Funding News

Siliconangle

224

Image Credit: Siliconangle

Startup Typedef gets $5.5M seed funding to build customized data pipelines for AI model workloads

- Data processing startup Typedef Inc. secures $5.5 million in seed funding to expedite AI application pilot deployments.

- The funding was led by Pear VC, with participation from Verissimo Ventures, Monochrome Ventures, Tokyo Black, and other investors.

- Typedef targets a $200 billion market for AI infrastructure, emphasizing efficient data platforms for AI workloads.

- Their platform caters to scaling data pipelines essential for large language models, aiding rapid AI deployment for value assessment.

- The startup addresses 'pilot paralysis' prevalent in AI projects, aiming to enhance predictability and operational efficiency.

- Co-founder Yoni Michael highlights the challenge in moving AI workloads to production due to legacy data platform limitations.

- Typedef's infrastructure is designed to handle the intricacies of large language models efficiently, ensuring reliable AI workflows.

- The platform offers simplicity through serverless operations, allowing quick data pipeline creation for customers without infrastructure setup.

- Early adopters like Matic benefit from Typedef's platform to streamline production AI workflows and improve cost savings and compliance.

- Investors view Typedef as pivotal in simplifying reliable and scalable AI infrastructure, ushering in a new era in AI technology.

Read Full Article

13 Likes

SiliconCanals

103

Image Credit: SiliconCanals

Dutch firm Rival Foods secures €10M to boost clean-label plant-based meat production

- Dutch food-tech company Rival Foods secures €10M in Series B funding round.

- New investors in the funding round include APG, Pymwymic, ROM Utrecht Region, and existing investor PeakBridge.

- Pymwymic is a community of European wealth holders backing sustainable investments.

- Funding will enable Rival Foods to double production capacity, scale manufacturing technology, and reduce production costs.

- Rival Foods addresses challenges in plant-based meat market like high prices and undesirable taste with patented technology.

- Plant-based meat only accounts for 5% of meat consumption in Europe.

- Investment marks a milestone in Rival Foods' mission to mainstream high-quality plant-based meat.

- Rival Foods, founded in 2019, focuses on supplying whole-cut plant-based products to chefs and food service providers.

- CEO Birgit Dekkers aims to reshape the future of protein with the support of new investors.

- Shift to alternative proteins can significantly reduce food-related emissions, making plant-based meat vital for sustainability.

- Rival Foods' technology converts simple ingredients into clean-label, protein-rich cuts resembling real meat.

- The company aims to accelerate the adoption of plant-based eating through quality plant-based alternatives.

- Pymwymic community sees Rival Foods as pivotal in accelerating the shift towards a sustainable, plant-powered future.

- Rival Foods collaborates with chefs and consumer brands to enhance plant-based menus and increase the popularity of plant-based eating.

- With the recent funding, Rival Foods is poised to scale rapidly, focusing on taste, texture, and nutrition of plant-based products.

Read Full Article

6 Likes

SiliconCanals

242

Image Credit: SiliconCanals

Sweden’s Polar raises €8.6M to build the open-source monetisation platform for one-developer unicorns

- Polar, a payments infrastructure company based in Stockholm, has raised €8.68M in seed funding led by Accel.

- Notable angel investors who participated in the funding round include Guillermo Rauch, Tobi Lütke, and others.

- Accel, known for backing successful companies like Slack and Spotify, led the round, recognizing Polar's potential in the developer community.

- Polar, founded by Birk Jernström in 2022, simplifies billing implementation for AI-native SaaS businesses.

- Their open-source Merchant of Record solution allows for quick billing integration with just six lines of code.

- The company boasts a growing customer base including Bolt AI, Midday, and more.

- The funding will support Polar in expanding globally, developing new billing tools, and strengthening developer relationships.

- Polar aims to assist developers in monetizing their software efficiently, handling billing and international sales taxes.

- With over 18,000 customers in 100+ countries, Polar experienced significant growth since its billing platform launch in September 2024.

- The company has seen a 120% month-on-month growth in online sales over the last six months.

- Polar's focus on open source and developer-centered products has attracted a community of 16,000 developers using its platform.

- The platform offers automated SaaS entitlements and integrates with tools like Framer, Raycast, and Zapier for upselling opportunities.

- Overall, Polar aims to simplify billing complexities for developers, enabling them to focus on product development and business growth.

Read Full Article

14 Likes

Eu-Startups

256

German FinTech startup NaroIQ raises €5.8 million to establish European fund infrastructure

- German FinTech startup NaroIQ raises over €5.85 million in Seed financing round led by VC investor Magnetic and FinTech VC Redstone.

- The funding aims to expand NaroIQ's digital fund infrastructure, enabling companies to launch and manage ETFs and funds more efficiently.

- NaroIQ addresses the shift towards ETFs replacing mutual funds with a technological solution to level the playing field for smaller fund providers.

- Founded in 2022, NaroIQ focuses on democratizing access to the ETF and fund market through its modular technology platform.

- The startup aims to offer European alternative to the US-dominated ETF landscape by reducing costs and improving digital capabilities for fund providers.

- Outdated manual processes in the European fund market hinder innovation and broader market access, leading to asset concentration among a few providers.

- NaroIQ's digital infrastructure platform reduces costs and time-to-market for launching and managing ETF and fund products.

- The European UCITS and AIF market, representing €22.9 trillion in assets, requires greater digitalization for efficiency and cost reduction.

- NaroIQ's approach aligns with market demand for flexible, digital solutions to decrease operational costs and drive innovation.

- The company plans to invest the raised capital in technical development and regulatory licensing for partner integrations.

- NaroIQ aims to close the gap in the European ETF market dominated by a few players by providing a resilient and high-performance fund infrastructure.

- The funding round was supported by existing VC investors like General Catalyst to propel NaroIQ's support for smaller fund providers entering the market.

- The company's API-first and cloud-native platform is designed to enhance efficiency, real-time transparency, and cost savings in fund servicing.

- NaroIQ's focus on digital solutions highlights the need for innovation to address the disconnect between asset growth and profit margins.

- The startup plans to drive the next wave of innovation in fund servicing across Europe and beyond with its modular technology platform.

- NaroIQ's vision includes delivering a powerful European ETF administrator to balance the dominance of US-based issuers in the market.

Read Full Article

15 Likes

Eu-Startups

152

Finnish SaaS startup Swarmia secures €10 million to power engineering productivity

- Helsinki-based SaaS startup Swarmia has raised €10 million to enhance engineering productivity with real-time insights into product development.

- The funding round was led by DIG Ventures and Karma Ventures, with participation from notable angel investors like Romain Huët and Cal Henderson.

- Swarmia, founded in 2019, focuses on improving developer productivity and experience for software engineering teams through real-time insights and data-driven decision-making.

- The company helps organizations master the three pillars of engineering effectiveness: business outcomes, developer productivity, and developer experience, aiming for growth and success.

- Software engineering intelligence tools, like Swarmia, are gaining adoption according to Gartner, with expectations to grow significantly in the coming years.

- Many companies struggle to adopt modern practices due to lack of data, which Swarmia addresses by combining quantitative metrics with qualitative survey data.

- Swarmia's client portfolio includes well-known companies like Docker, Webflow, Miro, Trustpilot, and Pleo, with plans to expand in the US market.

- The company is praised for redefining software engineering intelligence, offering ease of adoption and unified data sources for engineering leaders in top-tier software firms.

Read Full Article

9 Likes

Fintechnews

166

Image Credit: Fintechnews

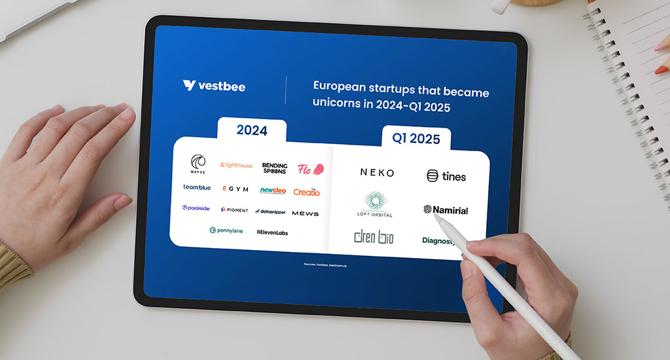

Europe’s Startup Ecosystem Surges With Over 600 Unicorns Emerging to Date

- Europe's startup landscape is flourishing, with 606 unicorn companies emerging in Europe since 2020.

- The UK leads in unicorn creation with 185 companies, followed by Germany, France, Sweden, and the Netherlands.

- London is Europe's top unicorn-producing city, fueled by a strong VC environment and fintech sector.

- The fintech sector dominates unicorn creation, with 65 out of 198 European tech unicorns in Q1 2025.

- London hosts six of the top ten most valuable fintech startups in Europe.

- Challenges in European fundraising include a growth-stage funding gap and reliance on US capital.

- Talent shortage, particularly in green tech and digital innovation, poses a challenge for European startups.

- Regulatory fragmentation in Europe's single market complicates cross-border growth for startups.

- Top valuable fintech startups in Europe include Revolut, Klarna, and Checkout.com.

- Late-stage investments in Q1 2025 amounted to US$3.6 billion for European startups.

- Geographic distribution shows strong unicorn hubs in cities like London, Berlin, Paris, and Stockholm.

- Significant rebound in unicorn creation in early 2025, with six new unicorns established in Q1.

- Fintech unicorns such as Revolut and Klarna hold banking licenses to enhance profitability.

- Europe faces challenges in retaining top talent and navigating regulatory differences among 27 national systems.

- Berlin benefits from a rich talent pool in software-driven industries, while Stockholm thrives due to digital infrastructure.

- Despite progress, Europe struggles with funding gaps and talent shortage, hindering tech innovation.

Read Full Article

10 Likes

Insider

299

Image Credit: Insider

TCV cofounder Jay Hoag slams VCs' AI herd mentality: 'like 7-year-olds playing soccer'

- Venture capitalist Jay Hoag criticized VCs' blind rush toward AI, likening the behavior to kids on a soccer field.

- Hoag expressed concern about the large sums poured into startups during the 2020-2021 tech boom.

- He believes that the hyperfocus on AI is diverting attention and capital away from other sectors like consumer internet.

- Hoag, with over four decades in tech investment, co-founded TCV and has backed major companies like Netflix, Expedia, and Spotify.

- He wishes that the AI enthusiasm had not overshadowed the potential of new consumer internet businesses.

- Hoag called for more modesty in the tech investment business regarding the enormous capital being poured into startups.

- In the first quarter, over half of VCs' investments went to AI and machine learning startups.

- Global investments in AI reached $131.5 billion last year, showing significant growth from 2023.

- MIT economist Daron Acemoglu warned of potential waste due to the hype around AI, emphasizing possible economic losses.

- VC Vinod Khosla also expressed concerns about overvaluation in startups and predicted losses in AI investments.

Read Full Article

13 Likes

Eu-Startups

89

Dutch DeepTech startup OrangeQS raises €12 million for its quantum chip testing

- Dutch DeepTech startup Orange Quantum Systems has closed an oversubscribed €12 million Seed round, the largest in the Netherlands' quantum computing sector.

- The round was led by Icecat Capital, with support from Cottonwood Technology Fund, QBeat Ventures, QDNL Participations, and InnovationQuarter Capital.

- Orange Quantum Systems focuses on developing solutions for automated testing and characterisation of quantum chips, aiming to transition to industrial-grade quantum computers.

- Their products streamline quantum chip testing and address challenges related to scalability, precision, and cost-effectiveness.

- OrangeQS MAX, their flagship product, sets new industry benchmarks for high-volume, standardised quantum-chip testing.

- OrangeQS FLEX offers customisable chip-testing solutions, used by various research labs globally.

- OrangeQS Juice, an open-source operating system, simplifies quantum research setup management for labs.

- The investment of €12 million will be used to build faster test machines for quantum chips, reducing testing time from weeks to days.

- OrangeQS aims to help chip makers double the number of reliable quantum bits every few years, analogous to Moore's Law in classical computing.

- This investment reflects the importance of Orange Quantum Systems' technology for the advancement of quantum computing.

Read Full Article

5 Likes

SiliconCanals

40

Image Credit: SiliconCanals

Delft’s Orange Quantum Systems raises €12M: CEO Garrelt Alberts on slashing quantum chip testing time and enabling Moore’s Law scaling

- Delft-based Orange Quantum Systems raises €12M in an oversubscribed seed round, the largest in the Netherlands' quantum computing sector.

- The round was led by Icecat Capital, with support from various funds like Cottonwood Technology Fund and QBeat Ventures.

- Orange Quantum Systems plans to use the funds to build faster test machines for quantum chips, aiming to reduce testing time from weeks to days.

- Faster testing will enable chip makers to double the number of reliable quantum bits, driving progress towards a quantum version of Moore’s Law.

- Testing quantum hardware is crucial as chips become more complex, demanding scalable, accurate, and affordable testing solutions.

- Orange Quantum Systems addresses testing challenges with OrangeQS MAX, a system designed for speed, automation, and scalability in quantum chip testing.

- The company aims to halve the test time per qubit every two years by continuously improving their testing process.

- OrangeQS MAX allows leading quantum computer manufacturers to release 30-50% of their R&D teams from test equipment duties.

- Orange Quantum Systems, founded in 2020 as a spin-off of TNO and QuTech, develops solutions for automated quantum chip testing.

- The company's products, including OrangeQS MAX and OrangeQS FLEX, enhance testing capabilities for quantum chips in various research and industry settings.

- The company envisions supporting global leaders in quantum computing with innovative test systems, preparing for a quantum-driven future.

- OrangeQS aims to provide high-throughput test solutions for the latest generation of quantum chips once error-corrected quantum computers become a reality.

Read Full Article

2 Likes

SiliconCanals

408

Image Credit: SiliconCanals

Dutch energy startup HeatLeap secures €1M to bring gas-free heating to social housing: Know more

- Dutch energy startup HeatLeap secures €1M in funding to revolutionize heating in social housing with gas-free technology.

- The investment round was led by Arket Ventures and supported by several other investors.

- The funding will enable HeatLeap to scale its operations and roll out their technology at select housing corporations this summer.

- The investment marks a critical milestone in HeatLeap's growth, offering a solution that eliminates gas reliance and addresses energy poverty.

- The capital will support the commercial rollout, infrastructure development, and operational expansion of HeatLeap's smart heating solution.

- HeatLeap's technology aims at transforming social housing units with sustainable, grid-conscious heat systems.

- The startup offers gas-free heating systems for renovated homes, aligning with the Netherlands' climate goals.

- The iCV 1.0 system uses existing pipes and radiators, a heat pump, and heat storage for home and water heating.

- The modular system allows phased implementation and quick installation with minimal disruption.

- For residents, the system offers energy cost stability, easy operation, and space-saving installation in the attic.

- HeatLeap continues to enhance its system with features like battery storage and smart grid integration.

- The company contributes to the country's goal of reducing CO2 emissions and becoming climate-neutral by 2050.

- HeatLeap was founded in 2020 with a focus on developing intelligent, climate-neutral heating systems for social housing.

- Their technology supports housing corporations in upgrading to sustainable energy systems without major changes.

- HeatLeap's system transition properties to sustainable heating solutions quickly and efficiently.

- The startup's innovation stands out for its grid-conscious heat systems and support for broader energy goals.

Read Full Article

24 Likes

Economic Times

364

Image Credit: Economic Times

Oben Electric raises Rs 50 crore; total Series A funding hits Rs 100 crore

- Oben Electric has raised an additional Rs 50 crore in an extended Series A funding round, bringing the total Series A funding to Rs 100 crore.

- The funding will support growth, expand the distribution network to over 150 showrooms in 50 cities, and fast-track product development for the 'O100' platform under Rs 1 lakh.

- Part of the funds will be used to scale up the Bengaluru manufacturing facility and strengthen after-sales service network.

- New and existing investors like Helios Holdings, Sharda family office, Kay family, and others participated in the latest funding round.

- Oben Electric's Founder and CEO, Madhumita Agrawal, emphasized expanding the retail footprint and innovation roadmap.

- The company aims to democratize electric motorcycles for the mass market with platforms like O100.

- The funding, backed by vertical integration and a resilient supply chain, prepares Oben Electric for scalability, impact, and growth opportunities.

- Oben Electric has received a total capital infusion of Rs 200 crore so far.

- Following the initial Series A fundraise, Oben Electric expanded with 37 retail outlets across 26 cities in 13 states, including key markets like Punjab, Gujarat, MP, UP, Telangana, Chhattisgarh, and Odisha.

Read Full Article

21 Likes

Eu-Startups

22

German AI startup Mercanis raises €17.3 million for its Agentic-AI procurement solution

- German AI startup Mercanis, based in Berlin, raises over €17.3 million in its latest Series A round to strengthen their Agentic-AI procurement solution and expand internationally, including entry into the U.S.

- The funding round was led by new investors Partech and AVP, with additional support from existing investors like Signals.VC, Capmont Technology, and Speedinvest, as well as business angels.

- Mercanis, founded in 2020, aims to revolutionize procurement processes with its Agentic-AI Procurement Suite, combining procurement, supplier management, and contract management.

- The AI solution offers significant process savings, efficiency gains, and return on investment, leveraging intelligent agents and AI for data analysis.

- The cloud-based platform includes modules for spend analytics, sourcing processes, supplier management, and contract management, along with the Mercu AI Co-Pilot for task automation.

- Clients like GASAG, BASF-Coatings, Goldbeck, Wilson, and Brose have benefited from Mercanis' solutions, with positive feedback on improved efficiency and decision-making.

- Investors and industry experts acknowledge Mercanis' progress, with Partech and AVP emphasizing the platform's capabilities and potential for becoming a market leader in procurement.

- Overall, Mercanis' funding success and technology advancements have positioned them as a key player in reshaping procurement operations for businesses globally.

Read Full Article

1 Like

TechCrunch

172

Image Credit: TechCrunch

After Shopify bought his last startup, Birk Jernström wants to help developers build one-person unicorns

- Birk Jernström aims to support developers in creating one-person billion-dollar companies through his new startup Polar, a platform for 'one-person unicorns.'

- Polar stands out by focusing on developers' needs, offering a 'Merchant of Record' service to handle billing and taxes, enabling global sales from day one with minimal code implementation.

- Accel led Polar's $10 million seed round, recognizing the opportunity in supporting AI-native early-stage businesses free from distractions.

- Jernström's previous startup, Tictail, was acquired by Shopify in 2018 for $17 million in cash, leading him to join Shopify's Shop team before resigning in 2021.

- Polar, launched in September 2024, has gained 18,000 customers, mainly developers monetizing software, with backing from notable entrepreneurs in the tech industry.

- The startup integrates with popular developer tools like Framer and Raycast, aiming to make building and scaling software businesses easier for developers.

Read Full Article

10 Likes

SiliconCanals

292

Image Credit: SiliconCanals

Helsinki’s Supermetrics acquires Amsterdam’s Relay42: CEO Anssi Rusi on unifying marketing intelligence, scaling enterprise and future-proofing with AI

- Helsinki-based Supermetrics acquires Amsterdam-based Relay42, a real-time Customer Data Platform (CDP) to enhance marketing intelligence.

- Relay42 transforms siloed customer data into personalised customer journeys for business growth.

- Relay42 enables strong customer relationships through smart technology and seamless customer experiences.

- Major brands like Air France, KLM, and Levi’s use Relay42 for real-time customer understanding and meeting needs.

- The acquisition aims to revolutionize marketing by addressing data overload and enabling smarter analysis.

- The combination of Supermetrics and Relay42 technologies creates an all-in-one marketing intelligence platform.

- The unified platform connects data performance, customer behavior, and revenue outcomes for efficient analysis.

- Both Supermetrics and Relay42 prioritize privacy-by-design and user-friendly AI in their solutions.

- Customers can expect integrated AI-powered features for automated data analysis and journey optimization.

- The success of the acquisition will be measured by seamless integration and customer growth and results.

Read Full Article

17 Likes

Economic Times

3.8k

Image Credit: Economic Times

IPO-bound BlueStone geared for unicorn tag

- Wealth management arms of 360 One and Centrum Wealth are facilitating secondary deals valued at Rs 300–350 crore for BlueStone ahead of its IPO, valuing the company at Rs 10,500 crore ($1.2 billion).

- RB Investments will exit BlueStone through the deals with an expected return of 10–12x on its investment; it had backed the company between 2016 and 2019.

- Interest from investors led to the secondary deals, with BlueStone expected to finalize IPO pricing soon.

- Private wealth managers are pooling investments for clients, often including family offices and high net worth individuals, before public issues.

- BlueStone's IPO includes a fresh capital raise of Rs 1,000 crore and an offer-for-sale component involving 24 million shares from existing investors.

- BlueStone closed a funding round worth Rs 900 crore in August 2024 and raised Rs 40 crore in debt in May 2025.

- Investors have shown interest in the jewellery sector, following Tata Group's acquisition of CaratLane and Giva's talks for a financing round.

- BlueStone reported Rs 1,266 crore in revenue in fiscal 2024, a 64% increase over the previous year, with a net loss of Rs 142 crore in that fiscal year.

Read Full Article

27 Likes

For uninterrupted reading, download the app