as enterprises expand their investments in AI.

- Qualytics offers AI-powered tools for proactive data quality management, including rule generation, anomaly detection, and no-code workflows, to support deep learning at higher scales and automate data quality rules.

- The startup targets urgent challenges related to ensuring AI models access dependable data and the need for governance democratization with its automated platform.

- As the demand for data quality automation grows, Qualytics strives to revolutionize data quality management by automating complex rules to enhance data resilience and address AI project requirements.

- Gartner forecasts a 70% automation rate for data quality by 2027 to mitigate costly data issues, and Qualytics is making strides by attracting major customers and ensuring platform compatibility with various big data tools.

- The funding round will support Qualytics in expanding its product and go-to-market teams to improve platform capabilities, onboard customers efficiently, and enhance sales, as acknowledged by BMW i Ventures' Baris Guzel.

- Qualytics' CEO emphasizes the company's focus on automation and usability in data quality management, confident in its ability to meet modern data practitioners' needs at scale.

- Analyst Michael Ni underlines the shift towards proactive data quality management and Qualytics' position as a key player in modern data stacks, offering AI-driven automation paired with observability tools.

- The company's vision aligns with the evolving data industry where data quality is fundamental for building reliable AI tools, driving organizations to prioritize automated data quality monitoring at the production layer.

- The innovative approach by Qualytics in data quality automation signifies a fundamental shift in ensuring reliable AI outputs and minimizing data pipeline breakdowns, positioning the company for further growth and industry impact.

Read Full Article

3 Likes

Alleywatch

236

The Weekly Notable Startup Funding Report: 6/23/25

- Applied Intuition raised $600.0M for software infrastructure for autonomous vehicles.

- Senra Systems secured $25.0M for manufacturing harnesses using software configuration.

- Uncountable obtained $27.0M for providing a unified R&D laboratory informatics platform.

- Profound received $20.0M for analytics and tools enhancing visibility in AI search.

- Sedai raised $20.0M for AI-powered cloud cost optimization and performance tuning.

- Onebrief garnered $23.6M for web-based military planning software.

- Mach Industries secured $100.0M for defense manufacturing and unmanned systems.

- Payabli raised $28.0M for payments infrastructure and monetization platform.

- PublicAI obtained $8.0M for a Web3 distributed AI training network.

- Juniper Square raised $130.0M for software and fund administration services.

Read Full Article

14 Likes

Roadtovr

138

Image Credit: Roadtovr

VR Treadmill Company Virtuix Raised Another $3M in Crowd Investments, Now at $200M Valuation

- Virtuix, a VR treadmill company, raised over $3 million in its Series B-2 round of crowd-based investments, bringing its total Series B funding to over $18 million.

- The investment campaign for Omni One, a consumer-focused VR locomotion device, attracted funds from more than 1,300 investors through StartEngine.

- Omni One is marketed as an at-home device but is expanding its use to military training programs with the introduction of the Virtuix Omni Mission Trainer (OMT).

- Virtuix OMT, created with the U.S. Air Force, enables soldiers to train physically in realistic 360-degree VR environments while carrying real weapons and equipment.

- After the recent funding round, Virtuix received a $201.13 million valuation, based in part on its pre-IPO stock price of $6.22 per share.

- Virtuix, established in 2013 through Kickstarter, has raised over $40 million in funding and counts investors like Mark Cuban, Maveron, and Scout Ventures.

- The company has sold products worth over $18 million to major clients, including Dave & Buster’s, and has 400,000 registered players.

- Virtuix claims its factory can manufacture up to 3,000 Omni One units monthly.

- The news was reported by Road to VR.

- Virtuix continues to innovate in the VR space with its consumer device Omni One and its military training system OMT.

- The company's valuation has increased to $200 million after the recent funding round.

- Virtuix stock is currently not publicly traded on major exchanges as it remains a privately held company.

- The successful funding rounds indicate investor confidence in Virtuix's vision and products.

- The company's ability to expand into military applications shows the versatility of its VR technology.

- Virtuix's growth trajectory and strategic partnerships are positioning it as a key player in the VR industry.

- Virtuix's achievements in fundraising, product sales, and market penetration reflect its steady progress and potential for further success.

Read Full Article

8 Likes

Eu-Startups

191

German startup Steuerboard raises €725k to eliminate email “ping-pong” in tax advisory firms

- German startup Steuerboard raises €725k in a pre-Seed financing round led by High-Tech Gründerfonds (HTGF) to accelerate product development and market expansion.

- Steuerboard, a Düsseldorf-based B2B SaaS platform, founded in 2023 by Matyas Heins and Jakob Brandt, focuses on innovating tax workflows by eliminating email ping-pong.

- The platform integrates AI technology to address the specialist-staff shortage in tax advisory firms, aiming to improve efficiency and transparency.

- The global tax software market was valued at €16.1 billion in 2023 and is expected to grow at a 10% CAGR through 2030.

- Germany, accounting for about 30% of the European total, represents a significant opportunity for solutions like Steuerboard in the tax management software segment.

- Steuerboard has onboarded nearly 100 tax offices and supports thousands of businesses monthly, indicating strong demand for AI-driven collaboration in Germany's tax industry.

- With the new funding, Steuerboard plans to expand its teams, enhance AI workflows, and increase its sales presence in the DACH region over the next 24 months.

Read Full Article

11 Likes

Eu-Startups

414

Swedish entrepreneurship platform Techarena secures a €1 million investment to expand across the continent

- Stockholm-based Techarena has secured a €1 million investment from VC firm Backingminds to expand their international footprint.

- Techarena, founded in 2014, is a Nordic platform for innovation and entrepreneurship gathering thousands of Founders, investors, and leaders annually.

- The platform hosts events, accelerator programs, and media channels to foster cross-border collaboration and growth.

- Techarena connects startups and scaleups from over 120 countries through flagship formats like Techarena Challenge and TOP46.

- Their revenue has reportedly grown by 600% over the past three years, with over 18,000 participants in events and programs in the last year.

- BackingMinds foresees Europe's business events market to be worth €108.1 billion by 2030.

- Techarena plans to expand its events and programs to boost Europe's innovation resilience amidst technological and geopolitical changes.

Read Full Article

24 Likes

SiliconCanals

244

Image Credit: SiliconCanals

After €92.7M, Amsterdam’s FINOM raises €115M from AVP and others

- Amsterdam-based FINOM, a digital banking solution, has raised €115M in a Series C funding round led by AVP.

- AVP is an independent global investment platform managing over €2.5B of assets, impressed by Finom's execution and strategy.

- The funding round includes new investor Headline Growth and existing investors General Catalyst, Northzone, and Cogito Capital.

- This funding follows a previous round of €92.7M, bringing FINOM's total funding to over €300M.

- The company aims to expand its reach across Europe and support European SMEs.

- FINOM currently serves over 125,000 customers with local IBAN accounts in several European countries.

- They plan to reach one million European business customers by the end of 2026.

- Since its Series B round in 2024, FINOM has doubled revenue and maintained positive unit economics.

- The funding will help FINOM accelerate its growth in technology and customer trust.

- FINOM was founded in 2020 by fintech veterans and offers banking tools for businesses such as account opening, online banking, payment processing, and more.

- The company operates under an Electronic Money Institution (EMI) license across Europe.

- FINOM's goal is to develop a full-stack financial operating system for entrepreneurs and SMEs.

- Warda Shaheen from AVP will join Finom’s board of directors as part of the funding round.

- The company's vision is to empower European businesses, regardless of size, within a thriving business environment.

- The Series C funding is intended to strengthen FINOM's position as the financial infrastructure provider for European SMEs.

Read Full Article

14 Likes

For uninterrupted reading, download the app