Startup News

Pymnts

422

Image Credit: Pymnts

Shift4 Pays $180 Million for Australian Payments Processor Smartpay

- Shift4, an integrated payments and commerce technology firm, is set to acquire Australian payments processor Smartpay for $180 million to strengthen its presence in Australia and New Zealand.

- The acquisition aims to combine payment infrastructure with Smartpay’s distribution capabilities to offer leading products like SkyTab POS for restaurants, SkyTab Venue for stadiums, and end-to-end payment solutions for hotels and unified commerce merchants in the region.

- Shift4's strategy involves combining acquisitions to provide an integrated payment experience with localized distribution, service, merchant-facing products, and owned payment rails to scale in various regions including Ireland, Germany, and the United Kingdom.

- Shift4's previous acquisition of Global Blue in February marked a significant move with an enterprise value of about $2.5 billion, enhancing the company's unified commerce capabilities worldwide.

- Outgoing Shift4 CEO Jared Isaacman described the Smartpay deal as transformative, enabling the company to excel in unified commerce globally.

- In the realm of point-of-sale payments, providing a smooth payment experience at large events remains a challenge, with increased demand for quick and personalized transactions to satisfy customer preferences.

- Consumers increasingly seek faster, more personalized, and frictionless experiences at each touchpoint, with a preference for self-service options like ordering directly from their seats, as highlighted by PYMNTS Intelligence.

- Tom Lapham, senior vice president of Cheq at Cantaloupe, emphasized the shift towards quicker service and enhanced customer satisfaction by offering self-service options in large venues.

Read Full Article

25 Likes

Massivelyop

290

Blue Protocol Star Resonance ties down July 17 release date in China followed by global launch this year

- Blue Protocol Star Resonance, initially cancelled in Japan, is set for a global launch under Tencent.

- The mobile and PC version is being developed by Shanghai Bokura Network Technology and published by A Plus Japan.

- The game is confirmed to arrive on PC through Steam and EGS sometime this year.

- The MMORPG is scheduled for a release in China on July 17th, as announced in a new trailer posted on BiliBili.

- Japanese voice actors have been confirmed for the title.

- The game's producer, Dai Yi, mentioned challenges in making Star Resonance and promised improvements to the core experience and infrastructure while still aiming for a 2025 global launch.

- The game is described as a full anime MMORPG with a typical tank/healer/DPS group trinity.

Read Full Article

17 Likes

Medium

426

Image Credit: Medium

Investing in Climate: What We Can Learn from Lowercarbon Capital and Breakthrough Energy Ventures

- Lowercarbon Capital and Breakthrough Energy Ventures are prominent investors in the impact/climate space, managing over $5.5 billion collectively.

- LCC invests globally across software and hardtech startups, while BEV, founded by Bill Gates, focuses on technologies to remove >0.5 Gt CO₂/year.

- BEV operates with a long-term industrial investor approach and targets various sectors including energy, manufacturing, and transport.

- The article discusses trends in the energy vertical, emphasizing energy management, renewables, energy storage, and fusion as key areas of focus.

- Renewables, once a major focus, are still crucial but considered more mature, with a shift towards energy storage as the next frontier.

- Fusion, though high-risk, offers vast sustainable power potential with significant investments from LCC and BEV.

- BEV backs moonshot technologies like fusion, focusing on high-CAPEX R&D infrastructure tech, while LCC pursues a hybrid model balancing short and long-term plays.

- The article highlights the importance of blending software-led energy optimisation with high-potential hardtech investments for scalable climate solutions.

- Both LCC and BEV support startups that combine technical ambition with market scalability, aiming to build a sustainable future.

- The article provides insights into how investors like Breega are shaping their climate strategies based on the approaches of LCC and BEV.

Read Full Article

25 Likes

TechCrunch

166

Image Credit: TechCrunch

Japanese shipping firm NYK acquires Kadmos, a salary payment platform for seafarers

- Japanese shipping company NYK Line is acquiring the salary payment platform Kadmos for seafaring workers to expand its fintech services in the maritime sector.

- The financial terms of the acquisition deal between NYK Line and Kadmos were not disclosed, with the completion expected in the coming weeks.

- Kadmos, founded in 2021 by MIT alumni, aims to provide affordable and transparent salary transfer options internationally for ship management companies.

- NYK previously launched MarCoPay in the Philippines, offering financial services to Filipino seafaring workers and obtained an Electronic Money Issuer license.

- NYK plans to integrate Kadmos into MarCoPay to offer payroll solutions to seafaring workers globally, leveraging Kadmos' reach and MarCoPay's advantages.

- Kadmos intends to expand its services to include cross-border payments and corporate cards, targeting the cruise industry and additional financial services for shipping companies.

- Kadmos' team will remain with the company, and slight management structure adjustments are planned.

- Among digital payment platforms for maritime companies like MarTrust and ShipMoney, Kadmos differentiates itself with cashless features and flexible pricing.

- Kadmos recently secured a $29.5 million Series A funding round in 2022, bringing its total raised capital to $38 million, with over 40 enterprise customers.

Read Full Article

9 Likes

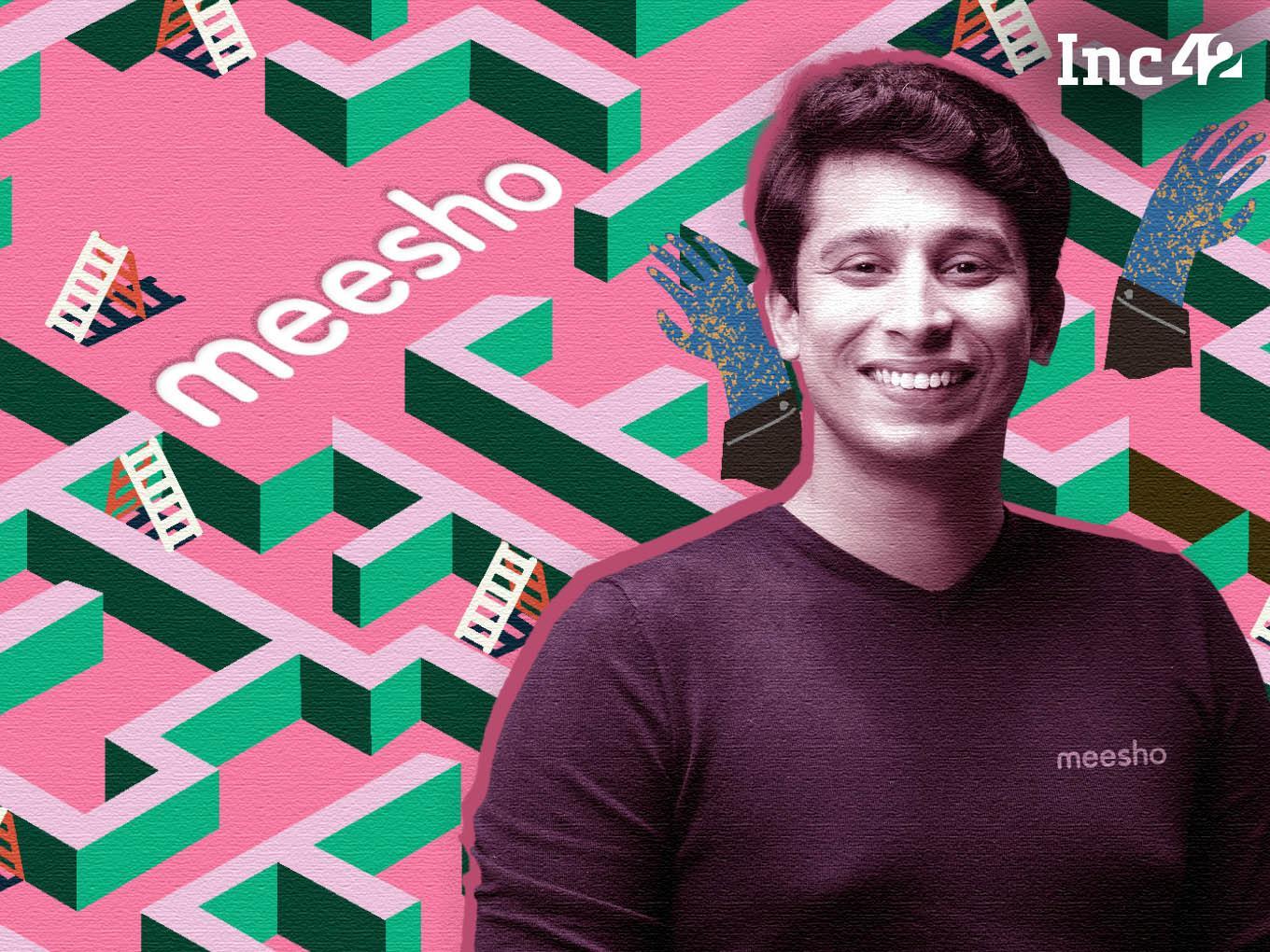

Inc42

185

Image Credit: Inc42

Meesho Completes Reverse Flip To India: Report

- Meesho has completed its process of reversing back to India after receiving approval from NCLT.

- The startup's board passed a resolution to merge its US-based entity Meesho Inc with its India entity.

- 406.99 Cr shares have been transferred to the shareholders of Meesho Inc in a ratio of 60 equity shares to 1 common stock.

- Additionally, shares have been transferred to Meesho founder Vidit Aatrey.

- Meesho's headquarters shift aligns with its business operations predominantly based in India.

- The company is liable to pay around $300 Mn in taxes for shifting its headquarters from the US.

- Meesho is set to file its draft red herring prospectus (DRHP) for an IPO after the domicile shift.

- The startup aims to raise between $700 Mn to $800 Mn from the IPO.

- Citigroup, Kotak Mahindra Capital, and Morgan Stanley will be the investment bankers for Meesho's IPO.

- Meesho has converted into a public company and changed its legal name to 'Meesho Limited'.

- In January, Meesho raised $250 Mn to $270 Mn funding with investors like Tiger Global and Think Investments.

- The IPO filing is expected to happen in a few weeks via the confidential route.

- Meesho is set to file its IPO papers soon. The startup has roped in investment bankers like Citigroup, Kotak Mahindra Capital, and Morgan Stanley.

- Meesho has completed the necessary process to convert into a public company before the IPO.

- The startup raised significant funding in January with new investors joining the cap table.

- Meesho's reverse flip to India has been completed according to ET reports.

Read Full Article

11 Likes

ISN

22

Image Credit: ISN

Zerodha’s Nikhil and Nithin Kamath acquire Rs 250 crore stake in InCred Holdings

- Nithin and Nikhil Kamath, co-founders of Zerodha, have acquired a Rs 250 crore stake in InCred Holdings, the parent company of InCred Financial Services Ltd.

- This investment precedes InCred Finance’s anticipated IPO valuing the company at $1.8 billion to $2.5 billion, aiming to raise Rs 4,000–5,000 crore.

- The Kamath brothers' investment reflects support for India’s evolving credit ecosystem towards formality, digitization, and accessibility.

- Nikhil Kamath highlighted InCred Group's strong team, technology-forward approach, and grasp of market trends as key reasons for the investment.

- Founded in 2016 by Bhupinder Singh, InCred has expanded into a diversified NBFC involved in consumer, SME, and education lending.

- InCred's competitive advantage lies in its proprietary risk analytics, profound data science integration, and fully digital operations.

- InCred Group consists of InCred Finance (NBFC), InCred Capital (wealth and investment banking), and InCred Money (mutual fund distribution and investment advisory).

- InCred Finance has raised over $370 million to date, including a $60 million Series D funding round that elevated it to unicorn status.

- InCred Capital recently secured $50 million for its capital markets and advisory segment from family offices.

Read Full Article

1 Like

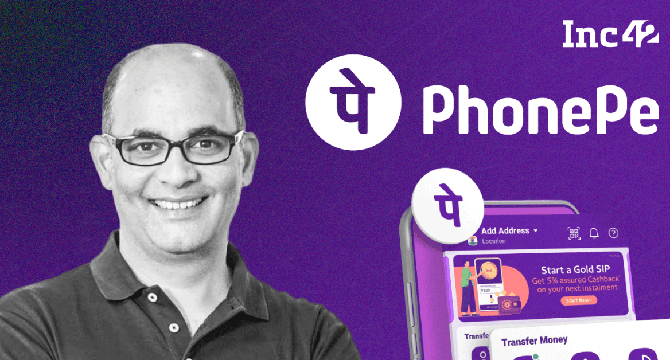

Inc42

25

Image Credit: Inc42

EKA Mobility Bags INR 200 Cr From Enam Holdings

- Pune-based EKA Mobility raises INR 200 Cr from Enam Holdings to expand manufacturing capacity.

- Funding round confirmed by EKA Mobility's founder Sudhir Mehta; Enam Holdings did not respond to queries.

- Report suggests fundraise will elevate EKA Mobility to unicorn status based on internal targets.

- Capital to be used for expanding existing e-bus manufacturing in Pune and setting up new facility in Madhya Pradesh.

- EKA Mobility was founded in 2022 and manufactures e-buses and electric small commercial vehicles.

- Current e-bus manufacturing unit in Pune aims to double capacity to 500 units per month by FY26.

- Initial capacity of 2,000 vehicles per month at SCV and electric truck facility in Chakan.

- Upcoming facility in Madhya Pradesh to have initial capacity of 5,000 e-buses per year.

- EKA claims order book of 3,000 e-buses and 1,000 SCVs.

- Operating revenue for FY24 jumped to INR 53 Cr, but net loss also increased to INR 32 Cr.

- Previous funding round of INR 200 Cr from Mitsui and Co. Ltd. in 2023; included commitments from VDL Groep and Pinnacle Industries.

- EKA to deploy capital for scaling manufacturing, expanding products, and meeting capex needs.

- Government push for EV adoption in commercial mobility; schemes like PM-E Drive support electric buses and trucks.

- India's EV market projected to be a $132 Bn opportunity by 2030.

- EKA Mobility's funding development reported by YourStory and Inc42 Media.

Read Full Article

Like

Inc42

248

Image Credit: Inc42

PhonePe To File Draft Papers For $1.5 Bn IPO By August

- Walmart-owned fintech major PhonePe is set to file draft IPO papers to raise $1.5 billion, valuing the company at $15 billion.

- PhonePe has chosen Kotak Mahindra, Citigroup, and Morgan Stanley to lead the IPO and is expected to file its DRHP in August.

- The IPO marks a 25% increase from its last private valuation of $12 billion attained after a $100 million investment from General Atlantic in 2023.

- PhonePe became a public company in April 2025 and shifted its domicile to India from Singapore in December 2022.

- The startup has raised a total of $2.3 billion from investors like Ribbit Capital, Tiger Global, and Tencent.

- PhonePe's IPO would be the second largest in the Indian fintech sector, following Paytm's $2.4 billion IPO.

- Several other fintech unicorns like Groww, Navi, and Pine Labs are also considering public listings.

- PhonePe's parent company Walmart is also planning an IPO for Flipkart, potentially valued between $60 billion and $70 billion.

- PhonePe remains loss-making but reported turning profitable in FY24, with an operating revenue increase of 74%.

- Despite losses, the company reported a profit of INR 197 crore in FY24, excluding ESOP costs.

- PhonePe's IPO has been in the works for years as it aims to list on the Indian bourses.

- The fintech industry in India is witnessing several companies planning IPOs to raise significant capital.

- The separation of PhonePe and Flipkart by Walmart in 2022 paved the way for their individual IPO plans.

- The public listing of PhonePe would be significant for the Indian startup ecosystem.

- PhonePe is among the leading players in India's fintech sector with significant funding backing its growth.

- Investors are closely following PhonePe's IPO process to gauge market interest in Indian fintech startups.

Read Full Article

10 Likes

Economic Times

105

Image Credit: Economic Times

Swiggy GOV growth came at the cost of profitability: Prosus

- Swiggy managed to grow its business and reduce operational losses in 2024 but faced profitability challenges, according to early investor Prosus.

- The company saw a 29% year-on-year growth in gross order value (GOV) and a decrease in adjusted EBITDA loss.

- Growth was driven by food delivery and quick commerce expansion, leading to heightened competition.

- Swiggy's quick commerce arm, Instamart, expanded by adding 316 dark stores during the March quarter.

- In comparison, Zomato's Blinkit added 294 dark stores during the same period.

- March quarter results showed GOV growth with food delivery up by 18% and quick commerce by 101% year-on-year.

- Food delivery segment improved with an adjusted EBITDA margin over GMV of 2.9% by March 2025.

- Quick commerce, however, saw increased investments with an adjusted EBITDA margin over GMV declining to -18%.

- Swiggy aims for contribution breakeven in the quick commerce segment in the next 3 to 5 quarters.

- Balancing growth and cost management remains a challenge for Swiggy in the competitive quick commerce space.

- Morgan Stanley believes Swiggy can withstand quick commerce competition due to its financial strength.

- Prosus, an early investor in Swiggy, holds a 24.8% stake in the company after reducing its ownership post the listing.

- Swiggy's expansion into the travel and lifestyle concierge app, Crew, showcases its diversified efforts.

- The challenge for Swiggy lies in managing growth while ensuring sustainable cost control amidst competition.

- Swiggy's robust financials in food delivery provide support for continued investments in quick commerce.

- Prosus remains a significant investor in Swiggy, with a strategic stake in the company since 2017.

Read Full Article

6 Likes

Inc42

137

Image Credit: Inc42

Coliving Startup Truliv Gets Strategic Investment From The Times Group

- Chennai-based coliving startup Truliv receives a strategic equity investment from Bennett, Coleman & Co. Ltd (BCCL) at a valuation of INR 356.50 Cr.

- The financial terms of the deal were not disclosed.

- Truliv plans to use the investment to expand into new cities, enhance its tech platform, and enter segments like holiday homes and retirement living.

- The startup aims for an annual revenue of INR 200 Cr in the next three years.

- BCCL, also known as The Times Group, is a Mumbai-based media conglomerate with major brands like The Times of India and The Economic Times.

- Truliv reported a revenue of INR 15.55 Cr and a net loss of INR 3.4 Cr as per the financials for the year ended March 31, 2024.

- The strategic investment from BCCL will help Truliv expand its presence and enhance technology solutions according to cofounder Ranjeeth Rathod.

- Founded in 2019, Truliv offers coliving spaces, raised $2 Mn in seed funding, and plans to expand to cities like Bengaluru, Pune, and Hyderabad.

- Truliv competes with other coliving startups like Stanza Living, Colive, Zolo Stays, and NestAway.

- Investors are interested in coliving startups due to their growth potential driven by changing lifestyle preferences.

- Coliving investments are seen to offer higher returns than traditional real estate with increased occupancy rates and scalable models.

- In a report by Colliers India, the coliving sector is expected to grow 5X from INR 4,000 Cr in 2025 to nearly INR 20,000 Cr in 2030.

- Investors are showing interest in the coliving sector, with companies like Stanza Living also raising significant funds.

- Truliv aims for significant growth with the strategic investment from BCCL.

- The coliving sector in India is attracting attention due to its potential for high returns and rapid expansion.

- The news was reported on Inc42 Media.

Read Full Article

8 Likes

ISN

87

Image Credit: ISN

Shark Tank India-featured Eat Better Co partners with Unicommerce to strengthen its operations

- Shark Tank India-featured Eat Better Co has partnered with Unicommerce to boost its e-commerce operations.

- Eat Better Co secured Rs 17 crore in a pre-Series A funding round in April 2025.

- Founded in 2020, Eat Better Co offers clean-label snacks focusing on health and taste.

- The startup aims to enhance its D2C presence using Unicommerce's solutions for order and warehouse management.

- Uniware platform will facilitate order processing across various channels for Eat Better Co.

- The warehouse management system by Unicommerce will synchronize inventory in real-time.

- Unicommerce's predictive analytics will help Eat Better Co align its offerings with consumer preferences.

- Shaurya Kanoria, Founder of Eat Better Co, expressed excitement about the partnership for streamlined operations.

- Unicommerce aims to assist Eat Better Co in meeting the needs of health-conscious customers efficiently.

- Unicommerce serves numerous brands across regions and helps streamline operations for various clients.

Read Full Article

5 Likes

Alleywatch

233

The Weekly Notable Startup Funding Report: 6/23/25

- Applied Intuition raised $600.0M for software infrastructure for autonomous vehicles.

- Senra Systems secured $25.0M for manufacturing harnesses using software configuration.

- Uncountable obtained $27.0M for providing a unified R&D laboratory informatics platform.

- Profound received $20.0M for analytics and tools enhancing visibility in AI search.

- Sedai raised $20.0M for AI-powered cloud cost optimization and performance tuning.

- Onebrief garnered $23.6M for web-based military planning software.

- Mach Industries secured $100.0M for defense manufacturing and unmanned systems.

- Payabli raised $28.0M for payments infrastructure and monetization platform.

- PublicAI obtained $8.0M for a Web3 distributed AI training network.

- Juniper Square raised $130.0M for software and fund administration services.

Read Full Article

14 Likes

ISN

1k

Image Credit: ISN

Campus Fund launches $100 million fund to invest in student, college dropout-led startups

- Campus Fund, the only SEBI-registered Category II alternative investment fund for student and recent college dropout-led startups, has launched its third fund with a target of $100 million.

- The fund has achieved its first close, securing over 50% of the corpus and has started deploying capital.

- Founded by Richa Bajpai during her MBA, Campus Fund aims to democratize startup capital and nurture entrepreneurial ambition in India.

- The fund focuses on student and recent graduate founders, aiming to invest in 60 to 80 startups over four years.

- Investments range between Rs 1 crore and Rs 8 crore with half the fund reserved for follow-on rounds.

- Campus Fund has an expanding portfolio with investments in startups like Expand My Business and EtherealX.

- The fund receives over 7,000 startup applications annually and is sourced through a network of more than 100 student scouts.

- Notable backers in the fund include 360 One, Fireside Ventures, HDFC Securities, and Google early investor Asha Jadeja Motwani.

- Some startups backed by Campus Fund have raised capital from prominent global investors like Accel and a16z.

- The fund aims to seize the generational opportunity as higher education decentralizes and startup infrastructure expands to Tier 2 and Tier 3 cities.

- Campus Fund believes in the potential of student founders and views backing them as a strategic investment for the future.

- The fund's investments include sectors like B2B digital services, space situational awareness, reusable rockets, flying taxis, and online dispute resolution.

- Campus Fund has begun returning capital to investors from its earlier funds.

- Founder Richa Bajpai sees supporting student startups as a significant milestone in her career, having launched her startup from a college dorm in 2009.

- The fund has made early-stage investments in startups like Serendipity Space, which focuses on pharmaceutical processing in microgravity.

Read Full Article

12 Likes

Eu-Startups

189

German startup Steuerboard raises €725k to eliminate email “ping-pong” in tax advisory firms

- German startup Steuerboard raises €725k in a pre-Seed financing round led by High-Tech Gründerfonds (HTGF) to accelerate product development and market expansion.

- Steuerboard, a Düsseldorf-based B2B SaaS platform, founded in 2023 by Matyas Heins and Jakob Brandt, focuses on innovating tax workflows by eliminating email ping-pong.

- The platform integrates AI technology to address the specialist-staff shortage in tax advisory firms, aiming to improve efficiency and transparency.

- The global tax software market was valued at €16.1 billion in 2023 and is expected to grow at a 10% CAGR through 2030.

- Germany, accounting for about 30% of the European total, represents a significant opportunity for solutions like Steuerboard in the tax management software segment.

- Steuerboard has onboarded nearly 100 tax offices and supports thousands of businesses monthly, indicating strong demand for AI-driven collaboration in Germany's tax industry.

- With the new funding, Steuerboard plans to expand its teams, enhance AI workflows, and increase its sales presence in the DACH region over the next 24 months.

Read Full Article

11 Likes

Economic Times

972

Image Credit: Economic Times

Incuspaze acquires Pune's Trios to expand co-working biz

- Managed office space provider Incuspaze acquires Pune-based co-working firm Trios in a cash and stock deal.

- The deal value was not disclosed by the company.

- Incuspaze, established in 2016, operates in over 50 locations across 18 cities covering 40 lakh square feet.

- Trios, founded in 2017, manages 12 co-working centres in Pune and Gurugram.

- Incuspaze aimed at addressing the rising demand for flexible workspaces in Pune through the acquisition.

- Sanjay Choudhary, Incuspaze's CEO, foresaw a 10-15% increase in revenue after the acquisition, targeting Rs 350-400 crore by 2025-26.

- The acquisition is viewed as a strategic and cultural fit by Incuspaze, enhancing its regional presence and operational efficiency.

- The founders of Trios will have extended roles in Incuspaze post-acquisition to aid in the integration process.

- Customers from both firms can expect a seamless transition with improved services and pricing model remaining unchanged.

- Sanjay Chatrath, Incuspaze's cofounder, emphasized the move towards creating a nationwide network of top-notch flexible workspaces.

- FlexLeaze, a new initiative by Incuspaze, offers comprehensive office leasing solutions to businesses, led by co-founder and CEO Rahul Sarin.

- Incuspaze ventures into fit-out lease services through FlexLeaze within its managed office space segment.

Read Full Article

Like

For uninterrupted reading, download the app