Funding News

TechCrunch

269

Image Credit: TechCrunch

Here are the 24 US AI startups that have raised $100M or more in 2025

- In 2024, 49 AI startups in the U.S. raised $100 million or more, with three raising more than one mega-round and seven exceeding $1 billion.

- In 2025, the AI industry's momentum in the U.S. continues, with multiple billion-dollar rounds and more AI mega-rounds in Q1 compared to 2024.

- Notable U.S. AI startups raising funds in 2025 include Glean, Anysphere, Snorkel AI, LMArena, TensorWave, SandboxAQ, Runway, OpenAI, Nexthop AI, Insilico Medicine, and Celestial AI.

- Other notable fundraisers in 2025 include Lila Sciences, Reflection.Ai, Turing, Shield AI, Anthropic, Together AI, Lambda, Abridge, Eudia, EnCharge AI, Harvey, ElevenLabs, and Hippocratic AI.

- Various rounds led by prominent investors such as Thrive Capital, Lightspeed Venture Partners, General Atlantic, SoftBank, and Sequoia, among many others, fueled the AI ecosystem growth in the U.S.

- Several companies surpassed valuation milestones, with Glean valued at $7.25 billion, Anysphere at nearly $10 billion, OpenAI at $300 billion, and Anthropic at $61.5 billion.

- The U.S. landscape for AI funding is diverse and includes sectors like enterprise search, AI coding tools, data labeling, AI models, AI infrastructure, autonomous systems, and more.

- AI startups in 2025 are attracting significant capital, highlighting the continued interest and growth opportunities in the AI space across various verticals.

- The AI investment trend is expected to reflect a positive trajectory for the remainder of the year as the industry witnesses robust funding activities and valuation expansions.

- The wide array of fundraising rounds and increasing valuations signify the eagerness of investors to back innovative AI solutions and technologies in the U.S. market.

Read Full Article

16 Likes

Pymnts

22

Image Credit: Pymnts

Pelico Raises $40 Million for AI-Powered Supply Chain Orchestration Platform

- Pelico has raised $40 million to accelerate the growth of its AI-powered supply chain orchestration platform for manufacturing operations in North America.

- The platform is deployed in more than 15 countries, supporting companies that operate over 1,000 factories worldwide.

- Pelico's customers include half of the top 10 aerospace and defense companies.

- This funding round brought Pelico’s total funding to $72 million.

- The AI-powered co-pilot is designed to create a connected, real-time view of supply chain operations.

- The platform synchronizes teams and processes, enhancing decision-making, collaboration, and responses to disruptions.

- Companies using the platform have seen significant improvements, including a 40% reduction in parts shortages and maintenance times, and a 15% increase in on-time deliveries.

- General Catalyst led the funding round, highlighting Pelico's potential to transform operational data into actionable insights.

- Businesses, including manufacturers, are increasingly investing in technologies to improve procurement processes.

- Cleo recently acquired DataTrans Solutions to enhance procurement automation in the supply chain orchestration space.

- The collaboration aims to ensure resilient and intelligent supply chains amid global manufacturing challenges.

- Investments in upgrading procurement technology are on the rise, with 42% of manufacturers currently investing in this area.

- Pelico's platform aims to address the urgent challenge of supply chain fragmentation and enhance operational efficiencies.

- The company's AI-powered solution has shown tangible benefits for companies across various industries.

- The Pelico platform emphasizes the importance of real-time data for informed decision-making and improved supply chain performance.

Read Full Article

1 Like

TechCrunch

319

Image Credit: TechCrunch

Seed to Series C: What VCs actually want from AI startups

- AI investments hit $110 billion in 2024, making the funding landscape in 2025 highly competitive.

- At TechCrunch Sessions: AI, experienced investors outlined their criteria for evaluating AI startups from seed to Series C.

- Investors advise founders to focus on building trust, surviving the hype cycle, and preparing for copycats once product-market fit is achieved.

- VCs emphasize the importance of real relationships over the perfect pitch.

- Challenges of competing with major players without being overwhelmed are discussed.

- Consumer focus and swiftness still play a crucial role in the success of B2B AI.

- The impact of agents and automation on reshaping the startup landscape is highlighted.

- Equity podcast releases weekly news roundup episodes.

- Equity podcast, TechCrunch's flagship show, is produced by Theresa Loconsolo and airs on Wednesdays and Fridays.

- Listeners can subscribe to Equity on various platforms like Apple Podcasts, Overcast, and Spotify.

- Follow Equity on social media @EquityPod and Platforms X and Threads.

- For those who prefer reading, full episode transcripts are available in the archive of episodes.

Read Full Article

18 Likes

TechCrunch

269

Image Credit: TechCrunch

Scale smarter: 5 days left to save up to $210 on your TechCrunch All Stage pass

- TechCrunch All Stage pass prices are set to increase after June 22 at 11:59 PM PT.

- Founders can save $210 and investors can save $200 by registering before the deadline.

- The summit on July 15 at Boston's SoWa Power Station is designed for founders and investors looking to scale and grow.

- Attendees can expect tactical breakouts, real investor feedback, networking opportunities, and a live pitch showdown.

- The event features two stages focusing on early-stage and Series A+ strategies.

- Topics covered include The 2025 VC Playbook, Inception Stage building, Founder challenges, Capital acquisition for AI-native startups, and democratization of investing through technology.

- Key speakers at the summit include representatives from Sapphire Ventures, Underscore VC, NEA, Index Ventures, and more.

- Register before June 22 to save up to $210 and access valuable insights and networking opportunities.

Read Full Article

16 Likes

Eu-Startups

170

French HealthTech company DESKi raises €5.2 million for its cardiac imaging software

- French HealthTech company DESKi raises €5.2 million in a Seed round to support the global launch of its FDA-approved cardiac imaging software, HeartFocus.

- The funding was led by Racine2 with participation from various funds and investors.

- HeartFocus was founded in 2016 by brothers Bertrand Moal and Olivier Moal and leverages AI algorithms trained on over 10 million data points.

- The software aims to improve early heart disease detection and bring life-saving diagnostics to more providers.

- DESKi collaborates with US and European platforms to expand the reach of HeartFocus globally.

- Recent milestones include FDA clearance for HeartFocus and the implementation of a Predetermined Change Control Plan for software updates.

- Clinical studies showed that HeartFocus AI can assist first-time users in capturing quality heart scans.

- Heart disease is a leading cause of death globally, and DESKi aims to address limited access to echocardiography with AI guidance.

- BNP Paribas Développement supports HeartFocus for its potential to transform cardiovascular disease management worldwide.

- HeartFocus enables healthcare professionals to conduct cardiac ultrasounds after minimal training, expanding early diagnosis capabilities.

- DESKi's announcement signifies a step toward making life-saving diagnostics more accessible and cost-effective in various care settings.

- Épopée Gestion also backs DESKi's international expansion efforts.

- The funding round marks progress for DESKi in advancing healthcare technology and enhancing patient care.

- DESKi's innovative AI products, including HeartFocus, aim to revolutionize cardiovascular disease detection and management.

- DESKi's vision is to revolutionize healthcare by making cutting-edge diagnostics widely available.

- The support and investments received by DESKi indicate growing recognition of the company's potential impact on healthcare systems globally.

Read Full Article

10 Likes

Siliconangle

363

Image Credit: Siliconangle

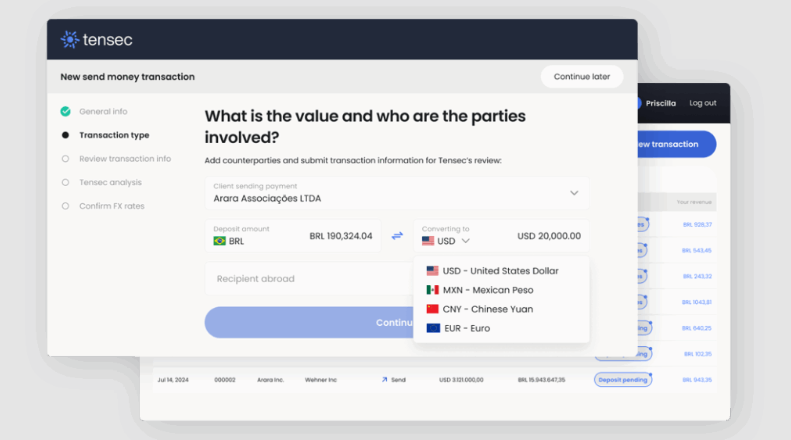

Tensec to deliver real-time, cross-border payments to smaller businesses after raising $10M in funding

- Tensec Holdings Ltd. secures $12 million in seed funding to revolutionize financial services for small and medium-sized businesses by offering real-time cross-border payments and banking services.

- The funding round was led by Costanoa Ventures with participation from Quiet Capital, WillowTree Investments, Cambrian VC, Ignia Partners, Montage Ventures, Renegade Partners, and Endeavor Scale Up Ventures.

- Tensec targets global trading companies, trade compliance consultants, investment firms, and foreign exchange brokers to enable seamless cross-border transactions and provide banking services to small and medium-sized businesses (SMBs).

- The startup has developed a global financial infrastructure platform to integrate international payments, FX services, treasury, loans, and other services at lower costs compared to traditional banks.

- Tensec aims to empower global trade companies to offer financial services directly to their partners, making global commerce faster, cheaper, and more accessible.

- The traditional SWIFT network for cross-border payments is deemed inefficient, prompting Tensec to provide modern financial tools for SMBs and global trade partners.

- Tensec simplifies global payments, hedging, and trade finance services into a single platform, enabling quick client onboarding and efficient transactions in over 150 countries and 70 currencies.

- The platform offers FX hedging services, treasury tools, customizable pricing models, and AI-powered compliance checks, enhancing efficiency for trading companies and their SMB clients.

- Tensec's services allow companies engaged in global trade to offer financial innovations, addressing the underserved needs of SMBs and aiding in their growth.

- Partnership with local banks, like Stearns Financial Services Inc., facilitates the delivery of payments and banking services through Tensec's platform.

- Tensec's platform integration is swift, requiring minimal setup time, and supports risk assessment and compliance checks to enhance security.

- Amy Cheetham from Costanoa Ventures praises Tensec for bridging the gap in financial services, providing new revenue opportunities for trading companies and modern tools to SMBs.

Read Full Article

21 Likes

Eu-Startups

265

Swedish FinTech startup Polar raises €8.6 million for its monetisation platform

- Swedish FinTech startup Polar raises €8.6 million in a Seed funding round led by Accel.

- The funding will support expanding Polar's team across Europe and investing in growth, developer relations, and partnerships.

- Notable investors include Guillermo Rauch, Tobi Lütke, and Harley Finkelstein.

- Polar is an open-source monetisation platform for digital products and SaaS, founded in 2022.

- The platform has gained rapid traction, with over 17,000 signups and 5,300 GitHub stars.

- Polar aims to address the challenge of monetizing software in the evolving landscape of SaaS and usage-based pricing models.

- It targets solo developers and early-stage startups, offering features like usage-based billing automation and zero boilerplate integrations.

- Polar handles international sales tax, compliance, and fraud protection as a merchant of record, emphasizing community contributions with its open-source foundation.

- The company sees a future where software development is accessible, but monetization remains a significant hurdle.

Read Full Article

15 Likes

TechBullion

399

Image Credit: TechBullion

Junction Announces Major New Investment, Senior Appointments, and Rebrand to Drive Travel Tech Innovation

- Junction, formerly Snowfall, secures a significant investment from Korelya to drive travel tech innovation.

- The company undergoes a rebrand and appoints new senior executives to focus on its core travel technology offering.

- The investment enables Junction to concentrate on creating the best multimodal marketplace for the travel sector.

- New senior appointments include Herve Gilg as deputy CEO and Matthew Turner as Chairman of the Board.

- The rebranding from Snowfall to Junction reflects the company's commitment to seamless multimodal travel solutions.

- Junction aims to provide a one-stop global platform for AI-native customers in the travel industry.

- CEO Stefan Cars emphasizes the company's focus on smarter technologies and creating effortless travel experiences.

- The company is poised for growth with new capital, management, and clients like Oppo and Ragusa Xpress.

Read Full Article

24 Likes

Global Fintech Series

224

Image Credit: Global Fintech Series

MasterQuant Introduces AI Bot for Smarter, Automated Trading Success

- MasterQuant has launched an innovative investment platform powered by an artificial intelligence trading bot.

- The platform aims to make smart investments accessible to all investors by leveraging advanced AI technology.

- The AI bot conducts real-time market analysis, identifies profitable opportunities, and generates optimized trading strategies.

- It dynamically adjusts risk exposure and diversifies assets to enhance overall effectiveness.

- The bot continuously optimizes trades and shows promising results in generating profits.

- MasterQuant's Director of Communications highlighted the demand for a smarter investing method.

- The platform initially focuses on the cryptocurrency market and plans to expand into forex and traditional stocks.

- MasterQuant represents a new era in investing by utilizing deep learning technology for wealth development.

Read Full Article

13 Likes

Alleywatch

269

Octaura Raises $46.5M to Digitize Electronic Trading in Syndicated Loan and CLO Markets

- Octaura raises $46.5 million to digitize electronic trading in syndicated loan and CLO markets, addressing inefficiencies and lack of liquidity in these markets.

- The platform combines real-time trading capabilities, data analytics, and connectivity solutions, capturing 4.6% of total secondary loan trading volume in just two years.

- Octaura offers an electronic trading platform for syndicated loans and CLOs, revolutionizing how these markets trade through improved accessibility and streamlined processes.

- The funding round was backed by investors like Moody’s Analytics, major banks, and new investors like Barclays, Deutsche Bank, and BNP Paribas.

- Octaura's business model includes transaction-based fees for its trading platform and subscription-based offerings for data and analytics products.

- The company plans to continue penetrating the leveraged loan market, launch its CLO trading platform, and develop innovative data and analytic solutions.

- Octaura's focus on addressing client challenges and the platform's proven use case were key factors that led investors to support its growth.

- The company aims to digitize the credit market through innovation, expanding its market share and product offerings in the coming months.

- Octaura's CEO, Brian Bejile, started the company to modernize electronic trading in syndicated loans and CLOs, inspired by his experience as a CLO trader.

- The platform has shown rapid growth, attracting dealers and buy-side firms and quickly capturing a significant percentage of market trading volume.

Read Full Article

16 Likes

The Robot Report

426

PrismaX launches with $11M to scale virtual datasets for robotics foundation models

- PrismaX launches with $11M funding to address challenges in physical AI and robotics industry.

- The platform aims to provide reliable data for training artificial intelligence models for robots.

- PrismaX is building a robotics teleoperations platform to create an ecosystem for diverse and scalable datasets.

- The company is developing a standard for fair data use and revenue sharing in the industry.

- The founders emphasize the importance of human capital in building models for autonomous robots.

- PrismaX focuses on data, teleoperation, and models as foundational elements for robotics advancements.

- The company plans to create a 'data flywheel' by improving data quality, teleoperation efficiency, and real-world data collection.

- PrismaX plans to build humanoid robots capable of various tasks and aims to expand its fleet.

- a16z CSX led the $11M funding round for PrismaX, with several other investors participating.

- The funding will be used to enhance teleop standards, expand data-collection portal, and attract AI enthusiasts.

- PrismaX's launch coincided with a16z's CSX Demo Day on June 3.

- The company intends to empower robotics firms by providing access to teleoperators for scaling visual datasets.

- PrismaX seeks to accelerate the building of smarter machines through community participation.

- PrismaX envisions creating an ecosystem that promotes innovation and collaboration in the robotics industry.

- The company aims to drive breakthroughs in robotics by harnessing advanced technologies and decentralized approaches.

- PrismaX is set to revolutionize data collection, teleoperation standards, and model development in AI and robotics.

Read Full Article

25 Likes

Futurefundraisingnow

368

What’s wrong with expert opinions about fundraising?

- Expert opinions on fundraising can sometimes be overwhelming due to providing too much information, making it challenging for the questioner to act on the advice.

- Experts tend to suffer from the Curse of Knowledge, attempting to share all their expertise when asked a question, resulting in answers that may not be practical or actionable for the questioner.

- When receiving highly specific questions like choosing between red and blue for fundraising, experts often provide extensive background information rather than concise and practical guidance.

- Experts are advised to offer focused and specific answers to questions, like stating a color choice and providing a couple of reasons to support it, to help questioners with actionable advice.

- Questioners are encouraged to frame their inquiries to elicit precise responses from experts and to ask follow-up questions if initial responses are too overloaded with information.

Read Full Article

22 Likes

Analyticsindiamag

247

Image Credit: Analyticsindiamag

GenAI startup Darwix AI Secures $1.5 million in Funding

- GenAI platform Darwix AI secures $1.5 million in funding from Rebalance, IPV, JITO Incubation and Innovation Foundation, Growth Sense, Growth91, Ankit Nagori, and Amit Lakhotia.

- Darwix specializes in omnichannel GenAI solutions for conversational intelligence in enterprise sales discussions using a large language model (LLM) technology.

- Primary clients in banking, financial services, and retail sectors in the US, India, and the Middle East.

- Startup founded by IIM graduates Ajay Sethi and Hanit Awal aims to enhance product development and market reach with funding.

- Funds to be utilized for team expansion, product development, and diversifying omnichannel platform applications.

- Darwix AI’s Transform+ platform offers conversational insights, agent support, and automation across voice, chat, email, and in-person interactions.

- Focus on creating a unified, generative AI stack for enhanced customer interactions with actionable intelligence and automation.

- Investors like Rebalance backing the startup's vision for smarter, contextual sales conversations in BFSI and retail sectors.

- Rebalance emphasizes investment in startups led by women and diverse entrepreneurs, providing up to $200K in pre-seed or seed capital.

Read Full Article

14 Likes

Eu-Startups

22

“From the shop floor to the boardroom” – Paris-based Pelico raises €34.7 million to advance GenAI in its Supply Chain Orchestration platform

- Pelico, a French Supply Chain Orchestration platform, has raised €34.7 million in a strategic financing round led by General Catalyst to expand in North America.

- The funding round, which included investors 83North and Serena, brings Pelico’s total funding to €62.6 million.

- Founded in 2019, Pelico aims to address operational challenges in supply chain management by providing a real-time, AI-powered platform.

- The company has offices in Paris, Miami, and Frankfurt and caters to global manufacturers like Airbus, Safran, Eaton, and Daikin.

- Pelico's platform has enabled customers to reduce parts shortages by 40%, increase on-time deliveries by 15%, and cut MRO cycle times by 40%.

- The company has seen significant growth, with 300% revenue increase year-over-year, and has tripled its headcount since 2022.

- Pelico plans to use the recent funding to accelerate expansion in North America, hire in data science and engineering, and invest in Agentic AI for smarter supply chains.

- Investors like General Catalyst and Microsoft recognize Pelico's potential to transform manufacturing operations through AI-driven insights and optimization.

Read Full Article

1 Like

Ketto

188

Image Credit: Ketto

Your Guide to The Best Hospitals in Ahmedabad

- When looking for quality medical care in Ahmedabad, it can be overwhelming due to the numerous hospitals available.

- Marengo CIMS Hospital in Ahmedabad is renowned for various medical achievements, including pioneering heart transplants and advanced cardiac care.

- Zydus Hospital is another top medical institution known for its super-speciality services and comprehensive care across different specialities.

- Sterling Hospitals, Sindhu Bhavan, excels in gastro sciences, oncology, and robotic surgery, offering advanced treatments for various health conditions.

- KD Hospital, also known as Kusum Dhirajlal Hospital, stands out for its multi-speciality services, especially in cardiology, oncology, and joint replacements.

- Shalby Hospitals is a leading healthcare provider in Ahmedabad, specializing in orthopaedics, cardiac sciences, and advanced surgical procedures.

- Lifeline Hospital is noted for its expertise in spine surgery, joint replacements, and comprehensive care across multiple disciplines.

- Narayana Hospital offers advanced medical care in haemato-oncology, rheumatology, cardiac sciences, and paediatrics, ensuring multidisciplinary care.

- Life Care Hospital is a trusted healthcare facility known for its cardiac care, neurology, orthopaedics, and patient-centric services.

- Kaizen Hospital, being the first NABH-accredited gastroenterology super-speciality hospital in Western India, provides cutting-edge care in gastrointestinal disorders and surgery.

Read Full Article

11 Likes

For uninterrupted reading, download the app