Funding News

Bloomberg Quint

220

Image Credit: Bloomberg Quint

Trump Plans ‘Major’ Russia Statement Monday, Mulls Sanctions

- President Donald Trump plans to make a 'major statement' on Russia and criticized Russian President Putin's actions in Ukraine.

- Trump expects the Senate to pass a tough Russia sanctions bill and mentioned that NATO allies will pay for US arms to be sent to Ukraine.

- US arms, including air-defense missiles and artillery shells, are being sent to Ukraine despite an earlier Pentagon pause due to Trump's frustration over aid to Kyiv.

- Trump expressed mounting frustration with Putin as Russia intensified attacks on Ukrainian cities.

Read Full Article

13 Likes

Bloomberg Quint

228

Image Credit: Bloomberg Quint

Trump Threatens 35% Canada Tariff, Floats Higher Blanket Rates

- Trump plans to levy a 35% tariff on Canadian goods from August 1.

- He also considers increasing blanket tariffs on most trading partners.

- This move shows no retreat from his trade war despite Canadian efforts for a deal.

Read Full Article

13 Likes

Bloomberg Quint

314

Image Credit: Bloomberg Quint

PPF Vs SIP Comparison: How Much Rs 12,500 A Month Will Make By Retirement

- Comparing a monthly investment of Rs 12,500 over 15 years in PPF and SIPs shows significant differences in outcomes.

- PPF, with its stable and government-backed nature, could yield an estimated maturity amount of around Rs 39.44 lakh at an interest rate of 7.1% per annum.

- On the other hand, investing the same amount in mutual fund SIPs with an assumed average return of 12% per annum could result in an estimated maturity amount of around Rs 63 lakh.

- Investors looking for stable returns and tax benefits may opt for PPF, while those seeking higher returns and are willing to take on more risk might prefer SIPs. A balanced approach could involve investing in both for stability and long-term wealth creation.

Read Full Article

18 Likes

Bloomberg Quint

192

Image Credit: Bloomberg Quint

Apple Plans New MacBook Pro, iPhone 17e And iPads By Early 2026

- Apple plans new MacBook Pro, iPhone 17e, and iPads for early 2026.

- Updates to entry-level tablet, iPad Air, and MacBook Pros are expected.

- The new products aim to boost revenue growth after spotty demand recently.

Read Full Article

11 Likes

Bloomberg Quint

94

Image Credit: Bloomberg Quint

Oil Prices Steady As Traders Focus On OPEC+ Supply And Trump Tariffs

- Oil prices steadied after falling more than 2% on Thursday as investors assessed the impact of OPEC+ supply decisions and President Trump's tariffs.

- West Texas Intermediate was around $67 a barrel, while Brent closed below $69 in the previous session.

- OPEC+ is considering pausing production increases after a planned hike in September, potentially reversing recent output cuts earlier than anticipated.

- Despite concerns about oversupply, there are indications of tightness in the physical oil market, with demand typically strong during the Northern Hemisphere summer.

Read Full Article

4 Likes

Bloomberg Quint

141

Image Credit: Bloomberg Quint

US Stock Futures Fall, Dollar Gains on Tariff Jitters: Markets Wrap

- Contracts for S&P 500 and European stocks fell 0.2% due to proposed tariffs.

- Dollar strengthened after Trump hinted at higher tariffs, causing equity-index futures to retreat.

- Tariff tensions rise as Trump plans to remake global trade, impacting stock markets worldwide.

Read Full Article

8 Likes

Bloomberg Quint

1.3k

Image Credit: Bloomberg Quint

DMart Q1 Results To Be Announced Today — Here Are Earnings Estimates

- DMart is set to announce its Q1 results, with analysts expecting a 14% rise in profit for the June quarter.

- Bloomberg estimates predict a 17.8% year-on-year revenue increase to Rs 16,583 crore for DMart in Q1.

- Ebitda is expected to increase by 11% to Rs 1,354 crore, with margins likely to narrow to 8.2%.

- Despite concerns of weak demand impacting consumer staples, multiple companies including Avenue Supermarts Ltd., Amal Ltd., and Aditya Birla Money Ltd. are set to report their Q1 financial results.

Read Full Article

21 Likes

TechCrunch

240

Image Credit: TechCrunch

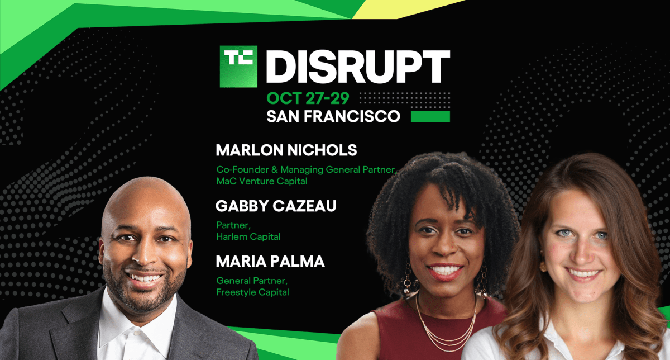

How to actually raise a seed round: Actionable advice from top investors at TechCrunch Disrupt 2025

- TechCrunch Disrupt 2025 will take place in San Francisco from October 27–29, bringing together over 10,000 startup and VC leaders to explore the future of innovation.

- A panel at the event will discuss actionable advice on raising a seed round, featuring investors Maria Palma, Gabby Cazeau, and Marlon Nichols sharing insights on pitching and selecting the right investors.

- Maria Palma, Gabby Cazeau, and Marlon Nichols, all experienced investors, will provide valuable insights on early-stage fundraising based on their backgrounds and successes in the industry.

- Attendees can expect valuable insights on navigating the fundraising process, building lasting investor relationships, and optimizing their approach to securing funding at TechCrunch Disrupt 2025.

Read Full Article

11 Likes

Pymnts

232

Image Credit: Pymnts

Bilt Raises $250 Million and Expands Loyalty Program to All Housing Categories

- Bilt raised $250 million and expanded its loyalty program to include all housing categories.

- The loyalty program, initially for rent payments, now covers condo HOA fees, student housing payments, and mortgage payments.

- Bilt's program allows members to pay with points at local merchants and offers personalized recommendations through an AI-powered 'neighborhood concierge.'

- The funding round valued Bilt at $10.75 billion, with recent acquisitions aimed at strengthening analytics and engagement with neighborhood merchants.

Read Full Article

12 Likes

Bloomberg Quint

256

Image Credit: Bloomberg Quint

Amazon India's Samir Kumar Draws Inspiration From Shubman Gill In Second Run At E-Commerce Giant

- Samir Kumar, country manager for Amazon India, draws inspiration from cricketer Shubman Gill for his second innings at the company.

- Kumar, who previously worked with Amazon India during its 2012–2016 launch, is impressed by the company's growth and customer loyalty in India.

- Amazon's strategy in India focuses on serving all regions with a wide selection, efficient logistics, and a strong customer-centric approach.

- Kumar emphasizes the importance of Amazon's supply chain, deep product assortment, customer satisfaction, employee welfare, and support for small businesses in India.

Read Full Article

15 Likes

Bloomberg Quint

916

Image Credit: Bloomberg Quint

It’s All About AI And Jobs

- Around a quarter of Indian CMOs lack responsible AI guidelines and believe their teams lack necessary talent for AI.

- CMOs face gaps in responsible AI, talent readiness, and data utilization, impacting ambition versus execution.

- Microsoft saved $500 million using AI in call centers but also cut 15,000 jobs, focusing on customer-facing roles.

- Salesforce reports 30% of internal work is AI-handled, sparking discussions on technology's impact on job necessity.

Read Full Article

14 Likes

Bloomberg Quint

367

Image Credit: Bloomberg Quint

India Now Makes Faster Payments Than Any Other Country, Courtesy UPI: IMF Note

- India now leads in faster payments globally, driven by the rapid growth of UPI (Unified Payments Interface), as per an IMF note.

- IMF's Fintech Note highlighted UPI's growth since its launch in 2016, processing over 18 billion transactions monthly and surpassing other digital payment methods in India.

- The note emphasized the value of interoperable payment systems like UPI, encouraging increased digital payment adoption and a decrease in cash transactions.

- Authors of the note recommend monitoring the emergence of dominant private providers in the ecosystem and ensuring a competitive, open, and interoperable system.

Read Full Article

22 Likes

Bloomberg Quint

85

Image Credit: Bloomberg Quint

NPCI International Payments Expands UPI Acceptance To Boost Digital Payments

- NPCI International Payments Ltd. is expanding Unified Payments Interface (UPI) acceptance in the UAE to boost digital payments and support a cashless economy.

- The platform aims to enable UPI in high-frequency sectors like retail, hospitality, entertainment, transportation, and essential services by collaborating with regulators and acquirers.

- The initiative supports the UAE's goal of achieving 90% digital transactions by 2026 and enhances payment experiences for Indian travelers visiting the UAE.

- NPCI International's partnerships in the UAE with financial institutions and payment providers have facilitated QR-based UPI acceptance at outlets like Dubai Duty Free and Lulu Hypermarket.

Read Full Article

Like

Bloomberg Quint

316

Image Credit: Bloomberg Quint

Google’s Gemini AI App Can Now Turn Photos Into Short Video Clips

- Google's Gemini AI app now allows paid users to convert photos into short video clips. The feature is available to subscribers of Google AI Ultra and Pro plans in select regions.

- Users can create 8-second video clips with sound based on a photo and text description. The videos are generated as MP4 files at 720p resolution in a 16:9 landscape format.

- The feature is powered by Veo 3, Google's latest video generation model. The AI tool aims to bring still images to life but may have limitations in accurately representing faces or complex prompts.

- Google restricts the creation of videos featuring publicly identifiable figures or encouraging dangerous activities. While the tool excels in animating objects and nature scenes, it may struggle with complex prompts like changing a person's appearance accurately.

Read Full Article

19 Likes

Bloomberg Quint

371

Image Credit: Bloomberg Quint

Italy’s Ferrero Agrees To Buy Kellogg In $3.1 Billion Deal

- Ferrero International SA has agreed to acquire WK Kellogg Co. for $3.1 billion, offering $23 per Kellogg share in cash, representing a 31% premium from Kellogg's closing price.

- Ferrero's acquisition of Kellogg will expand its empire of comfort foods, diversifying its portfolio and boosting its foothold in the US market.

- Kellogg, struggling with growth since being split into two businesses, will see Ferrero invest in and grow key brands like Frosted Flakes and Rice Krispies.

- The deal, expected to close in the second half of 2025, has been unanimously approved by Kellogg's board. Ferrero aims to strengthen Kellogg's position in the US market amidst changing consumer trends.

Read Full Article

19 Likes

For uninterrupted reading, download the app