Venture Capital News

Medium

50

Image Credit: Medium

How Colonization Changed Native Peoples: 10 Eye-Opening Facts

- Colonization has had a significant impact on indigenous cultures across the world.

- Effects of colonization on indigenous peoples include forced displacement, language loss, introduction of new diseases, and changes in traditional foods.

- Colonizers imposed their languages, religions, and governance systems, leading to clashes with traditional practices.

- Despite challenges, many indigenous cultures exhibit resilience by preserving traditions and sharing them with the world.

Read Full Article

3 Likes

Medium

397

Last Week in ConTech — 12 May 2025

- In construction, having the best solutions is useless without proper training on how to use them effectively.

- Many companies struggle with adopting AI due to lack of knowledge on where to start and how to utilize it.

- Mid-sized firms can bridge the gap by outsourcing AI training to startups, which often offer onboarding sessions for workforce exposure.

- Safety1Breadcrumb, an Australian startup, raised $4.5m for a workforce and process management platform for safety documentation.

- WearablesTended in the UK secured £2m for developing wearables in construction and rail that map safe work zones.

- Lightsonic, a Norwegian startup, raised €3.3m for infrastructure monitoring using fiber optic networks.

- Scalera in Switzerland received $6.5m for an AI-based tender assistant to streamline bidding processes.

- Quantum Systems in Germany secured €160m for drones and intelligence systems used in various applications.

- P-1AI in San Francisco raised $23m for an AI system automating cognitive tasks in engineering.

- Trump administration releases funds for low-income HVAC program; various other updates on energy, infrastructure, and policy changes worldwide.

Read Full Article

23 Likes

Siliconangle

230

Image Credit: Siliconangle

Perplexity reportedly near $500M funding round at $14B valuation

- Perplexity AI Inc. is reportedly in talks to raise $500 million from investors at a $14 billion valuation, led by Accel.

- The company's flagship offering is a search engine using large language models, with approximately 15 million monthly users as of last April.

- Perplexity generates revenue through paid versions of the service for individuals and organizations, and has expanded into the developer tooling market with the launch of Sonar.

- The new funding round could help Perplexity further expand its developer tooling portfolio and consumer business, with an annual recurring revenue of just under $100 million according to CNBC.

Read Full Article

13 Likes

Medium

18

Image Credit: Medium

A Week with PRENDETE in Silicon Valley: Seven Days of Argentine Innovation in the World’s Startup…

- A group of Argentine innovators conducted a week-long tour in Silicon Valley, visiting various tech labs and startups run by Argentines in the US.

- Insights shared during the tour included the importance of data quality, cloud-GPU usage, and merging domain-specific data for innovation.

- The team learned valuable lessons in areas like autonomous driving, AI robotics, and the impact of technology on various industries.

- The visit emphasized the significance of California's ecosystem in nurturing startups and enhancing execution culture.

- Innovative strategies discussed ranged from software-defined operations to blended squads combining engineering and design.

- Practical takeaways included advice on budgeting, legal and financial setup, design-driven development, and global market penetration.

- The importance of storytelling, pitching, and user experience in startup success was highlighted among the key learnings.

- Critical insights on securing funding, engaging mentors, and leveraging university resources were also shared during the tour.

- The need for a strong technical narrative, clear value proposition, and effective risk management were recurring themes.

- Lessons on utilizing AI responsibly, ensuring compliance, and fostering innovation through collaboration were emphasized.

- The journey reinforced the idea that innovation transcends borders and requires a collaborative, disciplined approach for success.

Read Full Article

1 Like

Medium

328

Image Credit: Medium

7 Steps to validate your idea before building.

- Determine if the issue has been resolved before and define the unique selling proposition of your solution.

- Engage in direct conversations with potential clients and list the main issues they are facing.

- Create a sign-up page and advertisement for your proposed solution and seek feedback.

- Adjust your idea based on the feedback received from potential clients and continue validating until you see positive engagement.

Read Full Article

19 Likes

Medium

143

Image Credit: Medium

From Vision to Execution: How Smart Project Oversight Builds Better Businesses

- Projects often face breakdowns when lacking real-time direction or performance benchmarks, hindering execution and alignment with broader strategy.

- Successful founders prioritize execution by establishing clear metrics, accessible data, and defined workflows for every initiative.

- Centralized project oversight tools like AAK Tele-Science streamline project management, task assignment, performance tracking, and funding within a single ecosystem.

- Platforms such as AAK Tele-Science connect operational execution with external opportunities, providing real-time insights and enhancing productivity without micromanagement.

Read Full Article

4 Likes

Medium

147

Image Credit: Medium

Why Fundraising Needs a Gearbox, Not a Megaphone

- Fundraising for startups should be approached like building a scalable, repeatable machine, rather than a one-off event.

- Effective founders treat fundraising like a product launch or a continuous pipeline, focusing on relationship-building and processes.

- Treating fundraising like enterprise sales with a structured process can significantly reduce the time needed between rounds.

- Having a well-defined process also helps manage expectations internally and externally, providing confidence to investors.

- Starting early, investing in tools, and developing habits for fundraising can lead to better outcomes and increased confidence.

- Transforming ad-hoc fundraising approaches into repeatable systems can distribute responsibilities and align the team towards a shared goal.

- By building the fundraising engine correctly, future fundraising efforts can feel smooth and well-prepared, rather than stressful and last-minute.

- Fundraising should be seen as a systematic function that demands structured processes and preparation.

- A well-structured fundraising process increases efficiency, morale, and alignment within the team.

- Approaching fundraising like switching gears in a well-built engine can lead to smoother and more successful fundraising efforts.

Read Full Article

8 Likes

Alleywatch

198

Stash Raises $146M to Enhance Financial Guidance with its AI-Powered Platform

- Stash has raised $146M in a recent Series H round to provide accessible financial education and investing tools for everyday Americans.

- Their platform offers innovative features like the Stock-Back® Card and Smart Portfolio to help users begin their wealth-building journey.

- The newly launched Money Coach AI provides personalized financial guidance to democratize expert advice previously reserved for the wealthy.

- Stash targets Americans earning between $50,000 and $150,000 annually, offering a subscription-based model starting at $3/month for a full suite of financial tools.

- With 1.3M paying subscribers and over $4B in assets under management, Stash has shown success in helping customers build wealth over time.

- The company's focus on personalized guidance, automation, and real-time advice differentiates it from traditional financial institutions.

- Stash prioritizes customer growth and engagement, aiming to simplify financial decisions and make investing accessible for everyone.

- In the next six months, Stash plans to expand capabilities of Money Coach AI and enhance the Stock Rewards program that offers fractional shares to customers.

- Focusing on resilience and providing value to existing customers, Stash is prepared for potential economic slowdowns with strong cash reserves and steady revenue streams.

- Stash CEO advises companies in New York to prioritize unit economics, leverage local talent, focus on customer and team satisfaction, and refine their story for investors.

Read Full Article

11 Likes

Saastr

337

Where AI Will, and Won’t, Replace Sales Reps in 2026

- AI is increasingly outperforming human sales reps in certain areas, such as transactional sales and customer support, especially for deals under $10K.

- It is predicted that AI will continue to excel in handling tasks like answering technical questions and providing efficient solutions for lower-value activities.

- In contrast, AI is not yet capable of replacing humans in building deep, trust-based relationships, strategic negotiations, and creative problem-solving that often characterize enterprise sales.

- The future of sales in 2026+ is expected to involve a hybrid model where AI handles routine tasks while human salespeople focus on aspects that require emotional intelligence and creativity.

Read Full Article

20 Likes

Medium

272

Image Credit: Medium

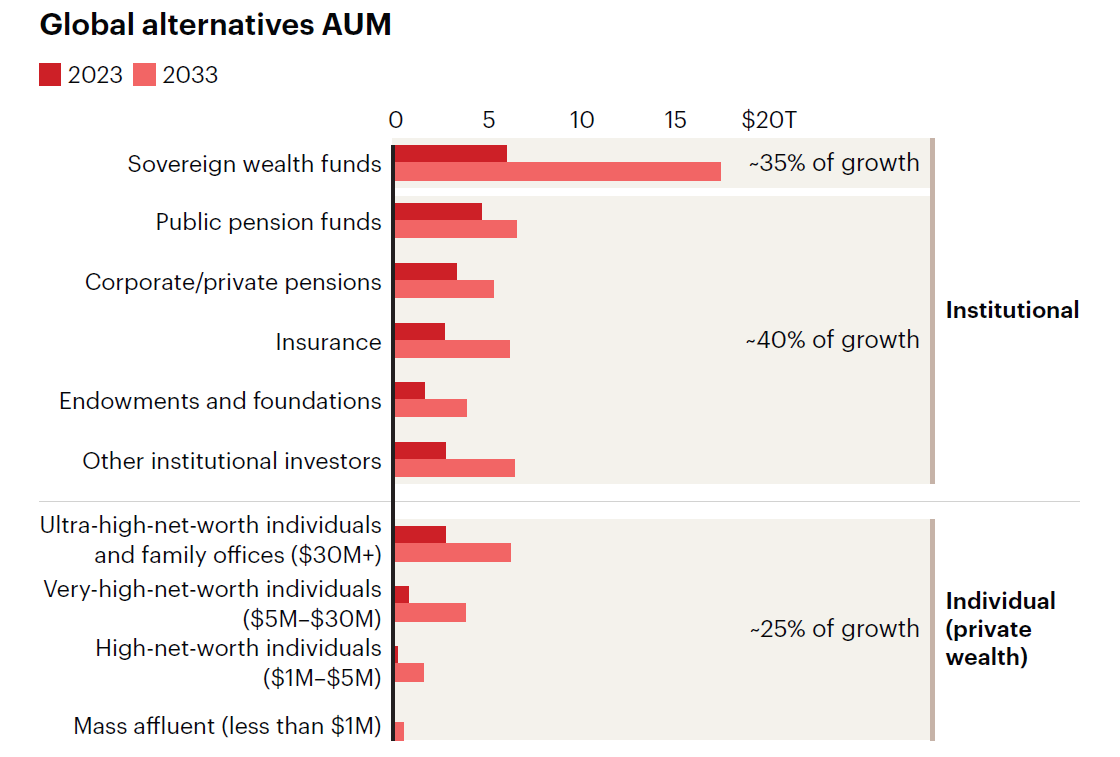

Watch Out As Venture Capital Goes Mainstream

- Retail investors are finding it challenging to navigate the venture capital landscape without proper preparation and understanding of the complexities involved.

- The increasing interest from retail investors in VC deals is reshaping the traditional dynamics, with asset managers introducing new offerings to tap into this growing trend.

- Online platforms are reducing barriers to entry for retail investors, enabling them to access alternative investments like venture capital with lower minimum investments.

- Regulatory changes, such as the JOBS Act, are expanding eligibility for retail investors to participate in private markets, driving further growth in this sector.

- Millennials and Gen Z, who are poised to inherit significant wealth, are showing a keen interest in VC and alternative investments, fueling the shift towards retail capital in the industry.

- While retail investors can provide valuable capital and networks to startups, their short-term focus and liquidity expectations may clash with the long-term goals of institutional VCs.

- Venture capital offers the potential for significant wealth creation, especially with successful ventures like Stripe and Revolut outperforming other investment options over the years.

- Tax incentives and tech advancements are making VC more accessible to retail investors, although the long-term commitment and risks associated with startups remain key considerations.

- Implementing strategies like SPVs, utilizing tax-advantaged schemes, and keeping investors engaged can help startups effectively manage retail investor relationships and streamline operations.

- As retail investors increasingly participate in VC, founders need to vet these investors, communicate effectively, and align expectations to ensure a successful partnership and capitalize on the benefits of retail capital.

- While challenges exist, the evolving landscape of retail participation in VC presents opportunities for both startups and investors, emphasizing the need for a strategic approach to navigate this changing environment.

Read Full Article

16 Likes

Teten

108

Image Credit: Teten

Interviewing the CTO of PE Front Office: Alternative Investments Technology: Bridging the Gap?

- Ankur Agarwal, Cofounder and CTO of PE Front Office, shared insights on the challenges in implementing and integrating global business systems for private equity firms.

- His book, 'Alternative Investments Technology: Bridging the Gap?', addresses dilemmas faced by fund managers in technology adoption, such as automation decisions and system implementation choices.

- PE Front Office provides a specialized SaaS platform for alternative investment firms, offering services from deal origination to portfolio monitoring and investor reporting.

- While competitors like Allvue and Dynamo exist, PE Front Office sets itself apart by focusing on customized solutions without compromising scalability.

- Agarwal emphasized the importance of solving real pain points to convince conservative alternative investment firms to adopt new technologies.

- Technologies like NLP and Real-time data analytics have great potential in private markets, offering efficient data processing and reporting capabilities.

- In the next five years, real-time data aggregation, self-service analytics, and AI-generated commentary are predicted to impact GP/LP operations significantly.

- PE Front Office seeks solutions for LP onboarding, seamless KYC, automated financial data retrieval, and ESG compliance to address unmet technology needs.

- The firm focuses on improving AI-powered reporting and platform interoperability, balancing customization with scalability for PE/VC clients.

- AI is expected to transform the finance industry by assisting in deal creation, risk assessment, drafting reports, and enhancing compliance processes.

Read Full Article

6 Likes

Medium

328

Image Credit: Medium

Jack Dorsey’s Top Advice for Founders Navigating Venture Capital

- Raising capital is a major challenge for startups, according to Jack Dorsey.

- Jack advises founders to have a tangible product or service to show to potential investors.

- Twitter and Square both had user traction before approaching investors.

- Showing investors a working prototype helps them understand the potential of the startup.

Read Full Article

19 Likes

Minis

660

Image Credit: Minis

Databricks doubles down in India with staff hires, new R&D hub

- Databricks to expand workforce in India by 50% and open new R&D hub in Bengaluru.

- India offers business and engineering opportunities for Databricks due to data abundance and demand for analytics and generative AI.

- Databricks follows the trend of global tech firms by establishing an R&D center in Bengaluru for talent availability and competitive salaries.

- Strong interest in Databricks' offerings in India from sectors like finance, retail, healthcare, with notable customers including InMobi and Swiggy.

Read Full Article

32 Likes

Minis

419

Image Credit: Minis

Tech experts predict tough times ahead for Silicon Valley startups

- Tech industry experts fear worst is yet to come for Silicon Valley Startups, as many startups are facing a tough market downturn, with plummeting venture capital investment and an increasing number of down rounds due to a lack of investor cash.

- Many high-profile companies, including Stripe, Klarna, and Snyk, have already taken valuation cuts.

- More startups are expected to run out of money, with down rounds projected to increase in the second half of this year.

- Investors are becoming more skeptical and driving harder bargains for every startup, even in the buzzy space of artificial intelligence.

Read Full Article

13 Likes

Minis

325

Image Credit: Minis

VC funding in Indian startups drops by 25% in Q1 2023: KPMG report

- VC funding in Indian startups drops to $2.1 billion in March quarter due to a decline in large-ticket deals, KPMG report reveals.

- Despite companies like PhonePe and Lenskart raising millions in the same quarter, VC funding in India experiences a 25% drop from the previous quarter.

- Single rounds of $100 million or more are now classified as large ticket rounds, indicating a change in India's investment landscape.

- The number of active micro VC funds in India has increased to over 80 in 2022, according to a recent report from consulting firm Bain, which focuses on pre-seed, seed, and Series A deals with smaller cheques.

Read Full Article

11 Likes

For uninterrupted reading, download the app