Startup News

Medium

113

Image Credit: Medium

Why Cluey’s Not Cheating, It’s Winning the Future

- Cluey was initially seen as a potential scam promising to cheat at everything, but trying it changed perceptions.

- Contrary to expectations, Cluey is focused on being at the forefront of innovation rather than promoting cheating.

- Cluey operates as a behind-the-scenes utility seamlessly integrated with various apps, ready to assist at all times.

- The key feature of Cluey is its anticipatory nature and seamless integration into the user's workflow, resembling a helpful teammate.

- It is not a conventional chatbot but a futuristic tool aimed at enhancing daily AI habit formation.

- Cluey is marketed as a form of rebellion as a service, emphasizing effortless AI utilization for improved workflow.

- A16Z, a well-known venture capital firm, was attracted to Cluey for its potential to revolutionize future workflow processes.

- Although some individuals may misuse Cluey for cheating, its broader focus lies in shaping future workflow experiences.

- The inevitability of widespread adoption suggests that similar AI agents will become commonplace in the future.

- Cluey's distinction lies in being an early contender in introducing and popularizing such innovative AI tools.

- The prevalence of AI agents like Cluey signals a shift towards a new digital era rather than a moral decline.

- Cluey's success represents an important turning point and advancement towards futuristic workflow integration.

- Cluey's approach is not a moral shortcoming but a significant advancement in the evolution of digital tools and workflows.

Read Full Article

6 Likes

Siliconangle

236

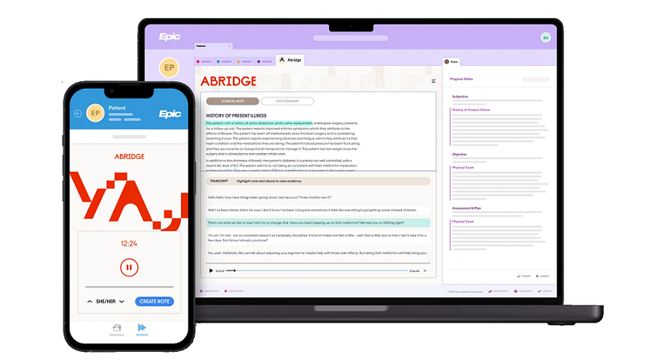

Image Credit: Siliconangle

Medical AI startup Abridge closes $300M investment at $5.3B valuation

- Medical software developer Abridge Inc. raised $300 million in funding led by Andreessen Horowitz, valuing the startup at $5.3 billion.

- The investment included Khosla Ventures and saw Abridge's valuation nearly double since its previous funding round.

- Abridge's AI platform, the Contextual Reasoning Engine, automates tasks like recording patient conversations and generating medical notes.

- The platform offers customization options based on user requirements and can enrich text with data from earlier medical notes.

- Abridge automates tasks such as drafting medical orders, syncing documents to electronic health record systems, and generating ICD-10 codes.

- The company also generates medical billing codes, condensing clinical information for ease of management in healthcare organizations.

- Abridge tests platform updates rigorously with medical professionals to minimize AI errors and refine its output quality.

- The funding will be used to develop more features for the platform, with a focus on easing the process of generating medical billing codes.

- Abridge's CEO highlighted the importance of capturing signals in medical conversations, allowing clinicians to focus on crucial moments.

- The company plans to leverage the investment to enhance its platform and further support healthcare professionals.

- SiliconANGLE Media is a key player in digital media innovation and technology content creation for elite tech professionals.

Read Full Article

14 Likes

Gritdaily

74

Image Credit: Gritdaily

Why Smart Contracts Might Be Your Next Sitemap

- Search engines now crawl structured data and rely on sitemaps to understand content, but what about projects not built on websites.

- Smart contracts are being used like sitemaps, organizing public data and aiding in content discovery.

- By embedding metadata, smart contracts become structured data hubs, eliminating the need for middle layers.

- This approach enhances content discoverability, indexing, and display in a trustless manner.

- Projects can leverage smart contracts for on-chain SEO strategies, improving visibility in Web3-native search tools.

- Smart contracts can carry various structured data beyond token traits, enhancing project discoverability.

- Using smart contracts as data sources benefits Web3 marketplaces, improving trust and accuracy in listings.

- By storing metadata in smart contracts, projects can appear more accurately in decentralized search engines.

- Various projects are utilizing contract-level metadata for enhanced functionalities and transparency.

- Smart contracts offer a new way for central banks to manage policy tools effectively in a tokenized economy.

Read Full Article

4 Likes

TechCrunch

61

Image Credit: TechCrunch

India’s GoKwik raised a small $13M round for a hefty leap in valuation

- GoKwik, an Indian startup offering e-commerce products, raised a $13 million 'growth' round, increasing its valuation to $450 million pre-money.

- The funding round was led by RTP Global and included existing investors Z47, Peak XV Partners, and Think Investments, bringing the total fundraising to $68 million since 2020.

- GoKwik attracts investors by helping companies establish an online presence and enter the direct-to-consumer (D2C) space, a market expected to reach $60 billion in India by 2027.

- The startup serves over 12,000 paying merchants globally, offering SaaS products to set up online stores and facilitate online payments, returns, and various checkout options.

- Notable customers of GoKwik include Lenskart, Honasa Consumer, Lakmé, Pepe Jeans, and Xplosive Ape.

- While some GoKwik products overlap with competitors, its integrated suite encourages customers to purchase multiple solutions, driving revenue growth by 20% annually to over $30 million ARR.

- The startup has processed a cumulative gross merchandise value of $2 billion, with a focus on prepaid payments and integration with the Unified Payments Interface in India.

- With the latest funding, GoKwik plans to expand into new markets like Germany, France, and Latin America, enhance AI capabilities, and offer a global checkout solution for Indian merchants.

- GoKwik aims for profitability within 18 months, with plans to go public in the next 3–5 years. It currently has close to $35–$37 million in the bank with around 400 employees.

Read Full Article

3 Likes

TheStartupMag

188

Image Credit: TheStartupMag

Local SEO Best Practices for Small Businesses in 2025

- Local SEO in 2025 is crucial for small businesses to thrive and be easily discoverable in local searches.

- Google Business Profile is vital - claim, verify, fill out completely, keep it current for better search visibility.

- Encourage and respond to reviews to build trust and credibility with potential customers.

- Maintaining consistent Name, Address, and Phone Number (NAP) across all online listings is essential for legitimacy.

- Consider hiring a professional SEO company to handle the technical aspects of SEO for better results.

- Local SEO success is achieved through strategic steps like optimizing profiles, obtaining genuine reviews, and ensuring data consistency.

Read Full Article

11 Likes

TheStartupMag

412

Image Credit: TheStartupMag

Opinion: AZA CEO Daniel Ashe’s Dangerous Appeasement Strategy

- AZA CEO Daniel Ashe's leadership has been criticized for pursuing an appeasement strategy towards organizations that seek to eliminate zoos and aquariums.

- Ashe's approach involves legitimizing anti-zoo movements by allowing them platforms at AZA events, despite their goal of shutting down zoos.

- His involvement in a Swaziland elephant import article backfired, leading to negative portrayals of zoos and the transfer program.

- Ashe's connection with PETA, a group that litigated against elephant transfers, exposes his strategic blindness.

- The consequence of Ashe's appeasement strategy includes harm to AZA members, their facilities, and their conservation efforts.

- His actions not only weaken the industry's position in public debates but also threaten the conservation mission of accredited zoos.

- The comparison to Neville Chamberlain highlights Ashe's misunderstanding of dealing with ideological opposition.

- The article argues that professional associations like AZA should advance their members' interests, not legitimize those seeking to harm their work.

- Ashe is urged to abandon his appeasement strategy or AZA to seek new leadership to avoid further damaging the organization and its members.

Read Full Article

24 Likes

TechCrunch

113

Image Credit: TechCrunch

In just 4 months, AI medical scribe Abridge doubles valuation to $5.3B

- Abridge, an AI startup automating medical notes, secures $300 million in Series E funding at a valuation of $5.3 billion.

- The round was led by Andreessen Horowitz with participation from Khosla Ventures, following a previous fundraise in February at a $2.75 billion valuation.

- Abridge, founded 7 years ago, is a leader in the AI-powered medical scribe market, known for its integration with Epic Systems, a prominent health record software.

- In Q1, Abridge reached $117 million in contracted annual recurring revenue, showcasing significant growth and adoption in the market.

- The company also announced an expansion into converting medical notes into AI-powered medical codes, positioning itself against competitors like CodaMetrix.

- Abridge's technology is utilized by over 150 major health systems in the U.S., demonstrating widespread adoption within the healthcare industry.

Read Full Article

6 Likes

Pymnts

385

Image Credit: Pymnts

Capchase Acquires Vartana to Grow Tech-Powered Vendor Financing Offerings

- Capchase has acquired Vartana to enhance its tech-powered vendor financing offerings.

- The acquisition aims to accelerate product roadmap and market expansion.

- The move combines Vartana's vendor financing platform with Capchase's offerings for B2B software and hardware companies.

- Capchase CEO highlights faster approvals and automation benefits for sales and finance teams.

- Both companies utilize API- and AI-driven platforms integrated into sales workflows and CRMs.

- The merged entity will provide digitized vendor financing workflows meeting B2B buyers' demands.

- The focus is on offering flexible and tech-enabled financing options to vendors.

- The collaboration intends to support a larger number of businesses with improved financing capabilities.

- Capchase previously secured a credit facility to aid SaaS vendors in the UK and Europe.

- In a separate move, Capchase partnered with Stripe for a B2B buy now, pay later payment method.

- Additionally, Capchase collaborated with WeTransact to provide capital and payment services to B2B SaaS providers.

Read Full Article

23 Likes

Inc42

14

Image Credit: Inc42

CCI Clears Manipal Group’s Proposal To Buy Stake In Aakash

- The Competition Commission of India (CCI) has approved Manipal Group’s proposal to acquire a stake in Aakash Educational Services from its founder JC Chaudhry.

- Manipal Group, led by Ranjan Pai, already holds about 40% stake in Aakash.

- Ranjan Pai invested $300 Mn to make Aakash debt-free and now has a controlling interest in the coaching chain.

- Aakash is currently seeking to raise INR 500 Cr for its operations, but faces opposition in making changes to its articles of association.

- The National Company Law Tribunal (NCLT) has temporarily halted changes to Aakash's shareholding or AoA.

- BYJU’S, which previously owned Aakash and is undergoing insolvency proceedings, has raised concerns over further reduction in its ownership.

- BYJU’S counsel argued that changes in Aakash's shareholding would dilute its stake and questioned alterations to AoA.

- The National Company Law Appellate Tribunal (NCLAT) recently rejected BYJU’S appeal against NCLT’s consent order.

- Aakash, post the Manipal Group's investment, is in a strong position with no debt and seeking fresh funds for operations.

- CCI’s approval for Manipal Group’s acquisition of stake comes amidst Aakash's fundraising efforts and regulatory challenges.

Read Full Article

Like

Pymnts

276

Image Credit: Pymnts

Orus Raises $29 Million to Expand Small Business Insurance Platform

- Paris-based digital insurer Orus raised 25 million euros (about $29 million) in a Series B funding round to support its pan-European expansion.

- Orus offers customized insurance solutions for small- to medium-sized businesses (SMBs) with plans to expand beyond France into Spain and other European markets by 2026.

- CEO Côme Dartiguenave highlighted the need for more transparent, efficient insurance solutions for SMBs.

- Orus is introducing a new broker platform to enhance its digital capabilities and provide brokers with tools for streamlined client management.

- The funding round was led by Singular with Orus aiming to redefine commercial insurance with its digital platform.

- Orus' Series B funding follows a previous Series A round in October 2023, enabling the expansion of its insurance product portfolio.

- In a separate development, French embedded insurance startup Neat secured 50 million euros to offer white-label insurance services to retailers and companies.

- Vitesse, a London-based company, completed a $93 million Series C funding round to enhance its treasury and payment solutions for the insurance sector.

- The developments in the insurance space indicate a growing trend towards digital and embedded insurance services tailored for various industries.

- Orus is strategically positioning itself to meet the evolving needs of SMBs through technology-driven insurance solutions.

- The expansion plans of Orus and similar companies reflect the demand for efficient and transparent insurance offerings across Europe and beyond.

- The increased funding received by Orus signifies investor confidence in its approach to disrupting the SMB insurance sector.

- Innovation and digital transformation are key drivers in reshaping the commercial insurance landscape, as demonstrated by the recent funding announcements.

- Fintech companies like Orus, Neat, and Vitesse are at the forefront of revolutionizing traditional insurance practices through advanced technology.

- The focus on user experience and speed in obtaining insurance quotes highlights the importance of tailored, efficient services in the industry.

Read Full Article

16 Likes

Medium

162

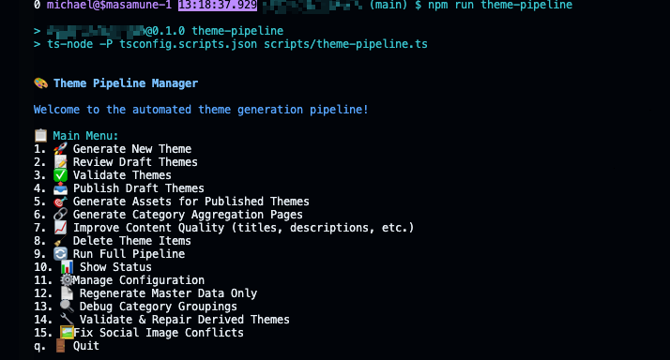

Image Credit: Medium

The making of colorpages.app

- The article discusses the creation of colorpages.app, driven by the founder's observation of the popularity of coloring activities online.

- Recognizing the significant search demand for coloring pages, the founder decided to cater to a diverse audience including parents, teachers, and Amazon sellers.

- Emphasizing benefits over features, the website offers a user-friendly interface focused on user needs and motivations.

- The strategic use of SEO and thematic organization through slug pages enables efficient content generation and optimization.

- The author highlights the importance of leveraging automation and metadata to streamline processes and enhance SEO efforts.

- The development process involved utilizing Typescript, NextJS, Supabase, and Stripe for different functionalities within the application.

- The article underscores the value of adopting a tech-minimalistic approach for efficient product creation and scalability in a competitive environment.

- The focus on pragmatic problem-solving and managing complexity reflects a deliberate and impactful build process for colorpages.app.

- The founder encourages sharing insights with others in the tech community and welcomes feedback on the colorpages.app platform.

Read Full Article

9 Likes

Inc42

337

Image Credit: Inc42

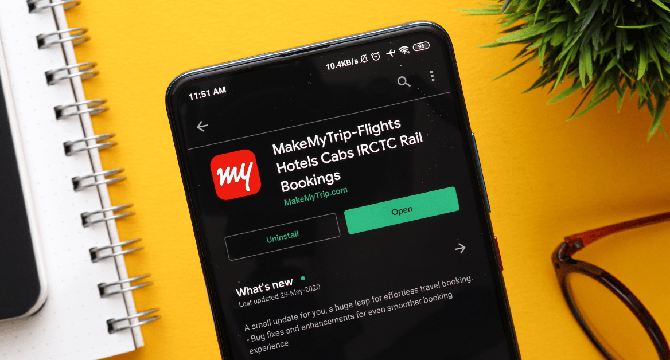

MakeMyTrip To Pay $3 Bn To Repurchase Stake: Trip.Com Group

- MakeMyTrip (MMT) will pay nearly $3 Bn to repurchase shares from Trip.com Group.

- Trip.com amended its share repurchase agreement with MMT.

- MMT is set to pay approximately $3 Bn for the repurchase.

- Trip.com expects the transaction to be completed by early July 2025.

- After the repurchase, Trip.com will retain ownership of nearly 16.90% in MMT.

- MMT previously announced plans to raise funds to buy back stake from Trip.com.

- MMT recently raised $3.1 Bn to repurchase Class B shares from Trip Group.

- MakeMyTrip was initially set to issue 14 Mn primary shares but increased it to 18.40 Mn.

- Trip.com will remain the largest minority shareholder in MMT even after reducing its stake.

- MMT is yet to officially disclose the closure of the deal.

- MMT accelerated the repurchase agreement after allegations related to data security were made by EaseMyTrip cofounder.

- MMT denied the allegations of data exposure due to Chinese ownership.

- MMT's board includes founder Deep Kalra, CEO Rajesh Magow, Moshe Rafiah, and four Chinese directors.

- The dispute arose amid tensions between India and Pakistan, following a terrorist attack.

- In summary, MakeMyTrip is repurchasing shares from Trip.com Group for $3 Bn amidst ongoing developments in the ownership structure.

Read Full Article

20 Likes

Gritdaily

280

Image Credit: Gritdaily

A Visionary Pivot: How Seeking’s Founder Is Shaping a Stronger Future

- Seeking.com, a unique player in the online dating scene, has undergone a significant transformation under its founder's vision.

- Brandon Wade launched Seeking.com in 2006 to address the challenges he faced in dating, focusing on achievement over appearance.

- Initially attracting more women than men, Seeking.com promised clarity, honesty, and lifestyle compatibility but drifted towards 'sugar dating.'

- Wade's personal transformation through meeting Dana Rosewall led to a pivot towards intentional love, focusing on values and emotional alignment.

- Seeking.com removed transactional dating, emphasizing values, purpose, and emotional maturity over financial arrangements.

- The platform now advocates for intentional relationships, filtering out scammers and fostering genuine connections based on shared values.

- The shift towards intentional love reflects Wade and Rosewall's personal values and commitment to promoting meaningful relationships.

- Seeking.com's new direction embraces complementary hypergamy, where partners bring different but respected forms of value to the relationship.

- The goal is to combat modern dating fatigue by offering depth, clarity, and a sense of direction in building intentional relationships.

- Seeking.com hopes to redefine love as a commitment and decision, moving away from shallow connections towards long-term partnerships.

Read Full Article

16 Likes

Gritdaily

363

Image Credit: Gritdaily

Why Smart Capital Is Targeting Multi-Asset Juniors in the Gold Cycle Ahead

- Gold prices are performing better today than they did five years ago, attracting investor interest in the gold cycle ahead.

- Investors looking to capitalize on the gold cycle should consider junior miners for potentially higher returns, despite higher volatility.

- Multi-asset explorers, with diversified portfolios, tend to perform well, offering high risk-high reward opportunities.

- Axcap Ventures, a multi-asset explorer, holds multiple gold projects in the US and Canada, potentially poised for success.

- Exploration is where value creation in the mining industry happens, making juniors with discoveries appealing for investment.

- Major mining companies may need to acquire juniors for new deposits, leading to stock price rallies and investor benefits.

- With a robust gold price and flowing credit in the economy, junior miners, particularly multi-asset explorers, present promising investment opportunities.

Read Full Article

21 Likes

Hitconsultant

78

Image Credit: Hitconsultant

Abridge Secures $300M to Embed Revenue Cycle Intelligence into Clinical Conversations

- Abridge secures $300M in Series E funding led by Andreessen Horowitz to embed revenue cycle intelligence into clinical conversations.

- The funding will accelerate efforts to transform care delivery, documentation, and reimbursement from the point of care.

- U.S. healthcare annually spends around $1.5 trillion on administrative costs, with a significant portion linked to clinical documentation and revenue cycle management.

- Abridge's platform integrates revenue cycle intelligence into clinical conversations to streamline documentation and billing processes, reducing clinician burden and improving reimbursement speed.

- The Contextual Reasoning Engine within Abridge supports the latest guidelines and risk adjustment models, ensuring compliant documentation during patient conversations.

- By capturing relevant HCC codes and evidence during conversations, the platform facilitates accurate claims submission without the need for post-visit queries, aiming to expedite reimbursement cycles and reduce denials.

- Abridge has successfully deployed its AI platform in 150 large health systems, serving conversations in various specialties and languages.

- The platform is expected to support over 50 million medical conversations this year, with over 90% of clinicians continuing to use it after adoption.

- Abridge aims to alleviate the documentation burden on clinicians, allowing them to focus on patient care with its background signal activation and complexity handling.

Read Full Article

4 Likes

For uninterrupted reading, download the app