Venture Capital News

Minis

2y

220

Image Credit: Minis

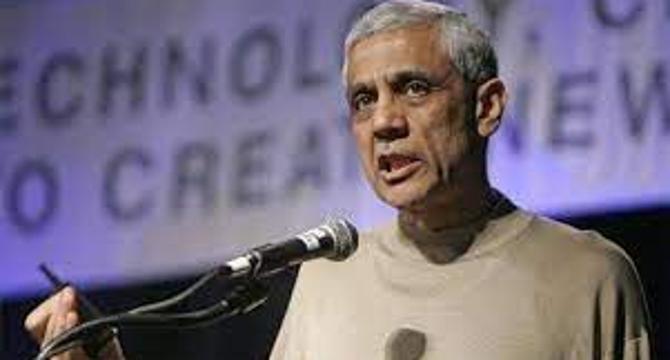

Indian startups with ‘strong fundamentals’ will survive: VC Vinod Khosla

- Venture capitalist Vinod Khosla predicts that Indian startups that are "not so good" will go bankrupt in 2023.

- Khosla expects that innovative ideas will still receive funding, but with lower valuations than before.

- Khosla anticipates that there will be another hype cycle in four years, during which fewer companies will thrive.

Read Full Article

1 Like

Minis

2y

585

Image Credit: Minis

Passed on deal because CEO was rude to waiter: American VC Michael Arrington

- Venture capitalist Michael Arrington declines business deal due to CEO's behavior.

- Michael tweets "he passed on an investment deal that he was almost going to say yes to "because the CEO was rude to our waiter".

- Arrington's decision to pass on the deal was widely celebrated on Twitter, resulting in the post going viral.

- Twitter users expressed their agreement with Arrington's decision, with one user stating that there was "No excuse to behave like that ever," and another calling it a "good call".

Read Full Article

4 Likes

For uninterrupted reading, download the app