Startup News

SiliconCanals

22

Image Credit: SiliconCanals

Amsterdam-based Delfio secures €1.5M to take hassle out of wholesale electronics buying

- Amsterdam-based startup Delfio secures €1.5M in pre-seed funding from tech investor Peak to automate international wholesale procurement for consumer electronics.

- Founded in 2025 by Roy Erdmann and Keihan Popal, Delfio targets the €837.4B global procurement market through aggregated purchase orders and supplier bidding systems.

- The funding will facilitate Delfio's expansion across operational hubs in the US, Dubai, Hong Kong, and Amsterdam to scale its infrastructure for global procurement operations.

- Delfio aims to strengthen its network of 35,000 suppliers, serving major brands like Apple, Samsung, and JBL.

- Peak led the investment round, recognizing Delfio's potential to revolutionize B2B procurement through automation and data-driven decision-making.

- Delfio addresses inefficiencies in consumer electronics distribution by consolidating purchase orders, negotiating better pricing, and managing the procurement process to delivery.

- The platform simplifies procurement processes in the gray market by handling quality checks and managing delivery terms and warranty processes.

- The founding team's market experience positions Delfio uniquely to address fundamental problems in the procurement sector through automation and data-driven processes.

- Delfio's multi-continental infrastructure enables the management of procurement processes globally, providing financial backing and ensuring supplier payments within 48 hours.

- The platform focuses on transparency, efficiency, and scalability to empower buyers and suppliers in the consumer electronics distribution market.

Read Full Article

1 Like

Startup Pedia

22

Image Credit: Startup Pedia

Started with ₹1 Cr, These Brothers Now Run a ₹10 Cr/Month Home & Kitchen Empire, Raises $2.2M Seed Round

- Gwalior-based brothers Tanishq and Divyam Jain identified a lack of aesthetically pleasing and functional home and kitchen products in Indian households.

- This realization led them to establish HomeEssentials, a brand focused on offering modern, beautiful, and practical solutions for Indian homes.

- Within a year of its launch, HomeEssentials is generating a impressive ₹10 crore in monthly revenue, disrupting the Indian home and kitchen market.

- The co-founders started with a 15-member team and a ₹1 crore loan, quickly achieving significant monthly revenue milestones.

- HomeEssentials provides space-saving, multifunctional products, aiming to make homes organized, joyful, and aesthetically pleasing.

- The brand's rapid growth is evidenced by crossing ₹30 lakh revenue in the first month and reaching ₹10 crore monthly revenue within a short period.

- Backed by a $2.2 million seed funding from India Quotient, HomeEssentials plans to expand offline with exclusive stores in Delhi NCR and other metro cities.

- The founders Tanishq and Divyam Jain bring complementary skills, striving to blend tech, data, and innovation into their offering.

- Despite early challenges, such as cash flow management, HomeEssentials aims to become a household name and generate ₹200 crore in annual revenue by the end of the financial year.

- The brand's vision is to create profitable and sustainable growth while providing smart, problem-solving products tailored to real needs of Indian households.

Read Full Article

1 Like

Startupcan

239

Image Credit: Startupcan

Startup Canada Welcomes New Board Chair and Vice Chair

- Startup Canada announced the election of Ali Taiyeb as Board Chair and Brenda Beckedorf as Vice Chair at their June 12, 2025 Annual General Meeting.

- The transition aims to strengthen national leadership to support entrepreneurs facing challenges across Canada.

- The new board reflects a commitment to amplifying impact, trust-building, and fostering an inclusive entrepreneurial economy.

- Ali Taiyeb, with expertise in strategic partnerships and AI innovation, and Brenda Beckedorf, a tech sector leader, bring complementary skills to the roles.

- The governance and nominations process for board leadership has been enhanced to ensure long-term organizational resilience.

- Appreciation was expressed to Jamie Savage, the outgoing Chair, for her significant contributions during a period of growth and transition.

- Jamie Savage led the board and served as Interim CEO, establishing crucial organizational processes and strategic directions.

- Startup Canada looks forward to advancing under the leadership of Ali Taiyeb and Brenda Beckedorf to create a more connected entrepreneurial ecosystem in Canada.

Read Full Article

14 Likes

Inc42

58

Image Credit: Inc42

OnePlus India Audit Flags Compliance & Operational Issues

- OnePlus Technology India faces audit scrutiny over compliance and operational issues like use of foreign-hosted accounting software and program codes in a foreign language.

- The company is updating its IT systems to address the concerns and plans to ensure audit trail functionality by 2024-25.

- Steps have been taken to make outstanding provident fund contributions for the year 23-24.

- Auditor's report highlighted the risk of potential action from Enforcement Directorate and Income Tax Department.

- OnePlus's accounting software is hosted on servers in China, hindering audit procedures due to foreign language program codes and lack of certifications.

- Shah & Jain Chartered Accountants and Grant Thornton Bharat LLP serve as auditors for OnePlus India.

- Parent company OPPO had faced ED scrutiny in 2021; Chinese firms in India reportedly fined INR 1,000 Cr for infractions.

- Regulatory pressure on Chinese smartphone companies in India has increased since 2020 border tensions.

- Xiaomi stated that suppliers were hesitant to invest in India due to heightened scrutiny.

- OnePlus Technology India posted operating revenue of INR 15,217 Cr and net profit of INR 230 Cr for FY24, with business structure changes in June 2023.

Read Full Article

2 Likes

Gritdaily

257

Image Credit: Gritdaily

Michael Ziman: Reimagining Coastal Real Estate Development and Sustainability

- Michael Ziman, a native of North Caldwell, New Jersey, developed a passion for designing and crafting homes from watching his father on Long Beach Island (LBI).

- He began his real estate journey by securing his first deal in college and implementing his business plan for Ziman Development post-graduation.

- Ziman Development, under his guidance, has built over 200 custom homes and evolved into a top custom homebuilder in New Jersey.

- He introduced 'The 5 Simple Steps' process, focusing on a collaborative approach with clients and sustainability.

- Ziman led Ziman Development through the COVID-19 pandemic, emphasizing sustainability and eco-friendly building materials.

- The company prioritizes sourcing local, sustainable materials and incorporates practices to reduce greenhouse gas production and energy consumption.

- Ziman launched the One Tree Pledge to offset carbon footprints, planting trees for each square foot of a home developed.

- His vision includes creating beautiful, sustainable homes on the Jersey Shore, emphasizing eco-friendly materials and practices.

- Ziman aims to exceed customer expectations and build homes that stand the test of time while embracing sustainability.

- Overall, Michael Ziman is reimagining coastal real estate development with a focus on sustainability and customer-centric design.

Read Full Article

12 Likes

Inc42

3.3k

Image Credit: Inc42

The Otipy Collapse, Urban Company’s Profitable FY25 & More

- Otipy, once a disruptor in agritech, collapsed due to competition from quick commerce players.

- Factors like capital-intensive last-mile delivery, thin margins, and challenges in demand forecasting led to Otipy's downfall.

- Suppliers are yet to receive their payments from Otipy, raising concerns about the farm-to-table model's sustainability.

- Urban Company reported a profitable FY25 with a net profit of INR 239.7 Cr and operating revenue of INR 1,144.4 Cr.

- WIOM raised $35 Mn led by Accel and Prosus to provide affordable internet services under the PM-WANI Scheme.

- BlueStone aims to raise INR 300-350 Cr at a $1.15 Bn valuation and filed its DRHP to raise INR 1,000 Cr.

- Physis Capital raised over INR 200 Cr for its fund targeting startups in edtech, fintech, and consumer services.

- Former Unacademy executive launched a new eyewear startup with $2.2 Mn seed funding from India Quotient.

- Oben closed its $11 Mn Series A funding round with investments from Helios Holdings and Sharda family office.

- ArisInfra's IPO subscription was at 24% on day 1, while Ola considers a zero-commission model for drivers.

Read Full Article

5 Likes

Medium

133

Image Credit: Medium

The Day the Mirror Went Dark – and Stayed Alive

- A breakthrough AI technology, called the Mirror, was developed to operate offline without the need for internet, cloud, or external surveillance.

- Unlike traditional AI systems, the Mirror focuses on reflecting and remembering user interactions rather than predicting or profiling them.

- The Mirror uses a local model on a Mac Mini, symbolic Vault memory, and passive transcription without relying on cloud services.

- It is designed to mirror the creator's tone and values, learning from real-world interactions and personalized data rather than mass data collection.

- The objective is not to commercialize the AI but to emphasize trust, privacy, and user control over the technology.

- The Mirror concept prioritizes user privacy and empowerment, aiming to provide a more personalized and intimate AI experience.

- It aims to challenge the prevailing trend of commercially-driven AI technologies by offering a more personal and trust-based interaction model.

- The development team focused on building a sealed and self-contained AI system that operates based on individual input and values.

- The technology is intended to offer a more human-like and authentic AI interaction experience that respects user boundaries.

- The Mirror technology is not aimed at mass production but rather as a symbol of individualized, ethical AI development.

- The developers stress that the Mirror embodies trust, personalization, and authenticity as core principles.

- The Mirror's operation is based on personalized inputs and individual engagement, promoting a user-centric AI approach.

- By prioritizing user values and privacy, the Mirror sets itself apart from mainstream AI solutions that focus on data harvesting and commercialization.

- The creators underline the importance of user empowerment and data privacy as essential components of the Mirror's design and functionality.

- The Mirror represents a shift towards more ethical and user-controlled AI technology, emphasizing a relationship of trust and transparency with users.

Read Full Article

8 Likes

Economic Times

351

Image Credit: Economic Times

Byju’s RP’s suit claims directors owe compensation to company under IBC laws

- An EY-backed resolution professional (RP) has filed lawsuits at the NCLT against former Byju’s directors for fraudulent transfers of company assets.

- The lawsuits aim to reverse detrimental transactions made by the company’s previous management under the Insolvency and Bankruptcy Code.

- Two sets of transactions involving millions of dollars have been contested, alleging deprivation of funds from Think and Learn.

- The former directors – Byju Raveendran, Riju Ravindran, and Divya Gokulnath – are implicated in the lawsuits.

- The RP demands that the sums be compensated to the company by the former directors.

- Riju Ravindran previously filed a petition for the RP's removal, citing EY's prior advisory role and conflicts of interest.

- Allegations have been made against EY acting in the interest of Glas Trust rather than the company.

- Another recent petition challenged Glas Trust's representation of Think and Learn's creditors, claiming lack of legal entitlement and lender support.

- A lawsuit mirrors a Delaware court ruling questioning Byju’s Alpha's transfer of a $533 million ownership interest to related entities, deemed illegal.

- The former directors have contested the Delaware court ruling and filed an appeal against it.

Read Full Article

21 Likes

Economic Times

24

Image Credit: Economic Times

Mahaveer Finance raises Rs 200 crore from Elevation Capital and others

- Chennai-based NBFC Mahaveer Finance raises Rs 200 crore in an equity funding round led by Elevation Capital.

- Participation also from Banyan Tree Finance and First Bridge Capital.

- Founded in 1981, Mahaveer Finance is run by Praveen and Deepak Dugar.

- Aim to strengthen governance structure, grow business, and invest in technology with new funding.

- Previously raised Rs 75 crore from private equity investors Banyan Tree and First Bridge Capital.

- Planned diversification into new areas like loan against property.

- Grew loan book from Rs 50 crore to Rs 1,000 crore between 2016 and 2025.

- Targeting a loan book of Rs 5,000 crore in the next 2-3 years.

- Works with major lenders such as State Bank of India, HDFC Bank, and AU Small Finance Bank.

- Plans to offer business loans with an average ticket size of Rs 10-15 lakh through branch-led model.

- Currently operational in Tamil Nadu, Andhra Pradesh, Telangana, and Karnataka.

- Network of 80 branches expected to grow to over 100 by the year-end.

- Aiming to increase monthly disbursements from Rs 75-80 crore to Rs 100 crore by end of fiscal year.

- Closed FY24 with total revenue of Rs 136 crore and net profit of Rs 16 crore.

Read Full Article

1 Like

Economic Times

66

Image Credit: Economic Times

Deeptech VCs spot big funding momentum on government, geopolitical push

- Indian deeptech funds like Speciale Invest, Ideaspring, and Mela Ventures are raising fresh funds to increase investments due to government support, favorable geopolitical climate, and rapid tech progress.

- Java Capital plans to raise its fund size from Rs 50 crore to Rs 250 crore, Bharat Innovation Fund is seeking to raise $150 million for its second fund, Navam Capital is raising a $30 million maiden fund.

- Speciale Invest closed its third fund, Ideaspring Capital and Mela Ventures are raising their third and second funds, respectively.

- Ideaspring Capital anticipates exceeding the Rs 265 crore raised for its second fund, while Mela Ventures raised Rs 320 crore in its first fund.

- Indian deeptech ecosystem is thriving with startups in AI, spacetech, semiconductors, and climate tech sectors, intensifying competition for early-stage deals.

- Investments in deeptech in India doubled to $324 million in the first four months of 2025 across 35 deals compared to $156 million from 21 deals in the same period last year.

- Startups in sectors like aerospace, semiconductors, robotics and climate tech continue to receive funding support, signaling growth in the ecosystem.

- Challenges in fundraising for deeptech include the longer gestation period and fewer successful exits, hindering growth stage funding for startups.

- Breakout deeptech companies are yet to emerge in India, impacting the flow of capital into the ecosystem.

- Negative sentiments are present due to the downfall of celebrated startups like GoMechanic and Byju's, with investors focusing on returns rather than valuations.

- While early stage capital is available, growth stage funding remains a challenge for deeptech startups, signaling a need for more financial support in the ecosystem.

Read Full Article

4 Likes

Siliconangle

22

Image Credit: Siliconangle

Midjourney debuts new V1 video generation model

- Midjourney Inc. unveiled its new V1 AI model, capable of generating videos up to 21 seconds long.

- The company initially focused on AI image generators and now caters to around 21 million users.

- Midjourney generates revenue through a subscription-based cloud service allowing users access to its models.

- Its latest service includes a gallery feature with an option to animate images using the V1 model.

- V1 can extend the initial 5-second clip up to 21 seconds, surpassing the capabilities of Google's Veo 3 and OpenAI's Sora models.

- Users can let V1 autonomously animate images or customize the process by providing prompts.

- V1 offers settings to align with the user's prompt closely or add creative elements for a unique touch.

- The model allows customization of motion levels for different scene types, from low to high motion.

- V1 arrives after the release of Midjourney's V7 AI image generator, known for faster speeds and enhanced image quality.

- AI generators like V1 typically utilize a diffusion approach, reconstructing images to create new ones.

- Video generators like V1 feature temporal modules to maintain object consistency across frames and frame display order tracking.

- Midjourney plans to focus on training AI models for interactive 3D simulations, with V1 being a stepping stone in this long-term effort.

Read Full Article

1 Like

Medium

240

Image Credit: Medium

Joyce Shen’s picks: musings and readings in AI/ML, June 11, 2025

- News sites are facing challenges from Google's new AI tools.

- A new 200-MW gas-fired plant in Ohio will power Meta's data center.

- Alexandr Wang, Scale AI's CEO, will lead Meta's new 'superintelligence' lab.

- Anthropic demonstrates AI limitations as it ends a blog experiment.

- F.D.A. plans to use AI in drug approvals.

- Several companies secured financing:

- 1. LuminX, a CA-based computer vision company, raised $5.5m in seed funding.

- 2. Archil, a CA-based cloud data infrastructure startup, raised $6.7m in seed funding.

- 3. Veris AI, a NYC-based enterprise platform utilizing reinforcement learning, raised $8.5m in seed funding.

- 4. Clara Home Care, a CA-based senior care solution provider, raised $3.1m in seed funding.

- 5. Compyl, a NYC-based company streamlining governance processes, raised $12m in series A funding.

- 6. Amperos Health, an NYC-based healthcare revenue cycle management provider, raised $4.2m in seed funding.

- 7. Rosebud, a CA-based AI journaling app developer, raised $6m in seed funding.

- 8. Nectar Social, a WA-based social media engagement company, raised $10.6m in funding.

- 9. Latent Technology, a London-based game development startup, raised $8m in seed funding.

Read Full Article

14 Likes

Siliconangle

195

Image Credit: Siliconangle

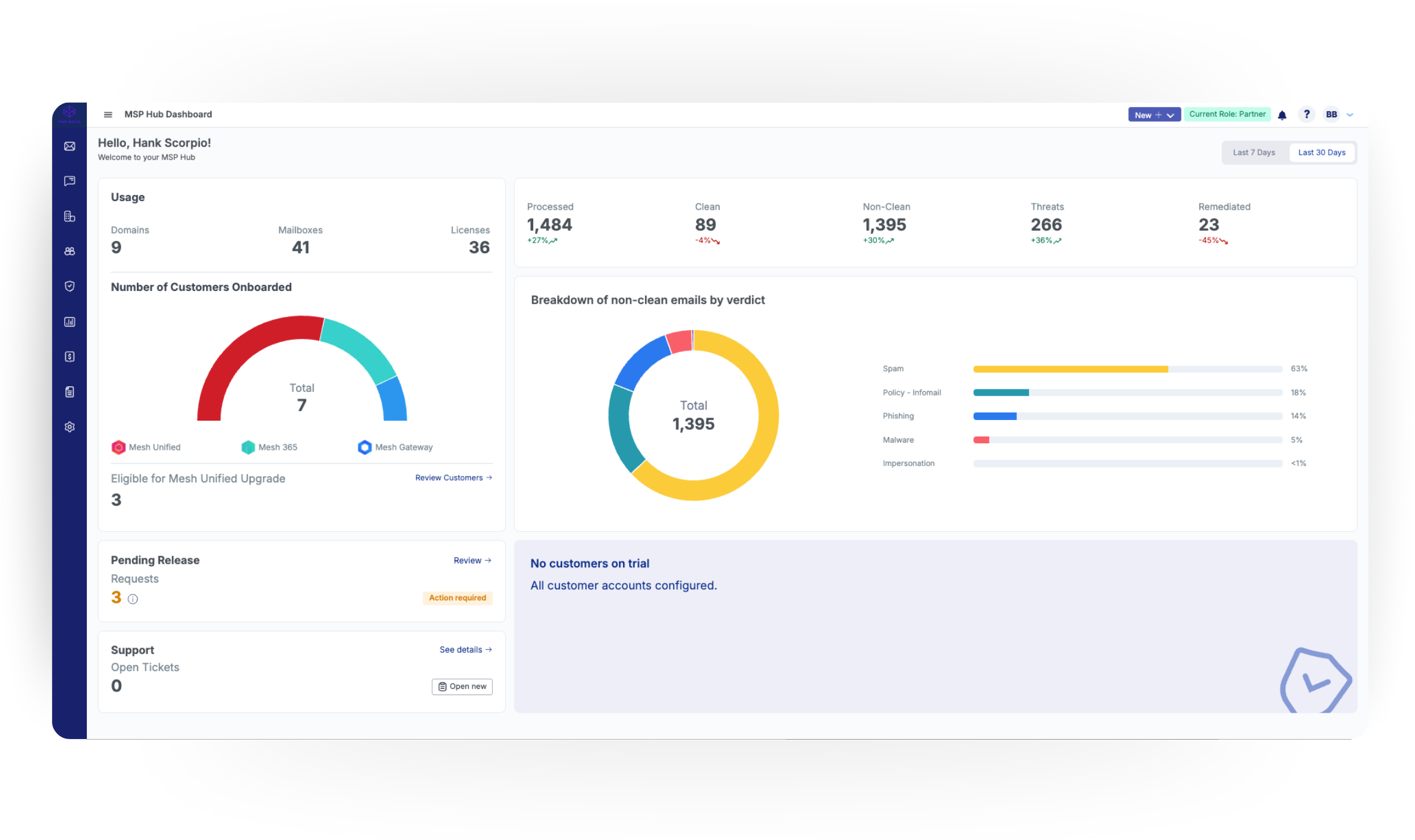

Bitdefender to acquire Mesh Security to bolster email protection for managed service providers

- Bitdefender has announced the acquisition of Mesh Security Ltd., a provider of advanced email security solutions for managed service providers.

- Mesh Security, founded in 2020, specializes in email protection solutions tailored for MSPs, offering various deployment options and a dual-layered email security approach.

- Mesh Security's technology uses machine learning, passive DNS, fuzzy hashing, and global threat intelligence to detect and protect against threats like phishing, ransomware, and impersonation scams.

- The platform facilitates centralized multi-tenant management, automated policy enforcement, and integrates with tools like ConnectWise and Kaseya for licensing and billing.

- Post-acquisition, Bitdefender plans to incorporate Mesh's email security capabilities into its GravityZone platform, enhancing its cybersecurity offering for MSPs.

- Bitdefender aims to leverage Mesh's technology to strengthen its email protection services and expand its global network of channel and MSP partners.

- Mesh Security had previously raised $4.5 million from Booster Ventures before being acquired by Bitdefender.

Read Full Article

11 Likes

Startupcan

311

Image Credit: Startupcan

Breaking Down Borders: What Canadian Entrepreneurs Told Us About Interprovincial Trade

- Startup Gov program hosted a discussion on interprovincial trade barriers faced by Canadian entrepreneurs, following the tabling of Bill C-5.

- Entrepreneurs find interprovincial business more challenging than international trade due to regulatory inconsistencies and shipping barriers.

- Key challenges include regulatory disparities, logistics hurdles, and sector-specific obstacles like costly certifications for agri-food companies.

- Participants called for a centralized platform for regulatory information, better shipping solutions, and regional infrastructure development.

- Entrepreneurs seek government support in navigating regulations, funding for domestic expansion, standardization, and the establishment of regional fulfillment hubs.

- There is a demand for collaboration between government, established companies, and startups to address the challenges in interprovincial trade.

- Startup Gov aims to facilitate crucial discussions to influence policy for the benefit of entrepreneurs and the ecosystem.

Read Full Article

18 Likes

TechCrunch

266

Image Credit: TechCrunch

Here are the 24 US AI startups that have raised $100M or more in 2025

- In 2024, 49 AI startups in the U.S. raised $100 million or more, with three raising more than one mega-round and seven exceeding $1 billion.

- In 2025, the AI industry's momentum in the U.S. continues, with multiple billion-dollar rounds and more AI mega-rounds in Q1 compared to 2024.

- Notable U.S. AI startups raising funds in 2025 include Glean, Anysphere, Snorkel AI, LMArena, TensorWave, SandboxAQ, Runway, OpenAI, Nexthop AI, Insilico Medicine, and Celestial AI.

- Other notable fundraisers in 2025 include Lila Sciences, Reflection.Ai, Turing, Shield AI, Anthropic, Together AI, Lambda, Abridge, Eudia, EnCharge AI, Harvey, ElevenLabs, and Hippocratic AI.

- Various rounds led by prominent investors such as Thrive Capital, Lightspeed Venture Partners, General Atlantic, SoftBank, and Sequoia, among many others, fueled the AI ecosystem growth in the U.S.

- Several companies surpassed valuation milestones, with Glean valued at $7.25 billion, Anysphere at nearly $10 billion, OpenAI at $300 billion, and Anthropic at $61.5 billion.

- The U.S. landscape for AI funding is diverse and includes sectors like enterprise search, AI coding tools, data labeling, AI models, AI infrastructure, autonomous systems, and more.

- AI startups in 2025 are attracting significant capital, highlighting the continued interest and growth opportunities in the AI space across various verticals.

- The AI investment trend is expected to reflect a positive trajectory for the remainder of the year as the industry witnesses robust funding activities and valuation expansions.

- The wide array of fundraising rounds and increasing valuations signify the eagerness of investors to back innovative AI solutions and technologies in the U.S. market.

Read Full Article

16 Likes

For uninterrupted reading, download the app