Funding News

Futurefundraisingnow

445

Nonprofit Navel-Gazing Syndrome [Nonprofit Diseases]

- Nonprofit organizations suffering from Nonprofit Navel-Gazing Syndrome (NPNGS) focus on their internal understanding, leading to uninteresting fundraising efforts.

- NPNGS causes nonprofits to believe donors share their detailed understanding of their work, leading to ineffective fundraising strategies.

- Donors have a less nuanced view of nonprofit work and are drawn to simple and clear descriptions of impact.

- Some organizations affected by NPNGS may only want support from donors who fully understand their internal processes.

- Nonprofits should focus on showcasing the outcomes of their work to donors, rather than the intricate details of their operations.

- Donors are interested in supporting organizations to create positive change, not in the internal workings of the nonprofit.

- Nonprofits should prioritize meeting donors where they are and emphasizing the impact their contributions can make.

- Focusing on staff achievements, methodology, or internal processes may not resonate with donors looking to support tangible outcomes.

- Nonprofits should adjust their fundraising approach to align with donors' interests and motivations to drive successful fundraising efforts.

Read Full Article

26 Likes

Siliconangle

107

Image Credit: Siliconangle

With $27M in funding, Fleet wants to bring more freedom to enterprise device management

- Fleet Inc. secures $27 million in Series B funding to enhance enterprise device management.

- The funding round was led by Ten Eleven Ventures with participation from CRV, Open Core Ventures, and other investors.

- Fleet offers an open-source device management platform for companies to secure their computing devices.

- The platform provides transparency, extensibility, and repeatability compared to proprietary software.

- Fleet aims to give organizations control over device management for compliance with regulations like PCI and FedRAMP.

- It offers both hosted and on-premises deployment options.

- Netflix, Stripe, Fastly, Uber, and Reddit are among the well-known enterprises using Fleet.

- Fleet's platform supports various devices like iPhones, Android phones, laptops, and even data centers.

- Customers praise Fleet for providing flexibility and avoiding forced cloud migrations.

- The company's rapid growth is attributed to its channel partners and open-source approach.

- Fleet CEO emphasizes the company's dedication to open hosting options.

- Ten Eleven Ventures Partner endorses Fleet for its comprehensive device management capabilities.

- Fleet plans to maintain its open approach and customizable hosting solutions.

- The company has been seeing significant adoption for its device management platform.

- Flexible hosting options are generating increased interest in web searches.

- Fleet's platform is designed to cater to a wide range of operating systems and devices.

- The company's mission is to provide free, relevant, and in-depth content to the community.

Read Full Article

6 Likes

TechCrunch

319

Image Credit: TechCrunch

Sword Health nabs $40M at $4B valuation, pushes IPO plans to at least 2028

- Sword Health, the AI-powered digital health startup, secures $40 million at a $4 billion valuation with General Catalyst leading the funding.

- The funding round marks a 33% increase from the previous year's $3 billion valuation.

- CEO Virgílio Bento aims to enhance the company's valuation and prepare for strategic acquisitions with the additional capital.

- Initially considering an IPO for 2025, Sword Health founder now eyes a potential IPO in 2028 to broaden remote healthcare offerings beyond existing services.

- Bento is diversifying the company's AI care specialist, Phoenix, to cater to various health conditions apart from musculoskeletal and pelvic care, including cardiovascular and speech therapy.

- The founder has been learning about managing a public company and is currently unconvinced about the necessity of an IPO despite the company's healthy financials.

- Bento highlights that private companies like Ikea and Lego have succeeded without going public and emphasizes the availability of private capital and liquidity for employees through secondary markets.

- Sword Health plans a tender offer soon, anticipates raising more capital next year, and predicts a $50 million raise at a $5 billion valuation in the future.

- The latest funding round, led by General Catalyst, also saw participation from Khosla Ventures, Comcast Ventures, and others, bringing the company's total funding to $380 million.

Read Full Article

19 Likes

TechSpark

413

Silicon Gorge Profiles: Opti Compliance

- Silicon Gorge pitching competition featured 24 early-stage startups with 12 finalists pitching at the investor showcase.

- Opti Compliance, a B2B SaaS company focuses on transforming building compliance management, specifically fire safety.

- Their Fire Compliance Software digitizes workflows, centralizes documentation, and automates admin tasks to boost consultant productivity.

- Opti aims to improve safety, increase efficiency, and expand into construction and health & safety industries.

- The company addresses manual paperwork and disconnected systems in the compliance sector to enhance safety outcomes.

- Opti's platform is designed in collaboration with fire safety consultants, offering tailored functionality and regular updates based on industry feedback.

- Opti stands out for its industry-specific approach, user-friendly platform, and white-label solutions for other compliance-heavy sectors.

- The company is raising £500,000 to grow, enhance their platform, expand teams, and explore partnerships in the insurance sector for data-driven insights.

- Partnerships with Prevention 1st, Alacrity Foundation UK, and Cyber Innovation Hub have been crucial for Opti Compliance's success.

- The company's proudest achievement is building software loved by professionals, improving safety standards and operational efficiency.

- Opti Compliance's focus is on defensibility, scalability, and continuous innovation to create a compliance platform across industries.

- For more information about Opti Compliance, visit their website www.opticompliance.co.uk or find them on LinkedIn.

Read Full Article

24 Likes

Pymnts

40

Image Credit: Pymnts

Autonomous Vehicle Startup Applied Intuition Raises $600 Million for AI

- Autonomous vehicle startup Applied Intuition has raised $600 million in new funding, doubling its valuation to $15 billion.

- The company works with major carmakers like Toyota and Volkswagen to integrate AI technology for improving safety.

- Founded eight years ago, Applied Intuition focuses on AI technology for various machines, including cars, trucks, drones, and factories.

- The company's CEO, Qasar Younis, aims for an IPO as a short-term goal, with the latest funding possibly being the final round before going public.

- Industry experts at CES discussed the integration of AI in cars, emphasizing its rapid adoption compared to other devices.

- Experts foresee AI driving transformation in customer experience within automotive technology, making interactions more conversational and intuitive.

- The future entails leveraging AI to enhance customer engagement and provide seamless, voice-first experiences in vehicles.

- Automotive AI evolution involves powerful hardware to improve performance, latency, and elevate customer engagement levels.

- Applied Intuition's successful funding reflects the growing importance of AI technology in revolutionizing the automotive industry.

- The advancements in AI are poised to significantly enhance the overall customer experience in personalized vehicles.

- AI integration in vehicles is expected to lead to innovative ways of utilizing technology to create a more engaging and user-friendly driving experience.

Read Full Article

2 Likes

Bloomberg Quint

2.1k

Image Credit: Bloomberg Quint

BSE F&O Expiry Shifts To Thursday From Tuesday

- BSE announced that the expiry day for its futures and options contracts will shift from Tuesday to Thursday.

- SEBI agreed to the proposed Thursday expiry day by BSE.

- For existing contracts, the expiry day of derivatives contracts will remain unchanged except for long-dated index options contracts.

- New contracts with expiry dates on or before Aug. 31, 2025, will continue with the present expiry day.

- In May, SEBI introduced new regulations mandating equity derivatives contracts to expire exclusively on Tuesdays or Thursdays.

- Stock exchanges were allowed to select one of these days for the weekly expiry of their benchmark index options contracts with prior approval from SEBI.

- SEBI sought preference on the choice of expiry day from stock exchanges and discussed feedback with the Secondary Market Advisory Committee.

- The move follows a consultation paper floated by SEBI in March.

- The change aims to align with the new regulations set by SEBI for equity derivatives contracts.

- The BSE circular indicated the realignment of the expiry date for long-dated index options contracts following past practices.

- The shift in expiry days is part of the regulatory changes in the derivative segment of the Indian stock market.

- The BSE's decision aligns with SEBI's guidelines on selecting Tuesday or Thursday for expiry days.

- The alterations to the futures and options contracts aim to streamline practices across stock exchanges.

- The move comes after SEBI requested exchanges to confirm their preferred expiry day by a specified deadline.

- Stock exchanges are required to adhere to SEBI's new regulations regarding the expiry dates of derivatives contracts.

Read Full Article

26 Likes

Alleywatch

251

Compyl Raises $12M to Simplify Governance and Compliance

- Compyl raised $12M in Series A funding led by Venture Guides, addressing challenges in the Governance, Risk, and Compliance (GRC) market.

- The platform turns GRC complexity into data-driven insights, unifies enterprise data in real-time, and enables risk management and compliance without heavy IT development.

- Compyl differentiates itself by offering automated security benchmark checks, real-time contextual insights, and customized GRC processes without third-party dependencies.

- The company targets mid-market and lower enterprise companies in regulated industries like software, financial services, and healthcare, aiming to streamline information security programs.

- Compyl's business model includes direct sales and channel partners, preparing for economic slowdown by prioritizing sustainable growth initiatives and customer relationships.

- Key challenges in raising capital included educating investors on the dynamic GRC space and positioning Compyl as a comprehensive GRC platform with strong differentiation.

- Investors were attracted by Compyl's experienced team, growing demand for consolidated GRC tools, strong revenue metrics, and technical depth in automating workflows for security teams.

- Future milestones include expanding go-to-market operations, accelerating AI-driven product development, and securing strategic customer wins in regulated sectors.

- Compyl advises companies to stay close to customers, build efficiently, and consider profitability or break-even operation during lean times for long-term resilience.

- The company aims to deepen its presence in core verticals, enhance product intelligence, and foster partnerships to lead the next generation of GRC innovation.

Read Full Article

15 Likes

Pymnts

251

Image Credit: Pymnts

Ubyx Raises $10 Million to Advance ‘Stablecoin Epoch’

- Digital asset startup Ubyx has raised $10 million to advance what it calls 'stablecoin ubiquity.'

- Ubyx aims to promote the global acceptance of many stablecoins with issuers like Paxos, Ripple, Agora, Transfero, Monerium, and GMO Trust.

- The company addresses barriers to mass adoption in the stablecoin market by providing a clearing system that connects issuers and receiving institutions.

- Ubyx allows redemption of stablecoins for fiat at par value into bank and FinTech accounts, standardizing redemption for cash-equivalent accounting treatment.

- The company believes it will usher in the stablecoin epoch by solving market fragmentation and aligning economic incentives.

- Stablecoins are becoming more common with companies like Bank of America, Walmart, and Amazon looking to launch their versions of the dollar-pegged currency.

- The rise of stablecoins is driving operational innovation but also raising questions about ecosystem control and interoperability.

- Interoperability is a challenge for stablecoins, including those issued by major banks, as they may lack broader token landscape compatibility.

- Stablecoins are praised for their ability to transfer value efficiently, but challenges arise when they need to be utilized for specific purposes.

Read Full Article

15 Likes

Siliconangle

58

Image Credit: Siliconangle

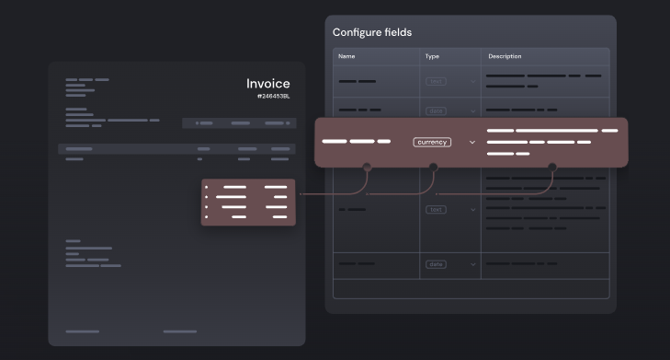

Extend gets $17M in funding to boost the speed and accuracy of document processing with AI models

- Document processing startup Extend has secured $17 million in funding through a seed investment and Series A round, with Innovation Endeavors leading the investment.

- Other investors in the funding rounds include Y Combinator, Character VC, and notable angels such as Scott Belsky, Guillermo Rauch, and Jeff Weinstein.

- Extend, also known as CrowdView Inc., aims to enhance document processing speed and accuracy using artificial intelligence, specifically large language models.

- The startup leverages advanced LLMs to transform complex PDFs and various files into validated, production-ready data with over 95% accuracy, even with degraded scans or handwritten documents.

- Extend seeks to outperform traditional optical character recognition tools by utilizing LLMs to extract, classify, and organize information from documents comprehensively.

- The company involves its customers in fine-tuning the LLMs to better understand document nuances, offering a higher level of accuracy in data extraction.

- Extend's software enables seamless integration into existing business processes, aiding departments in analyzing and gaining insights from fresh data efficiently.

- Co-founder and CEO Kushal Byatnal highlighted the importance of making document processing accessible and accurate, especially for businesses with data residing within documents.

- Extend plans to expand its product offerings with a user-friendly document processing platform that can be deployed swiftly by non-technical users.

- The recent funding will support Extend in expanding its teams, investing in research and development, and enhancing its product to cater to growing demand for accurate and flexible document automation.

Read Full Article

3 Likes

SiliconCanals

166

Image Credit: SiliconCanals

Germany’s Realyze Ventures closes first fund: Here are the VC platform’s focus areas

- Realyze Ventures, based in Köln, Germany, closed its first fund, totaling approximately €50M, with support from industry players, institutional capital, and entrepreneurial families.

- Investors in the fund include Art-Invest Real Estate, Cordes & Graefe KG, Goldbeck, MOMENI, ZECH, and renowned family offices, along with an institutional investor from the European banking sector.

- The focus of Realyze Ventures is on profound transformation in the building sector, construction industry, and skilled trades to enhance Europe's climate performance and global competitiveness.

- The investment platform aims to fund technologies that reduce carbon emissions, enhance digital efficiency, and improve overall effectiveness in the real estate, construction, and skilled trades sectors.

- Realyze Ventures' founding team has a track record of over 40 successful investments and manages more than €120M in venture capital, leveraging their expertise from BitStone Capital and MOMENI Ventures.

- The firm is a sector-specialist venture capital entity focusing on European technology startups transforming construction, real estate, and skilled trades, bringing together industry leaders, institutional investors, and pioneering entrepreneurs.

- The goal of Realyze Ventures is to sustainably transform Europe's construction and real estate sectors by combining strategic capital with operational execution capability.

Read Full Article

10 Likes

Siliconangle

233

Image Credit: Siliconangle

Coralogix gets $115M in funding to pioneer agentic AI-powered observability

- Coralogix closes a $115 million late-stage funding round and launches an AI agent named 'olly' to democratize observability beyond technical users.

- The Series E funding was led by NewView Capital with participation from Canada Pension Plan Investment Board and NextEquity.

- Existing investors like Advent International, Brighton Park Capital, and others also joined the funding, valuing Coralogix at over $1 billion.

- Coralogix's observability platform aims to detect issues in IT infrastructure by analyzing telemetry data to prevent application failures.

- The launch of 'olly' intends to involve non-technical users like business leaders and product managers in the observability process.

- 'olly' offers a conversational interface to guide users, provide insights, and suggest actions to enhance decision-making and resolve issues.

- Users can ask 'olly' specific questions about problems and receive explanations and solutions in simple language, without technical expertise.

- The AI assistant helps technical users understand system failures by consolidating and interpreting system logs, metrics, and traces.

- Coralogix CEO Ariel Assaraf views 'olly' as an intelligent assistant that empowers employees to access data and make informed decisions.

- 'olly' marks the latest in Coralogix's updates following the acquisition of Aporia Inc., introducing new AI-powered observability capabilities.

- Coralogix previously introduced the AI Center and Continuous Profiling feature to enhance observability and improve application performance.

- The company's investors believe in its potential to drive innovation in observability using AI, distinguishing it from other vendors in the market.

Read Full Article

14 Likes

Siliconangle

346

Image Credit: Siliconangle

Diskover gets $7.5M from Snowflake, NetApp and others to facilitate unstructured data discovery for AI

- Diskover Data Inc. secures $7.5 million in seed funding from investors like Snowflake Inc. and NetApp Inc.

- The startup aims to make unstructured data more usable and secure for artificial intelligence models.

- Funds will be used for expanding go-to-market and engineering teams to cater to enterprise data needs.

- Diskover focuses on untangling valuable unstructured data like documents, videos, text messages, etc., accounting for 80% of enterprise data.

- Its platform scans and indexes unstructured data files to provide metadata for easy searchability and governance.

- Diskover's technology helps curate information for AI data pipelines and ensures compliance with existing permissions.

- The startup transforms unstructured data into a structured and actionable resource for AI developers.

- Diskover acquires CloudSoda Inc. to enhance its capabilities in AI-ready intelligent data management.

- Partnerships with Snowflake and NetApp indicate the innovation and potential of Diskover's platform.

- The collaboration with industry giants helps enterprises surface and activate unstructured data for AI and storage efficiency.

Read Full Article

20 Likes

Economic Times

350

Image Credit: Economic Times

Israeli data security platform Coralogix raises $115 million

- Israeli data security platform Coralogix has raised $115 million in a series E funding round led by NewView Capital.

- The company plans to deploy a significant portion of the capital in India to increase market share in sectors like BFSI, IT & Telecom, Logistics, and EdTech.

- They aim to expand their office in Gurugram and accelerate hiring in Bengaluru and Mumbai over the next five years, creating hundreds of high-value tech jobs.

- Coralogix's Indian portfolio includes customers like Postman, Jupiter Money, Meesho, BookMyShow, and others.

- The funding round values the Tel Aviv-based firm at over USD 1 billion and saw participation from Canada Pension Plan Investment Board and NextEquity.

Read Full Article

21 Likes

Eu-Startups

112

German VC platform Realyze Ventures announces successful first closing with assets of around €50 million

- Cologne-based Realyze Ventures completes the first closing of its fund with assets totaling around €50 million.

- The fund includes investments from partners like Art-Invest Real Estate, Cordes & Graefe, Goldbeck, MOMENI, and ZECH, along with an institutional investor from the European banking sector.

- Realyze Ventures, founded in 2023, focuses on European technology startups driving climate and process efficiency in construction and real estate.

- The General Partners aim to seize promising opportunities and deliver high returns for investors, with a collective investment experience exceeding €120 million.

- The investment platform targets technology-driven solutions for decarbonisation, digitalisation, and efficiency improvement in the real estate, construction, and skilled trades sectors.

- Realyze Ventures emphasizes being a sector specialist with deep industry access and market integration, aiming to transform Europe's construction and real estate sectors sustainably.

Read Full Article

6 Likes

Bloomberg Quint

305

Image Credit: Bloomberg Quint

Rupee Closes At Over Two-Month Low Against US Dollar

- The Indian rupee closed at a two-month low of 86.24 against the US dollar on Tuesday.

- Rupee opened flat at 86.07 against the US dollar.

- Brent oil prices rose to $74.04 per barrel due to Israel-Iran conflict concerns and soft economic data from China.

- The US dollar strengthened with the DXY climbing above 98.2 amid rising geopolitical tensions in the Middle East.

- President Trump's call for the evacuation of Tehran and Israeli airstrikes on Iran raised fears of a wider regional conflict.

- Markets are watching for potential disruptions to energy flows and trade routes, along with inflation risks from elevated oil prices.

- Focus now shifts to the Federal Reserve's policy decision, with rates expected to stay unchanged.

Read Full Article

18 Likes

For uninterrupted reading, download the app