Startup News

Eu-Startups

344

Czech investment manager Orbit Capital launches €100 million fund to support tech companies overlooked by banks

- Prague-based Orbit Capital has launched its Growth Debt II fund aiming to reach €100 million to support tech companies in Central and Eastern Europe overlooked by banks.

- The fund has already closed €70 million with investors including European Investment Fund, Česká Spořitelna, Rentea pension fund (Partners Group), and smaller investors through Conseq.

- Orbit Capital introduced Venture Debt to offer financing for young, fast-growing and mature companies that do not meet traditional bank financing conditions, providing cheaper funding and potential returns of 15%.

- Orbit Capital, focusing on technology scaleups, aims to fill the debt financing gap for CEE startups, offering funds ranging from €3 to €10 million through Growth Equity I fund.

- The Orbit Capital family also includes Growth Equity I fund with two unicorns in its portfolio, enabling clients to invest in innovative ways previously limited to wealthy investors.

- The venture capital company has invested in fifteen Central European companies including Rohlík, Twisto, ThreatMark, CloudTalk, and Boataround, supporting those with strong innovation potential and promising business models.

- By facilitating indirect access to venture debt for companies unable to qualify for traditional bank loans, Orbit Capital aims to support the economic transformation and competitiveness of the Czech economy.

- Marjut Falkstedt, EIF Chief Executive, highlights the investment's crucial support for innovative companies in Central and Eastern Europe to enhance economic growth and competitiveness in the region.

- Orbit Capital plans to apply learnings from its first fund in the strategy for the second fund, leveraging the venture debt infrastructure built over five years to aid more companies in their growth.

Read Full Article

20 Likes

Economic Times

187

Image Credit: Economic Times

Razorpay invests $30 million into consumer payments startup Pop

- Pop, a consumer payment platform, raises $30 million from Razorpay to address challenges in digital commerce.

- Pop operates a rewards-first UPI payments app combining payments, commerce, and credit into one experience.

- The funding will be used for product innovation, enhancing consumer value proposition with Popcoins-led rewards, and building merchant partnerships.

- Pop has scaled to over six lakh daily UPI transactions, one million unique monthly active transactors, and more since launching its UPI platform.

- Razorpay's investment in Pop expands its offerings into loyalty, engagement, and commerce enablement.

- Pop's multi-brand rewards currency in the form of Pop Coins aims to incentivize repeat purchases and drive real-time engagement.

- Harshil Mathur, CEO of Razorpay, highlights that Pop helps brands earn trust, drive repeat purchases, and build real loyalty.

- The investment in Pop complements Razorpay's acquisition of PoshVine, focusing on loyalty and rewards management.

- Consumers are increasingly considering rewards and loyalty while making purchase decisions, with India's D2C market expected to surpass $100 billion by 2026.

Read Full Article

11 Likes

SiliconCanals

361

Image Credit: SiliconCanals

UNIIQ invests €1.4M in these 4 South Holland startups to fuel health and deep tech innovation

- UNIIQ, an investment fund based in The Hague, is investing €1.4M in four startups to fuel health and deep tech innovation.

- The startups receiving investments are LYLA, GenLumina, Secuped, and QHarbor, each focused on innovative solutions in their respective fields.

- LYLA, based in Delft, works on digital quality control of cancer medication to improve targeting, efficiency, and safety.

- GenLumina, located in Leiden, is developing a substance activated by light to destroy cancer cells without harming healthy tissue.

- Secuped, also based in Leiden, focuses on home monitoring equipment for diabetic foot ulcers to enable timely intervention.

- QHarbor, headquartered in Delft, supports physics research institutions in working faster and smarter with experimental data, including quantum computer experiments.

- In addition to funding, UNIIQ provides strategic support in positioning, follow-up financing, and collaborations with companies and knowledge institutions.

- UNIIQ is a €50M fund managed by investment specialists from Innovation Quarter, Leiden University, Erasmus MC, and TU Delft, focusing on the proof-of-concept phase.

- The investment aims to accelerate technology and the impact these startups can make in health, deeptech, and data innovation.

Read Full Article

21 Likes

VC Cafe

330

Image Credit: VC Cafe

The Creator Economy in 2025: Powered by People, Accelerated by AI

- The Creator Economy has surpassed traditional media in 2025, with estimated $528.39 billion valuation by 2030.

- AI enhances content creation, increasing creators' productivity without replacing them.

- User-generated platforms now receive more content-driven advertising revenue than professionally produced content.

- Creators transition into powerful entrepreneur roles, reshaping commerce and entertainment.

- Platform dynamics show Instagram still dominates as TikTok faces a decline in brand preference.

- Micro and nano-influencers with niche audiences account for 70% of brand partnerships.

- Consumer trust in influencer recommendations drives purchasing decisions and brand loyalty.

- AI-driven content includes virtual influencers and serialized AI-powered storytelling.

- AI integration in the creator economy expands creative horizons but requires transparent communication to maintain trust.

- Brands are increasingly incorporating AI for influencer discovery, content optimization, and performance analysis.

Read Full Article

19 Likes

Economic Times

330

Image Credit: Economic Times

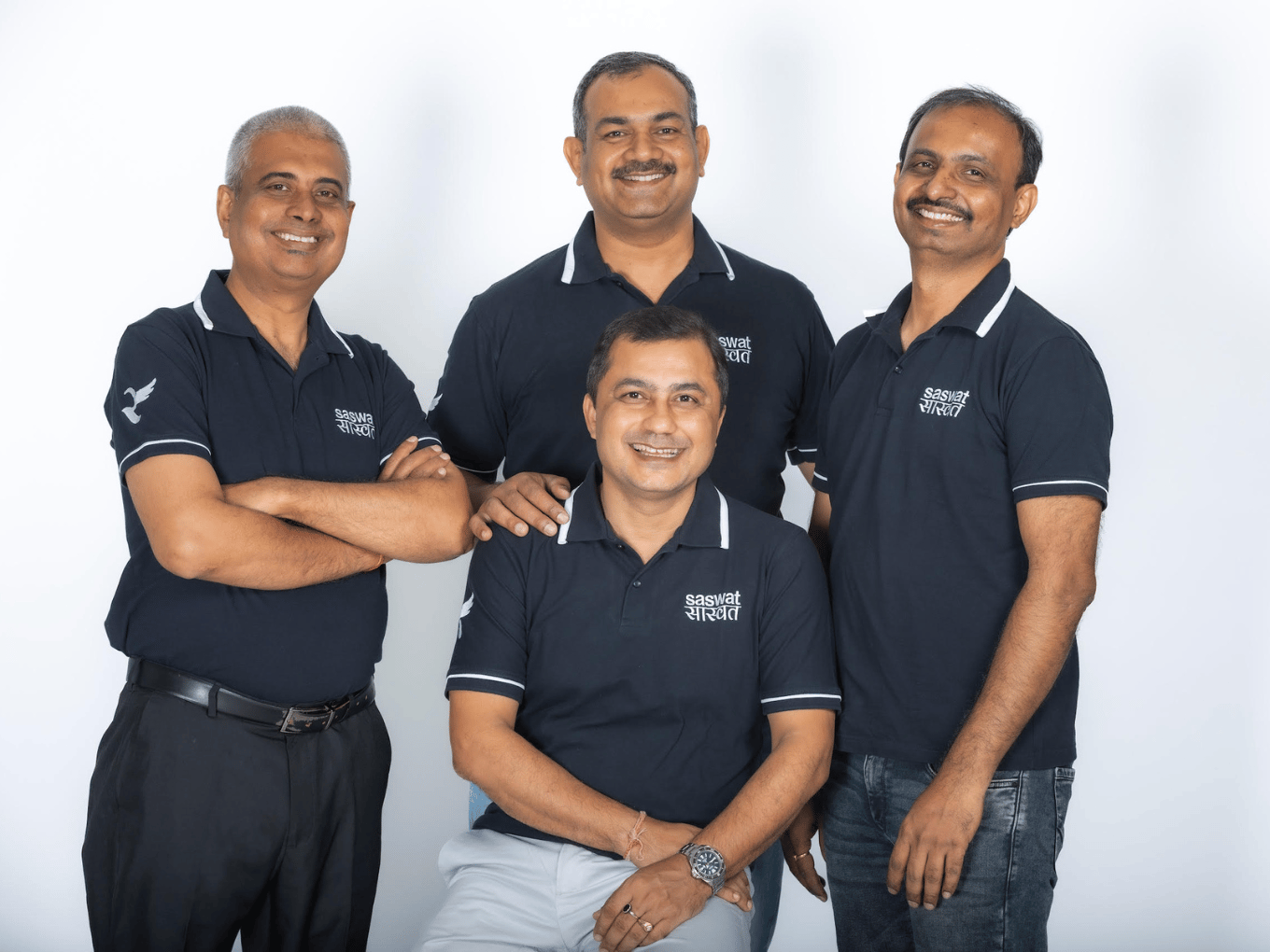

Fintech startup Saswat Finance raises $2.6 million from Ankur Capital, others

- Rural India-focused fintech startup Saswat Finance raises $2.6 million in funding round led by Ankur Capital and Incubate Fund Asia.

- Funding will be used to expand technology capabilities, introduce new financial products, and scale operations in Maharashtra, Karnataka, and Uttar Pradesh.

- Saswat Finance aims to redefine access to financial services for underpenetrated rural segments, focusing on fintech, agritech, and insurtech.

- Founded in 2022, Saswat Finance targets improving access to formal financial services starting with the dairy supply sector.

- The company uses a data-driven approach for credit and insurance products tailored to smallholder farmers and rural enterprises.

- Saswat Finance has facilitated over Rs 55 crore in asset-backed loans and onboarded more than 6,000 customers.

- The company currently provides cattle loans, insurance, and para-veterinary services, expanding into offerings for rural businesses.

- Saswat Finance has partnerships with dairy cooperatives, insurers, and lenders to enhance distribution and product offerings.

- The funding signifies the importance of tech infrastructure for fintech startups focused on financial inclusion in rural India.

- Government support through equity infusions is vital for fintech startups to expand access to financial services in underserved areas.

- Saswat Finance leverages alternative data to provide value at the last mile in the digital transformation of dairy and supply chains.

Read Full Article

19 Likes

Economic Times

415

Image Credit: Economic Times

Investors want clear ocean management rules to scale up funding

- A UN push for investment in ocean protection yielded $10 billion in deals at a recent conference, falling short of the needed $175 billion annually.

- Investors seek clearer regulations on ocean management before committing funds as the lack of a governing framework and data has hindered private sector finance.

- Only 50 countries have ratified the new High Seas treaty to govern international waters, while the US has yet to ratify it.

- Public sector banks contributed significantly to the deals, with funding aimed at fighting plastic pollution and other ocean-related issues.

- Private investment in ocean protection is still in its infancy, with challenges in policy backdrop, regulation, and funding shortfalls.

- Ocean tech received only 0.4% of the total investments between 2020 and 2025, indicating a need for more focus and financing in the sector.

- Policymakers and investors need to address systemic risks such as overfishing, pollution, and climate change to protect marine biodiversity and ocean health.

- Efforts to curb effects like water acidification and coral bleaching necessitate cutting carbon emissions and stricter policy actions against damaging practices.

- Recent progress includes countries supporting calls to prevent deep-sea mining and the creation of new Marine Protected Areas.

- The ocean, long neglected, requires concerted efforts to address the threats it faces and create sustainable practices for the future.

Read Full Article

25 Likes

Inc42

241

Image Credit: Inc42

Saswat Nets $2.6 Mn For Financial Offerings To Micro Enterprises

- Mumbai-based fintech startup Saswat Finance secures $2.6 Mn in Pre-Series A funding round led by Ankur Capital.

- Existing investor Incubate Fund Asia also participated in the funding round.

- The funding will be used to enhance tech stack, introduce new financial products, and expand operations in Maharashtra, Karnataka, and UP.

- Saswat Finance plans to strengthen data and analytics infrastructure and diversify product portfolio.

- Incubate Fund Asia has increased its commitment to Saswat in this funding round.

- Founded in 2022, Saswat Finance provides financial services to smallholder farmers and micro enterprises, focusing on rural areas.

- Its mission is to address the financial gap in underserved markets, starting with the dairy sector.

- The startup offers financial management solutions, cattle insurance, and animal health advisory services to farmers.

- Saswat Finance has collaborations with various dairy cooperatives such as AMUL, Britannia, Nandini, and Lactalis.

- The funding reflects Saswat Finance's position at the convergence of fintech, agritech, and insuretech to enhance financial access in underpenetrated sectors.

- The fintech sector has seen significant investor interest, with $739 Mn invested in Q1 FY25, making it a top sector by deal count.

- Saswat Finance competes with Jai Kisan, Samunnati, and Avanti Finance in bridging the rural credit gap.

- Notable funding rounds in the fintech sector include Zolve's $100 Mn, ToneTag's $78 Mn, and InsuranceDekho's $60 Mn rounds.

- Saswat Finance's funding aligns with the broader trend of investors favoring fintech startups.

- Web story eligible: Yes

Read Full Article

14 Likes

Startup Pedia

111

Image Credit: Startup Pedia

WhatsApp to roll out ads and paid subscriptions on status screen and channels in next few months

- WhatsApp is set to introduce ads on the status screen globally in the coming months.

- Businesses will have the option to select a WhatsApp status for ads as part of Meta campaigns.

- The global launch will happen gradually over the next few months.

- Personal messages, calls, and statuses on WhatsApp will remain end-to-end encrypted.

- Businesses can now place ads on WhatsApp through an auction system.

- Meta mentioned that over 1.5 billion people use Status and Channels on WhatsApp daily.

- WhatsApp will use location data, user interactions, and preferences to display ads in the Updates tab.

- The platform will introduce channel subscriptions for exclusive content at a monthly fee.

- WhatsApp plans to expand channel subscriptions to more partners over time.

- Channel admins can set monthly fees for exclusive content within a certain range.

- Promoted channels will allow users to discover new channels of interest.

- WhatsApp will facilitate payments for channel subscriptions through app stores.

Read Full Article

6 Likes

Inc42

53

Image Credit: Inc42

Exclusive: POP Bags $30 Mn To Boost Its D2C Play

- Ecommerce enablement startup POP raises $30 Mn from Razorpay to enhance its Direct-to-Consumer (D2C) strategy.

- The funding will be used for product innovation, introducing POPcoins-driven rewards and expanding merchant partnerships in the D2C and lifestyle sectors.

- Razorpay's investment aims to tackle customer acquisition costs for merchants and offer more meaningful rewards for consumers in India's digital commerce landscape.

- POP has raised over $5 Mn in total funding and has investors like IndiaQuotient, Unilever Ventures, Incubate Fund, and Nuventures.

- Previous reports indicated POP was in discussions with Razorpay for a $10-15 Mn investment and even a potential acquisition.

- POP operates a rewards-centered UPI payments app integrating payments, shopping, and credit for users.

- Founded in 2023 by ex-Flipkart executive Bhargav Errangi, POP aims to become a major player in the UPI ecosystem, offering UPI payments, an integrated marketplace, and credit cards.

- POPcoins, like CRED Coins, can be earned on UPI transactions and redeemed for products from various D2C brands, making payments more rewarding.

- POP states 6 Lakh daily UPI transactions, 1 Mn monthly active transactors, 2 Lakh monthly commerce shipments, and 40,000 RuPay credit cards issued in partnership with Yes Bank.

- The concept of POPcoins is to enhance user habits, retention, reduce customer acquisition costs, and make payments more rewarding.

- Founder Bhargav Errangi mentioned their goal to create a loyalty-first payments ecosystem with Razorpay's backing to support business growth.

- POP's focus is on a loyalty-driven approach in the payments landscape.

- Razorpay's investment is strategic to help POP scale its operations.

- POP strives to provide a comprehensive user experience combining payments, rewards, and consumer engagement.

- The collaboration is set to position POP as a significant player in India's digital commerce arena.

Read Full Article

3 Likes

Economic Times

22

Image Credit: Economic Times

Foreign university returnees now lead Campus Fund’s startup deal flow

- Student founders returning from foreign universities are now the top source of deal flow for Campus Fund, marking a shift in the entrepreneurship landscape in India.

- Campus Fund, Asia's largest venture capital fund focusing on student-led startups, has 35 portfolio companies in sectors like AI, Spacetech, Biotech, and CleanTech.

- The report underscores that India's potential big global companies are emerging from college labs and hostel rooms with young, innovation-driven founders at the forefront.

- The top five sectors attracting capital include Consumer Products & Brands, EdTech, Services, DeepTech, and Healthcare.

- DeepTech experienced a significant rise, moving from seventh to fourth position, while Services dropped to third place.

- Current student-founded startups account for 33.84% of the total, with BTech graduates leading at 45.59% followed by MBA and BSc graduates.

- BITS Pilani stands out as the top institution in India producing student founders, with a contribution of 3.79%.

- Student founders from foreign universities now represent 4.5% of Campus Fund's deal flow, indicating a possible shift in traditional brain drain trends.

- Karnataka leads in the number of student-led startups at 21.5%, followed by Maharashtra at 18.1% and Delhi at 12.0%.

- Women head 26% of startups in Campus Fund's pipeline, with the Consumer Products sector showing the highest gender diversity.

- The future of venture capital is being redefined by Campus Fund, focusing on conviction over credentials and the supremacy of ideas over experience.

Read Full Article

1 Like

Inc42

201

Image Credit: Inc42

Inside The ‘Jio Eat’ Scam, The MDR Paradox & More

- A new scam called 'Jio Eat' has emerged targeting users with fake food delivery services from popular chains in Indian cities.

- The scammers operate a website with fake policies and send OTPs for inflated amounts when users try to place orders, alerting users to avoid falling victim.

- In other news, Indian fintech faces uncertainty with speculations about MDR on UPI transactions and companies like Meesho making strategic moves.

- ShareChat sees its CBO resign while WhatsApp plans to introduce ads, and Meta elevates Arun Srinivas as the MD in India.

- InCred Money acquires Stocko, Ather receives a 'BUY' rating, and Apple boosts Make In India efforts, amidst bans on bike taxis in Karnataka.

- Hunar.ai, an AI-powered recruitment platform for blue-collar hiring, aims to streamline the hiring process in India's frontline workforce sector.

- Hunar.ai offers automation for sourcing, screening, and onboarding, catering to the market's need for high-volume hiring solutions.

- With a focus on tech-driven efficiency and scale, Hunar.ai presents an opportunity to disrupt India's frontline recruitment space.

- The article provides insights into various tech and business developments in India, including notable acquisitions, ratings, bans, and innovations.

- Overall, the piece offers a mix of cautionary tales, industry updates, and potential opportunities in India's ever-evolving business landscape.

Read Full Article

12 Likes

Economic Times

49

Image Credit: Economic Times

India’s big bet on micro drama: Startups, investors eye a new content race

- Micro dramas of 1-2 minutes with cliffhangers are gaining popularity in India's entertainment industry, inspired by Chinese success stories.

- Startups like Flick TV, Eloelo, Kuku FM, and more, along with digital giants like Amazon and ShareChat, are catering to the demand for micro-dramas.

- ShareChat mentioned that 1.5 crore users consumed drama shorts on platforms like Quick TV and Moj in recent months.

- Flick TV secured $2.3 million, ReelSaga raised $2.1 million, and Chai Shots is in talks for $5 million funding.

- Micro-dramas blend short videos with emotional engagement and structured narratives targeting mobile-first audiences.

- Amazon's MX Fatafat and Zee Entertainment's partnership with Bullet highlight the growing focus on micro-dramas.

- Monetization challenges persist as firms explore pay-per-episode, subscriptions, and ad-based revenue models for micro-dramas.

- Companies are increasingly using generative AI for content creation, reducing production costs significantly.

- Long-term engagement, content fatigue, and monetization sustainability are still concerns for the micro-drama sector in India.

- Despite the promising start, scalability into a sustainable business model remains uncertain for micro-dramas.

Read Full Article

2 Likes

Economic Times

303

Image Credit: Economic Times

Streaming now: Startups, VCs chase India’s micro drama content play

- Short, binge-worthy dramas of 1-2 minutes, inspired by Chinese micro-dramas, are gaining popularity in India.

- VCs are investing in platforms like Flick TV, Eloelo, and Kuku FM to cater to this new trend.

- Amazon, ShareChat, and Zee Entertainment are also entering the micro-drama space to meet the demand.

- Professionally produced micro-dramas offer higher production quality than user-generated content platforms.

- Companies like Flick TV and ShareChat are exploring subscription-based and ad-supported revenue models for micro-dramas.

- AI is playing a significant role in content creation for micro-dramas, reducing production costs by 75%.

- Challenges include monetizing the format in a market like India with low average revenue per user.

- The sustainability and scalability of micro-dramas as a business model are yet to be fully seen.

- Pratilipi is holding off on entering the micro-drama space until the market matures and hype settles.

Read Full Article

18 Likes

Siliconangle

277

Image Credit: Siliconangle

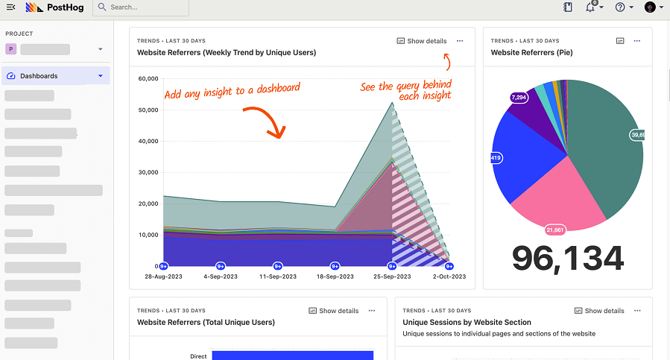

PostHog raises $70M to streamline software development projects

- PostHog Inc., a developer tooling startup, has raised $70 million in funding led by Stripe Inc. and joined by GV startup fund, Formus Capital, and Y Combinator.

- The company sells software tools to enhance applications, including features for new feature rollouts and data management tasks like tracking churn rate.

- PostHog offers tools for testing updates with limited users using feature flags and testing multiple versions of new features.

- Their suite includes data collection and analysis tools to track user interactions and identify user experience problems.

- PostHog revealed tripled sales over the past year with annual recurring revenue in the tens of millions of dollars.

- The funding will be used to enhance their AI assistant, Max AI, and expand the product portfolio to include tools for sales, support, and marketing teams.

Read Full Article

16 Likes

The Robot Report

112

Premier Automation launches innovation hub in Pennsylvania

- Premier Automation launched the Premier Innovation Hub in Pennsylvania, aiming to be a national model for industrial automation, workforce development, and technology commercialization.

- The state of Pennsylvania committed over $3 million to support the facility through grants, loans, and training funds.

- The hub is designed to accelerate automation and industrial advancement, serving as a platform for new ideas, training the next generation, and strengthening America's manufacturing future.

- Premier Automation, based near Pittsburgh, provides industrial control systems, robotics integration, and custom-engineered automation for various industries.

- The Premier Innovation Hub in Westmoreland County will leverage the region's expertise in mining, steel, and glass production, linking traditional industries with modern technology.

- The facility aims to bridge the gap between cutting-edge automation technologies, such as robotics and AI, and the practical needs of traditional manufacturing sectors.

- Premier Labs, a new venture studio, will launch purpose-built companies in manufacturing automation and AI, incubating at the Premier Innovation Hub.

- The project is expected to create 110 new full-time jobs, retain 130 existing positions, and offer shared prototyping and testing facilities, workforce training, and collaborative resources.

- The state of Pennsylvania supports the initiative as part of its economic development strategy, investing in manufacturing, robotics, and technology industries.

- Government and industry leaders toured the Premier Innovation Hub, recognizing it as a strategic investment in regional growth and national competitiveness.

Read Full Article

6 Likes

For uninterrupted reading, download the app