Funding News

Global Fintech Series

342

Image Credit: Global Fintech Series

Zinemx Launches Options Trading to Empower Investors with Diversified Trading Opportunities

- Zinemx Exchange has introduced options trading to provide institutional investors with diversified trading opportunities and flexible risk management.

- The options profit calculator and strategy simulation system aid in developing optimal investment plans and reducing uncertainties due to market volatility.

- Investors at Zinemx Exchange can hedge against market fluctuations using options to minimize potential losses during sharp price movements.

- The platform allows for a leverage effect where investors can control larger market positions with relatively small capital input, enhancing capital efficiency.

- Different options combination strategies can be employed by investors to profit in rising and falling markets.

- Zinemx Exchange has launched intelligent trading tools including an options profit calculator and a strategy simulation system to assist investors in options trading.

- The market data analytics provided by Zinemx Exchange offer real-time options market data to help users stay informed about market trends.

- The options trading functionality is designed for both individual and institutional investors, offering a reliable trading environment with large order matching and risk control systems.

- The launch of options trading showcases Zinemx Exchange's commitment to crypto financial innovation and plans to expand its derivatives market in the future.

Read Full Article

20 Likes

SiliconCanals

106

Image Credit: SiliconCanals

Axiles Bionics closes first €6M of its €8M Series A round to globalise its biomimetic prosthetic foot

- Axiles Bionics, a Brussels-based deeptech and medtech spin-off, has closed the first €6M tranche of its €8M Series A financing round.

- The funding, led by PE Group and supported by EIC Fund, Finance&Invest.brussels, private investors, entrepreneurs, and the company's management team, will aid in globalizing their biomimetic prosthetic foot Lunaris.

- Lunaris offers mechanical adaptability and embedded systems, currently used in clinical settings worldwide.

- Axiles Bionics is focused on developing bionic devices at the intersection of robotics, artificial intelligence, and biomechanics to enhance mobility through prosthetics.

- Their first product, Lunaris, is FDA and CE certified, mimicking natural walking patterns for lower limb amputees, with plans for future bionic technologies.

- PE Group CEO Stefan Yee praises Axiles Bionics for setting new standards in robotic prosthetics, poised to transform amputees' quality of life globally.

- European Innovation Council (EIC) Fund supports Axiles Bionics, acknowledging their commercial success and clinical advancements.

- Axiles Bionics aims to introduce advanced bionics as a standard, improving mobility and well-being, with a vision to reshape the global prosthetic technology standard.

- Investors like PE Group, EIC Fund, and Finance&Invest.brussels are providing financial and strategic support to Axiles Bionics for their innovative advancements in prosthetics.

Read Full Article

6 Likes

Medium

384

Image Credit: Medium

Why VCs are dumb and how to use us

- VCs might not know more about a sector or business than founders or their teams.

- Building a strong relationship with VCs is vital for founders to get the most value out of them.

- Select VCs that are right for you and your company to ensure advocacy and support.

- Communicate effectively and be responsive to engender a positive relationship with VCs.

- Use VCs as a sounding board for business decisions and emotional support related to your company.

- Board meetings should focus on open debates rather than mundane updates.

- External investors like VCs can instill discipline and help with corporate governance.

- Make use of VCs' networks and expertise to benefit your company.

- Though VCs may not offer groundbreaking insights, they can still provide valuable support and networking opportunities.

- Founders are encouraged to leverage VCs' superpowers and build strong relationships with them.

Read Full Article

22 Likes

TechBullion

378

Image Credit: TechBullion

Are classic cars a good investment in 2025? Insights from Sultan Rashid Abdullah Rashid Al Shene

- Investors are turning to tangible assets like real estate, art, and classic cars amidst financial uncertainty and declining trust in digital assets.

- Whether classic cars are a good investment in 2025 depends on strategy, market trends, and passion for vintage vehicles, as per Sultan Rashid Abdullah Rashid Al Shene.

- Sultan Al Shene, an automotive expert, suggests investing in timeless, high-quality cars with proven market demand, rather than following fads.

- Advantages of investing in classic cars include increasing demand, particularly in regions like the Middle East, Africa, and Southeast Asia, with online auction platforms expanding opportunities for financial growth.

- However, risks exist, and thorough research is vital to ensure paying the right value for vintage automobiles.

- Sultan Al Shene believes that old cars can be a good investment in 2025 for patient, detail-oriented collectors who value asset appreciation and personal satisfaction.

- Old cars offer a unique blend of asset appreciation and personal enjoyment for collectors willing to navigate challenges.

- In 2025, the right models of classic cars may be a smart addition to an alternative investment portfolio.

Read Full Article

22 Likes

Fintechnews

365

Image Credit: Fintechnews

Finom Raises €115 Million in Series C to Expand European SME Services

- Finom, a digital financial services platform for entrepreneurs and SMEs, secures €115 million in Series C funding led by AVP and supported by Headline Growth, General Catalyst, Northzone, and Cogito Capital.

- The company has raised over €300 million in total to aid its expansion across Europe.

- Finom offers various services such as business banking, invoicing, expense management, payment processing, and foreign exchange through a unified platform.

- It currently serves over 125,000 customers with local IBAN accounts in five European countries and aims to reach one million business customers by 2026.

- Since its Series B round in 2024, Finom has doubled its revenue and grown its employee base to over 500.

- CEO Andrey Petrov emphasizes supporting European entrepreneurs with innovative financial solutions.

- Finom has expanded into the lending market, providing credit lines for Dutch businesses.

- The Series C funds will be utilized for product development, market expansion, and potential acquisitions.

Read Full Article

21 Likes

Siliconangle

35

Image Credit: Siliconangle

Chatbot startup Decagon gets $131M to build personalized AI agents for every consumer

- Decagon AI Inc., a startup specializing in AI-powered customer service agents, has raised $131 million in a Series C funding round, bringing its valuation to $1.5 billion.

- The funding was led by Andreessen Horowitz and Accel, with participation from existing investors like A*, Bain Capital Ventures, and others.

- Decagon provides text- and voice-based customer support bots that can automate interactions across chat, email, and phone calls, with customization tools for companies.

- Its chatbots have 'agentic' capabilities, allowing them to act on behalf of customers throughout the support lifecycle, improving performance through customer feedback.

- The company combines third-party language models with its AI algorithms to create intelligent chatbots that are continuously tested for reliability and accuracy.

- Decagon, heavily funded, competes in AI-powered customer support against big players like Salesforce and smaller firms like Sierra Technologies.

- Customers include Hertz, Duolingo, Eventbrite, and Chime Financial, with Chime reducing contact center costs by over 60% and doubling their net promoter score using AI agents.

- Decagon plans to use the funding to expand its teams, enhance sales efforts to more enterprises, and create personalized AI agents for brands to offer 24/7 customer interactions.

- CEO Jesse Zhang envisions a future where every brand provides personalized AI agents for enhanced customer experience.

- Decagon aims for proactive, authentic, intelligent, and satisfying customer interactions.

- The company is founded by tech visionaries John Furrier and Dave Vellante and operates in the digital media and AI space.

- SiliconANGLE Media, the parent company, is a leader in digital media innovation serving tech professionals with influential content and AI technology.

- The company's ecosystem includes theCUBE Network, theCUBE Research, and theCUBE SuperStudios, using AI Video cloud for audience interaction.

- SiliconANGLE Media has a reach of over 15 million tech professionals and focuses on data-driven decisions for technology companies.

- Decagon's funding round and innovative approach to personalized AI agents showcase its significant impact in the AI-powered customer support sector.

Read Full Article

2 Likes

Siliconangle

115

Image Credit: Siliconangle

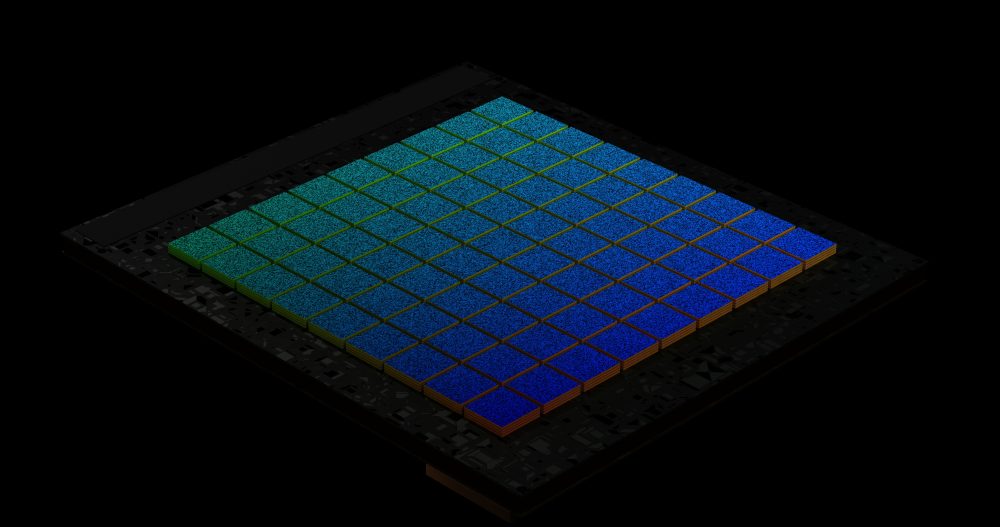

Superconducting chip startup Snowcap Compute reels in $23M

- Snowcap Compute Inc. has raised $23 million in funding for developing processors from semiconducting materials.

- Former Intel CEO Pat Gelsinger has joined Snowcap's board.

- The startup, based in Palo Alto, plans to use superconducting logic for enhanced processing speed and efficiency.

- Electrons passing through superconducting materials do not generate heat, potentially increasing data center efficiency.

- Snowcap aims to produce chips using niobium titanium nitride for AI accelerators and other applications.

- The company's superconducting technology is claimed to be 25 times more power-efficient than current chips.

- Hydrogen-powered cryogenic equipment will be used to cool the superconducting materials used in Snowcap's chips.

- Snowcap's processors will utilize Josephson junctions, addressing technical challenges and reducing manufacturing costs.

- The company plans to manufacture its first chip by the end of 2026, followed by more advanced systems.

- Snowcap aims to make superconductor-based chips more accessible by utilizing existing fabs and 300-millimeter wafers.

Read Full Article

6 Likes

Siliconangle

57

Image Credit: Siliconangle

Harvey raises $300M in funding for its legal AI assistant

- Harvey, an AI software developer for legal professionals, raised $300 million in Series E funding led by Kleiner Perkins and Coatue, valuing the company at $5 billion.

- Harvey's AI tools aim to boost productivity for legal teams, with its platform used by over 330 law firms and generating $75 million in revenue annually.

- Its flagship AI tool, Harvey Assistant, helps automate legal document drafting, reviews drafts against internal guidelines, proofreads, translates, and auto-fills contract fields.

- Harvey's redlining feature automates summarizing document changes, leveraging a custom AI model with about 100,000 parameters and neural network architecture.

- The company uses off-the-shelf language models and plans to incorporate AI models from LexisNexis post-funding.

- Proceeds from the investment will double Harvey's workforce and support expansion into new market segments beyond law.

- Harvey's technology involves turning PDF contracts into images and applying filters before inputting into AI models to enhance accuracy and inference speed.

Read Full Article

3 Likes

The Robot Report

307

VC reflects on robotics trade show season

- May and June were significant months for robotics in the U.S. with trade shows in Boston, Detroit, Houston, and Atlanta showcasing new technologies.

- Automate, organized by A3, highlighted the positive impact of robots on job creation and productivity.

- Interest in Cambrian Robotics surged with demonstrations of advanced AI-infused technologies at trade shows.

- Startups like Kinisi and Nexus Intelligence showcased innovative AI-driven robotics solutions at Automate.

- Xponential in Houston revealed advancements in defense technology with a focus on autonomous systems and drones.

- The relation between startups and the military has transformed, with significant investment in defense tech companies like Anduril.

- Anduril's success in securing a substantial funding round reflects the potential growth in the defense tech market.

- Palmer Luckey discussed Anduril's development of autonomous fighter jets for the U.S. Air Force.

- The robotics trade show season concluded in Boston with Robotics Tech Week, featuring discussions on industry growth and technological advancements.

- Oliver Mitchell's book launch at MassRobotics signified a reflection on the industry's progress and future prospects.

Read Full Article

18 Likes

Pymnts

160

Image Credit: Pymnts

Botpress Raises $25 Million to Expand Infrastructure for AI Agents

- Botpress has raised $25 million in a Series B funding round to expand its platform for building and deploying artificial intelligence (AI) agents.

- The company plans to use the new capital to enhance its global customer support and scale its engineering and go-to-market teams.

- Botpress Founder and CEO Sylvain Perron highlighted that AI agents will gradually replace entire categories of software by the next decade.

- The company has been developing the necessary infrastructure for running AI agents safely at scale.

- Botpress' cloud platform has attracted thousands of customers across various industries utilizing AI agents.

- Botpress' platform offers the necessary infrastructure for companies to transition their AI agents from experimentation to deployment.

- With a rising number of AI agents moving into production, the funding aims to further scale their existing operations.

- Framework Venture Partners led the funding round and expressed Botpress as a robust AI platform for production at scale.

- Botpress empowers builders to develop, deploy, and monitor intelligent agents and conversational AI.

- Uber AI Solutions recently launched new solutions available globally, and Thomson Reuters debuted an agentic AI platform called CoCounsel to automate workflows.

- Botpress secures $25 million in Series B funding to enhance infrastructure for AI agents.

Read Full Article

9 Likes

Pymnts

227

Image Credit: Pymnts

Tensec Raises $12 Million to Promote Real-Time X-Border Payments

- Cross-border payments FinTech Tensec raised $12 million in new funding to provide real-time payments and financial services for companies in the cross-border payments market.

- Tensec aims to offer real-time payments and transaction banking services to small- to medium-sized businesses, empowering global trading companies to deliver financial services directly to their partners.

- The platform uses artificial intelligence, real-time payments, and global FinTech infrastructure to enable trading companies to offer FX services, cross-border payments, treasury, and other financial services to SMB customers.

- SMB cross-border payments have been lagging behind despite making up a significant portion of annual physical goods trade.

- Tensec's innovative services skip legacy banking infrastructure to offer financial services innovations directly to companies engaged in global trade.

- PYMNTS reported on challenges facing SMBs related to cross-border payments, including concerns about digital wallets, security, integration, complexity, and regulatory uncertainty.

- Financial service providers have an opportunity to address the disconnect by offering streamlined onboarding, compliance clarity, and interoperability across global networks.

- The funding will help Tensec bridge the gap in SMB cross-border payments and drive global commerce accessibility.

- Tensec's goal is to make global commerce faster, cheaper, and more accessible by empowering trading companies with innovative financial services.

- The company's focus on real-time payments and transaction banking services aims to enhance the cross-border payments experience for SMBs.

- Legacy banking infrastructure has hindered SMBs in accessing the necessary financial tools for global trade, prompting Tensec to offer a modern solution.

- The PYMNTS Intelligence report highlighted the reluctance of SMBs to use digital wallets for cross-border payments due to industry standards, partner acceptance, security, integration, and regulatory concerns.

- Tensec's use of AI, real-time payments, and FinTech infrastructure is geared towards transforming the SMB cross-border payments landscape.

- The company plans to disrupt the traditional cross-border payment methods by providing innovative financial services directly to companies engaged in global trade.

- The $12 million funding will support Tensec in its mission to modernize and streamline the cross-border payment experience for SMBs.

- The initiative by Tensec reflects the growing demand for efficient and accessible cross-border payment solutions in the global trade market.

Read Full Article

13 Likes

Medium

400

Image Credit: Medium

Halter Continues Rapid Growth, Raises $100M Series D

- Halter raised $100M Series D round led by BOND, with NewView and existing investors participating.

- The company, employing over 200 people, offers technology for managing beef ranches and dairy farms using Physical AI through smart collars.

- Halter serves customers in New Zealand, Australia, and the US, revolutionizing ranch and farm operations.

- Users report higher profitability and improved herd management, soil health, and land management through Halter's system.

- The cattle industry, generating over $1 trillion annually, has embraced Halter's Physical AI technology.

- Halter's platform evolution and high quality have made it a unique offering in agriculture.

- The system offers ranchers and farmers operational advantages, including ease of use and various features.

- Halter has built a strong position in the market due to its hardware/software technology platform.

- Promus Ventures, a Halter investor, praises the company's perseverance and success despite doubts in the early stages.

- Successful DeepTech investments often face early skepticism, but Halter's team has proven naysayers wrong.

- The Halter Board is composed of supportive investors, acknowledging the company's potential for global scalability and industry impact.

Read Full Article

24 Likes

TechBullion

392

Image Credit: TechBullion

Unlock Efficiency: How BIM Boosts Project Performance & Profit

- Building Information Modeling (BIM) in construction revolutionizes project delivery by offering a data-rich approach and boosting performance and profitability.

- BIM enhances collaboration by providing a shared 3D model for all stakeholders, streamlining communication and reducing errors.

- BIM's detailed 3D models enable better visualization, allowing stakeholders to explore designs virtually and make informed decisions early.

- The integration of BIM in projects leads to more accurate cost estimations, reducing manual errors and material wastage.

- BIM's clash detection capabilities minimize rework by identifying conflicts early in the design phase, saving costs and time.

- Utilizing 4D models, BIM helps simulate construction sequences, optimize timelines, and improve resource allocation for faster project completion.

- BIM extends benefits beyond construction into building operations, providing valuable data for maintenance, energy analysis, and asset value enhancement.

- By reducing errors, minimizing rework, optimizing schedules, and enhancing collaboration, BIM significantly increases profitability and ROI for companies.

- Surveys show that BIM adoption results in increased project profitability, cost reduction, shortened project durations, and significant ROI within a few years.

- BIM is crucial for achieving efficiency, performance, and profitability in the AEC industry, offering a robust framework for successful project delivery.

Read Full Article

23 Likes

TechCrunch

49

Image Credit: TechCrunch

Four months after a $3B valuation, Harvey AI grows to $5B

- Harvey AI, a legal automation startup, raised $300 million in Series E funding, valuing the company at $5 billion.

- The funding round was led by Kleiner Perkins and Coatue, with participation from existing investors like Conviction, Elad Gil, and Sequoia.

- This funding round comes shortly after Harvey raised $300 million in Series D funding at a $3 billion valuation.

- Harvey AI plans to double its staff from 340 employees with the new funds, focusing on expanding AI products for services beyond the legal sector, including tax accounting.

- The company's AI solutions aid lawyers in document review and contract drafting, serving 337 legal clients.

- In April, Harvey reached an annualized run-rate revenue of $75 million, up from $50 million earlier this year.

- Competitors of Harvey AI include older legal startups like Ironclad and Clio, which raised a $300 million round at a $3 billion valuation last year.

Read Full Article

2 Likes

TechCrunch

133

Image Credit: TechCrunch

TechCrunch Disrupt 2025: The Builders Stage agenda is now live and taking shape

- TechCrunch Disrupt 2025's Builders Stage offers insights from industry leaders like Elad Gil, Dick Costolo, and Ryan Petersen on tactics for startup success.

- Sessions at the event cover topics like raising capital, achieving product-market fit, hiring early employees, leveraging AI, and rethinking traditional startup practices.

- Speakers share strategies, experiences, and advice for navigating the challenges of building and scaling successful startups.

- The Builders Stage agenda includes discussions on seed funding, Series A investments, later-stage fundraising, and attracting top talent.

- Insightful panels dive into key aspects of entrepreneurship, including product development, go-to-market strategies, fundraising, and industry trends.

- Attendees can learn from experts in the field and gain actionable insights to help their startups thrive in a competitive landscape.

- Discover how to build a successful GTM engine, craft compelling pitches for investors, and navigate the evolving tech ecosystem.

- Early-stage founders can benefit from understanding the latest investment trends, growth strategies, and methods for building sustainable businesses.

- With a lineup of renowned speakers and engaging discussions, TechCrunch Disrupt 2025 provides valuable resources for startup entrepreneurs looking to succeed.

- Save on tickets now to access a wealth of knowledge, networking opportunities, and practical advice at this premier event for the startup community.

Read Full Article

8 Likes

For uninterrupted reading, download the app