Startup News

TechCrunch

419

Image Credit: TechCrunch

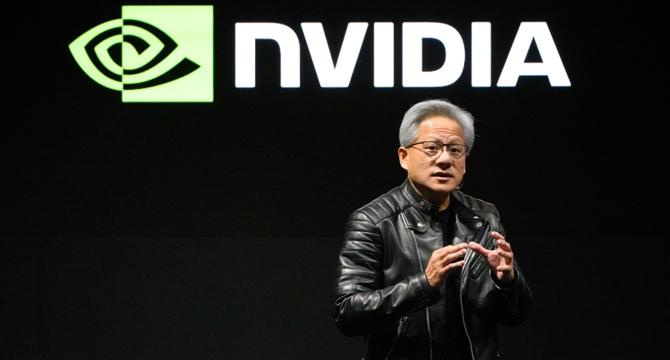

Nvidia’s AI empire: A look at its top startup investments

- Nvidia has capitalized on the AI revolution, leading to a surge in revenue, profitability, and cash reserves since the introduction of ChatGPT.

- In 2024, Nvidia significantly increased investments in AI startups, participating in 49 funding rounds compared to 34 in 2023, according to PitchBook data.

- Nvidia aims to expand the AI ecosystem by investing in startups considered 'game changers and market makers.'

- Notable investments include OpenAI ($6.6 billion round), xAI ($6 billion round), Inflection ($1.3 billion round acquired by Microsoft), Wayve ($1.05 billion round for autonomous driving), and Scale AI ($1 billion round for data-labeling services).

- Nvidia has also invested in startups like Crusoe, Figure AI, Mistral AI, Lambda, Cohere, Perplexity, Poolside, CoreWeave, Together AI, Sakana AI, Imbue, Waabi, Ayar Labs, Kore.ai, Sandbox AQ, Hippocratic AI, Weka, Runway, Bright Machines, and Enfabrica.

Read Full Article

24 Likes

ISN

2k

Image Credit: ISN

ISN Exclusive: ex-Ola executive Varun Dubey starts up a hospital chain, in talks to raise seed funding

- Former Ola executive Varun Dubey has launched a hospital chain startup, set to raise Rs 12-13 crore in seed funding from Sparrow Capital.

- Dubey's company, Superhealth Hospitals Pvt Ltd, aims to open small hospitals in cities with minimal capital to attract more patients.

- Dubey draws on his experience from Practo and Apollo Hospitals to scale his new venture.

- The venture details and funding are not publicly known as of now.

- Dubey, supported by Dr. Alexander Kuruvilla from Practo, is focused on improving healthcare for patients and doctors.

- Despite not responding to emails, Dubey continues to work stealthily on his startup.

- Executives like Nirmal NR from Zoomcar India are also venturing into the healthcare sector with initiatives like Preventify.

- The dynamic hospital space with numerous players will be closely watched to see the emerging winners.

Read Full Article

20 Likes

Eu-Startups

337

EU-Startups Podcast | Episode 122: Miki Yokoyama, Managing Director and Partner at Aurum Impact

- In episode 122 of the EU-Startups Podcast, Miki Yokoyama from Aurum Impact discusses the role of family offices in climate innovation.

- Focus on impact should prioritize 'what' is being done over 'how' it's done.

- Environmental challenges require systemic thinking.

- There is a crucial need for standardized impact metrics.

- Empathy plays a crucial role in successful investing and leadership.

- Long-term climate funding should consider the true cost of nature.

- Topics include choosing fund managers, impact measurement, and understanding corporate structures.

- Investors, founders, and those interested in climate action will find this episode insightful.

- Miki Yokoyama shares insights on how capital can drive positive change.

- The episode delves into the intersection of family offices and climate innovation.

- This conversation highlights challenges and opportunities in funding meaningful climate action.

- Understanding the 'what' of impact is emphasized in this discussion.

- The podcast explores the impact of family offices on climate capital.

- Listeners gain a unique perspective on investing in startups and funds.

- This episode underscores the importance of long-term thinking in climate investments.

- The episode concludes by discussing the role of empathy in successful investments.

Read Full Article

20 Likes

ISN

70

Image Credit: ISN

Nat Habit enters omnichannel retail with q-commerce; aims to reach 6,000 trade stores by 2025-end

- Nat Habit has entered omnichannel retail with a dual expansion strategy, now available in over 1,000 general trade stores in Delhi NCR and partnering with quick commerce platforms.

- The company's offline retail move is driven by consumer insight, targeting Tier 2 and 3 cities for deeper market penetration.

- Nat Habit aims to reach 6,000 general trade stores and expand its Q-commerce footprint to cover 60% of its customer base by 2025-end.

- The new channels are expected to contribute 15% of total revenue by FY26.

- Nat Habit launched a Just-in-Time (JIT) supply chain system for freshness-led products, enabling real-time order intake and frequent restocking.

- Swiggy Instamart lauded Nat Habit's supply chain designed for quick commerce, highlighting strong customer loyalty and repeat orders.

- Nat Habit, founded in 2019, offers 'Fresh Ayurveda' products with 100% natural ingredients and an in-house R&D and tech-enabled manufacturing setup.

- The brand raised $10.2 million in a Series B funding round led by Bertelsmann India Investments, with other key investors including Fireside Ventures and Amazon India Fund.

Read Full Article

3 Likes

Inc42

226

Image Credit: Inc42

ArisInfra IPO Day 2: Issue Subscribed 84% So Far

- The IPO of B2B ecommerce company ArisInfra Solutions saw a subscription of 84% on the second day.

- Retail investors played a significant role in driving the subscription on the first day, with an overall 24% subscription.

- As of 2:21 PM on the second day, the IPO received bids for 1.1 Cr shares against 1.3 Cr shares on offer.

- Retail investors showed strong interest, resulting in a 2.4X subscription for their portion.

- Non-institutional investors (NIIs) subscribed 88% by bidding for 31.72 Lakh shares.

- Qualified institutional buyers (QIBs) had a 31% subscription rate, bidding for 22.09 Lakh shares.

- The IPO has a division of 75% for QIBs, 15% for NIIs, and 10% for retail investors; no reservation is made for employees.

- ArisInfra has set a price band of INR 210 to INR 222 for its IPO, aiming to raise INR 499.6 Cr.

- At the upper price band of INR 222, the company targets a post-issue implied market capitalization of INR 1,799 Cr.

- ArisInfra is expected to list its shares on June 25 post closure of the IPO on June 20.

- Ahead of the IPO opening, ArisInfra raised INR 224.8 Cr from anchor investors at INR 222 per share.

- Anchor investors included Astorne Capital VCC, Niveshaay Hedgehogs Fund, and Nexus Global Opportunities Fund.

- The IPO is progressing well and generating significant investor interest.

- The IPO closing date is scheduled for June 20, and shares are expected to list on June 25.

- The company aims to raise INR 499.6 Cr through the IPO at a price band of INR 210 to INR 222 per share.

- The subscription rates by various investor categories indicate a positive market reception for ArisInfra's IPO.

Read Full Article

13 Likes

Eu-Startups

288

Spanish clean energy startup Tether secures €1.3 million to turn EVs into the “world’s largest connected battery”

- Barcelona-based clean energy startup Tether raises €1.3 million to enhance grid resilience and efficiency.

- Funding secured in a pre-Seed round led by Draper B1 and K Fund, with support from other investors.

- Tether aims to leverage electric vehicles to create a massive connected battery for the grid.

- Founder Luis Medina Rivas emphasizes the importance of flexibility in the evolving energy landscape.

- The technology is designed to reduce CO2 emissions significantly over a car's lifetime.

- Tether's solution involves coordinating the charging patterns of private electric vehicles.

- The company plans to expand into Nordic markets to advance the green energy transition.

- Tether collaborates with EV manufacturers like Audi and Zeekr and charge point operators.

- The team consists of professionals with expertise in engineering, mathematics, and data science.

- The funding will be used to extend partnerships, scale teams, and enhance integrations.

Read Full Article

17 Likes

Inc42

168

Image Credit: Inc42

Capillary Technologies Refiles For IPO

- Capillary Technologies has refiled for an initial public offering (IPO) with a draft red herring prospectus (DRHP) filed with SEBI after receiving approval for the INR 2,250 Cr IPO.

- The IPO will include a fresh issue of INR 430 Cr and an offer for sale (OFS) component of 18.3 million shares, with plans to list on NSE and BSE.

- Key selling shareholders of Capillary include several entities and individuals such as Ronal Holdings, Trudy Holdings, and various other named stakeholders.

- Funds raised from the IPO will be allocated towards investments in cloud infrastructure, research and development, computer systems, acquisitions, and general corporate purposes.

- Capillary Technologies, founded in 2008 by Aneesh Reddy, focuses on loyalty management and customer engagement platforms for over 390 clients in various industries.

- This marks Capillary's second attempt at an IPO after deferring plans in 2021, following profitability in FY25 with INR 13.3 Cr profit compared to INR 59.4 Cr loss in FY24.

- The company's operating revenue in FY25 stood at INR 598.3 Cr, a 14% increase from the previous fiscal year, with an EBITDA profit of INR 78.6 Cr.

Read Full Article

10 Likes

Eu-Startups

31

Belgian scale-up Bizzy raises €4 million to expand its AI Sales Agent across Europe

- Belgian scale-up Bizzy has raised €4 million in fresh funding to expand its AI Sales Agent across Europe.

- The funding round is led by Fortino Capital with participation from prominent figures from Ghent's tech ecosystem and existing investors like Pitchdrive.

- Bizzy, founded in 2021, aims to save sales professionals' time by automating lead generation using smart technology.

- The platform helps companies identify high-quality prospects from a database of over 34 million European businesses and 76 million professional contacts.

- Over 500 paying customers use Bizzy each month, with more than 10,000 sales professionals utilizing the platform for lead generation.

- Bizzy is expanding its platform to automate the entire go-to-market process, integrating seamlessly with most CRMs and prospecting tools.

- The launch of the AI Sales Agent aims to autonomously identify, qualify, and enrich leads, providing targeted recommendations for sales teams.

- The more the AI Sales Agent is used, the smarter and more tailored its recommendations become.

- Bizzy's focus on smart data and streamlined processes aligns with the evolving landscape of sales technology.

- The company is determined to lead the development of breakthrough solutions for European sales teams with its innovative approach.

- Investors believe in the potential of Bizzy's AI Sales Agent to revolutionize sales processes.

- The expansion of Bizzy's AI Sales Agent signifies the company's commitment to enhancing sales efficiency and effectiveness.

- Bizzy's success and growth reflect the increasing demand for intelligent sales technology in the market.

- The funding will catalyze Bizzy's expansion efforts and contribute to its mission of optimizing sales operations across Europe.

- Bizzy's vision and dedication to leveraging technology to empower sales professionals showcase its potential to drive innovation in the sales industry.

- Bizzy's innovative solutions position it as a key player in reshaping the future of sales technology and strategy.

Read Full Article

1 Like

The Robot Report

328

All3 launches AI and robotics to tackle housing construction

- All3, a London-based company, unveiled its building system integrating AI and robotics to address housing construction challenges in Europe and North America.

- The construction industry spends less on R&D than other sectors, leading to manual labor reliance and skilled worker shortages.

- All3 aims to revolutionize construction with a vertically integrated AI and robotics approach, streamlining processes for faster, cost-effective, and sustainable development.

- The company's technology offers bespoke designs, automated manufacturing, and robotic assembly, particularly suited for inner-city sites and complex projects.

- All3's AI platform facilitates custom building designs and optimized space utilization, enhancing productivity and sustainability in housing construction.

- By using structural timber composites and standard building elements, All3 automates design generation, manufacturing, and robot programming, reducing costs and enhancing efficiency.

- Targeting real estate developers, All3 promises to accelerate project timelines, reduce costs, and minimize carbon impact by integrating AI and robotics across the construction value chain.

- Founded by experienced entrepreneurs, All3 has secured $30 million in funding and plans to commence construction on its first build in Europe in 2025.

- With a focus on delivering end-to-end solutions for multifamily housing, All3 envisions a future where robotic automation dominates construction processes.

- The company's innovative approach to housing construction signifies a significant shift towards AI and robotics-driven solutions in the industry.

Read Full Article

19 Likes

Inc42

159

Image Credit: Inc42

Amazon India To Invest INR 2,000 Cr To Strengthen Logistics, Tech Infra

- Amazon India plans to invest INR 2,000 Cr in enhancing logistics and tech infrastructure.

- The investment aims at expanding and upgrading operations infrastructure, ensuring associate safety, and developing new technology.

- The focus is on strengthening the operation model for smoother delivery across India.

- Funds will be allocated to launch new sites and upgrade existing facilities for improved delivery accessibility.

- Infrastructure upgrades include energy-efficient centers with consideration for employee safety and accessibility.

- Amazon aims to enhance processing capacity and implement advanced technology to better serve customers.

- The company recently proposed merging its logistics arm Amazon Transportation Services with its marketplace entity.

- Amazon also infused INR 350 Cr into Amazon Pay India to expand in the UPI market.

- Abhinav Singh, VP of Operations at Amazon India and Australia, highlighted the importance of infrastructure enhancements.

- The article is expected to be updated soon with additional information.

- Amazon's investments reflect its commitment to strengthening operations and technology in India.

- The focus on infrastructure and technology upgrades demonstrates Amazon's effort to enhance customer service.

- The company's investment also includes improving accessibility and safety for employees.

- Amazon's strategies aim at enhancing fulfillment and delivery processes across the country.

- The story indicates Amazon's continuous efforts to innovate in logistics and tech to serve Indian customers.

- Amazon's recent investments signify its intent to expand and upgrade its presence in the Indian market.

Read Full Article

9 Likes

Inc42

39

Image Credit: Inc42

BYJU’S RP Sues Former Directors Over Alleged Transfer Of Company Assets

- BYJU’S RP has filed a lawsuit against former directors for alleged transfer of company assets.

- The lawsuit at NCLT named Byju Raveendran, Riju Ravindran, Divya Gokulnath, and Jiney Thathil.

- RP demands compensation for fraudulent transfers totaling $533 Mn and INR 130 Cr.

- BYJU’S founders refute allegations, calling them baseless.

- Next hearing scheduled for July 9 regarding the lawsuit.

- ICAI to resume probe on financial statement lapses at BYJU’S.

- Four new benches constituted by ICAI to investigate the matter.

- Investigation found negligence by BYJU’S auditors and gross negligence on accounting practices.

- Ajmera appointed as RP of BYJU in March replacing former RP Pankaj Srivastava.

- Lenders requested Srivastava's removal as RP for not involving them in the creditors' committee.

- Allegations of 'criminal collusion' raised by BYJU’S founders against EY, RP, and lenders.

- US Insolvency Court ruled in favor of lenders in BYJU’S Alpha case involving a fraudulent transfer of $533 Mn.

- BYJU’S RP lawsuit reflects ongoing legal and financial challenges faced by the edtech firm.

- The case continues to unfold amidst allegations and legal proceedings.

- The complex situation highlights the intricacies of corporate governance and financial oversight.

- BYJU’S and its stakeholders are navigating a tumultuous period of legal scrutiny and investigations.

Read Full Article

2 Likes

Analyticsindiamag

407

Image Credit: Analyticsindiamag

A Single-Owner, Bootstrapped AI Startup Gets Acquired for $80 Million

- Wix, an Israeli software company, acquired Base44, a bootstrapped AI startup, for $80 million.

- Base44 offers an AI-enabled no-code platform for creating applications with natural language prompts.

- Base44's founder, Maor Sholmo, is the sole owner and stated that the startup is profitable with $189k in profit last month.

- Started nine months ago, Base44 has 250k users and only six employees, targeting B2B customers with a new Teams plan.

- Sholmo believes Wix is the perfect fit to help Base44 scale while maintaining product velocity.

- Base44 aims to enable people to create software instead of buying it.

- The acquisition emphasizes the rising trend of no-code platforms, such as 'vibe coding'.

- Lovable, a similar platform, helped a Brazilian startup generate $3 million in revenue in 48 hours.

- The acquisition showcases the potential of no-code platforms in the creation and monetization of applications.

Read Full Article

24 Likes

Insider

359

Image Credit: Insider

A new dating app made by college students uses mutual friends to match you. Read the pitch deck it raised $1.6M with.

- Cerca is a new dating app founded by college students, limiting users to seeing four profiles daily with mutual contacts.

- The app raised $1.6 million from Corazon Capital using a pitch deck.

- CEO Myles Slayton focuses on connecting Gen Z users through established social circles rather than strangers.

- Cerca utilizes mutual friends for matchmaking and emphasizes common contacts over just appearances.

- Users can involve mutual friends in matchmaking and need to bring five friends to join the app.

- Cerca targets college students with over 20,000 users mostly aged between 18-30.

- The app's feature allows users to search for specific people, a unique approach in dating apps.

- Cerca's growth plan includes IRL events for user engagement and connection building.

- The article details Cerca's pitch deck, core problems it aims to solve, early growth stats, IRL events, team, and product demo.

Read Full Article

21 Likes

Economic Times

2k

Image Credit: Economic Times

Explained: Sebi’s new Esop norms for IPO-bound startup founders

- Sebi approved measures to ease doing business, including relaxed Esop norms for IPO-bound startup founders.

- Founders can now hold Esops post listing, unlike the previous rule where they had to liquidate them after being classified as 'promoters' in IPO documents.

- Old rules prevented founders from benefiting from long-term growth by selling their holdings early, impacting them negatively.

- Startups often compensate founders with Esops in early stages to align their interests with shareholders, but equity stake dilution posed challenges.

- Sebi's new rule allows founders with Esops from at least a year prior to DRHP filing to retain benefits, addressing ambiguity and unfairness.

- The old regulation required forgoing Esop benefits once a shareholder was classified as a promoter, which Sebi found unjustified.

- The change is aimed at ensuring founders can benefit from their company's growth post IPO through stock options.

- Many founders considered the previous rule as unfair since it forced them to sell holdings early instead of benefiting from future growth.

- The relaxed Esop norms aim to support startup founders in aligning their interests with the company's growth trajectory.

- Sebi's move is part of broader efforts to promote ease of doing business and provide a conducive environment for startups in the capital markets.

- The decision is expected to positively impact startup founders looking to list their companies and retain ownership through Esops.

- This change reflects Sebi's recognition of the challenges faced by founders due to the previous Esop regulations.

- The rule change is in line with efforts to enhance the startup ecosystem and encourage more companies to go public in India.

- Sebi's initiative is seen as a step towards creating a more investor-friendly environment and supporting entrepreneurial endeavors in the country.

Read Full Article

6 Likes

Startup Pedia

35

Image Credit: Startup Pedia

‘Narayana Murthy side mein naach raha hai’: Karnataka’s 12-hour workday proposal triggers online meme fest

- Karnataka's proposal to increase daily work hours triggers online reactions, referencing Narayana Murthy's 70-hour workweek debate.

- The state considers amending labor laws, proposing a 10-hour work limit per day and allowing up to 12 hours of overtime.

- Proposed changes include increasing the three-month overtime limit from 50 to 144 hours.

- The Labour Department held a meeting with industry representatives and unions regarding the amendment.

- Opposition from trade unions labels the proposal as 'modern-day slavery' and warns of work-life balance and job security risks.

- KITU leaders emphasize that the amendment could turn employees into machines to please corporations.

- Netizens react with humor, recalling Murthy's 70-hour workweek remarks and suggesting the work hours be termed 'Narayana Murthy Hours.'

Read Full Article

2 Likes

For uninterrupted reading, download the app