Startup News

Getfullyfunded

282

Image Credit: Getfullyfunded

Events on a Shoestring: High-Impact Auctions for Small & Mighty Teams

- Small teams can achieve big fundraising success by focusing on efficient workflows.

- Utilize templates, outsourcing, and automation to prevent overwhelm and ensure smooth operations.

- Partners like Get Fully Funded and Auctria offer resources and platforms for support.

- By strategizing with free resources and outsourcing tasks, even small teams can succeed.

- Automation of communications and tasks can streamline event planning for maximum efficiency.

Read Full Article

16 Likes

Inc42

330

Image Credit: Inc42

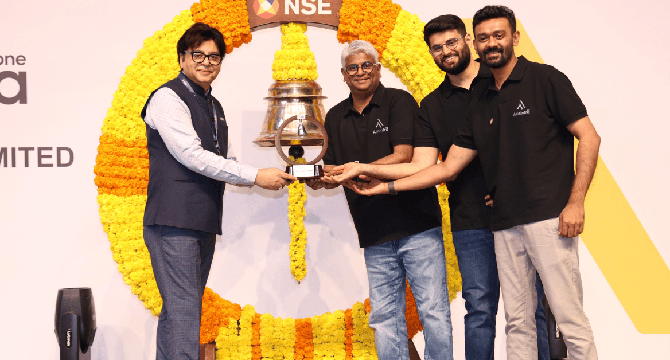

ArisInfra Ends First Trading Session 22% Below IPO Price

- Shares of ArisInfra Solutions ended the first trading session 22% below its IPO price.

- The company closed at INR 174.10 on the BSE, down 21.6% from the IPO issue price of INR 222.

- ArisInfra's market capitalization was $164 million, lower than the IPO valuation of $209 million.

- The stock closed 16.7% below its opening price of INR 209.10 on the BSE.

- Trading on the NSE saw the stock closing at INR 173.9, down 21.7% from the issue price.

- 19.3 lakh equity shares of ArisInfra were traded on the BSE on the first day.

- ArisInfra faced weak investor sentiment on its listing day despite a positive broader market trend.

- The IPO, oversubscribed 2.65X, witnessed strong interest from retail investors.

- Qualified institutional buyers showed tepid response, oversubscribing 1.4X.

- Brokerage firms like Bajaj Broking and Religare Broking had mixed opinions on ArisInfra's IPO.

- ArisInfra posted profits in the first nine months of FY25 after losses in FY24.

- The company's operating revenue improved in 9M FY25 compared to FY24.

- ArisInfra is expected to announce its full-year FY25 financials soon.

Read Full Article

19 Likes

Medium

2.5k

Image Credit: Medium

The $85B Engineering SaaS Market: Where the Next Decade of Growth Is Happening

- The Engineering SaaS market is experiencing significant growth driven by global infrastructure demand, ESG compliance, AI modeling, and digital twin technologies.

- By 2025, Engineering SaaS is predicted to surpass $85 billion globally, with key segments including AEC Design, Plant & Process, Simulation & CAE, Digital Twins, and AI Engineering SaaS.

- Engineering SaaS comprises five interconnected layers: AEC Design Platforms, Plant & Process Platforms, Simulation & CAE, Digital Twins, and AI Engineering SaaS.

- Private equity firms are heavily investing in the Engineering SaaS space, leading to the emergence of multi-domain giants and AI-native startups.

- A competitive power shift is underway in the market, with legacy SaaS providers facing challenges from AI-native SaaS companies offering faster onboarding and consumption-based pricing.

- The go-to-market complexity in Engineering SaaS involves enterprise ABM sales, solution selling, API embedded sales, and self-service PLG, catering to various stakeholders.

- Key metrics for success in Engineering SaaS include ACV, Net Revenue Retention, Usage Intensity, AI model accuracy improvement, sales cycle length, and product expansion rate.

- The future of Engineering SaaS lies in platforms mastering compounding AI flywheels driven by data growth, AI learning loops, workflow embedding, outcome automation, retention, and expansion.

- To succeed in the Engineering SaaS market, platforms need to deeply integrate into workflows, utilize AI learning loops, expand modularly, and deliver operational outcomes.

Read Full Article

22 Likes

Inc42

312

Image Credit: Inc42

Top-Level Exits Continue At ONDC As Independent Director Arvind Gupta Quits

- Arvind Gupta, independent director at ONDC, has resigned from his position.

- Gupta, a founding member, played a significant role in shaping and guiding ONDC's early growth.

- He decided not to continue as an independent director after a full three-year term.

- Gupta remains a staunch supporter of ONDC's mission.

- Previously, ONDC's managing director T Koshy and chief business officer Shireesh Joshi also stepped down.

- Vibhor Jain is currently the acting CEO of ONDC after Koshy's exit.

- With Gupta's departure, ONDC now has three independent directors left on its board.

- ONDC, founded in 2021, aims to empower local sellers to access a wider audience.

- It functions as a network platform and does not own a consumer-facing ecommerce portal.

- The platform has achieved 200 Mn transactions and operates in several sectors like foodtech and consumer goods.

- Despite some success, ONDC faces competition from quick delivery platforms like Zepto and Swiggy Instamart.

- The network's transaction volume dropped from 120 Mn to 30 Mn transactions by March this year.

- ONDC is governed by a board of directors and an advisory council.

- The platform was developed as an alternative to major ecommerce players like Flipkart and Amazon.

- Gupta has over 30 years of experience in entrepreneurship and leadership.

- He is also the co-founder and head at Digital India Foundation.

Read Full Article

18 Likes

Startup Pedia

1.4k

Image Credit: Startup Pedia

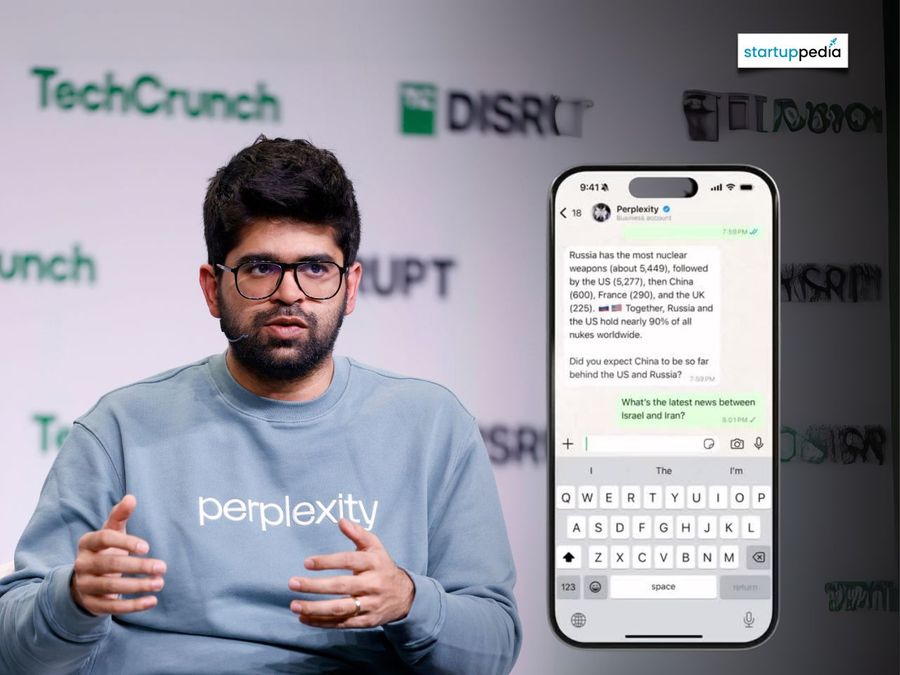

“You can now schedule tasks with Perplexity”, Aravind Srinivas announces new feature to schedule tasks on WhatsApp

- Perplexity AI co-founder Aravind Srinivas introduced a new feature enabling users to schedule tasks on WhatsApp.

- Users can now leverage Perplexity on WhatsApp to receive news alerts, set custom reminders, and more using natural language commands.

- The AI chatbot can send reminders, provide updates, and facilitate various tasks like turning off appliances, all via WhatsApp.

- To access Perplexity on WhatsApp, users need to add +1 (833) 436-3285 to their contacts and chat with the AI chatbot directly.

- Through Perplexity, users can interact with the AI chatbot for tasks such as answering questions, researching, generating images, and summarizing content.

- The WhatsApp integration of Perplexity simplifies usage without requiring additional app installations, unlike the native Perplexity app.

- Future plans for Perplexity on WhatsApp include introducing voice mode, memes, videos, fact-checking features, and more.

- Perplexity also upgraded its chatbot on social media platform X to allow users to create short videos with sound using generative AI.

- There are reports of possible acquisition offers from Apple and Meta towards Perplexity AI.

- The article mentions other news like Google launching AI Mode in India for asking multi-layered questions.

- Aravind Srinivas previously discussed adding more functionalities to the WhatsApp version of the chatbot.

- Perplexity AI's integration with WhatsApp marks a user-friendly approach for delivering AI-based services.

- Users can now benefit from an AI 'assistant' experience on WhatsApp by leveraging Perplexity for task scheduling and more.

- The innovation by Perplexity AI enhances user experience by offering various functionalities via WhatsApp without complex sign-up procedures.

- The article highlights the convenience brought by Perplexity's AI chatbot on WhatsApp for interacting with AI capabilities seamlessly.

- The expansion of features and accessibility improvements by Perplexity embody advancements in AI integration for user convenience.

- The integration of scheduling tasks on WhatsApp via Perplexity reflects the ongoing evolution of AI technologies in everyday applications.

Read Full Article

26 Likes

Eu-Startups

78

London-based AI platform Metaview raises €30.1 million dollars to help recruiters in “the war for talent”

- British startup Metaview secures €30.1 million in Series B funding led by GV to enhance their AI platform for recruitment.

- The funding round also saw participation from existing investors like Plural, Vertex Ventures, Seedcamp, and others.

- Metaview, founded in 2018, focuses on transforming job interviews into actionable hiring intelligence using AI technology.

- The platform aims to make recruiting more efficient by analyzing hiring conversations and providing rich data for decision-making.

- Metaview helps recruiting teams at every stage of the hiring process from intake to final offer, emphasizing the importance of building great teams.

- The AI tools by Metaview capture, analyze, and leverage interview data to ensure consistency and objectivity in talent decisions.

- With over three million recorded interviews, Metaview enables hiring teams to operate with high-quality insights.

- The platform has 2,500 customers, including Sony, Deliveroo, and KellyOCG, providing time savings and improved hiring processes.

- Metaview's AI technology offers purpose-built solutions for recruitment, aiming to revolutionize hiring with data-driven decision-making.

- The platform's AI agents automate various hiring workflows and offer features such as AI Notetaker, AI Reports, AI Answers, and AI Job Posts.

- The technology optimizes the hiring funnel, provides customizable reporting, instant candidate insights, and quick job description generation.

Read Full Article

4 Likes

Startup Story

394

Image Credit: Startup Story

Broking Platform Sahi Raises $10.5 Million in Series A Funding Led by Accel and Elevation Capital

- Algorithmic trading startup Sahi secures $10.5 million in Series A funding led by Accel and Elevation Capital.

- The fresh funding will be utilized to enhance product capabilities, expand market presence, and strengthen the team.

- Sahi aims to democratize advanced trading tools for retail investors and has gained significant traction with over 200,000 app downloads in under six months.

- The startup's 'chart-first' approach and upcoming features like no-code strategy builders and multi-leg options execution set it apart in the market, catering to the growing demand for user-friendly trading solutions in India.

Read Full Article

21 Likes

ISN

34

Image Credit: ISN

D2C jewellery brand GIVA raises Rs 530 crore in funding led by Creaegis, others

- GIVA, a D2C fine jewellery brand based in Bengaluru, raises Rs 530 crore in funding led by Creaegis and existing investors like Premji Invest, Epiq Capital, and Edelweiss Discovery Fund.

- The investment will be used to expand retail presence, enhance technological capabilities, and grow lab-grown diamond jewellery offerings.

- Founded in 2019, GIVA has transitioned from a silver jewellery brand to offering gold and lab-grown diamond jewellery across 240 stores in India.

- The company plans to open 145-150 new locations this year, focusing on Tier-II cities, while also leveraging digital channels for customer acquisition.

- With a focus on aspirational design, quality assurance, and affordability, GIVA targets India's increasing demand for accessible luxury.

- Aditya Labroo, the COO, has been promoted to co-founder, reflecting the company's growth and evolution.

Read Full Article

2 Likes

Inc42

6.9k

Image Credit: Inc42

ArisInfra Shares List At 8% Discount Over IPO Price

- Shares of ArisInfra Solutions debuted on the NSE at INR 205, a 7.65% discount over its IPO price, and on the BSE at INR 209, a 5.81% discount.

- ArisInfra's INR 499.6 Cr IPO had an issue price of INR 222, oversubscribed 2.65X, with bids for 3.47 Cr shares against 1.31 Cr shares on offer.

- Founded in 2021 by Ronak Morbia and Bhavik Khara, ArisInfra is a B2B construction material procurement platform serving real estate and infrastructure developers.

- The platform deals with products like ready-mix concrete, steel, cement, and construction chemicals.

- The story will be updated soon.

Read Full Article

27 Likes

Pymnts

160

Image Credit: Pymnts

Xero Acquires B2B Bill Pay Platform Melio for $2.5 Billion

- Xero, a New Zealand-based small business platform, is acquiring Melio for $2.5 billion.

- The deal will give Xero access to Melio's SMB bill pay platform, enhancing accounting and payment services.

- Xero CEO stated that this acquisition will help improve cash flow management for U.S. SMBs and accountants.

- The partnership between Xero and Melio aims to address crucial needs in accounting and payments for American SMBs.

- The U.S. SMB payment market is estimated at $29 billion, driven by digitization and demand for software solutions.

- Many businesses still rely on outdated payment methods and manual AP systems, facing challenges like paper checks.

- Research shows that most businesses have not automated supplier payments, leading to data entry errors and process delays.

- Late payments for small businesses remain a problem, with an average delay of 9.1 days, impacting financial stability.

- The acquisition aligns with the push for advanced payment methods to enhance financial operations for smaller firms.

- The news about Xero acquiring Melio was shared on PYMNTS.com.

Read Full Article

9 Likes

Ketto

260

Image Credit: Ketto

Your Guide to the Best Hospitals In Kolkata

- The article provides a comprehensive guide to the best hospitals in Kolkata, highlighting their specialities, facilities, and unique selling points.

- Hospitals like Manipal Hospital, Ruby General Hospital, and Peerless Hospital & B.K. Roy Research Centre are featured for their advanced medical care and facilities.

- Services such as Cardiology, Neurology, Oncology, and Critical Care are highlighted as key specialities across these hospitals.

- The article showcases the hospitals' excellence in areas like robotic surgery, emergency services, and specialised critical care units.

- Other hospitals like Desun Hospital, Medica Superspecialty Hospital, and Belle Vue Clinic are also included for their advanced medical treatments and patient-centric care.

- These hospitals offer services ranging from orthopaedics, oncology, nephrology, to dermatology, showcasing their multispeciality care approach.

- Woodlands Multispeciality Hospital and Sri Aurobindo Seva Kendra, known for their affordable services, are highlighted for their technological advancements and community outreach programs.

- The article emphasizes the hospitals' NABH accreditations, advanced diagnostic tools, and specialised departments that cater to a wide range of medical needs.

- Overall, the article serves as a comprehensive resource for individuals seeking quality healthcare in Kolkata, showcasing the diverse medical expertise and facilities available in the city.

Read Full Article

15 Likes

Eu-Startups

104

“Indistinguishable from a human voice”: Berlin-based Synthflow AI raises €17.2 million for its AI voice agent

- Berlin-based Synthflow AI, a voice AI platform, secures €17.2 million in Series A funding round led by Accel, with participation from existing investors Atlantic Labs and Singular.

- The total funding now amounts to €25.8 million, enabling global expansion and the opening of a new office in the US.

- Synthflow AI aims to democratise access to advanced voice AI with a no-code platform for creating natural-sounding, cost-effective voice agents tailored to business needs.

- Synthflow AI's white-label voice agents are highly customisable, require no code, and can handle tasks from simple inquiries to complex workflows.

- The company offers over 200 integrations across calendars, CRMs, and telephony systems, enabling rapid and cost-effective implementation.

- Synthflow AI's AI Voice OS is designed to be indistinguishable from a human voice, handling complex use cases without human intervention.

- The company has expanded its R&D team and integrated with BPO providers and contact centres since its Seed round.

- Accel partner Luca Bocchio praises Synthflow AI's accessibility and market potential in revolutionizing customer support through voice agents.

- AI voice agents have the potential to transform global operations and are cost-effective for businesses across various sectors.

- Synthflow AI agents have significantly impacted contact centre operations, with millions of hours saved, more calls answered, and a high uptime percentage.

- The growth of AI voice agents presents a substantial opportunity for contact centres and BPO companies in the expanding customer service market.

- Businesses can now deploy AI voice agents at scale for various use cases, from customer service to appointment scheduling, offering improved support at reduced costs.

Read Full Article

6 Likes

Inc42

308

Image Credit: Inc42

AuraML Nets Funding To Build Generative Simulation Platform For Robotics

- AuraML, a deeptech startup, has secured $1 million in pre-seed funding led by Turbostart, with participation from other investors like DeVC and GSF Accelerator.

- The funding will be used for product development, expanding presence in the US, and supporting enterprise pilots in warehouse automation and industrial robotics.

- AuraML specializes in generative simulation for industrial and warehouse robotics, aiming to accelerate innovations in Robotics and Physical AI.

- The company's technology allows robotics companies to test their robots across various scenarios, reducing time and costs compared to traditional methods.

Read Full Article

18 Likes

SiliconCanals

112

Image Credit: SiliconCanals

Prague’s Filuta AI secures €3.6M to advance patented composite AI technology; eyes Series A investment in H2 2026

- Prague-based Filuta AI has secured approximately €3.6M in a seed funding round led by Rockaway Ventures.

- Rockaway Ventures is part of Rockaway Capital investment group and focuses on investing in AI-driven startups.

- The fund under Jakub Havrlant's platform supports late-seed and Series A founders.

- Filuta AI aims to address challenges faced by game developers, offering cost-saving solutions.

- The company plans to expand its team with experts in mathematics and AI to enhance product development.

- Filuta AI intends to prepare for a Series A investment round by the second half of 2026.

- The company focuses on commercializing Composite AI across industries.

- Filuta AI's platform combines symbolic AI with subsymbolic AI for increased efficiency.

- The company automates the composition of AI technologies, enabling faster problem-solving in complex domains.

- The AI solution offered by Filuta AI significantly reduces testing time in the gaming industry.

- The company holds patents in areas like gaming, aviation, automotive, and defense.

- Filuta AI's founding team has experience from tech giants like Google and Microsoft as well as academia and government agencies.

- Within a year of inception in 2022, the company secured a significant pre-seed investment.

- Filuta AI plans to strengthen its position in the AI market moving forward.

Read Full Article

6 Likes

Eu-Startups

352

With over 45 startups already funded, Czech VC fund KAYA secures €70 million to back more Founders from CEE

- Prague-based VC fund KAYA raises €70 million for a fifth fund to support CEE Founders, backing up to 25 startups from pre-Seed to Series A.

- KAYA typically invests one to three million Euro initially and keeps a capital reserve for follow-on rounds, allocating up to €20 million to a single company through syndication.

- Founded in 2010, KAYA has backed over 45 ventures across Czechia, Poland, Slovakia, and the CEE region, actively using technology to enhance operations.

- Investors in KAYA include Central European entrepreneurs, multinational funds, major institutions, and regional banks.

- KAYA expands beyond the Czech Republic and Poland, seeking global products from strong technical teams across the CEE region.

- KAYA's portfolio includes unicorns like Rohlik and Docplanner, with Booksy anticipated to become a unicorn soon.

- They have invested in companies like Better Stack, SensibleBio, and Upheal, totaling over forty-five companies and €350 million in value.

- KAYA focuses on providing expert advice and facilitating follow-on investments for their portfolio companies.

- The fund's approach of not specializing in any particular industry allows them to support evolving technologies and trends for CEE entrepreneurs.

- KAYA aims to understand and support entrepreneurs globally, emphasizing a 'generalist' approach rooted in CEE sentiment.

Read Full Article

21 Likes

For uninterrupted reading, download the app