Startup News

Pymnts

378

Image Credit: Pymnts

Tipalti Expands Treasury Automation Offerings With Statement Acquisition

- Tipalti acquires AI-powered treasury automation provider Statement to enhance cash flow visibility and forecasting.

- Statement's solution automates cash position visibility, cash flow forecasts, and insights across platforms.

- The addition aims to optimize working capital, improve liquidity, and ensure accurate financial forecasts.

- The move aligns with the trend of technology like AI modernizing finance functions such as accounts receivable.

- Companies still struggle with automating AR operations despite the rise of FinTech tools.

- Late invoices, poorly enforced payment terms, and reactive collections remain common issues in AR processes.

- Delayed payments can lead to significant revenue losses and hinder working capital for firms.

- Automation in AR operations is crucial for maintaining financial health and customer relationships.

Read Full Article

22 Likes

Startup Pedia

374

Image Credit: Startup Pedia

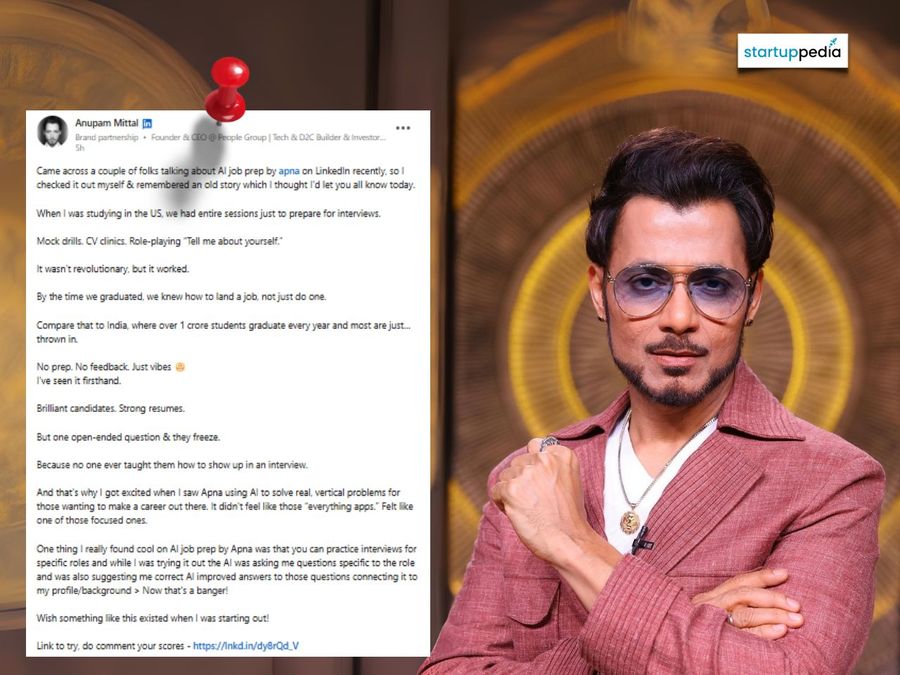

“A couple of folks are talking about AI job prep by apna, so I checked it out," Anupam Mittal lauds AI platform

- Anupam Mittal praises India's largest early talent hiring and jobs platform, apna, for its AI job preparation features.

- Mittal shared his experience of job preparation during his student life in the US and highlighted the lack of similar resources for Indian students.

- He expressed excitement about apna using AI to help candidates in India improve interview preparation and land jobs.

- Mittal found apna's focus on specific job roles in their AI job prep commendable, especially the personalized interview practice and feedback.

- He regretted that such AI-driven tools were not available when he was starting.

- apna.co, founded in 2019, is India's largest early talent hiring platform connecting millions of job seekers and employers across various sectors.

- The platform is trusted by leading enterprises in India and specializes in enterprise hiring solutions for various sectors like Retail, BFSI, BPO, Healthcare, and more.

Read Full Article

22 Likes

Medium

98

Image Credit: Medium

Why European founders will NEVER catch up to American founders

- European founders are lagging behind American founders due to a fear of taking risks, not lack of capital or regulatory obstacles.

- Failure is perceived differently in the US where it's seen as part of the learning process, whereas in Europe it carries a stigma.

- In Europe, bankruptcy laws are stricter, and the reputational cost of a failed startup is higher, discouraging risk-taking.

- The societal support system in Europe, like public healthcare and job security, makes founding a startup less necessary.

- In the US, the startup culture encourages risk-taking and rewards ambitious ventures, pushing talented individuals toward entrepreneurship.

- Equity is utilized more effectively in the US to build successful startups, while in Europe, founders tend to hoard equity, limiting growth potential.

- Complex compliance systems in Europe create hurdles for startups, leading to wasted resources on legal matters instead of product development.

- The fragmented nature of talent, VCs, and corporates across Europe hinders the growth and mentorship opportunities for startups.

- Europe faces a founder mindset problem, requiring a shift in beliefs and risk-taking attitudes to foster a more vibrant startup ecosystem.

- To compete with American founders, European founders need to embrace risk, act fast, and prioritize building impactful businesses over playing it safe.

Read Full Article

5 Likes

Inc42

3.5k

Image Credit: Inc42

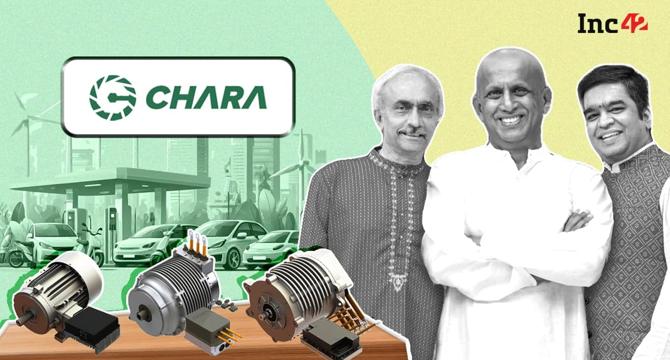

This Indian Startup Is Ditching China’s Rare Earth Grip With Smarter EV Motors

- China's ban on the export of rare earth minerals has caused disruptions in the global automotive industry, with India also affected due to the country's control over 90% of rare earth minerals.

- Amidst this crisis, Chara Technologies, founded by tech experts and automotive veterans, developed synchronous reluctance motors that do not rely on rare earth materials, offering a viable alternative for electric vehicles.

- Chara's motors are 5% more efficient than traditional rare-earth-based motors, addressing concerns of reliance on Chinese rare earths.

- The startup received initial funding from IISc Bengaluru and later raised significant investments from venture capital firms, enabling them to scale up production of these rare-earth-free motors.

- Chara's motors have been well-received, being 5% more efficient than rare-earth motors, although they are slightly heavier due to the absence of powerful magnets.

- The startup serves customers globally, including partnerships with European companies, and plans to ramp up production capacity to meet increasing demand in the electric vehicle market.

- Chara aims to sell 15,000 motors by the end of FY26, with potential revenues of $5 Mn, and is exploring partnerships for contract manufacturing to reduce costs.

- While facing challenges such as motor weight impacting vehicle efficiency, Chara's innovative approach to sustainable mobility amidst rare earth supply chain disruptions signifies a promising future for the startup.

- The startup's impact extends beyond electric vehicles, with a significant portion of revenue coming from off-highway applications, showcasing the versatility and market demand for their rare-earth-free motors.

- Chara's focus on sustainability and long-term impact aligns with the growing global shift towards reducing reliance on rare earth minerals, positioning the startup strategically in the evolving automotive industry landscape.

Read Full Article

45 Likes

ISN

44

Image Credit: ISN

India's unemployment rate rises to 5.6% in May 2025: Govt data

- India's unemployment rate increased to 5.6% in May 2025 from 5.1% in April as per govt data.

- The rise is attributed to seasonal changes, affecting rural labor demand after the Rabi harvest.

- Both rural and urban regions saw a hike in jobless rates, with youth unemployment climbing.

- Youth unemployment among 15–29 age group in rural areas reached 13.7% in May.

- Urban youth unemployment rose slightly to 17.9%.

- Female unemployment rate was slightly higher at 5.8% compared to the male rate of 5.6%.

- Labour Force Participation Rate declined to 54.8% in May, with rural LFPR at 56.9% and urban LFPR at 50.4%.

- Men displayed higher participation rates in the labor force than women, with rural men's LFPR at 78.3%.

- Worker Population Ratio dropped to 51.7% in May, with urban areas registering 46.9%.

- Employment in the primary sector, especially agriculture, decreased in May from April.

- Urban labor market remained stable with minor declines, impacting the overall unemployment rate.

- Monthly changes in PLFS indicators are influenced by short-term factors like climatic cycles.

- The data highlights persistent vulnerabilities in youth and female employment and rural livelihood sensitivity to seasonal shifts.

Read Full Article

2 Likes

Startup Story

196

Image Credit: Startup Story

Aspora Raises $93M from Sequoia, Greylock to Build Cross-Border Banking for Immigrants; Valuation Hits $500M

- London-based fintech startup Aspora, founded by Parth Garg, raises $93 million with a $500 million valuation.

- Funding rounds include $5M seed extension, $35M Series A led by Sequoia Capital, and $53M Series B co-led by Sequoia and Greylock.

- Backed by Y Combinator, Aspora is focused on cross-border banking for immigrant communities, initially targeting the Indian diaspora.

- Aspora's offerings encompass remittances, banking, credit, investments, and insurance, facilitating seamless money transfer for users.

- The platform has processed over $2 billion in remittances, saving its 250,000 users $15 million in fees.

- Luciana Lixandru from Sequoia, now on Aspora's board, highlights the uniqueness of Garg's vision.

- Prominent angels like Balaji Srinivasan, Sundeep Jain, and Prasanna Sankar are part of Aspora's cap table.

- Aspora operates in the UK, EU, and UAE, with plans for expansion to the US, Canada, Australia, and Singapore by year-end.

- The startup is gearing up to introduce cross-border credit, insurance, and investment products as it expands globally.

- The investment reflects VC interest in developing advanced fintech solutions for global Indians and immigrant communities.

Read Full Article

11 Likes

Hitconsultant

249

Image Credit: Hitconsultant

Nabla Raises $70M to Build an “Agentic” AI Assistant for Clinicians

- Nabla, a widely adopted AI assistant in clinical care, raises $70M in Series C funding led by HV Capital.

- Highland Europe and DST Global join as key investors, bringing Nabla's total capital raised to $120M.

- The funding will accelerate product development, fuel team growth, and support strategic partnerships for expansion.

- Nabla is transitioning from ambient documentation to a more agentic AI model for clinical use.

- The next phase aims to improve clinical documentation integrity, initiate EHR actions, and support diverse clinical roles.

- Nabla plans to build an Adaptive Agentic Platform with features like Proactive Coding Agent and Context-Aware Agent.

- The platform is expanding into various care settings to streamline clinical workflows.

- Nabla's assistant is used by major health systems like CVS Health and has seen revenue multiply by five in the past six months.

- The platform supports over 85,000 clinicians, with measurable results in reducing documentation time and improving patient satisfaction.

Read Full Article

15 Likes

Medium

8

Image Credit: Medium

The Venture Partner’s New Playbook: Your Network Is No Longer Your Greatest Asset

- The venture and growth landscape is shifting towards the 'agent-first' economy, where AI agents, not humans, will drive commerce.

- This change creates a 'Crisis of Verifiability' that will render traditional business models obsolete.

- In the new economy, AI agents prioritize provable, machine-readable trust over networks or marketing campaigns.

- Startups' integrity is now their most crucial asset in this evolving ecosystem.

- Venture Partners need to adapt to this new reality by developing new skills and behaviors.

- Mentorship in this context requires a shift toward ensuring integrity and trust.

- Venture Partners are expected to become the portfolio's Chief Integrity Officers in a trust-centric economy.

- Deep industry knowledge is essential to evaluate market trends and technological risks.

- Effective communication skills are needed to convey complex risks to investment committees.

- Success in this new era hinges on building generational companies based on verifiable trust.

- The most valuable Venture Partners will be those who can identify, nurture, and build such trustworthy companies.

Read Full Article

Like

TechCrunch

222

Image Credit: TechCrunch

Last call to volunteer at TechCrunch All Stage 2025

- Last call for exceptional volunteers to join TechCrunch All Stage 2025 in Boston on July 15.

- Volunteer spots are limited, and the application deadline is July 1.

- Volunteers will gain behind-the-scenes access, receive a complimentary ticket to All Stage 2025, and a pass to the Disrupt event in San Francisco.

- Opportunity for insight into startup events, workshops, and networking.

- Anticipated attendance of about 1,000 people, volunteers play a crucial role in creating a seamless experience.

- Volunteer tasks may include registration assistance, speaker coordination, guest guidance, ticket scanning, and event setup.

- Gain event management experience and access to enriching startup insights.

- Apply now to secure a volunteer spot at TechCrunch All Stage 2025.

- Companies interested in sponsoring or exhibiting can reach out to the sponsorship sales team.

Read Full Article

13 Likes

Inc42

8

Image Credit: Inc42

ArisInfra Raises INR 225 Cr From Anchor Investors

- Mumbai-based B2B ecommerce company ArisInfra raised INR 224.8 Cr from anchor investors a day before its IPO opens.

- 1.01 Cr shares were allotted to 15 investors, including Astorne Capital VCC, Niveshaay Hedgehogs Fund, Nexus Global Opportunities Fund, at INR 222 per share.

- No domestic mutual fund applied for the anchor investor portion of the issue.

- ArisInfra filed its red herring prospectus (RHP) on June 12 to raise INR 499.6 Cr via its public issue.

- ArisInfra's IPO is set to open tomorrow and close on June 20 with reserved portions for QIBs, NII, and retail investors.

- Shares are expected to list on the BSE and the NSE on June 25 with a price band of INR 210 to INR 222 apiece.

- At the upper end, ArisInfra targets a post-issue market cap of INR 1,799 Cr.

- ArisInfra, founded in 2021, is a B2B construction material procurement platform for real estate and infrastructure developers.

- The company faces competition from other B2B construction marketplaces like Infra.Market, OfBusiness, Moglix, and Zetwerk.

- ArisInfra differentiates itself through a tech-first, asset-light model and a focus on digitizing procurement.

- The company turned profitable before the IPO, reporting a net profit of INR 6.5 Cr in the first nine months of FY25.

- Operating revenue stood at INR 546.5 Cr in the mentioned period.

- ArisInfra had been a loss-making entity since its inception until FY25, where it changed its trajectory.

Read Full Article

Like

Medium

287

Image Credit: Medium

Why 90% of Developer SaaS Tools Fail in Year Two (Analysis of 50+ Failed Startups)

- A developer tools startup recently announced its closure despite positive feedback from users and significant funding.

- Many developer tools startups fail to sustain their businesses despite having products loved by engineers.

- An analysis of 50+ failed developer tool startups revealed that technical quality did not guarantee business success.

- The main reasons for failure were identified as business model and go-to-market challenges.

- These companies typically faced challenges around the 18–24 month mark, hindering their growth and sustainability.

Read Full Article

14 Likes

TechCrunch

356

Image Credit: TechCrunch

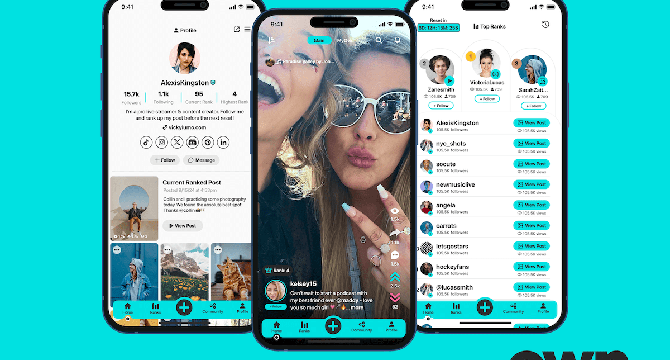

Own, a new social media app, aims to tokenize the creator economy

- Own, a decentralized social media app, launched its beta to the public with features like swipeable feed for short videos, text posts, and images, as well as direct messaging.

- The app aims to disrupt the market with blockchain technology and a token economy allowing creators to earn revenue without minimum follower or post count requirements.

- Developed by Amir Kaltak, Katia Zaitsev, and Sarah Mick, Own uses the $OWN Token rewarded based on video engagement, operates on Base Layer 2 blockchain for secure transactions and content ownership.

- Creators earn tokens on Own regardless of their location, leveling the playing field for global creators.

- A portion of the platform's revenue is used to buy $OWN Tokens from exchanges for creators, promoting buy-side demand and sustainability.

- Own offers monetization features like tipping, sponsorships, and Own Shop, promising creators to earn up to 50% more than on other platforms.

- Monetization features, including tokens, will be available in the third quarter, while Own Shop is expected to roll out between October and December.

- Creators can license content for additional revenue, tracked on the blockchain for proven ownership and origin.

- Own implements a ranking system where viewers can upvote or downvote posts, allowing creators with more upvotes to climb the leaderboard and gain exposure.

- Own app is free on App Store and Google Play Store, with nearly 40,000 waitlisted users. The startup has raised over $5 million from various investors.

Read Full Article

21 Likes

Hitconsultant

231

Image Credit: Hitconsultant

HOPPR Secures $31.5M to Scale its AI Medical Imaging Development Platform

- HOPPR secures $31.5M in Series A funding round led by Kivu and Greycroft to scale its AI medical imaging development platform, with participation from other investors.

- The funding will be used to accelerate platform development, scale operations, expand foundation model capabilities, and grow the team.

- HOPPR's platform enables fine-tuning and validation of models for medical AI imaging applications in a secure and compliant environment.

- It provides tools and data access for developing high-performing AI models with transparency and traceability.

- Unlike prebuilt AI application marketplaces, HOPPR allows users to fine-tune models using their own data or expertly curated datasets.

- The platform integrates trusted data provenance with secure development pipelines for concept-to-deployment streamlining.

- Dr. Khan Siddiqui, CEO and Co-founder of HOPPR, aims to democratize access to trustworthy imaging AI by providing developers necessary tools, data, and compliant environment.

Read Full Article

13 Likes

ISN

298

Image Credit: ISN

Rooftop solar-focused NBFC firm Dugar Finance raises $3 million in debt

- Dugar Finance, an NBFC focused on sustainable lending, raised $3 million in debt funding from Symbiotics Investments' Green Basket Bond.

- The funds will help expand Dugar Finance's EV and rooftop solar financing portfolio in tier-II and tier-III cities in India.

- The Green Basket Bond aims to promote renewable energy adoption in Asia and Africa, subscribed to by British International Investment.

- The funding will target residential, MSME clients, and housing societies for clean energy access.

- Ramesh Dugar, Founder & MD of Dugar Finance, sees this funding as an endorsement of their efforts to drive clean energy access and uplift small businesses.

- Dugar Finance offers income-generating vehicle loans and credit solutions for traditionally excluded borrowers, along with EV and rooftop solar financing.

- The company claims to have helped over 1,200 customers transition to clean energy, avoiding 3,000 tonnes of carbon emissions and saving Rs 2.96 crore in annual electricity costs.

- With 30 branches across six states, Dugar Finance has served over 25,000 customers, focusing on credit-invisible or underserved borrower segments.

Read Full Article

17 Likes

Eu-Startups

205

Portuguese startup Sword Health raises €34.6 million to address global mental health crisis

- Porto-based startup Sword Health raises €34.6 million funding round at a €3.4 billion valuation to accelerate M&A momentum, global expansion, and AI model development.

- The round was led by General Catalyst and included various other investors like Khosla Ventures, Comcast Ventures, Lince Capital, and Oxy Capital.

- Sword Health, founded in 2015, aims to shift healthcare to an AI-first model, focusing on physical, pelvic, movement health, and now mental health.

- The company has reached over 500,000 members across three continents with 6.5 million AI sessions, helping clients save €865 million in healthcare costs since 2020.

- Backed by 40 clinical studies and over 40 patents, Sword Health has raised more than €259 million from investors like Khosla Ventures and General Catalyst.

- Sword Health unveiled 'Mind,' a mental health solution combining AI and clinicians to offer continuous personalized care, transforming mental health care delivery.

- Mind aims to address mental health challenges with a proactive, 24/7 model integrating AI, wearable tech, and Ph.D.-level mental health specialists.

- Sword's Mind looks to enhance accessibility and quality of mental health care globally, targeting the 1 billion people living with mental health conditions.

Read Full Article

12 Likes

For uninterrupted reading, download the app