Startup News

Inc42

35

Image Credit: Inc42

EV Ride Hailing Startup Evera Bags $4 Mn From Mufin Green Finance

- EV ride hailing startup Evera Cabs secures $4 Mn from Mufin Green Finance through convertible debentures and debt.

- The investment aims to enhance customer experience with a focus on clean tech and seamless commuting.

- Evera Cabs recently acquired BluSmart's fleet and driver network, expanding its B2B and B2C services.

- Founded in 2019, Evera Cabs offers EV ride hailing services with no cancellation and surge charges.

- The startup currently operates with a fleet of 450 EV cabs, aiming to expand to 1,000 BluSmart EVs.

- Previous funding rounds included a $7 Mn pre-Series A funding led by international investors.

- The EV ride-hailing sector faced challenges with the downfall of BluSmart, affecting drivers and employees.

- Issues arose with Gensol Engineering promoters using company funds for personal investments.

- Evera Cabs caters to corporate clients such as EY and Orix while competing with Ola and Uber in the EV ride-hailing market.

- The Indian EV market is expected to reach nearly $114 Bn by 2029, providing growth opportunities for companies like Evera.

- The article is sourced from Inc42 Media.

Read Full Article

2 Likes

Eu-Startups

228

Danish BioTech startup Cellugy secures €8.1 million to eradicate microplastics in personal care products

- Danish biotech startup, Cellugy, has secured €8.1 million funding support to scale up production of its biofabricated cellulose-based material, EcoFLEXY, aimed at replacing harmful microplastics in personal care products.

- EcoFLEXY is designed to replace fossil-based carbomers, reducing environmental pollution and hazardous chemical use in cosmetics, while providing superior performance in beauty products.

- Microplastics from personal care items pose environmental and potential health risks, prompting the need for sustainable alternatives in the beauty industry.

- EcoFLEXY aims to prevent release of 259 tons of microplastics annually, scaling up to 1,289 tons per year by 2034, aligning with sustainability goals.

- The project responds to impending EU microplastics ban and US limitations on PFAS, addressing the industry's need for high-quality, sustainable alternatives.

- Cellugy CEO stresses the importance of delivering bio-based solutions that surpass petrochemicals in performance, scalability, and efficiency to drive industry change.

- EcoFLEXY promises superior performance, functionality, and user experience compared to traditional biobased ingredients, catering to cosmetics manufacturers' quality and sustainability demands.

- The BIOCARE4LIFE project involving specialist experts will facilitate EcoFLEXY's scale-up process through process optimization, including data management and sustainability validation.

- The €8.1 million investment will support critical scaling activities, process optimization, and commercial validation over the next four years.

- Cellugy aims to eliminate petrochemical use in the industry with revenue generation and environmental impact expected in the next three to five years, thanks to the funded scaling activities.

Read Full Article

13 Likes

Eu-Startups

8

Berlin-based Enter secures €20 million for energy efficiency in the real estate sector

- Berlin-based Enter raises over €20 million in Series B funding for energy efficiency in real estate.

- Returning investors include Coatue, Target Global, noa, Partech, and Foundamental, with SE Ventures joining for the first time.

- Enter founded in 2020, offers services for energy-efficient renovations for single-family and multi-family homes.

- Enter's platform simplifies energy-efficient renovations through innovative technological solutions.

- Their 'Address Intelligence Tool' and network of contractors streamlines the renovation process.

- Enter's AI-driven system cuts manual effort, reduces staff needs, and triples customer capacity.

- Strategic partnerships with Dr. Klein, Allianz, and Engel & Völkers help Enter reach over 6 million households annually.

- Enter's marketplace offers partners like Thermondo, Aira, TMP Fenster, and Otovo, providing tailored offers to customers.

- Enter Pro platform enables financial brokers to expand services around energy efficiency.

- Series B funding will accelerate Enter's growth strategy in the B2B segment, offering E2E service for energy portfolio optimisation.

Read Full Article

Like

AllTopStartups

100

Image Credit: AllTopStartups

Understanding Rewards Credit Cards

- Rewards credit cards allow users to earn cash back, points, or miles with each purchase, making them more rewarding than cash or debit cards.

- Understanding the complex rules of rewards programs, including redemption conditions, expiration dates, and varying rates, is crucial for maximizing benefits.

- Different types of rewards include cash back, points, and miles, each with unique features and redemption options.

- Managing multiple rewards cards can be challenging due to varying earning rates, redemption rules, and expiration dates, requiring careful organization.

- Tips for maximizing rewards include using cards for specific purchases, meeting minimum spend requirements for bonuses, and redeeming points wisely.

- Beware of fees and interest associated with rewards cards, as annual fees and interest charges can offset the value of rewards earned.

- Rewards credit cards should be seen as a financial tool rather than a reason to overspend, requiring responsible use and strategic management.

Read Full Article

6 Likes

AllTopStartups

26

Image Credit: AllTopStartups

Revitalize Your Living Space: The Benefits of Professional Couch Cleaning

- Professional couch cleaning is essential for maintaining the comfort and aesthetics of your living space.

- Regular vacuuming may not be enough to remove deep-set dirt and allergens from your upholstery.

- Professional cleaners have the expertise and tools to thoroughly clean and sanitize your couch without causing damage.

- Upholstered furniture can harbor bacteria and allergens, impacting the health of your family.

- Professional cleaning services can deodorize, sanitize, and protect your couch from future stains.

- Hiring professionals saves you time and effort, allowing you to enjoy other activities.

- Deep cleaning your couch enhances the room's aesthetics, making it a beautiful centerpiece.

- Professional cleaning can rejuvenate the material and extend the life of your furniture.

- Regular professional cleaning protects your investment, preventing premature aging and the need for replacements.

- Fabric protectants can be applied to repel spills and stains, reducing the frequency of deep cleanings.

- Professional couch cleaning services offer manifold advantages, improving the look, comfort, and longevity of your furniture.

- Choosing a reputable service provider is crucial for maintaining a fresh and inviting living space.

Read Full Article

1 Like

Eu-Startups

2.4k

French startup raises €25 million to become Europeʼs one-stop shop for SMB insurance

- Orus, a Paris-based digital insurer specializing in tailored insurance for independents and SMBs, raised €25 million in a Series B funding round to fuel international expansion, starting with Spain.

- The funding round was led by Singular, with participation from existing investors Notion Capital and Redstone.

- Orus aims to modernize the SMB insurance distribution model by offering transparent and tailored insurance solutions using technology.

- Founded in 2021, Orus provides online insurance products for small businesses and has a 70-person team with over 2,500 new clients per month.

- The company has raised a total of €41 million across funding rounds, focusing on simplifying business insurance for Europe's 25 million small businesses.

- Orus has experienced significant growth, with revenue increasing by tenfold since its Series A funding and protecting over 30,000 businesses in Europe.

- The platform uses algorithms and data points to assess risk and offer personalized coverage, including industry-specific options.

- Orus aims to offer a quick onboarding process and efficient claims management, distinguishing itself from traditional insurers.

- Spain is the first step in Orus' pan-European growth plan, with plans to enter more European markets in the future.

- Orus is introducing a new broker platform to allow intermediaries to quote, customize, and manage its digital-first insurance products.

- The platform combines technology and brokers' expertise to provide clients with a seamless digital experience.

- Investor Henri Tilloy praised Orus for redefining commercial insurance and recognized the company's rapid growth and potential to reshape the industry.

- Orus differentiates itself by offering comprehensive, intuitive solutions for various SMEs and accelerating the insurance process.

- The funding will support Orus in its mission to simplify SMB insurance across Europe and enhance its digital platform's capabilities.

- Orus leverages technology to make insurance processes simpler and more efficient for small businesses, addressing gaps in the traditional insurance sector.

- The company is focused on providing faster, customer-centric insurance solutions tailored to specific needs, setting itself apart from legacy insurance providers.

- Orus's strategic funding and growth plans position it as a leading digital insurer aiming to revolutionize the SMB insurance landscape in Europe.

Read Full Article

15 Likes

Economic Times

225

Image Credit: Economic Times

Ecommerce enabler GoKwik raises $13 million from RTP Global, others

- GoKwik, an Ecommerce enabler, has raised $13 million in a growth round led by RTP Global, with participation from Z47, Peak XV Partners, and Think Investments.

- The funding round brings the total funding raised by GoKwik to $68 million, which will be used for international expansion and R&D for its AI-first commerce stack.

- GoKwik aims to build a unified growth operating system for global brands as Ecommerce evolves towards intelligent, interoperable products.

- The company works with over 10,000 brands, serving more than 130 million shoppers, including names like Mamaearth, Lenskart, and Shoppers Stop in various shopping categories.

- RTP Global praises GoKwik's data-led approach and market anticipation, expressing support for the company's global scaling and data-driven commerce efforts.

- GoKwik offers four products, with its suite facilitating over $2 billion in gross merchandise value for brands by addressing various Ecommerce challenges.

- KwikEngage, GoKwik's WhatsApp commerce solution, helps over 100 UK merchants drive conversational commerce and enhance customer relationships.

- By focusing on shopper touchpoints from discovery to returns, GoKwik aims to deliver lasting value and sustainable growth for merchants of all sizes.

Read Full Article

13 Likes

SiliconCanals

105

Image Credit: SiliconCanals

Axiles Bionics closes first €6M of its €8M Series A round to globalise its biomimetic prosthetic foot

- Axiles Bionics, a Brussels-based deeptech and medtech spin-off, has closed the first €6M tranche of its €8M Series A financing round.

- The funding, led by PE Group and supported by EIC Fund, Finance&Invest.brussels, private investors, entrepreneurs, and the company's management team, will aid in globalizing their biomimetic prosthetic foot Lunaris.

- Lunaris offers mechanical adaptability and embedded systems, currently used in clinical settings worldwide.

- Axiles Bionics is focused on developing bionic devices at the intersection of robotics, artificial intelligence, and biomechanics to enhance mobility through prosthetics.

- Their first product, Lunaris, is FDA and CE certified, mimicking natural walking patterns for lower limb amputees, with plans for future bionic technologies.

- PE Group CEO Stefan Yee praises Axiles Bionics for setting new standards in robotic prosthetics, poised to transform amputees' quality of life globally.

- European Innovation Council (EIC) Fund supports Axiles Bionics, acknowledging their commercial success and clinical advancements.

- Axiles Bionics aims to introduce advanced bionics as a standard, improving mobility and well-being, with a vision to reshape the global prosthetic technology standard.

- Investors like PE Group, EIC Fund, and Finance&Invest.brussels are providing financial and strategic support to Axiles Bionics for their innovative advancements in prosthetics.

Read Full Article

6 Likes

Inc42

248

Image Credit: Inc42

Google Brings ‘AI Mode’ Search Experience To India

- Google has launched its AI Mode in India to enhance the search experience.

- Users can now ask longer questions and perform voice-based and photo-based searches.

- The AI Mode feature was piloted in the US and later at Google I/O 2025.

- It has received positive feedback for speed, quality, and responses.

- The feature is an experiment in India labs in English to gather user feedback and improve.

- Google's AI Mode is built on Gemini 2.5.

- Google is focusing on expanding its AI presence in India with various initiatives.

- The company's policy head mentioned favorable conditions for India's growth in AI.

- Google integrated RCS with Google Search for AI-powered customer services in India.

- Google supports Indian AI startups through partnerships and programmes.

- It provides AI startups with cloud credits and accelerator programmes.

- Google selected 20 Indian startups for its 'Google for Startups Accelerator: AI First' programme.

Read Full Article

14 Likes

Insider

35

Image Credit: Insider

The cofounder of the viral AI 'cheating' startup Cluely says he only hires people for 2 jobs

- Cluely, an AI startup, only has two job titles: engineer or influencer.

- CEO and cofounder Chungin "Roy" Lee believes influencers drive growth at Cluely.

- The startup recently received $15 million in funding led by Andreessen Horowitz.

- Cluely began as a tool to help with cheating on job interviews but has since refocused.

- The company aims to become viral on platforms like Instagram and TikTok.

- Lee emphasizes the importance of being tapped into young culture for success.

- The Cluely team lives and works together, promoting a no work-life balance culture.

- Lee believes that being fully dedicated to the company without work-life balance is key.

- The rejection of work-life balance is common in startup culture.

- Linkedin cofounder Reid Hoffman and entrepreneur Mark Cuban also support this idea.

Read Full Article

2 Likes

Medium

379

Image Credit: Medium

Why VCs are dumb and how to use us

- VCs might not know more about a sector or business than founders or their teams.

- Building a strong relationship with VCs is vital for founders to get the most value out of them.

- Select VCs that are right for you and your company to ensure advocacy and support.

- Communicate effectively and be responsive to engender a positive relationship with VCs.

- Use VCs as a sounding board for business decisions and emotional support related to your company.

- Board meetings should focus on open debates rather than mundane updates.

- External investors like VCs can instill discipline and help with corporate governance.

- Make use of VCs' networks and expertise to benefit your company.

- Though VCs may not offer groundbreaking insights, they can still provide valuable support and networking opportunities.

- Founders are encouraged to leverage VCs' superpowers and build strong relationships with them.

Read Full Article

21 Likes

Inc42

333

Image Credit: Inc42

Finance Ministry Holds Meet On Scaling Up Unified Lending Interface

- The finance ministry's DFS and RBI officials convened a meeting with various stakeholders to discuss scaling up the Unified Lending Interface (ULI), a new digital platform for credit delivery in India.

- ULI aims to revolutionize how credit is accessed and delivered in the country, currently in the testing phase awaiting nationwide launch.

- Participants included top officials from central and state governments, and RBI's Reserve Bank Innovation Hub.

- Key outcomes included plans to integrate government datasets, nominate nodal officers for fast-tracking integration, digitize land records, and align existing lending initiatives with ULI.

- RBI emphasized innovation in the lending space and the integration of technology, data, and policy in the ULI platform.

- ULI is seen as a transformative digital public infrastructure for inclusive credit delivery, leveraging government datasets for faster and more inclusive lending.

- RBI piloted ULI in August 2023, aiming to streamline credit delivery for various loan products using integrated data sources like Aadhaar e-KYC and PAN validation.

- Last year, RBI announced plans to launch a credit platform for rural and small businesses.

- The meeting aimed to accelerate ULI's scaling and integration with government datasets for efficient credit delivery.

- Participants included officials from central and state governments, RBI, and 11 state governments.

- ULI envisages transforming credit delivery in India similar to how UPI revolutionized payments.

- The platform aims to make credit more inclusive and efficient by leveraging trusted datasets for data-driven lending.

- ULI integrates technology, data, and policy to create a seamless credit delivery platform.

- The meeting emphasized the need for collaboration to integrate high-value government datasets with ULI for faster and inclusive lending.

- The finance ministry's meeting focused on strategies for scaling ULI and aligning existing lending initiatives to create a unified credit delivery ecosystem.

Read Full Article

20 Likes

Inc42

289

Image Credit: Inc42

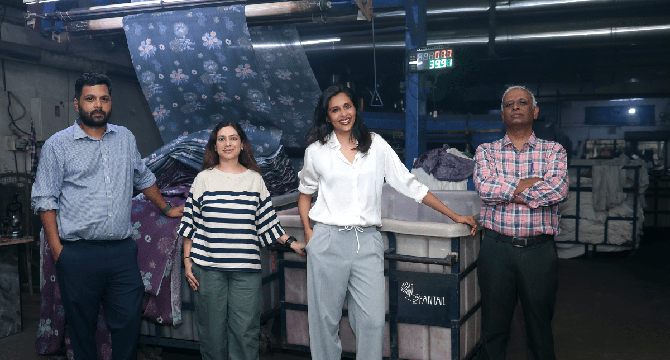

Textile Manufacturing Startup Fantail Nets Funding From Riverwalk, Others

- Fantail, a textile manufacturing startup, secures INR 13.75 Cr ($1.6 Mn) in seed funding from Riverwalk Holdings, Incubate Fund Asia, and All in Capital.

- The Surat-based startup intends to use the funding to upgrade machinery at partner weavers, mills, and processors, streamline operations, and hire across design, quality, and technology domains.

- Founded in 2023 by Ramya Iyer, Fantail operates in the B2B textile manufacturing space, specializing in man-made fabrics like nylon, viscose, and polyester.

- Fantail works with weavers, mills, and processors in Surat, serving retail fashion brands such as Vishal Megamart, Westside, Shopper Stop, and Lifestyle.

- The startup's manufacturing units are in GIDC Sachin, Udhna, Kim & Palsana in Surat, with a design facility in Gurugram, Delhi NCR.

- Operating in India's MMF sector, Fantial brings structure, technology, and scalability to small enterprise weavers and processors.

- In the competitive B2B fashion manufacturing sector, Fantail faces competition from companies like ZYOD, Fashinza, Groyyo, and others.

- Fantail's funding round comes amidst similar moves by other fashion manufacturing startups like Groyyo and ZYOD to enhance their operations and funding.

- Groyyo aims to raise $40 Mn and expand globally, while ZYOD concluded a $18 Mn Series A round to invest in technology and global expansion.

- Fantail's funding signals growth in India's apparel and textile industry, projected to reach $387.3 Bn by 2028.

Read Full Article

17 Likes

Inc42

342

Image Credit: Inc42

GoKwik Bags $13 Mn To Boost Its AI-led Commerce Stack

- GoKwik has secured $13 Mn in a growth round led by RTP Global and others to enhance its AI-led commerce stack.

- The funding will support global expansion and research and development.

- Founded in 2020, GoKwik offers checkout tools for ecommerce brands to improve conversion rates.

- The startup aims to build an integrated suite of solutions for ecommerce brands.

- GoKwik had previously raised $35 Mn in a Series B round.

- The company has processed over $2 Bn in GMV and has shown 100% YoY growth.

- GoKwik's WhatsApp commerce solution is used by nearly 100 merchants in the UK.

- It has made acquisitions including Return Prime and Tellephant to expand its offerings and reach.

- In FY24, GoKwik reported revenue of INR 94.7 Cr with a net loss of INR 72 Cr.

- Competitors of GoKwik in the ecommerce enabler space include GlobalBees, Delhivery, Shiprocket, and Shadowfax.

- The Indian e-commerce market is projected to reach $325 Bn by 2030.

- Ecommerce enablers like GoKwik play a crucial role in providing end-to-end solutions for businesses in the online space.

- Delhivery has introduced Delhivery Direct, a new on-demand transportation and delivery service.

- Shadowfax is gearing up for an IPO and plans to launch its public offering this year.

Read Full Article

20 Likes

Gritdaily

359

Image Credit: Gritdaily

Winning Big: The Benefits of Investing in a ClawCADE Franchise

- The ClawCADE franchise offers a unique blend of arcade games and modern entertainment, making it a lucrative investment opportunity.

- The business model focuses on interactive entertainment for all age groups, keeping operational complexity low while maximizing customer engagement.

- Franchisees benefit from established operating procedures, a proven business model, and a supportive franchise community.

- Brand recognition and customer loyalty are key strengths of ClawCADE, thanks to its experienced leaders and memorable experiences.

- Financially, ClawCADE franchises offer a compelling cost-to-profit ratio with various revenue streams like game profits and merchandise sales.

- Strategic location selection in high-traffic areas enhances profitability and customer reach for franchisees.

- ClawCADE provides comprehensive training, ongoing support, and assistance in marketing and business development for franchisees.

- The franchise offers diversified income opportunities and a strong brand, making it an appealing option for entrepreneurs in the entertainment industry.

Read Full Article

21 Likes

For uninterrupted reading, download the app