Startup News

Eu-Startups

186

Northern Gritstone and Parkwalk team up for new EIS fund – will it deliver the UK’s first trillion-euro startup?

- Northern Gritstone and Parkwalk have launched the Northern Universities Venture Fund, an EIS fund to support early-stage science and DeepTech spinouts from Northern English universities.

- The fund targets sectors like quantum computing, AI, engineering biology, and aims to commercialize innovation from the North of England.

- Managed by Parkwalk with €584 million in AUM, the fund is part of efforts to invest in UK university science and technology.

- Northern Gritstone, supporting startups from academic institutions since 2022, has invested in 37 companies in various sectors.

- They raised an additional €58.4 million this year, totaling committed capital to €423 million.

- Northern Gritstone's mission is to balance returns with societal impact, supporting job creation and regional development.

- Parkwalk Advisors, part of IP Group plc, is experienced in university-specific investment vehicles and manages funds for several UK universities.

- The collaboration aims to offer investors access to a pipeline of innovative spinouts.

- The fund leverages Northern Gritstone's university partnerships and aims to drive economic impact.

- High-net-worth individuals can now invest in early-stage university projects through this partnership.

- Creating opportunities for investors to support potential global companies emerging from Northern universities.

- The initiative seeks to encourage regional growth and benefit the UK economy.

- Both parties bring expertise in university commercialization and venture capital to the partnership.

- Lord Jim O’Neill sees the collaboration as a chance to support the next generation of global companies.

- The fund benefits from long-term agreements with partner universities, granting preferred investor access to spinout deals.

- Parkwalk will handle fund management, facilitating investment in early-stage university commercialization projects.

Read Full Article

11 Likes

Inc42

142

Image Credit: Inc42

Paytm Approaches RBI To Settle Alleged FEMA Breach: Report

- Paytm's parent company, One97 Communications, has filed a compounding application with the RBI to settle alleged violations of FEMA following a show cause notice from the Enforcement Directorate.

- The compounding process involves admitting to violations, accepting responsibility, and paying a penalty to settle the matter without legal proceedings; RBI has the discretion to approve or reject such applications.

- The ongoing case involves alleged violations related to Paytm's acquisition of two companies between 2015 and 2019, totaling INR 611.17 Cr in transactions.

- Out of the total alleged contraventions, INR 245.2 Cr was attributed to One97 Communications, and the rest to its subsidiaries, LIPL and NIPL.

- Paytm is also settling other legal cases, including SEBI violations related to ESOPs, technical glitch framework, non-compliance in tax invoices, and impending GST demand faced by its gaming arm.

- The company reported a consolidated net loss of INR 544.6 Cr in Q4 FY25, with operational revenue declining by 19% compared to the same period in the previous fiscal year.

Read Full Article

8 Likes

Siliconcanals

71

Image Credit: Siliconcanals

Belgium’s Bizzy raises €4M to help sales teams stop chasing leads and start closing deals

- Belgium's Bizzy raises €4M in funding to expand its AI Sales Agent across Europe with Fortino Capital leading the round.

- Fortino Capital specializes in growth-stage investments in European SaaS companies, particularly in sales automation and data intelligence platforms.

- Prominent Belgian investors, including founders of Silverfin, Lighthouse, Teamleader, and Henchman, participated in the funding round alongside existing investor Pitchdrive.

- The funding will support the expansion of Bizzy's AI Sales Agent across European markets utilizing its database of over 34 million European businesses and 76 million professional contacts.

- Bizzy's platform automates lead generation for sales teams by identifying, qualifying, and enriching leads with contextual intelligence to improve sales strategies.

- The AI-powered sales platform has over 500 paying customers monthly, 35 employees, and more than 10,000 sales professionals using the platform to find potential customers.

- Co-founder Hendrik Keeris highlights the importance of sales professionals focusing on building relationships rather than spending time on lead lists.

- Bizzy aims to empower every sales team in Europe with the capabilities of its AI Sales Agent.

- The platform integrates with most CRM and prospecting tools, prioritizing proprietary business data models to automate lead generation processes.

- Bizzy has shifted from market intelligence to automating end-to-end go-to-market processes for sales and marketing teams.

- Co-founder Hendrik Keeris emphasizes the need for smart data and streamlined processes in sales, aiming to lead the evolution of sales technology for European sales teams.

Read Full Article

4 Likes

Inc42

246

Image Credit: Inc42

Matter Of Minutes: Can Flipkart Strike A Fiscal Balance Ahead Of IPO?

- Flipkart has introduced quick commerce through 'Minutes' as it heads towards its IPO, raising concerns about cash burn as a late entrant in a competitive market.

- Parent company Walmart invested in Flipkart and PhonePe, with plans for share sales in 2026 to strategize its exit from the investments.

- Flipkart's marketplace revenues increased 21% in FY24, but faces increasing competition and acquisition-related losses, especially from companies like Meesho.

- The launch of Flipkart Minutes marked a strategic move to compete in quick deliveries and balance its operations in the evolving market.

- Flipkart's foray into quick commerce necessitates significant investments in Minutes alongside core ecommerce for sustainable growth pre-IPO.

- Walmart's emphasis on capital efficiency poses challenges for Flipkart's substantial investments required for the success of Minutes in the competitive landscape.

- The article explores the evolving dynamics of quick commerce, potential strategies, expansion plans post IPO, and the delicate balance Flipkart must strike between growth and profitability.

- Flipkart's push into quick commerce involves considerations around groceries, partnerships, financial discipline, and competitiveness against established players in the market.

- Despite Flipkart's measured approach and strategic pivots, the success of Flipkart Minutes hinges on effective scaling efforts to avoid reverting to high levels of cash consumption.

- Flipkart's upcoming IPO and subsequent expansion plans, including potential standalone app development for Minutes, signify its commitment to innovation and market relevance.

- The narrative captures Flipkart's intricate dance of growth, profitability, and market adaptation as it navigates the complexities of the ecommerce and quick commerce landscape.

Read Full Article

Like

Insider

235

Image Credit: Insider

I'm a VC founder. Here's a day in my life, from coffee and emails at 4 a.m. to taking a Waymo to dance class at noon

- Kate McAndrew, co-founder of Baukunst VC firm, follows a structured routine around her son and dance classes, starting her day at 4 a.m. for 'deep work.'

- She emphasizes planning based on natural rhythms, including reading with her son, having a green smoothie, and incorporating dance classes into her schedule.

- Walking with a weighted vest and utilizing a Waymo for commuting to dance class highlight her efficient lifestyle choices.

- Having lunch at a nearby store, engaging in back-to-back calls, focused work, and networking activities make up her workday.

- She ends her day at a wine bar, prioritizes family time with her son, and acknowledges the need for constant iteration in balancing life and work.

Read Full Article

14 Likes

Inc42

199

Image Credit: Inc42

Inside 3one4 Capital’s Decade-Long Exit Track Record

- 3one4 Capital achieved a 58x return from the equity sale of its partial shareholding in Darwinbox, marking a significant milestone for the Indian SaaS market.

- Despite launching during a challenging period in India's venture ecosystem, 3one4 Capital saw their entry valuations become highly affordable, leading to successful returns.

- Fund I of 3one4 Capital, launched in 2016, was fully returned within its 8+2 year lifecycle, registering an MOIC of 58.07x and an IRR of 65.08% on its exit.

- The firm has 4 funds under management, with Fund IV launched in 2023 with a $225 Mn corpus, backing 100+ startups and recording 26 profitable exits.

- 3one4 Capital's success was attributed to its operating background, hands-on investment approach, and ability to demonstrate clarity in strategy and governance.

- The Indian LPs backing 3one4 sought execution-oriented strategies and long-term discipline, contributing to the fund's successful performance and returns.

- 3one4 Capital emphasizes the importance of planning exits well in advance and collaborating with founders to achieve liquidity through various exit routes.

- Lessons learned include the challenges of managing positive surprises, fund size limitations affecting the ability to back breakout winners, and the importance of intuition in VC decisions.

- The firm's journey reflects the complexity and nuances of venture capital, highlighting the balance between risk management, discipline, and intuition.

Read Full Article

12 Likes

Inc42

408

Image Credit: Inc42

Conversational Payments Via AI Being Developed To Bolster India’s Digital Ecosystem: FM

- Conversational payments through AI and offline functionality are being developed to enhance India's digital financial ecosystem.

- India leads in real-time digital payments globally with 48.5% share and over 35 Cr users on the UPI system.

- Conversational payments enable users to interact with AI for transactions via natural language communication.

- Offline functionality allows digital transactions in areas with limited connectivity.

- Finance minister urges fintech startups to explore opportunities in rural India for expansion.

- Fintech firms encouraged to offer services in regional languages and voice-based options for wider adoption.

- India's fintech revolution is influencing the global market, with UPI now accepted in seven other countries.

- India's fintech market set to exceed $400 Bn by 2028-29, achieving 80% financial inclusion rate in just six years.

- NPCI introduced new mandates to expedite UPI payment processing response time to 10 seconds for specific transactions.

- In April, UPI transactions hit a record high of 18.68 Bn, showcasing continued growth in the digital payment landscape.

Read Full Article

24 Likes

Eu-Startups

214

Tadaweb secures €17.3 million to arm cybersecurity and defense teams with smarter OSINT

- Luxembourg-based Tadaweb secures €17.3 million to scale its Small Data Operating System for publicly available information (PAI) and open-source intelligence (OSINT), supporting product development and recruiting top talent.

- Arsenal Growth and Forgepoint Capital International lead the investment, with existing investor Wendel participating. Jason Rottenberg and Damien Henault will join the Tadaweb board.

- Tadaweb focuses on transparency, empowering analysts with a Small Data approach and combining technology with human intuition to reshape how organizations utilize digital information.

- Their SaaS platform aids defence, national security, and corporate security organizations across Europe and the U.S.

- OSINT, accounting for 80-90% of information-gathering activities for law enforcement agencies, involves collecting and analyzing publicly available data to support decision-making.

- Tadaweb helps organizations overcome information overload by providing rapid analysis of PAI to access accurate and actionable information in volatile markets.

- Tadaweb's technology augments analysts' Small Data skills with AI to integrate seamlessly with third-party tools, helping users meet crucial priorities like fraud reduction and threat identification.

- Investors are drawn to Tadaweb's Small Data approach, visual query engine, focus on human analysts, and committed management team.

- Tadaweb's funding now totals €34.7 million, with previous investments in 2023 and 2015.

Read Full Article

12 Likes

Medium

44

Image Credit: Medium

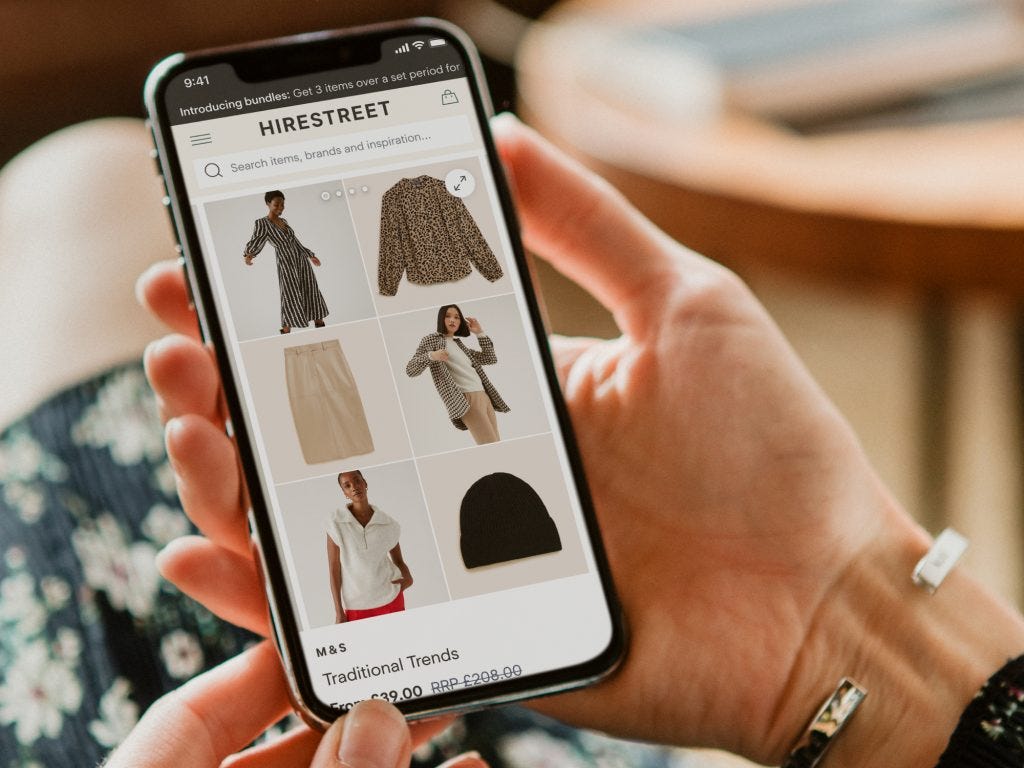

Rental. Reimagined. Why we invested in fashion startup, Hirestreet

- Investment in fashion startup Hirestreet by dmg ventures due to their super sleek rental platform with over 100 UK and international brands and a tiered subscription model for flexibility.

- Founder Isabella started Hirestreet to offer an alternative to fast-fashion, facing challenges but eventually building a strong team and technology platform.

- Hirestreet focuses on younger generation's demand for sustainable and affordable high-street fashion, addressing the issue of fast-fashion consumption.

- Rental provides a lucrative avenue for retailers to increase margins and monetize excess inventory, offering additional revenue streams.

- Hirestreet's partnership with dmg media aligns with the target audience demographic, utilizing platforms like Mail Online, Metro, and Eliza to reach a wide audience.

- Successful collaboration expected with Eliza, a social-first fashion and beauty brand under dmg media, to educate and inspire audience about the benefits of rental.

- Overall, the investment in Hirestreet is driven by its alignment with sustainable fashion trends, retailer profitability, and strategic media partnerships.

Read Full Article

2 Likes

Dev

395

Image Credit: Dev

FWFW - Find Websites From World

- FWFW (Find Websites From World) is a global platform for discovering websites, applications, and digital tools worldwide.

- Core features include smart regional navigation, flexible pricing options, rapid product launch, and a tool ecosystem.

- The platform offers continental categories, country breakdown, regional specialties, and showcases cultural diversity.

- Users can choose a pricing amount from $0-$10, enjoy free submissions with manual review, and instant publishing without hidden fees.

- Submitting content is simplified with one-click submission, smart categorization, instant publishing, and SEO optimization.

- Technical features involve a modern technology stack with Next.js, React, Tailwind CSS, and integration with Stripe for payments.

- High-performance architecture includes SEO-friendly rendering, image optimization, caching, and responsive design.

- Use cases cater to developers, entrepreneurs, designers, and marketing experts looking for tools, market insights, inspiration, and collaboration.

- To get started, users can browse fwfw.app, filter by region or category, and view detailed information on tools.

- The project vision aims to eliminate information barriers, promote cultural exchange, support innovation, and build an open tech community.

- Contributions in bug reports, feature ideas, content recommendations, code development, and documentation are welcomed.

- Contact information includes the fwfw.app website, email [email protected], GitHub repository Selenium39/find-websites-from-world, and Twitter @yuxing39.

Read Full Article

23 Likes

TechCrunch

145

Image Credit: TechCrunch

Stripe’s former growth lead helps African diaspora invest in startups, real estate

- Joe Kinvi, former growth lead at Stripe acquired equity from Touchtech Payments that converted to Stripe shares, allowing him to bootstrap Borderless to help African diaspora invest in startups and real estate.

- Borderless, based in the U.K., processes over $500,000 in transactions and aims to direct diaspora remittances into productive assets through collective investing opportunities.

- Hoaq, an investment club Kinvi was part of, faced challenges like opening bank accounts and dealing with currency mismatches before evolving into Borderless.

- Borderless facilitates diaspora collectives in investing securely in startups and real estate, with over 100 communities on its waitlist and successful backing of projects in Kenya.

- Operates under U.K. regulations for marketing investment opportunities to diaspora investors, focusing on startups and real estate initially with plans for further asset classes.

- Ensures trust and security by handling investor funds through verified channels, embedding legal and compliance checks in the process, and generating revenue through fees and spreads.

- Borderless's mission is to unlock migrant savings and build a platform for long-term investing, supported by investors like DFS Lab, Paystack CTO, and Stripe executives.

- Challenges ahead for Borderless include scaling vetting processes for growth and ensuring robust identity verification and legal compliance.

Read Full Article

8 Likes

Siliconcanals

328

Barcelona’s Tether raises €1.3M post-Spain blackout to tackle EU’s €135B/year grid instability risk

- Barcelona-based startup Tether has secured nearly €1.3M in pre-seed funding to enhance its AI-coordinated electric vehicle grid integration technology.

- Draper B1 and K Fund led the funding round, with support from other Southern European venture funds focused on impact investments.

- Tether aims to tackle Europe's grid stability challenge by transforming private electric vehicles into distributed battery assets for grid reinforcement.

- The technology coordinates charging schedules of private electric vehicles to reduce CO2 emissions and create revenue streams for OEMs and charge point operators.

- Without immediate action, EU economies could face up to €135B in annual grid instability costs by 2050.

- The funding will aid Tether's team growth and product launches in Nordic markets, Germany, and Belgium.

- Tether plans to expand its engineering and commercial teams and deepen collaborations with automakers and grid operators.

- The company has ongoing pilots with major car manufacturers and charge point operators like Audi and Zeekr.

- Founder Luis Medina Rivas highlights the urgency for flexibility in the grid due to the blackout in Spain and the potential grid instability costs in the EU.

- Luis Medina Rivas, with a background in power and renewable energy engineering, leads Tether, bringing expertise from notable companies and recognitions.

- Tether's development team includes engineers, mathematicians, and data scientists with diverse backgrounds to support its technical approach.

- Raquel Bernal, Partner at Draper B1, praises Tether's mission to bridge electric vehicles with the energy market and its innovative market transformation potential.

Read Full Article

19 Likes

Eu-Startups

409

Beyond the beat: How European music tech startups and AI are shaping creative futures

- Europe's music streaming market reached €11.13 billion in 2024, showcasing a deeper transformation fueled by AI and tech-savvy founders in reshaping the creative industries.

- Sónar+D 2025 highlighted how AI is redefining creativity, innovation, and commerce in European music tech startups.

- European startups featured at the event utilized AI for artist discovery, music production, and new models for music education.

- Startups like BEAM for Music and SongsWallet addressed financial and legal inefficiencies in the industry, while platforms like Sounds Market and Ticketoo focused on sustainability and ethical marketplaces.

- Sónar+D 2025 also included critical discussions on technology's impact, showcasing experimental installations and student projects reflecting concerns about algorithmic transparency and digital rights.

- While hopeful about AI and new technologies, the article warns of the challenges, emphasizing the importance of cautious optimism and thoughtful debate on technology's role in our lives.

Read Full Article

24 Likes

The Total Entrepreneurs

373

Image Credit: The Total Entrepreneurs

How to Validate Your Startup Idea in a Crowded Market

- Starting a business in a crowded market requires refining your idea to ensure it can thrive despite high competition.

- Validating your startup idea involves confirming genuine market demand and targeting the right audience for success.

- Identifying your target market precisely helps tailor user experience and marketing strategies effectively.

- Factors like conducting market research and defining your target audience play a crucial role in startup success in competitive markets.

- Market research tools like keyword research, surveys, focus groups, and competitor analysis aid in understanding market gaps and improving goods.

- Creating a Minimum Viable Product (MVP) and testing demand through pre-sale campaigns and crowdfunding can gauge initial interest.

- Feedback plays a vital role in developing and refining your product or service to meet customer needs and preferences.

- Constantly listening to feedback and making necessary improvements leads to a successful business that meets customer demands.

- Focusing on the target audience, conducting thorough market research, and leveraging feedback are essential steps for startup success in competitive markets.

- Understanding customer needs and continually enhancing your offerings can help turn your startup idea into a thriving business.

Read Full Article

22 Likes

Medium

0

Image Credit: Medium

From Playlists to Precision Tech: Why Spotify’s Founder Is Investing in Military Innovation

- Daniel Ek, known for Spotify, is now investing in military technology through a startup called HBF.

- HBF, co-founded by Ek, aims to modernize Europe's defense systems using advanced technologies like AI.

- Their goal is to make Europe more resilient and secure by improving defense capabilities.

- Areas of focus for HBF include AI, advanced software, and flexible defense tools.

- Ek's concern about Europe's defense readiness stems from geopolitical vulnerabilities.

- He emphasizes the need for innovation in defense for protection of democracy and freedom.

- HBF's involvement in military tech raises ethical questions due to the integration of civilian and military technologies.

- This move suggests a shift in Europe, where startups actively engage in building secure defense systems.

- While U.S. tech companies have strong ties to defense projects, Europe has been more cautious due to various factors.

- Daniel Ek's investment reflects a new era where technology plays a crucial role in Europe's security and defense.

- The future of European innovation involves defense, bringing about new ethical considerations.

Read Full Article

Like

For uninterrupted reading, download the app