Funding News

Eu-Startups

291

Spanish clean energy startup Tether secures €1.3 million to turn EVs into the “world’s largest connected battery”

- Barcelona-based clean energy startup Tether raises €1.3 million to enhance grid resilience and efficiency.

- Funding secured in a pre-Seed round led by Draper B1 and K Fund, with support from other investors.

- Tether aims to leverage electric vehicles to create a massive connected battery for the grid.

- Founder Luis Medina Rivas emphasizes the importance of flexibility in the evolving energy landscape.

- The technology is designed to reduce CO2 emissions significantly over a car's lifetime.

- Tether's solution involves coordinating the charging patterns of private electric vehicles.

- The company plans to expand into Nordic markets to advance the green energy transition.

- Tether collaborates with EV manufacturers like Audi and Zeekr and charge point operators.

- The team consists of professionals with expertise in engineering, mathematics, and data science.

- The funding will be used to extend partnerships, scale teams, and enhance integrations.

Read Full Article

17 Likes

Eu-Startups

31

Belgian scale-up Bizzy raises €4 million to expand its AI Sales Agent across Europe

- Belgian scale-up Bizzy has raised €4 million in fresh funding to expand its AI Sales Agent across Europe.

- The funding round is led by Fortino Capital with participation from prominent figures from Ghent's tech ecosystem and existing investors like Pitchdrive.

- Bizzy, founded in 2021, aims to save sales professionals' time by automating lead generation using smart technology.

- The platform helps companies identify high-quality prospects from a database of over 34 million European businesses and 76 million professional contacts.

- Over 500 paying customers use Bizzy each month, with more than 10,000 sales professionals utilizing the platform for lead generation.

- Bizzy is expanding its platform to automate the entire go-to-market process, integrating seamlessly with most CRMs and prospecting tools.

- The launch of the AI Sales Agent aims to autonomously identify, qualify, and enrich leads, providing targeted recommendations for sales teams.

- The more the AI Sales Agent is used, the smarter and more tailored its recommendations become.

- Bizzy's focus on smart data and streamlined processes aligns with the evolving landscape of sales technology.

- The company is determined to lead the development of breakthrough solutions for European sales teams with its innovative approach.

- Investors believe in the potential of Bizzy's AI Sales Agent to revolutionize sales processes.

- The expansion of Bizzy's AI Sales Agent signifies the company's commitment to enhancing sales efficiency and effectiveness.

- Bizzy's success and growth reflect the increasing demand for intelligent sales technology in the market.

- The funding will catalyze Bizzy's expansion efforts and contribute to its mission of optimizing sales operations across Europe.

- Bizzy's vision and dedication to leveraging technology to empower sales professionals showcase its potential to drive innovation in the sales industry.

- Bizzy's innovative solutions position it as a key player in reshaping the future of sales technology and strategy.

Read Full Article

1 Like

The Robot Report

332

All3 launches AI and robotics to tackle housing construction

- All3, a London-based company, unveiled its building system integrating AI and robotics to address housing construction challenges in Europe and North America.

- The construction industry spends less on R&D than other sectors, leading to manual labor reliance and skilled worker shortages.

- All3 aims to revolutionize construction with a vertically integrated AI and robotics approach, streamlining processes for faster, cost-effective, and sustainable development.

- The company's technology offers bespoke designs, automated manufacturing, and robotic assembly, particularly suited for inner-city sites and complex projects.

- All3's AI platform facilitates custom building designs and optimized space utilization, enhancing productivity and sustainability in housing construction.

- By using structural timber composites and standard building elements, All3 automates design generation, manufacturing, and robot programming, reducing costs and enhancing efficiency.

- Targeting real estate developers, All3 promises to accelerate project timelines, reduce costs, and minimize carbon impact by integrating AI and robotics across the construction value chain.

- Founded by experienced entrepreneurs, All3 has secured $30 million in funding and plans to commence construction on its first build in Europe in 2025.

- With a focus on delivering end-to-end solutions for multifamily housing, All3 envisions a future where robotic automation dominates construction processes.

- The company's innovative approach to housing construction signifies a significant shift towards AI and robotics-driven solutions in the industry.

Read Full Article

19 Likes

Eu-Startups

188

Northern Gritstone and Parkwalk team up for new EIS fund – will it deliver the UK’s first trillion-euro startup?

- Northern Gritstone and Parkwalk have launched the Northern Universities Venture Fund, an EIS fund to support early-stage science and DeepTech spinouts from Northern English universities.

- The fund targets sectors like quantum computing, AI, engineering biology, and aims to commercialize innovation from the North of England.

- Managed by Parkwalk with €584 million in AUM, the fund is part of efforts to invest in UK university science and technology.

- Northern Gritstone, supporting startups from academic institutions since 2022, has invested in 37 companies in various sectors.

- They raised an additional €58.4 million this year, totaling committed capital to €423 million.

- Northern Gritstone's mission is to balance returns with societal impact, supporting job creation and regional development.

- Parkwalk Advisors, part of IP Group plc, is experienced in university-specific investment vehicles and manages funds for several UK universities.

- The collaboration aims to offer investors access to a pipeline of innovative spinouts.

- The fund leverages Northern Gritstone's university partnerships and aims to drive economic impact.

- High-net-worth individuals can now invest in early-stage university projects through this partnership.

- Creating opportunities for investors to support potential global companies emerging from Northern universities.

- The initiative seeks to encourage regional growth and benefit the UK economy.

- Both parties bring expertise in university commercialization and venture capital to the partnership.

- Lord Jim O’Neill sees the collaboration as a chance to support the next generation of global companies.

- The fund benefits from long-term agreements with partner universities, granting preferred investor access to spinout deals.

- Parkwalk will handle fund management, facilitating investment in early-stage university commercialization projects.

Read Full Article

11 Likes

Siliconcanals

71

Image Credit: Siliconcanals

Belgium’s Bizzy raises €4M to help sales teams stop chasing leads and start closing deals

- Belgium's Bizzy raises €4M in funding to expand its AI Sales Agent across Europe with Fortino Capital leading the round.

- Fortino Capital specializes in growth-stage investments in European SaaS companies, particularly in sales automation and data intelligence platforms.

- Prominent Belgian investors, including founders of Silverfin, Lighthouse, Teamleader, and Henchman, participated in the funding round alongside existing investor Pitchdrive.

- The funding will support the expansion of Bizzy's AI Sales Agent across European markets utilizing its database of over 34 million European businesses and 76 million professional contacts.

- Bizzy's platform automates lead generation for sales teams by identifying, qualifying, and enriching leads with contextual intelligence to improve sales strategies.

- The AI-powered sales platform has over 500 paying customers monthly, 35 employees, and more than 10,000 sales professionals using the platform to find potential customers.

- Co-founder Hendrik Keeris highlights the importance of sales professionals focusing on building relationships rather than spending time on lead lists.

- Bizzy aims to empower every sales team in Europe with the capabilities of its AI Sales Agent.

- The platform integrates with most CRM and prospecting tools, prioritizing proprietary business data models to automate lead generation processes.

- Bizzy has shifted from market intelligence to automating end-to-end go-to-market processes for sales and marketing teams.

- Co-founder Hendrik Keeris emphasizes the need for smart data and streamlined processes in sales, aiming to lead the evolution of sales technology for European sales teams.

Read Full Article

4 Likes

Fintechnews

300

Image Credit: Fintechnews

UBS Invests in Icon Solutions to Advance Payment System Development

- UBS has made an equity investment in UK-based fintech, Icon Solutions, aimed at advancing payment system development.

- The investment round also includes contributions from existing backers Citi and NatWest.

- Pieter Brouwer from UBS emphasized the partnership with Icon Solutions to deliver innovative payment solutions efficiently.

- UBS, along with Citi and NatWest, will contribute to the strategic direction and development of the Icon Payments Framework (IPF).

- Tom Kelleher, Co-Founder of Icon Solutions, highlighted the increasing adoption of IPF by major financial institutions for innovative payments solutions.

- IPF is a development framework that allows banks to build, test, and deploy payment processing solutions proficiently while managing project timelines and costs.

Read Full Article

18 Likes

Eu-Startups

216

Tadaweb secures €17.3 million to arm cybersecurity and defense teams with smarter OSINT

- Luxembourg-based Tadaweb secures €17.3 million to scale its Small Data Operating System for publicly available information (PAI) and open-source intelligence (OSINT), supporting product development and recruiting top talent.

- Arsenal Growth and Forgepoint Capital International lead the investment, with existing investor Wendel participating. Jason Rottenberg and Damien Henault will join the Tadaweb board.

- Tadaweb focuses on transparency, empowering analysts with a Small Data approach and combining technology with human intuition to reshape how organizations utilize digital information.

- Their SaaS platform aids defence, national security, and corporate security organizations across Europe and the U.S.

- OSINT, accounting for 80-90% of information-gathering activities for law enforcement agencies, involves collecting and analyzing publicly available data to support decision-making.

- Tadaweb helps organizations overcome information overload by providing rapid analysis of PAI to access accurate and actionable information in volatile markets.

- Tadaweb's technology augments analysts' Small Data skills with AI to integrate seamlessly with third-party tools, helping users meet crucial priorities like fraud reduction and threat identification.

- Investors are drawn to Tadaweb's Small Data approach, visual query engine, focus on human analysts, and committed management team.

- Tadaweb's funding now totals €34.7 million, with previous investments in 2023 and 2015.

Read Full Article

12 Likes

Medium

269

Image Credit: Medium

How I Turned Investor Escalations into Trust— Cutting 45% with a Product Mindset

- The shift in perspective from managing touchpoints to asking product-style questions transformed investor interactions.

- The author mapped investor experiences similar to how a product manager maps user journeys, focusing on reducing friction in onboarding and follow-ups.

- Through proactive engagement, careful listening, and redesigning touchpoints, escalations on the Fluna investor portal decreased by 45%.

- The improvement was achieved without a major overhaul but by providing a better, more responsive, and human-centered experience.

- Investors seek reliability, clarity, and security, emphasizing the importance of understanding that debt capital involves real individuals.

- The author credits their team and boss, Miguel Sousa Dias, for supporting experimentation and fostering ownership of the process.

- The experience highlighted that investor relations transcends finance, functioning as a product with users, feedback loops, and outcomes.

- Adopting a product mindset focusing on user-centricity, iteration, and journey thinking enhanced the author's problem-solving skills and strategic thinking.

Read Full Article

16 Likes

Medium

44

Image Credit: Medium

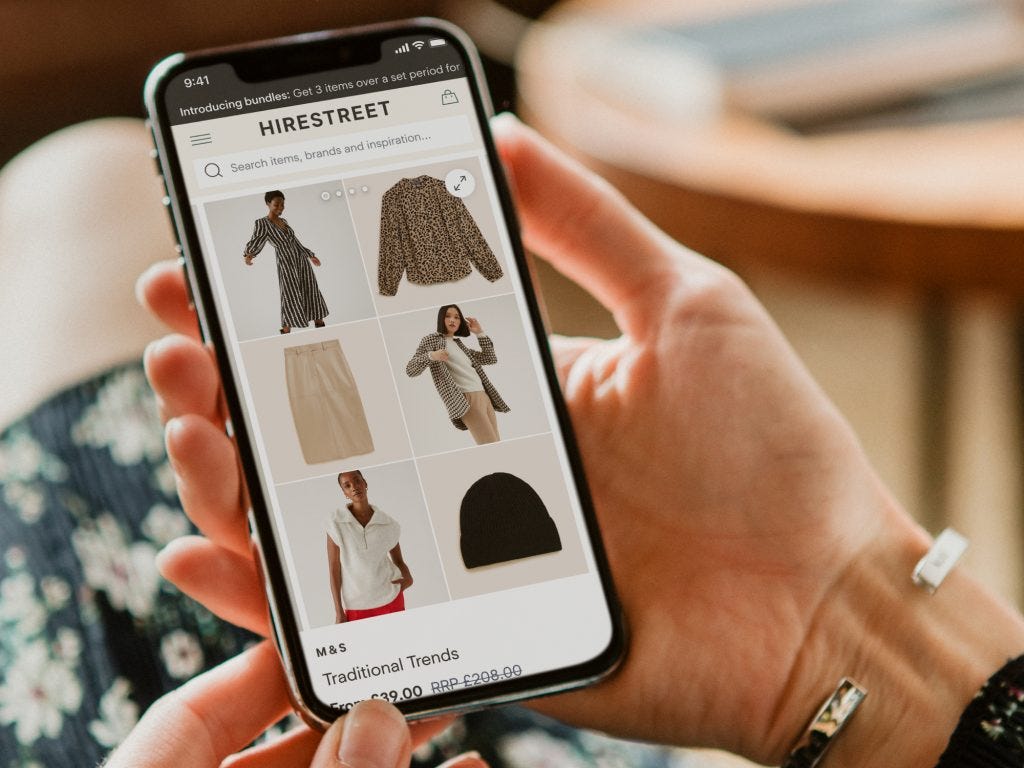

Rental. Reimagined. Why we invested in fashion startup, Hirestreet

- Investment in fashion startup Hirestreet by dmg ventures due to their super sleek rental platform with over 100 UK and international brands and a tiered subscription model for flexibility.

- Founder Isabella started Hirestreet to offer an alternative to fast-fashion, facing challenges but eventually building a strong team and technology platform.

- Hirestreet focuses on younger generation's demand for sustainable and affordable high-street fashion, addressing the issue of fast-fashion consumption.

- Rental provides a lucrative avenue for retailers to increase margins and monetize excess inventory, offering additional revenue streams.

- Hirestreet's partnership with dmg media aligns with the target audience demographic, utilizing platforms like Mail Online, Metro, and Eliza to reach a wide audience.

- Successful collaboration expected with Eliza, a social-first fashion and beauty brand under dmg media, to educate and inspire audience about the benefits of rental.

- Overall, the investment in Hirestreet is driven by its alignment with sustainable fashion trends, retailer profitability, and strategic media partnerships.

Read Full Article

2 Likes

Siliconcanals

332

Barcelona’s Tether raises €1.3M post-Spain blackout to tackle EU’s €135B/year grid instability risk

- Barcelona-based startup Tether has secured nearly €1.3M in pre-seed funding to enhance its AI-coordinated electric vehicle grid integration technology.

- Draper B1 and K Fund led the funding round, with support from other Southern European venture funds focused on impact investments.

- Tether aims to tackle Europe's grid stability challenge by transforming private electric vehicles into distributed battery assets for grid reinforcement.

- The technology coordinates charging schedules of private electric vehicles to reduce CO2 emissions and create revenue streams for OEMs and charge point operators.

- Without immediate action, EU economies could face up to €135B in annual grid instability costs by 2050.

- The funding will aid Tether's team growth and product launches in Nordic markets, Germany, and Belgium.

- Tether plans to expand its engineering and commercial teams and deepen collaborations with automakers and grid operators.

- The company has ongoing pilots with major car manufacturers and charge point operators like Audi and Zeekr.

- Founder Luis Medina Rivas highlights the urgency for flexibility in the grid due to the blackout in Spain and the potential grid instability costs in the EU.

- Luis Medina Rivas, with a background in power and renewable energy engineering, leads Tether, bringing expertise from notable companies and recognitions.

- Tether's development team includes engineers, mathematicians, and data scientists with diverse backgrounds to support its technical approach.

- Raquel Bernal, Partner at Draper B1, praises Tether's mission to bridge electric vehicles with the energy market and its innovative market transformation potential.

Read Full Article

19 Likes

SiliconCanals

22

Image Credit: SiliconCanals

Amsterdam-based Delfio secures €1.5M to take hassle out of wholesale electronics buying

- Amsterdam-based startup Delfio secures €1.5M in pre-seed funding from tech investor Peak to automate international wholesale procurement for consumer electronics.

- Founded in 2025 by Roy Erdmann and Keihan Popal, Delfio targets the €837.4B global procurement market through aggregated purchase orders and supplier bidding systems.

- The funding will facilitate Delfio's expansion across operational hubs in the US, Dubai, Hong Kong, and Amsterdam to scale its infrastructure for global procurement operations.

- Delfio aims to strengthen its network of 35,000 suppliers, serving major brands like Apple, Samsung, and JBL.

- Peak led the investment round, recognizing Delfio's potential to revolutionize B2B procurement through automation and data-driven decision-making.

- Delfio addresses inefficiencies in consumer electronics distribution by consolidating purchase orders, negotiating better pricing, and managing the procurement process to delivery.

- The platform simplifies procurement processes in the gray market by handling quality checks and managing delivery terms and warranty processes.

- The founding team's market experience positions Delfio uniquely to address fundamental problems in the procurement sector through automation and data-driven processes.

- Delfio's multi-continental infrastructure enables the management of procurement processes globally, providing financial backing and ensuring supplier payments within 48 hours.

- The platform focuses on transparency, efficiency, and scalability to empower buyers and suppliers in the consumer electronics distribution market.

Read Full Article

1 Like

Economic Times

24

Image Credit: Economic Times

Mahaveer Finance raises Rs 200 crore from Elevation Capital and others

- Chennai-based NBFC Mahaveer Finance raises Rs 200 crore in an equity funding round led by Elevation Capital.

- Participation also from Banyan Tree Finance and First Bridge Capital.

- Founded in 1981, Mahaveer Finance is run by Praveen and Deepak Dugar.

- Aim to strengthen governance structure, grow business, and invest in technology with new funding.

- Previously raised Rs 75 crore from private equity investors Banyan Tree and First Bridge Capital.

- Planned diversification into new areas like loan against property.

- Grew loan book from Rs 50 crore to Rs 1,000 crore between 2016 and 2025.

- Targeting a loan book of Rs 5,000 crore in the next 2-3 years.

- Works with major lenders such as State Bank of India, HDFC Bank, and AU Small Finance Bank.

- Plans to offer business loans with an average ticket size of Rs 10-15 lakh through branch-led model.

- Currently operational in Tamil Nadu, Andhra Pradesh, Telangana, and Karnataka.

- Network of 80 branches expected to grow to over 100 by the year-end.

- Aiming to increase monthly disbursements from Rs 75-80 crore to Rs 100 crore by end of fiscal year.

- Closed FY24 with total revenue of Rs 136 crore and net profit of Rs 16 crore.

Read Full Article

1 Like

Economic Times

67

Image Credit: Economic Times

Deeptech VCs spot big funding momentum on government, geopolitical push

- Indian deeptech funds like Speciale Invest, Ideaspring, and Mela Ventures are raising fresh funds to increase investments due to government support, favorable geopolitical climate, and rapid tech progress.

- Java Capital plans to raise its fund size from Rs 50 crore to Rs 250 crore, Bharat Innovation Fund is seeking to raise $150 million for its second fund, Navam Capital is raising a $30 million maiden fund.

- Speciale Invest closed its third fund, Ideaspring Capital and Mela Ventures are raising their third and second funds, respectively.

- Ideaspring Capital anticipates exceeding the Rs 265 crore raised for its second fund, while Mela Ventures raised Rs 320 crore in its first fund.

- Indian deeptech ecosystem is thriving with startups in AI, spacetech, semiconductors, and climate tech sectors, intensifying competition for early-stage deals.

- Investments in deeptech in India doubled to $324 million in the first four months of 2025 across 35 deals compared to $156 million from 21 deals in the same period last year.

- Startups in sectors like aerospace, semiconductors, robotics and climate tech continue to receive funding support, signaling growth in the ecosystem.

- Challenges in fundraising for deeptech include the longer gestation period and fewer successful exits, hindering growth stage funding for startups.

- Breakout deeptech companies are yet to emerge in India, impacting the flow of capital into the ecosystem.

- Negative sentiments are present due to the downfall of celebrated startups like GoMechanic and Byju's, with investors focusing on returns rather than valuations.

- While early stage capital is available, growth stage funding remains a challenge for deeptech startups, signaling a need for more financial support in the ecosystem.

Read Full Article

4 Likes

Medium

368

The Space-Data Gold Rush

- Space data, collected by satellites, holds immense potential in various industries.

- By 2030, Earth Observation data could contribute $700 billion/year to global GDP.

- Challenges in the space-data industry include data harmonization and limited downlink capabilities.

- Opportunities exist in creating data infrastructure, optical communications, and vertical SaaS solutions.

- Successful space-data startups require expertise in aerospace engineering, data science, and go-to-market strategies.

- Critical areas for innovation include harmonizing satellite data and developing specialized SaaS products.

- Building a unified schema across providers and focusing on specialized, high-value use cases are key.

- Capital deployment in the space-data industry has predominantly focused on launch and hardware platforms.

- There is significant potential for VC firms to invest in the growing space-data sector.

- Space-data presents an evolving landscape with opportunities for pioneering foundational tools and vertical solutions.

Read Full Article

22 Likes

Siliconangle

350

Image Credit: Siliconangle

Texas Instruments to invest $60B+ in US fab network

- Texas Instruments Inc. plans to invest over $60 billion to expand its manufacturing capacity in the U.S., focusing on analog chips.

- The investment includes previous commitments and aims to increase domestic production of a wide range of products.

- Analog chips function with various electrical signals beyond just 0s and 1s, serving tasks such as powering robots and acting as sensors.

- Texas Instruments also makes specialized chips like those for ultrasonic vibrations and power management in AI equipment.

- The company collaborates with Nvidia to enhance AI infrastructure and develop efficient power management hardware.

- With a diverse product portfolio, Texas Instruments plans to construct new fabs in the U.S. to cater to customer demands.

- A significant portion of the investment will go towards building a manufacturing campus in Sherman, Texas, with future expansions planned.

- Two other manufacturing campuses in Richardson, Texas, and Lehi, Utah, will also receive investments to increase production capacity.

Read Full Article

21 Likes

For uninterrupted reading, download the app