Startup News

Startup Story

433

Image Credit: Startup Story

Revathi Kamath Pens Autobiography Reflecting on Life Raising Zerodha Founders: “They Were Not Normal Kids”

- Revathi Kamath, mother of Zerodha co-founders Nithin and Nikhil Kamath, is working on an autobiography focusing on her journey raising the fintech pioneers.

- Kamath shared the announcement through a heartfelt Facebook post, offering a glimpse into her struggles and experiences as a mother.

- She mentioned the challenges of raising her sons, citing that they were not 'normal kids' due to the demands and responsibilities.

- Nithin and Nikhil Kamath attribute their success to their upbringing, which is expected to be detailed in Kamath's upcoming book.

- The memoir aims to reveal the sacrifices and dedication behind the Kamath brothers' journey from their early years.

- Kamath plans to document aspects like their upbringing and the role she played in shaping their lives.

- Her reflections on social media received admiration and praise for her resilience, optimism, and love for her family.

- Audience comments highlighted her energy, enthusiasm, and the impact of her selfless devotion.

- Revathi Kamath's book is anticipated to provide a human perspective on the Kamath brothers' success and the support of women behind entrepreneurs.

- The memoir will likely offer insights into the life of a mother nurturing successful entrepreneurs and the untold contributions of women in such journeys.

Read Full Article

26 Likes

Eu-Startups

201

Belgian early-stage investor biotope raises €5 million to support up to 30 international BioTech startups

- Belgian early-stage investor biotope by VIB has secured €5 million for its Biotope Ventures 2 fund to support up to 30 international early-stage BioTech startups.

- Contributors to the fund include Belgian Bank BNP Paribas Fortis, VC Agri Investment Fund (AIF), and others.

- The funding enables biotope to invest €250k in each startup, allowing founders to focus on their technology.

- biotope, launched in 2022 by VIB, backs BioTech startups driving positive change for planetary health.

- The approach is founder-centric, with a focus on diverse, mission-driven Founders.

- Biotope is setting up Biotope Ventures Fund 2 to continue its impact investing in BioTech.

- Startups receive a cash investment and support to prepare them for future rounds.

- Selected startups go through a basecamp and receive hands-on support to de-risk their biotechnology.

- biotope's first fund invested in 16 European startups and some have already closed their Seed round.

- The portfolio startups have collectively attracted €30 million in follow-on financing.

- biotope emphasizes the importance of investing in dedicated founders who share the vision for solving planetary health challenges.

- 75% of startups supported by biotope have mixed-gender founding teams.

- 58% of startup employees are women, with 48 high-quality FTE jobs created.

- Investors like AIF and Anacura express support for biotope's work in the BioTech ecosystem.

- The funding milestone marks a significant achievement for biotope and its commitment to supporting impactful BioTech ventures.

Read Full Article

12 Likes

Inc42

407

Image Credit: Inc42

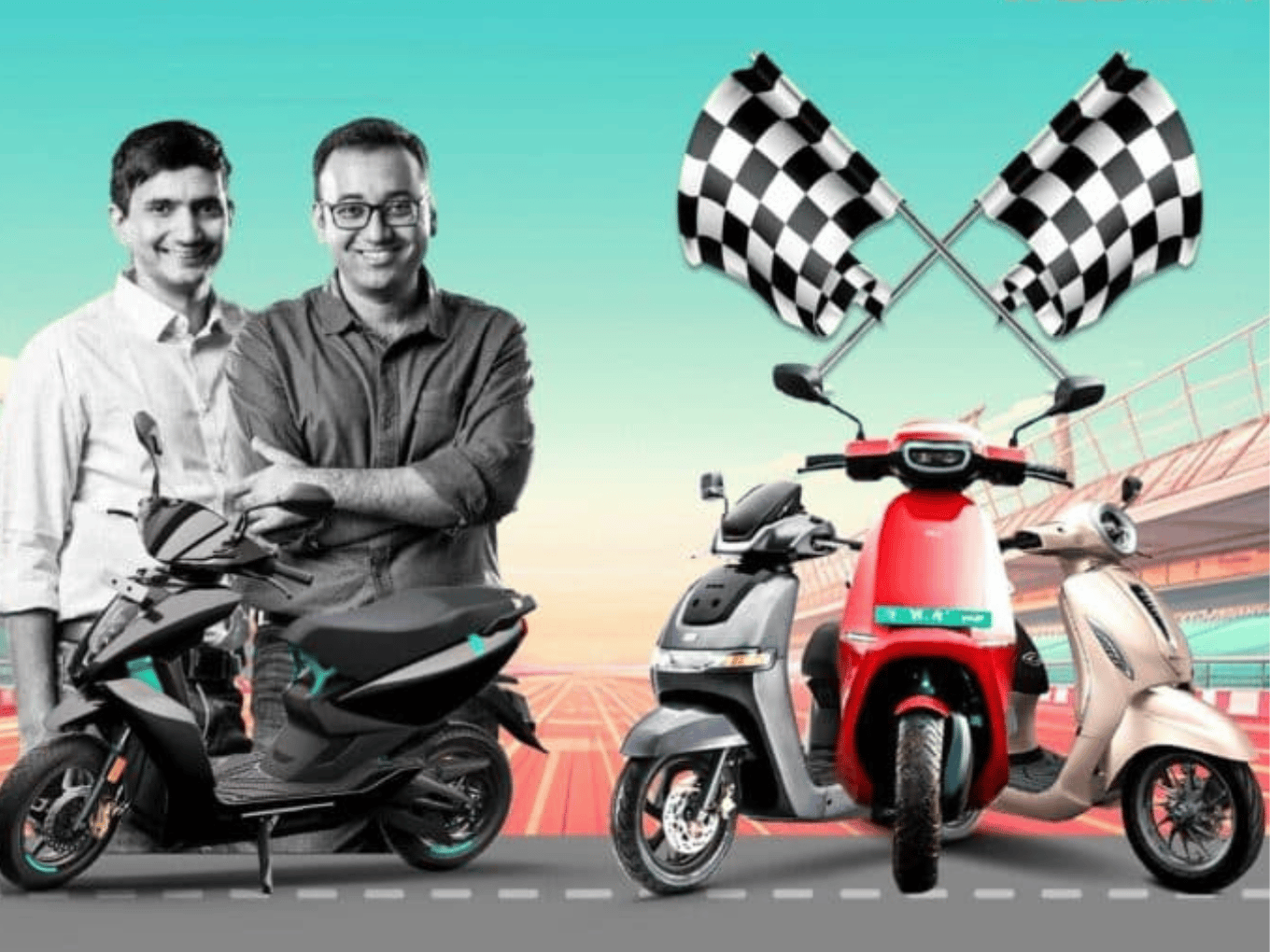

HDFC Securities Initiates Coverage On Ather With ‘Buy’ Rating

- HDFC Securities has initiated coverage on Ather Energy, an electric two-wheeler startup, with a 'Buy' rating.

- The brokerage firm has set a target price of INR 409 for Ather Energy, representing a 30% increase from its last closing price.

- Following the rating, Ather Energy's stock rose by 2.32% and traded at INR 320.90 on the BSE.

- Ather Energy's market capitalization reached INR 11,892.64 Cr with over 5 Lakh shares exchanged.

- The stock has seen fluctuations since its listing on May 6, showing both gains and losses.

- HDFC Securities expects Ather Energy to outgrow the industry and gain market share with its expanding product portfolio and network.

- The brokerage firm forecasts Ather to achieve EBITDA break-even by FY30 and improve profitability on various factors.

- Ather is focusing on transitioning to LFP battery and introducing new scooter platforms to enhance gross margins.

- Ather aims to expand its portfolio and dealer network to scale up in the market.

- Ather narrowed its net loss in the fourth quarter of FY25 and saw a 29% growth in operating revenue.

- The company is shifting focus to northern India with the introduction of a more affordable scooter, 'Rizta'.

- The new scooter may help Ather capture markets in states like Gujarat and Maharashtra.

- Ather is exploring rare earth-free motors to reduce costs and dependence on rare earth metals.

- Founded in 2013, Ather has raised over $630 Mn in funding and competes with players like Ola Electric and Bajaj Auto.

- The rating by HDFC Securities points towards positive growth prospects for Ather Energy in the electric two-wheeler market.

Read Full Article

24 Likes

SiliconCanals

348

Image Credit: SiliconCanals

Sweden’s Engrate raises €2.5M to plug Europe’s energy sector into a greener, smarter future

- Stockholm-based Engrate secures €2.5M funding led by Maniv to accelerate digital integrations for energy companies transitioning to renewable sources.

- Founded by Anna Engman and Richard Eklund in 2024, Engrate simplifies grid flexibility solutions through its digital platform.

- The funding will focus on further platform development to simplify digital integrations for energy companies enhancing grid flexibility.

- Participation from Eviny Ventures and Course Corrected, alongside early investors like Norrsken, NP-Hard Ventures, Pia Irell, Maex Ament, and Philip Stehlik.

- Engrate's platform addresses the growing need for digital infrastructure in the European energy sector amid market dynamics changes.

- The energy transition in Europe aims to triple renewable energy capacity by 2030, aligning with EU climate targets.

- Maniv's strategic support brings expertise in backing transportation and energy startups, essential for scaling energy technology solutions.

- Lead investor Nate Jaret sees Engrate as crucial for digitizing the energy sector to adapt to market changes.

- The €2.5M investment represents a milestone for Engrate in developing technology for Europe's critical energy infrastructure challenges.

- Engrate focuses on creating digital connections in the energy sector for smoother integration of renewable sources and grid flexibility.

- Funding will support platform expansion to help more energy companies transition to sustainable operations.

Read Full Article

20 Likes

SiliconCanals

17

Image Credit: SiliconCanals

After securing €46M, LemFi acquires UK fintech Pillar to expand credit access for immigrants globally

- LemFi, an immigrant financial services platform based in Oakland, California, has acquired UK credit fintech company Pillar.

- The acquisition follows LemFi raising $53M (approximately €46M) from Highland Europe earlier this year.

- Pillar's technology aims to help immigrants access credit products using unique data and analytics, powered by Open Banking.

- Pillar's co-founder expressed excitement about the partnership with LemFi to increase global credit access.

- LemFi recently launched LemFi Credit, the first remittance platform to integrate credit services.

- LemFi Credit has gained over 8,000 users with 18% weekly growth during a private beta.

- Users receive a virtual card compatible with Apple Pay and Google Pay, with physical Visa cards to be available later.

- The cards will leverage Pillar's technology to import international credit histories, assess creditworthiness, and facilitate credit building.

- Ridwan Olalere, LemFi CEO, highlighted the importance of credit within the LemFi app.

- The acquisition of Pillar enhances LemFi's ability to offer tailored credit services for immigrants.

- LemFi gains access to Pillar's technology, FCA credit license, and the expertise of Pillar's co-founders.

- LemFi, founded in 2021, provides financial services for immigrants, offering payments, remittances, and multi-currency accounts.

- The platform has over two million customers globally and $1B monthly transaction volume.

- LemFi plans to expand into Asia and Latin America, supported by $85M funding from investors like Y Combinator and Highland Europe.

- The company's team consists of 300+ individuals across Africa, Europe, and North America.

Read Full Article

1 Like

Eu-Startups

357

Zurich-based aerial robotics startup Voliro flies high with €19.8 million to deploy their maintenance drones

- Swiss aerial robotics startup Voliro raises €19.8 million in Series A extension to accelerate development of their inspection drones.

- Funding includes participation from noa and a debt facility from UBS, with Cherry Ventures leading the original round.

- Voliro's technology enhances industrial safety, asset maintenance for wind farms, and addresses workforce shortages in inspections.

- Their Voliro T drone features a patented tiltable rotor system for stable contact during inspections.

- The company aims to improve safety, data quality, and efficiency in inspections, offering a versatile and intelligent platform.

- Voliro has a global presence, conducting over 100 contact inspections monthly for customers like Chevron and Holcim.

- Their drones target hard-to-access infrastructure to prevent failures, reduce risks, and lower inspection costs in various industries.

- Traditional manual inspection methods are costly, infrequent, and reactive, leading to corrosion-related failures and accidents.

- Voliro's automation solutions help industries detect issues early, reduce downtime, and attract digital-native technicians.

- The investment will accelerate the development of AI-powered inspection reporting, enhanced autonomy, and modular payloads for Voliro's drones.

Read Full Article

21 Likes

Startup Pedia

250

Image Credit: Startup Pedia

Zomato delivery agent moved to tears by surprise birthday party from customers | watch viral video

- A Zomato delivery agent was surprised by a birthday celebration organized by customers, captured in a viral video by Krishna Ratnani.

- The emotional moment showed the delivery partner being greeted by strangers, balloons, a birthday cake, and smiles.

- The gesture melted the hearts of netizens, highlighting the usual lack of celebration for delivery agents during their birthdays due to work commitments.

- Netizens praised the heartwarming surprise, calling for a more compassionate world with comments like 'This is the world we want, and for that we all will have to change.'

- Many viewers expressed joy at the delivery agent's reaction, noting his evident happiness in the unexpected celebration.

- The video resonated with users, with comments appreciating the genuine emotions displayed and the positive impact of such gestures.

- A Chennai tech startup gifting SUVs to long-serving employees on its 10th anniversary was also highlighted in a related article.

Read Full Article

15 Likes

Insider

62

Image Credit: Insider

'Order the New Mountain special': How one private equity firm is bringing big exits back to healthcare VC

- New Mountain Capital, led by Matthew Holt, is making significant investments in healthtech with a focus on healthcare AI startups instead of traditional clinic rollups.

- The firm's creation of Smarter Technologies, combining Access Healthcare, SmarterDx, and Thoughtful AI, aims to revolutionize hospital revenue management.

- New Mountain's approach to healthcare PE prioritizes growth and tech innovation, earning praise from VCs for providing appealing exit opportunities.

- Despite a challenging healthcare market, New Mountain is aggressively pursuing healthtech deals, deviating from traditional PE strategies.

- The firm's successful healthcare investments have allowed it to blend PE and venture studio models, creating companies that prioritize growth over immediate profitability.

- New Mountain's previous exits, such as Signify Health's acquisition by CVS Health for $8 billion, showcase its ability to generate substantial returns in the healthcare sector.

- Matthew Holt's leadership in taking bold bets in healthtech and establishing strong relationships with founders has positioned New Mountain as a key player in the industry.

- Private equity's increasing interest in healthtech is leading to more competition in the sector, with firms like TowerBrook Capital and CD&R also making significant investments.

- Despite challenges and criticisms faced by private equity in healthcare, New Mountain's innovative approach and focus on technology have helped differentiate the firm in the market.

- New Mountain's strategic acquisitions, combining PE and VC sensibilities, showcase a unique approach to addressing the evolving landscape of healthcare investments.

Read Full Article

3 Likes

Insider

429

Image Credit: Insider

AI coding tools upend the 'buy versus build' software equation and threaten the SaaS business model

- AI coding tools like Bolt are disrupting the enterprise software landscape.

- These tools challenge the traditional SaaS models by lowering the barrier to building custom software.

- Companies using AI tools may gain control, reduce costs, and innovate faster by building in-house.

- AI coding services like Bolt, Replit, and Cursor are blurring the decision between buying external software or building it internally.

- AI-native developers can now create apps through English language prompts, changing the software development landscape.

- The shift towards AI-assisted development allows for the creation of internal tools, reducing the dependence on traditional SaaS.

- Major areas affected by this shift include HR, Training, Q&A, Revenue Operations, CPQ, Business Dashboards, and Marketing tools.

- Netlify and other companies have utilized AI coding tools to build internal tools such as employee survey tools and pricing calculators.

- The rise of AI in software development poses challenges in terms of maintenance and reliability, requiring robust infrastructure.

- The traditional SaaS industry faces significant strategic implications as companies can potentially build tailored internal tools at lower costs.

Read Full Article

25 Likes

ISN

339

Image Credit: ISN

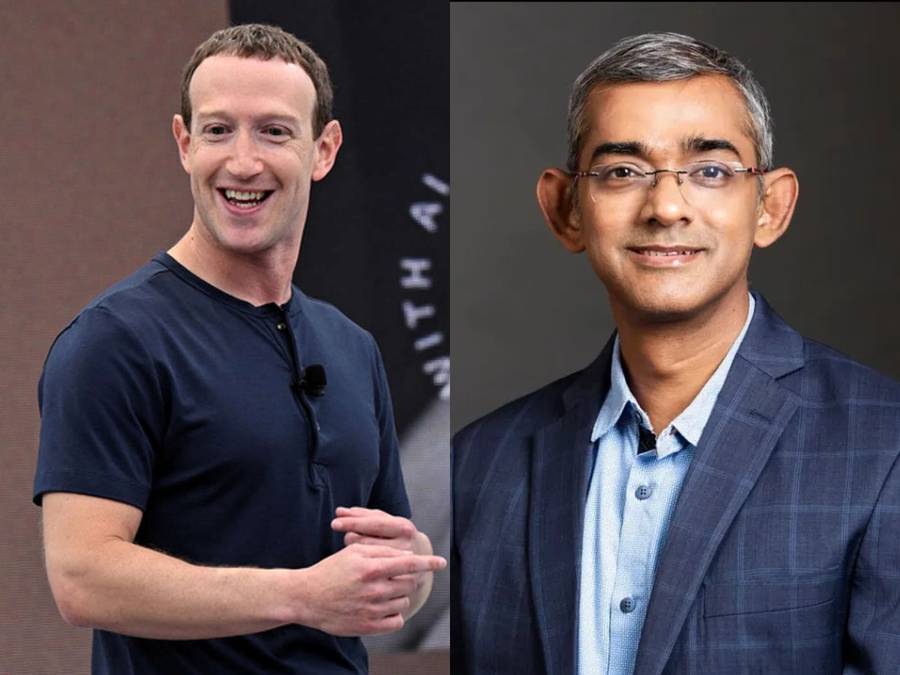

Meta appoints Arun Srinivas as MD and Head for Meta in India

- Meta appoints Arun Srinivas as the managing director and head for Meta in India.

- He will assume the new role effective July 1 and report to Sandhya Devanathan.

- Srinivas will focus on business, innovation, and revenue priorities to serve partners and clients.

- He will strengthen strategic relationships with leading brands, advertisers, developers, and partners.

- Srinivas joined Meta in 2020 and was later promoted to lead the ads business in 2022.

- India is Meta's largest user base globally and a strategically important region for the company.

- Meta's India business saw strong financial performance in fiscal 2024.

- Net profit rose 43% year-on-year to Rs 504.93 crore.

- Revenue from operations increased 9.3% to Rs 3,034.8 crore.

- Gross advertising revenue reached Rs 22,730.7 crore.

- Sandhya Devanathan, Vice President (India and South East Asia), Meta, commented on Srinivas' appointment.

- Srinivas brings nearly 30 years of experience in consumer and enterprise leadership.

- India is a leading geography for developer adoption of Meta's Llama language models.

- Arun Srinivas will lead Meta's India charter and drive growth in the market.

- Meta and India are collaborating on AI adoption, WhatsApp, and Reels.

- Arun Srinivas's appointment represents a significant leadership move for Meta in India.

Read Full Article

20 Likes

Inc42

120

Image Credit: Inc42

Digital Competition Bill: Startups Call For Protecting Domestic Innovation

- Indian online startups and tech product companies are urging a parliamentary panel to enhance the threshold for preventive regulations in the Digital Competition Bill to safeguard domestic innovation.

- The panel has sought input from the Ministry of Corporate Affairs regarding the feedback provided by Indian online players on the draft bill released for public comments in March last year.

- The bill, inspired by the EU framework, aims to regulate large digital companies to address anti-competitive practices and define the role of the Competition Commission of India (CCI) in the digital sphere.

- It classifies certain digital entities as systematically significant digital enterprises (SSDE) based on turnover or user count criteria.

- The bill's thresholds include INR 4,000 Cr turnover or INR 16,000 Cr GMV in India over three years for SSDE classification.

- Additionally, a digital entity serving over 1 Cr users or 10,000 enterprises will also be considered a SSDE under the bill.

- Discussions on the Digital Competition Bill have resumed after prior delays related to the US-India trade negotiations.

- US-India Business Council members, including tech giants like Google and Amazon, opposed the bill last year, citing its broad scope compared to the EU law.

- The need for the Digital Competition Bill arises from instances of anti-competitive conduct by big tech companies in India, prompting calls for regulation to ensure fair competition.

- CCl is investigating cases involving ecommerce giants like Flipkart and Google for potential anti-competitive behavior.

- Some startups support the bill, while the Internet and Mobile Association of India (IAMAI) warns that it could deter tech startup investments.

- The draft bill aims to balance regulation to prevent anti-competitive practices while protecting domestic innovation in India's digital market.

- The bill reflects growing concerns over market dominance and unfair competition in the digital space, necessitating regulatory intervention.

- The Indian startup ecosystem is divided over the implications of the Digital Competition Bill, with differing opinions on its potential impact on innovation and investment.

- The role of the Competition Commission of India in overseeing digital markets is a key aspect addressed in the proposed bill.

- Key players in India's digital economy have emphasized the importance of protecting domestic innovation while addressing anti-competitive behavior in the industry.

- The evolving digital landscape in India necessitates a regulatory framework to maintain fair competition and prevent market dominance by large tech companies.

- The parliamentary panel is considering input from various stakeholders to refine the Digital Competition Bill and ensure it supports both innovation and competition in India's digital economy.

Read Full Article

7 Likes

ISN

421

Image Credit: ISN

Hero FinCorp raises Rs 260 crore in pre-IPO funding round

- Hero FinCorp, the NBFC arm of Hero MotoCorp, raised Rs 260 crore in pre-IPO funding to reduce the fresh equity issue size.

- The company allotted 18.57 lakh shares at Rs 1,400 each to 12 investors, lowering the IPO's fresh equity component to Rs 1,840 crore.

- The total IPO size now stands at Rs 3,408.13 crore, including a Rs 1,568.13 crore offer-for-sale by existing shareholders.

- Major investors in the pre-IPO placement were Shahi Exports and RVG Jatropha Plantation.

- Investors also included Mohan Exports, AP Properties, Vivek Chaand Sehgal, Paramount Products, Tiger Laser Pte, and Virender Uppal.

- New allottees, except for specific individuals, are not connected with Hero FinCorp or related entities.

- Hero FinCorp, established in 1991, serves retail, MSME, and institutional borrowers with an AUM of Rs 51,821 crore as of March 2024.

- Proceeds from the fresh issue will enhance the company's Tier I capital base for expansion and lending needs.

- The OFS portion will allow exits for financial investors including AHVF II Holdings Singapore II Pte and others.

- Competing with listed NBFCs, Hero FinCorp aims to strengthen its position with the IPO funding.

- SEBI approved the IPO, managed by a consortium of lead managers like JM Financial, Axis Capital, and others.

Read Full Article

25 Likes

Inc42

299

Image Credit: Inc42

Meta Appoints Arun Srinivas As India Head

- Meta has appointed Arun Srinivas as the managing director and head for the company in India following the resignation of Shivnath Thukral, the previous head of public policy.

- Srinivas will focus on Meta's business, innovation, and revenue growth, as per the company's statement.

- He will lead the India charter, strengthen relationships with brands, advertisers, developers, and partners in the country for market growth.

- Srinivas joined Meta nearly five years ago and will transition to his new role in July, reporting to Sandhya Devanathan.

- Devanathan's role has expanded to include leadership of Meta's Southeast Asia operations.

- Srinivas has over 25 years of experience in consumer goods, tech, and other domains and was previously the director and head of Ads Business at Meta India.

- Previously, he held roles at Ola Mobility, Unilever, and Reebok.

- Meta and AI giant OpenAI are reportedly looking to partner with Indian conglomerate Reliance on new AI businesses.

- Meta is also expanding its presence in India by setting up a new office in Bengaluru and actively hiring for engineering and product roles in artificial intelligence.

- Meta's Asia-Pacific chief Dan Neary announced plans to leave after a 12-year tenure, with Benjamin Joe succeeding him.

Read Full Article

18 Likes

Eu-Startups

147

The Business side of TikTok: 10 accounts to learn, build, and grow

- TikTok has evolved into a source of knowledge, creativity, and cultural relevance beyond just entertainment and aesthetics.

- Traditional social media strategies don't apply on TikTok, allowing brands to be authentic and connect with audiences in new ways.

- The platform has become a space for startups, business creators, and entrepreneurs to share tutorials, quick breakdowns, and practical advice.

- Notable business-focused TikTok accounts include Gary Vaynerchuk, Tori Dunlap, Mark Tilbury, Codie Sanchez, Jack Dumoulin, Simon Squibb, Steven Bartlett, TED Talks, and Vivian Tu.

- These accounts offer valuable insights on business, entrepreneurship, finance, and personal development to inspire and educate their followers.

- From financial advice to practical entrepreneurship tips, the accounts cover a wide range of topics relevant to individuals looking to learn, build, or grow in the business world.

- The article also announces the launch of the official TikTok account for EU-Startups, offering founder insights, startup tips, and behind-the-scenes moments from events across Europe.

- Follow @eustartups for valuable content on startup stories in a fast and fun format.

Read Full Article

8 Likes

Inc42

429

Image Credit: Inc42

NCLT Approves Meesho’s Reverse Flip To India

- Meesho, an ecommerce major, has obtained approval from NCLT to relocate its headquarters from the US back to India amidst its IPO preparations.

- The NCLT Bengaluru Bench granted clearance to Meesho on May 27th, 2025, addressing objections raised by ROC/RD & the Income Tax Department.

- The move aligns with Meesho's transition to re-domicile in India, reflecting its operational presence in the country.

- As part of this process, Meesho is set to pay around INR 2,480 Cr to shift its headquarters, as reported by Moneycontrol.

- Meesho's board has approved its conversion to a public entity and name change to 'Meesho Limited' ahead of its IPO filing.

- The ecommerce platform plans to raise $1 Bn through its IPO and has engaged notable bankers like Morgan Stanley for the process.

- Meesho initiated the redomiciling procedure back to India in August 2024 and is gearing up for its IPO launch this financial year.

- Recently, the company closed a funding round, reduced net losses by 81.8% in FY24, and saw a 32.8% increase in operating revenue.

Read Full Article

25 Likes

For uninterrupted reading, download the app