Startup News

Startup Pedia

195

Image Credit: Startup Pedia

Influencer mimics Nikhil Kamath’s way of interviewing guests on WTF podcast, Zerodha boss reacts

- Influencer Rohit Raghuvendra mimicked Zerodha co-founder Nikhil Kamath's interviewing style on the WTF Podcast in a humorous video.

- Raghuvendra captured Kamath's calm persona and questioning style in his skit, asking philosophical questions similar to those on the podcast.

- The video went viral, with netizens and BharatPe founder Ashneer Grover praising Raghuvendra's portrayal, and Kamath himself reacting positively with emojis.

- The WTF Podcast, hosted by Nikhil Kamath, has garnered over 1.5 million subscribers on YouTube and features notable guests from various fields.

Read Full Article

11 Likes

ISN

1.4k

Image Credit: ISN

'Rs 5,215 crore in losses, no profitable year, so why do we celebrate Kunal Shah?': Deloitte consultant

- Deloitte Senior Consultant Adarsh Samalopanan questioned the celebration of Kunal Shah's entrepreneurial journey due to continuous losses and lack of profitability over his 15-year career.

- Kunal Shah co-founded Freecharge in 2010, which incurred significant losses despite being acquired by Snapdeal for Rs 2,800 crore and later purchased by Axis Bank for Rs 370 crore, a fraction of its earlier valuation.

- Shah's current venture, CRED, has amassed Rs 5,215 crore in losses with Rs 493 crore cumulative revenue over seven years, spurring debates on the celebration of unprofitable ventures and inflated valuations.

- Reactions to Adarsh's post varied, with some defending Shah's market-changing impact in digital payments and premium credit experiences, while others questioned the valuation metrics and profitability of such ventures.

Read Full Article

14 Likes

Medium

277

Image Credit: Medium

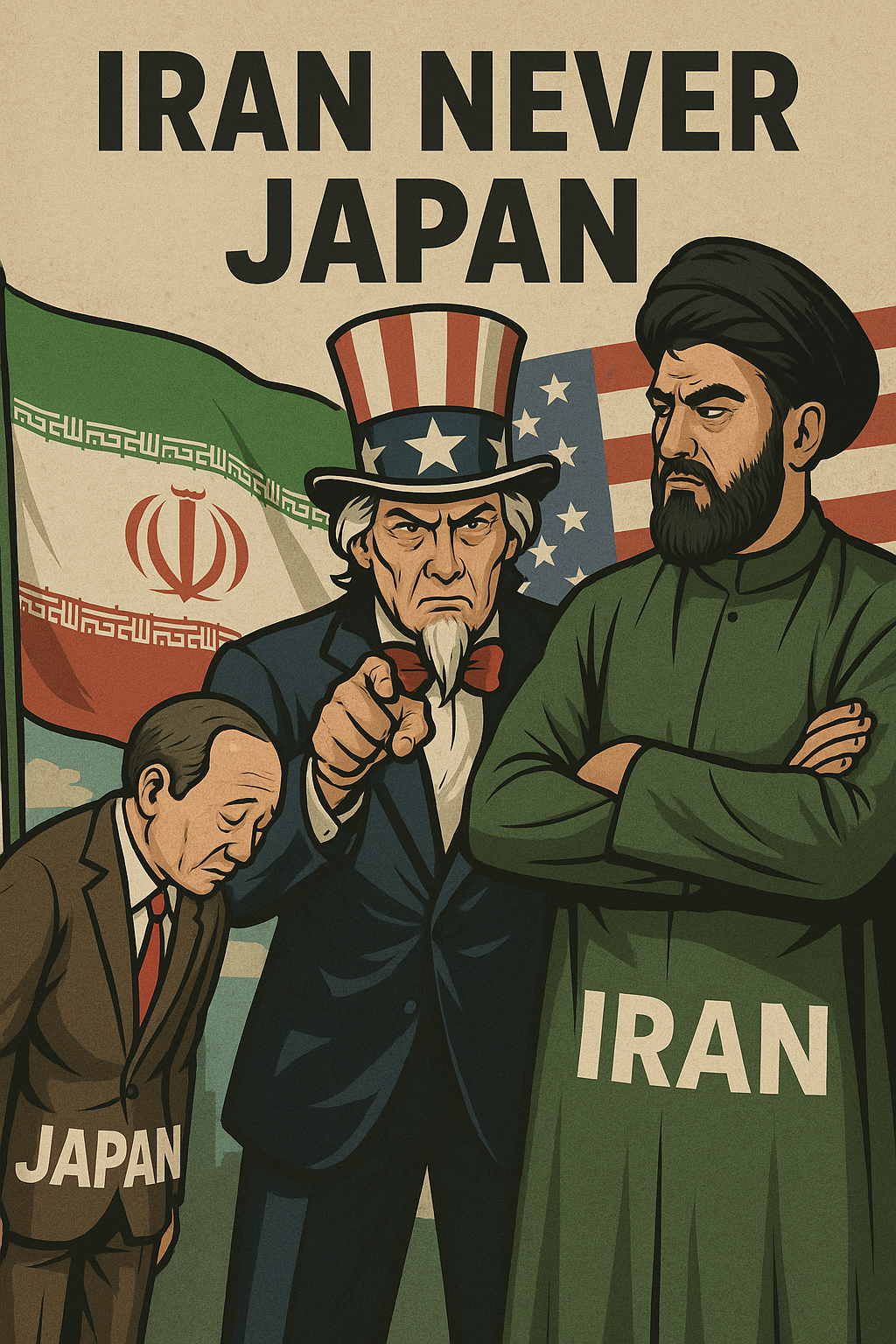

Official Statement by Seyed Mohsen Hosseini Khorasani

- Iran issues a statement declaring its stance amidst various threats and challenges it faces.

- Iran emphasizes that it is not comparable to Japan and will not submit to external pressures.

- Iran asserts its right to self-defense against any illegal strikes on its nuclear infrastructure.

- Iran advocates for conditional de-escalation based on maintaining dignity and sovereignty.

Read Full Article

16 Likes

Medium

36

Building with AI Feels Like Magic — Until You Hit Reality

- Building with AI requires skills and training, not just plug-and-play solutions.

- Working with AI involves orchestrating various components and designing systems rather than just writing code.

- Successful AI applications focus on context, adaptability, and scalability rather than quick fixes.

- Despite challenges like token limits, AI builders are encouraged to persevere for the ultimate magic of creating something transformative.

Read Full Article

2 Likes

ISN

83

Image Credit: ISN

'Employees don't leave companies, they leave managers', says Ghazal Alagh

- Mamaearth co-founder Ghazal Alagh highlighted on LinkedIn that employees leave managers, not companies.

- Alagh stated that the daily interactions with managers influence whether employees remain or depart, rather than company policies.

- She listed eight types of managers high performers struggle to work with, such as micromanagers, credit takers, and the never-satisfied.

- Alagh emphasized that building trust and respect through consistent leadership is key for real retention, beyond perks or policy changes.

Read Full Article

4 Likes

Inc42

245

Image Credit: Inc42

IPO-Bound Lenskart’s Peyush Bansal To Acquire 2% Stake From Investors

- Lenskart's CEO Peyush Bansal is looking to acquire 1.5% to 2% stake from existing investors at around $150 Mn.

- The stake is expected to be bought at a valuation of $7 Bn to $8 Bn.

- Negotiations are ongoing, and the transaction is likely to close in four to six weeks before filing draft IPO papers.

- Lenskart, founded in 2010, is an omnichannel eyewear retailer aiming for a public listing amid the IPO boom of tech companies, with recent financial growth and strategic investments.

Read Full Article

14 Likes

Inc42

298

Image Credit: Inc42

From Jumbotail To InCred Finance — Indian Startups Raised $315 Mn This Week

- Indian startups raised a total of $314.6 million this week, with Jumbotail becoming India's 124th unicorn.

- Ecommerce emerged as the most favored sector, attracting $155.6 million in investments, led by Jumbotail's $120 million funding round.

- Funding activities were diverse, with notable investments in sectors like fintech, agritech, health tech, and advanced hardware & technology.

- The week also witnessed startup IPO updates, with Curefoods filing for an IPO, Meesho and Shadowfax opting for confidential pre-filing, and Kissht and NoPaperforms transitioning into public entities.

Read Full Article

17 Likes

Startup Pedia

380

Image Credit: Startup Pedia

‘Building electronics capabilities in a sustained way’: Ashwini Vaishnaw says India to hit 38% value add compared to China in 5 years

- India is working towards enhancing its electronics manufacturing capabilities to reduce reliance on China.

- The country aims to achieve a value addition of 38% within the next five years, comparable to China's levels.

- Efforts are focused on developing local skills and supply chains to 'de-risk' and strengthen the electronics ecosystem.

- Initiatives like the India Semiconductor Mission and components incentive program are supporting the growth of India's electronics sector.

Read Full Article

22 Likes

Siliconangle

42

Image Credit: Siliconangle

Customer support automation startup Wonderful raises $34M

- Wonderful Ltd., a customer support automation startup, has raised $34 million in funding from a seed round led by Index Ventures and involving Bessemer Venture Partners and Vine Ventures.

- The company focuses on providing AI-powered customer support solutions for non-English markets, allowing enterprises to create custom AI agents for handling support requests through various channels like call centers, chatbots, and email.

- Wonderful's platform utilizes large language models to process customer inquiries, with plans to incorporate language-specific data points and support for more languages in the future.

- The company intends to use the funding to enhance its platform, add support for additional languages, and differentiate itself from competitors like CrescendoAI Inc. and Palona AI Inc.

Read Full Article

2 Likes

TechCrunch

100

Image Credit: TechCrunch

Ready-made stem cell therapies for pets could be coming

- San Diego startup Gallant has secured $18 million in funding to develop the first FDA-approved ready-to-use stem cell therapy for veterinary medicine.

- The therapy aims to address conditions in pets like Feline Chronic Gingivostomatitis (FCGS) and arthritis, with promising early results showing improvements in pain and mobility.

- Gallant's approach differentiates itself by utilizing ready-to-use cells from donor animals, potentially simplifying the treatment process compared to traditional stem cell therapies.

- Investors, including Digitalis Ventures and NovaQuest Capital Management, are optimistic about Gallant's potential, recognizing its novel approach and convenience.

Read Full Article

5 Likes

Medium

258

The Intricacies of VC Deals-1

- VC deals involve complex economic provisions outlined in a term sheet to simplify venture transactions for entrepreneurs.

- Ownership stake and dilution are key considerations for founders and employees when VCs invest, often mitigated by setting aside reserves for future financing rounds.

- Convertible debt and SAFE notes are common in early-stage financings, bridging financial gaps and critical for entrepreneurs to include in post-money valuation calculations.

- Critical terms like liquidation preference, anti-dilution protection, pay-to-play provisions, and pro rata rights are crucial elements of VC deals that require careful negotiation and understanding.

Read Full Article

15 Likes

Pymnts

352

Image Credit: Pymnts

BBVA to Continue Takeover Bid for Sabadell Despite Sale of TSB

- BBVA is moving forward with its efforts to acquire Banco Sabadell, despite Sabadell's decision to sell its U.K. unit, TSB.

- BBVA may make a tender offer to Sabadell's shareholders in the coming weeks, unaffected by Sabadell's sale of TSB.

- Analysts see Sabadell's sale of TSB as a strategy to boost investor dividends and defend against BBVA's takeover bid.

- BBVA has been pursuing a takeover of Sabadell for over a year, as both banks navigate the potential acquisition.

Read Full Article

21 Likes

Startup Story

172

Image Credit: Startup Story

Luma Fertility Raises $4 Mn Seed Funding Led by Peak XV’s Surge To Redefine IVF and Fertility Care in India

- Mumbai-based fertility startup Luma Fertility raises $4 million in seed funding led by Peak XV Partners’ Surge, with participation from Ameera Shah and Vijay Taparia.

- Founded by Neha K Motwani, Luma Fertility aims to revolutionize India's fertility ecosystem, focusing on patient-centric care.

- The startup offers a range of fertility services in Mumbai, including IVF procedures, fertility assessments, and complementary therapies.

- With plans for expansion, Luma Fertility aims to provide tech-enabled and emotionally supportive fertility solutions to meet the growing demand in India.

Read Full Article

10 Likes

Startup Story

803

Image Credit: Startup Story

GobbleCube Raises $3.5 Mn in Pre-Series A Round to Power Hyperlocal Brand Growth with AI

- Bengaluru-based AI startup GobbleCube raises $3.5 million in a Pre-Series A funding round led by InfoEdge Ventures and participated in by Kae Capital to scale its hyperlocal brand growth platform.

- GobbleCube, founded by former leaders at Blinkit, offers an AI-powered platform that helps brands identify revenue gaps and growth opportunities in hyperlocal markets, reporting 2-3x sales increases for clients.

- The funding will be used to enhance the platform's AI capabilities, expand geographic and platform coverage, and accelerate global go-to-market efforts, as brands navigate the complexities of hyperlocal and platform-specific competition.

- As retail evolves toward hyper-personalization, GobbleCube aims to empower consumer brands with actionable insights and predictive analytics to succeed in digital marketplaces.

Read Full Article

8 Likes

Hackernoon

344

Image Credit: Hackernoon

10 Things to Do After Your First Win—So It’s Not Your Last

- Getting traction may lead to overconfidence, killing momentum faster than expected.

- After initial success, key actions include not losing the scrappy mindset and avoiding entitled decisions.

- Suggested steps after traction involve self-reflection, challenging ideas, and staying humble and wary.

- It is emphasized to maintain a sense of urgency and avoid complacency after initial wins.

Read Full Article

20 Likes

For uninterrupted reading, download the app