Startup News

Hitconsultant

40

Image Credit: Hitconsultant

SuperDial Raises $15M to Automate Healthcare’s Endless Admin Phone Calls with AI

- SuperDial, a voice AI company, secures $15M in funding led by SignalFire to automate healthcare's admin phone calls.

- The funding will be used to scale its voice AI platform, targeting high-friction insurance calls costing billions annually in provider organizations.

- SuperDial's AI agents handle outbound phone calls, navigating phone trees, and automating documentation for claims status updates.

- Customers report up to 3x cost savings per call and 4x productivity gains for billing teams using SuperDial's platform.

- SuperDial has scaled to seven figures in revenue and acquired MajorBoost, specializing in insurer workflows, to enhance technical expertise.

- Investor support includes SignalFire's new $1 billion fund focusing on applied AI, showcasing strong market traction.

- SuperDial plans to deepen EHR integrations and expand into new administrative workflows, aiming to facilitate seamless communication in healthcare.

- Their vision is to enable AI-powered coordination among payers, providers, pharmacies, and labs in healthcare.

- Sam Schwager, Co-Founder and CEO of SuperDial, highlights the company's success in addressing urgent healthcare admin problems with AI.

Read Full Article

2 Likes

Startup Story

118

Image Credit: Startup Story

EKA Mobility Raises ₹200 Cr from ENAM Holdings; Eyes Unicorn Status & Expands Manufacturing Footprint

- EKA Mobility secures ₹200 crore in funding from ENAM Holdings, aiming for unicorn status.

- The fresh capital is raised via convertible preference shares to support the company's growth.

- The funds will be used for expanding manufacturing capabilities across three production facilities.

- EKA plans to launch various electric vehicles including buses and goods carriers.

- The company has an order book of over 3,000 buses with plans to deliver 2,000–2,500 electric buses in FY26.

- EKA aims to scale production to 1,000 buses per month in the upcoming year.

- The Madhya Pradesh facility, expected to go live by end of 2025, will add capacity for 5,000 vehicles per month.

- EKA and its suppliers have secured critical stocks of rare earth magnets to address EV supply chain concerns.

- The company is actively working to mitigate risks associated with supply chain dependencies.

- EKA Mobility is focused on full-scale electrification across commercial transport.

- The company aims to create India's largest commercial electric vehicle portfolio.

- EKA's vision includes products ranging from 3-seater electric vehicles to 125-seater electric buses.

- The company serves clients like state governments and private operators.

- The production roadmap, diverse vehicle pipeline, and investor support position EKA as a key player in India's green commercial mobility revolution.

Read Full Article

6 Likes

TechCrunch

404

Image Credit: TechCrunch

Thanks to Fidelity and our amazing sponsors, TechCrunch All Stage is where startups rise

- TechCrunch All Stage highlights partners' invaluable expertise in the startup ecosystem.

- Sessions at TC All Stage provide insights on legal foundations, fundraising, and startup growth strategies.

- Participants gain expert guidance on legal aspects, fundraising mistakes, overcoming burnout, and cap table management.

- Discussions cover M&A readiness, essential for startups eyeing acquisition or exit strategies.

- Upcoming sessions focus on navigating the changing VC landscape and preparing for future fundraising challenges.

- The event features sponsors like Fidelity and other industry leaders supporting the startup community.

- Attendees can save on passes to access valuable workshops, strategies, and network opportunities at TC All Stage in Boston.

- Tickets for the event on July 15 are available now, offering a chance to learn from top experts and industry veterans.

- The event provides a platform to connect, learn, and grow in the competitive startup environment.

- Joining TC All Stage can equip founders with the knowledge and tools needed to succeed in the dynamic entrepreneurial landscape.

Read Full Article

24 Likes

Startup Story

78

Image Credit: Startup Story

Apple Reportedly Eyes Perplexity AI to Bolster Siri and Search Capabilities

- Apple is reportedly considering acquiring or partnering with Perplexity AI, a startup in the conversational AI and real-time web search space.

- The move is aimed at enhancing Siri and reducing Apple's reliance on Google for search.

- Discussions are led by Apple's M&A head Adrian Perica and involve input from senior leaders like Eddy Cue.

- Perplexity AI, founded by Aravind Srinivas, specializes in generative AI with chatbot interfaces and real-time search results.

- Apple sees the acquisition as a means to modernize Siri's capabilities and potentially introduce an AI-powered native search engine.

- Two options are being considered: a full acquisition or a strategic partnership integrating Perplexity's tools into Apple's platforms.

- Apple's traditionally secretive AI efforts indicate a significant shift towards openness and standalone AI initiatives.

- This move comes amidst heightened competition from tech giants like Google, Microsoft, and Meta in the AI sector.

- Apple's interest in Perplexity aligns with its pursuit of top AI talent and strategic partnerships.

- The potential deal gains significance due to Apple's revenue from Google as the default search engine on Safari.

- The partnership with Perplexity could offer Apple an alternative if regulatory pressures impact its Google search deal.

- Apple's focus on generative AI and intelligent search reflects a push towards enhancing core services and competing in the AI space.

Read Full Article

4 Likes

Startup Story

418

Image Credit: Startup Story

GoKwik Secures $13 Million in Growth Round to Accelerate Global Expansion and AI-led Innovation

- GoKwik, India’s eCommerce enablement platform, secures $13 million in a growth round led by RTP Global.

- Funding also includes participation from Z47, Peak XV Partners, and Think Investments, bringing total capital to $68 million.

- Capital to drive global expansion and AI-driven innovation in GoKwik's commerce stack.

- GoKwik, founded by Chirag Taneja, Vivek Bajpai, and Ankush Talwar, enables over $2 billion in GMV annually.

- Company shows 100% year-on-year growth with AI integral to its operations.

- GoKwik solutions like KwikCheckout, KwikEngage, KwikPass, Return Prime cater to various eCommerce challenges.

- Products compatible with platforms like Shopify, WooCommerce, Magento, Salesforce, and custom sites.

- RTP Global's Galina Chifina praises GoKwik team's understanding of AI in eCommerce.

- KwikEngage, GoKwik's WhatsApp-enabled tool, gains traction globally, especially in the UK.

- Z47's Rajat Agarwal lauds GoKwik's AI-centric approach in eCommerce enablement.

- GoKwik aims to become foundational growth infrastructure for D2C brands by enhancing shopper touchpoints.

- GoKwik processes millions of transactions daily for brands like Mamaearth, Man Matters, and Shoppers Stop.

Read Full Article

23 Likes

Insider

217

Image Credit: Insider

Meet 19 startups in social networking, dating, and AI that investors have their eyes on

- Venture capitalists are showing interest in social startups leveraging AI and human connection for growth.

- AI-focused consumer tech startups are in the spotlight as investors hunt for new opportunities.

- Startups like Midjourney, Tolan, and Sitch are attracting attention for their AI capabilities.

- The trend of incorporating AI in consumer pitches is increasingly common among startup founders.

- Apart from AI, VCs are also keen on startups building dedicated communities in various niches.

- Smaller, niche-oriented platforms are gaining popularity among users seeking more personalized experiences.

- Investors are eyeing new AI startups with social elements, niche social networks, and platforms enabling real-life connections.

- Notable startups include Swsh, blending AI and social interaction for event photo sharing, and Status simulating a social media experience with AI characters.

- Other startups like Bible Chat, Doji, Gigi, Lore, and Series are also drawing interest for their innovative approaches.

- Companies like Cosmos, Mansa, Margins, Perfectly Imperfect, Spillt, Beli, Kndrd, Partiful, and Pie are making waves in their respective niches.

Read Full Article

13 Likes

Startup Story

263

Image Credit: Startup Story

Truliv Secures Strategic Investment from The Times Group at INR 356.5 Cr Valuation

- Chennai-based coliving startup Truliv secures strategic equity partnership with The Times Group at a valuation of INR 356.50 crore.

- Funds from the investment will be used to expand into new cities, enhance the tech-driven property management platform, and enter hospitality segments like holiday homes and retirement living.

- Truliv aims to achieve an annual revenue of INR 200 crore within the next three years.

- Founded in 2019, Truliv currently operates mainly in Chennai and offers premium coliving spaces with modern hospitality services.

- The startup reported significant growth, doubling revenue to INR 31.63 crore in FY25 with a net profit of INR 22 lakh.

- Truliv had previously secured $2 million in seed funding and $1.5 million in pre-seed funding from various investors.

- The company plans to expand operations to Bengaluru, Pune, and Hyderabad.

- The coliving sector in India is gaining investor interest due to evolving lifestyle choices and urban migration, with Truliv competing with players like Stanza Living and Zolo Stays.

- The Indian coliving sector is projected to grow from INR 4,000 crore in 2025 to INR 20,000 crore by 2030.

Read Full Article

15 Likes

ISN

378

Image Credit: ISN

Shark Tank India-featured ice popsicle brand Skippi raises $1.4 million in funding

- Skippi, an ice popsicle brand featured on Shark Tank India, raises $1.4 million in funding from Dubai-based family offices and angel investors.

- The pre-Series A funding round amounts to Rs 12 crore, with Rs 10 crore from the family offices and the rest from angel investors.

- Purpose of funding includes enhancing brand visibility, working capital, product development, and leadership team strength.

- Part of the funds will support international expansion, particularly targeting the Middle East for growth.

- Founded in 2021 by Ravi and Anuja Kabra, Skippi has a wide retail presence in India, available in over 20,000 outlets and various online platforms.

- Initially known for preservative-free ice pops, Skippi has expanded its product range to include snacks like Crazy Corn, Cornsticks, and Cream Rolls.

- Prior funding rounds include a bridge round this year led by Hyderabad Angels Network and Venture Catalysts.

- Skippi had earlier secured about Rs 1 crore on Shark Tank India Season 1 from all investors on the panel in exchange for a 15% equity stake.

- Ravi Kabra, CEO of Skippi, expresses gratitude for the investment, focusing on brand building, new product development, and team expansion.

- Raman Sharma from Bestvantage Investments sees Skippi's potential in the Indian market against global competitors, aiming to reach a wider audience.

Read Full Article

22 Likes

Nonprofithub

95

Image Credit: Nonprofithub

10 Reasons Your Nonprofit Should Participate in DAF Day 2025

- Consider participating in DAF Day 2025 to leverage donor advised funds (DAFs) and boost your nonprofit's funding.

- DAF Day is a national day of giving aimed at activating the potential of DAFs among supporters, taking place on October 9, 2025.

- Reasons to join DAF Day include the potential for donors to give double, the underutilization of DAFs, and the success of last year's event.

- Participation in DAF Day is free and offers ready-made campaigns and resources to educate donors about DAFs.

- Encourage DAF giving, engage supporters, and utilize social media to amplify your fundraising efforts.

- Gain free DAF training for your team, empower donors with easy DAF giving options, and kickstart your overall DAF strategy.

- Get verified, download the marketing toolkit, sign up for training, and spread the word to prepare for DAF Day success.

- Author Mitch Stein, from Chariot, emphasizes the importance of leveraging DAFs and shares his background in nonprofit technology and fundraising.

Read Full Article

5 Likes

Economic Times

372

Image Credit: Economic Times

Healthcare startup Abridge tops $5 billion valuation

- Healthcare startup Abridge raises $300 million at a $5.3 billion valuation led by Andreessen Horowitz and Khosla Ventures.

- The funding round aims to improve revenue cycles and enhance communication between clinicians and billing teams.

- AI-focused startups have gained significant interest from VC firms with substantial funding rounds and high valuations.

- Search startup Glean valued at $7.2 billion in a recent financing round led by Wellington Management.

- Andreessen Horowitz is focusing on AI investments and plans to raise a substantial fund to tap into global interest in U.S. AI companies.

- Abridge, founded in 2018, automates clinical notes and medical conversations for doctors using AI.

- David George, A16z's general partner, highlighted Abridge's role in addressing rising healthcare costs and burdens on clinicians and patients.

- Abridge partners with over 150 enterprise health systems in the U.S.

- The latest funding follows a $250 million raise earlier this year, with investor Elad Gil, known for backing fintech firm Stripe and IVP, co-leading.

- Abridge's valuation increased from $850 million last year to $5.3 billion in the recent funding round.

- The platform expanded to cover inpatient care and streamline outpatient orders.

Read Full Article

22 Likes

Inc42

239

Image Credit: Inc42

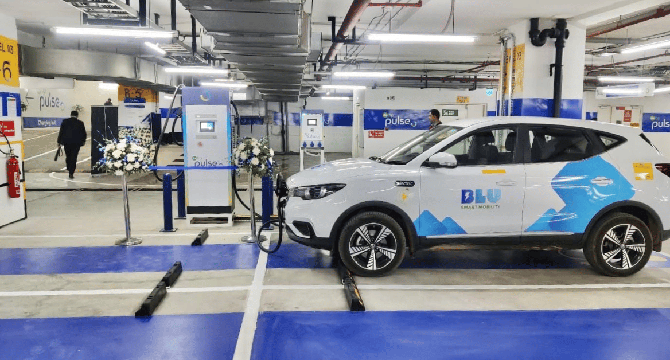

Crisis-Hit BluSmart’s App Breaks Down

- BluSmart, an EV ride-hailing startup, has faced app issues after suspending cab booking services in April.

- The app is crashing on both Android and iOS with a 'something went wrong!' message.

- BluSmart didn't officially terminate its 800 employees after suspending operations, leaving them in limbo for salaries.

- The app shutdown may be linked to the departure of the software team due to lack of work and pending salaries.

- More than 10,000 drivers lost their jobs due to the abrupt suspension of operations by BluSmart.

- Customers with money in BluSmart wallets are facing issues, with promised refunds delayed until July 18.

- SEBI's interim order implicated the Jaggi brothers, founders of Gensol Engineering, in misleading practices.

- The National Company Law Tribunal issued insolvency notices to BluSmart Mobility and Gensol Engineering.

- Creditors like Spectrum Trimpex, Catalyst Trusteeship, and Equentia Financial Services have claims against BluSmart.

- Despite reports of potential acquisition and investment plans, BluSmart's future remains uncertain.

Read Full Article

14 Likes

Economic Times

204

Image Credit: Economic Times

Uber-backed electric bike startup Lime hires banks for US IPO, sources say

- Lime, an electric bike and scooter startup backed by Uber, has hired banks for a potential US IPO next year.

- Goldman Sachs and JPMorgan Chase have been retained for the IPO, which could value Lime higher than its 2020 valuation of $510 million.

- The San Francisco-based startup operates in over 280 cities across nearly 30 countries, offering short-term rentals of electric bikes and scooters.

- Lime, led by former Uber executive Wayne Ting, has been eyeing the public markets for several years.

- The potential IPO comes amid a recovering market for listings, with IPOs in the U.S. raising nearly $27 billion this year, up 45% from last year.

- Lime's IPO attempt could boost confidence in both the IPO market and technology startups that have faced investor skepticism in recent years.

- In the micromobility sector, where Lime operates, many companies have struggled with regulatory challenges and high operating costs.

- Lime reported a 32% growth in net revenue to $686 million for 2024, and announced it was free cash flow positive for the second consecutive year.

- Stablecoin issuer Circle Internet recently raised over $1 billion from its IPO, signaling a positive trend in the listing market.

- Dealogic data shows IPOs in 2022 have not reached the levels seen in 2021, which had a record $177 billion raised during the same period.

- Lime's potential IPO will be a key test for the IPO market and investor confidence in technology startups.

Read Full Article

12 Likes

Medium

178

Image Credit: Medium

From Grit to Growth: Part I —Cash Won’t Buy Culture. But It Might Start a Venture Capital War.

- Meta reportedly offered a $100 million signing bonus to senior AI employees at OpenAI.

- Altman made a quiet bet on culture over capital in response to the high signing bonus.

- The focus is on culture rather than just fitting in for AI professionals.

- The best people in AI are staying in their current roles despite tempting financial offers.

- Recruiting, retention, and team design are influenced by culture considerations.

- Startups prioritize scaling precision over headcount in their organizational structure.

- Companies are embedding People Ops directly into teams as enablers, not just administrative support.

- Legal and compliance are important, but team building is now a core responsibility within teams.

- Successful strategies focus on high-signal, trust-based networks rather than just traditional HR approaches.

- Winning in today's landscape involves building tighter networks instead of just growing bigger organizations.

- VU Talent Partners is an example of a company adopting a network-based, signal-rooted approach to team building.

- Grit and growth now depend on clarity, community, and conviction in building teams and networks.

Read Full Article

10 Likes

ISN

887

Image Credit: ISN

Chennai-based deeptech startup Fabheads raises $10 million in funding

- Chennai-based startup Fabheads, founded by former ISRO engineers, has secured $10 million in funding in a Series A round led by Accel.

- The funding includes $2.3 million in venture debt from Trifecta Capital, bringing Fabheads' total funding to $13 million.

- The startup plans to use the funding to expand manufacturing capacity, strengthen R&D operations, and grow the engineering team to meet global demand.

- Fabheads aims to establish a new factory in Bengaluru's Aerospace Park, with 70+ advanced manufacturing machines.

- Fabheads utilizes Adaptive Tow Placement (ATP) technology, automating composite fiber placement for precise and efficient manufacturing.

- Their proprietary automation platform reduces material wastage by 20%, cuts production cycle time by 30%, and lowers manufacturing costs by up to 50%.

- The startup targets industries like aerospace, robotics, drones, shipping, and mobility, serving clients such as Tata Group, Motherson Group, and ISRO.

- Fabheads plans to expand globally, particularly in defense and clean energy sectors, leveraging its specialized composite manufacturing technology.

- Fabheads founders, Kanagaraj and Rathore, express readiness to lead innovation in composite manufacturing globally, making composites accessible across various sectors.

- Accel Partner Swaroop highlights Fabheads' role in addressing manufacturing bottlenecks in aerospace, defense, mobility, and renewable energy sectors.

Read Full Article

7 Likes

Inc42

133

Image Credit: Inc42

Mirae Asset India VC Arm CEO Ashish Dave Steps Down

- Ashish Dave, CEO of Mirae Asset Venture Investments (India), has resigned from his position after a seven-year tenure.

- Mirae Asset Venture Investments (India) is the VC arm of Mirae Asset Global Investments.

- Dave's responsibilities will be assumed by Mirae's Korean team until a new CEO is appointed.

- Dave joined the company in 2018 and has invested in companies such as Unacademy, Zomato, and Ola, among others.

- He is also the fund manager of Mirae's SEBI registered category II alternative investment fund.

- Mirae Asset VC invests in technology-led startups and has investments in companies like Ola Cabs and Zomato.

- Its global portfolio includes companies like Didi Chuxing, Grab, and SpaceX.

- Mirae is planning to launch an ETF focused on the EV and new-age automotive vehicle ecosystem.

- The VC firm's Indian portfolio companies Ola Cabs and Shadowfax are aiming for public listings.

- The news of Dave stepping down comes amidst a surge in startup funding led by VC and PE firms in India.

Read Full Article

6 Likes

For uninterrupted reading, download the app