Venture Capital News

Medium

41

Image Credit: Medium

TAM Is Basic Astrology for Capitalists

- The Total Addressable Market (TAM) slide in startup pitches has become a ritual, often more for showmanship than actual data accuracy.

- Instead of focusing on real metrics like traction, trial velocity, and friction to adoption, many pitch days devolve into feature creep brainstorming sessions.

- The startup ecosystem prioritizes being impressive over being focused, with TAM slides and shiny ideas getting more applause than grit and discipline.

- However, in 2025, there's a shift towards valuing tangible progress over venture astrology, with a focus on proving small successes before promising big ones.

- Legacy startup tropes like accelerator badges as divine rights and fantasy hockey stick growth graphs are being scrutinized for their lack of real substance.

- Investors now seek proof of viability through commercial traction and practical strategies, moving away from relying solely on big market projections.

- Key metrics like go-to-market fit, wedge strategies, and revenue density hold more weight than exaggerated TAM numbers in demonstrating startup potential.

- Emphasizing solving real problems, capturing customer value, and minimizing friction to adoption are now crucial for startup success in the modern landscape.

- Startups are encouraged to focus on trial velocity, iterative loops, and market network effects to demonstrate real growth potential and monetization strategies.

- Ultimately, the future of a startup is determined by concrete actions and decisions, not by fanciful projections or outdated startup traditions.

Read Full Article

2 Likes

Medium

101

Image Credit: Medium

Ethena Airdrop Claim Free $ENA Now (Season 3) Step-by-Step Full Guide

- Ethena Labs has launched Season 3 airdrop claims for its native token ENA, rewarding community participants for their engagement and loyalty.

- The rewards in Season 3 are distributed to stakers, liquidity providers, and on-chain participants based on their contributions.

- To claim the Season 3 ENA tokens, users need to check their eligibility on the Ethena airdrop claim page and connect their wallet to confirm the transaction.

- Claimed ENA tokens will be sent directly to the user's wallet, and active participation may lead to future airdrop opportunities as Ethena grows.

Read Full Article

6 Likes

Medium

424

Image Credit: Medium

TRL-5 and Other Dangerous Places

- Innovation investing often favors soft products that can quickly enter the market over hard science projects that need to be more mature to gain trust.

- There is a paradox where technologies with softer products can attract investments earlier than those with harder science backing.

- Technology Readiness Level (TRL) measures the maturity of an idea or product on a scale from 1 to 9, with higher levels indicating more advanced and proven technologies.

- Different industries have different TRL requirements, with biotech demanding higher readiness levels compared to fields like AI where projects can get initial funding at lower TRLs.

Read Full Article

25 Likes

Medium

329

Image Credit: Medium

Protein Panic and the Black Soldier Fly (BSF) Opportunity

- Insect protein, especially from Black Soldier Fly (BSF) larvae, is a promising and efficient alternative amidst the mounting food crisis.

- Insects require significantly less land and food compared to traditional livestock for protein production.

- Black Soldier Fly (BSF) larvae can convert waste into high-quality biomass efficiently due to their protein and fat content.

- BSF farming offers a sustainable solution, using less land and water compared to cattle while reducing greenhouse gas emissions.

- Production of dried larvae meal in India shows strong returns on investment, especially in regions like India with favorable conditions.

- The international insect protein market is projected to grow significantly, with companies like BioMar and Nestlé Purina investing in insect-based products.

- India is emerging as a key player in the insect protein market, with startups like Green Grahi paving the way for sustainable protein production.

- Investing in insect protein now presents strategic opportunities for firms and investors to shape and benefit from this growing market.

- Green Grahi, an Indian startup, is using BSF larvae to convert organic waste into valuable protein and biologicals, addressing waste management and protein production simultaneously.

- The decentralized but scalable model of Green Grahi not only boosts farm incomes but also generates employment opportunities, tackling organic waste management issues effectively.

Read Full Article

19 Likes

Medium

87

Image Credit: Medium

2 hour company assessment

- Start by identifying industries you are knowledgeable about to assess companies thoroughly.

- Research and compile a list of companies in the selected industries, checking public and private databases for information.

- Shortlist companies based on available data and your familiarity with them, while seeking feedback from experts in the startup space.

- Document your findings neatly and have someone unfamiliar with the subject review it for clarity and comprehension.

Read Full Article

5 Likes

Medium

117

Image Credit: Medium

Beyond the AI Monolith: YC’s Summer 2025 Request for Startups (and Why We’re Publishing Our Own…

- YC has released its Summer 2025 Request for Startups (RFS), focusing on AI as a key theme and indicator of Silicon Valley's priorities.

- The RFS highlights YC's positioning within the AI landscape and points out potential blind spots in the field.

- The author suggests that investors should not just passively receive startup pitches but actively shape narratives and identify unexplored opportunities.

- In response to YC's RFS, the author is creating their own Proto-RFS for 2025 to emphasize underrepresented domains and challenge traditional startup approaches.

Read Full Article

6 Likes

Guardian

133

Image Credit: Guardian

Foreign states limited to 15% stake in UK newspapers amid Telegraph uncertainty

- The UK government will allow foreign states to own stakes of up to 15% in British newspapers, potentially ending uncertainty over the ownership of the Telegraph titles.

- The limit announcement is expected through the introduction of a new statutory instrument in parliament, following consultations and lobbying by newspaper owners.

- A 15% ownership cap could pave the way for RedBird Capital's deal to acquire the Daily and Sunday Telegraph, resolving concerns raised over ownership by foreign entities.

- The decision on the 15% threshold comes after considerations of a 5% to 10% cap, with lobbying by major newspaper groups like News UK and Daily Mail & General Trust influencing the final ruling.

Read Full Article

8 Likes

Medium

291

Image Credit: Medium

Dan Morehead’s Bold and Optimistic Vision for Crypto — Presented at Token2049 Dubai

- Dan Morehead, founder of Pantera Capital, shared an optimistic vision for the future of crypto at TOKEN2049 Dubai.

- Morehead highlighted institutional adoption and the mainstreaming of digital finance as key factors for industry growth.

- His remarks suggested a positive outlook on the evolution of money, digital assets, and the future of finance.

- The industry is expected to mature with increased liquidity, clearer regulations, and reduced volatility for a healthier ecosystem.

Read Full Article

17 Likes

Medium

96

Image Credit: Medium

Data-Driven Decisions: Why Instinct Isn’t Enough Anymore

- Access to vast amounts of data is crucial for modern business owners, but proper interpretation is key for success in today's market.

- Integrated platforms with business intelligence capabilities, such as AAK Tele-Science, enable founders to visualize trends, compare benchmarks, and make informed decisions.

- Combining founder instinct with AI-driven analytics helps in decision-making, especially as businesses scale and face increased risks.

- Unified platforms like AAK Tele-Science help address siloed data issues, providing real-time insights that lead to faster, more informed everyday decisions and long-term business growth.

Read Full Article

5 Likes

Medium

244

Image Credit: Medium

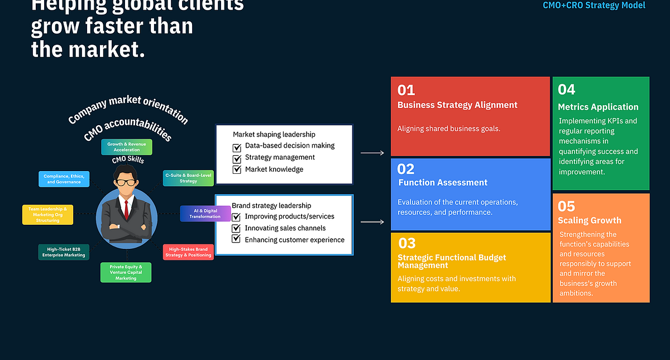

Why Private Equity and VC-Backed Companies are Turning to Fractional CMOs

- Marketing has become a crucial factor in enhancing portfolio value for private equity and VC-backed companies, influencing customer acquisition, brand positioning, and revenue growth.

- Reports indicate a significant increase in private equity distributions surpassing capital calls, emphasizing the need to optimize portfolio performance and focus on digital marketing strategies.

- Fractional CMOs are gaining preference among PE firms for their strategic vision, industry expertise, and cost-efficiency, especially in driving revenue growth and profitability through digital transformation and brand equity enhancement.

- The integration of Fractional CMOs with AI-powered marketing strategies is aiding PE-backed companies in achieving faster growth, precise decision-making, and scalable execution aligned with investment goals.

Read Full Article

14 Likes

Saastr

442

5 Interesting Learnings from Atlassian at $5.4 Billion in ARR

- Atlassian has reached $5.4 billion in ARR and is predicting a 19% growth for Q4’25.

- Atlassian's AI is now a core feature included in all core apps, not just an upsell or add-on.

- The company is seeing accelerated enterprise expansion, with $10k+ customers driving growth.

- Atlassian has 500 customers with over $1 million in spending, while still serving 250,000 customers below $10k.

Read Full Article

26 Likes

Global Fintech Series

113

Image Credit: Global Fintech Series

BlockFills and Definitive Finance Partner, Enhancing BlockFills Automated Trade Execution Capabilities for DeFi, On-Chain Transactions

- BlockFills and Definitive Finance have partnered to enhance BlockFills' automated trade execution capabilities for DeFi and on-chain transactions.

- The partnership allows BlockFills to leverage Definitive's advanced on-chain execution platform to offer smoother and more efficient trading experiences for institutional clients.

- Definitive's platform aggregates liquidity across multiple chains and optimizes trades to minimize price impact and achieve superior execution for on-chain transactions.

- The collaboration benefits clients of both firms by expanding the variety of tokens BlockFills can trade and providing access to deep OTC liquidity across different markets.

Read Full Article

6 Likes

VC Cafe

406

Image Credit: VC Cafe

Are AI Wrappers Investable? The Case For and Against

- Investing in AI wrappers poses both opportunities and challenges due to the fast-evolving nature of the AI landscape.

- AI wrappers leverage existing AI models to offer specialized functionality, making AI capabilities accessible for specific purposes.

- Arguments for investing in AI wrappers include demonstrated revenue, rapid development, solving real problems, and lowering costs with open-source AI models.

- Investors are attracted to AI wrappers with strong teams, niche focus, strategic execution, and potential for market acquisition.

- Concerns against investing in AI wrappers involve market saturation, reliance on third-party models, lack of proprietary moats, and questionable long-term sustainability.

- Factors that make AI wrappers more investable include proprietary data sources, deep vertical integration, exceptional user experience, and strong monetization.

- Successful AI wrappers go beyond basic interfaces, solve specific niche problems, and offer end-to-end solutions, making them attractive for investors.

- The key to investing in AI wrappers lies in identifying teams that build defensibility and deliver unique value beyond simple API functionalities.

- While some AI wrappers may face challenges, those that innovate, differentiate, and demonstrate strong market fit are considered highly investable.

- Ultimately, the success of AI wrappers is determined by factors like strategic vision, execution, user need, and differentiation rather than just the underlying AI technology.

Read Full Article

24 Likes

TechCrunch

258

Image Credit: TechCrunch

Databricks to buy open-source database startup Neon for $1B

- Databricks has agreed to acquire Neon, an open-source database startup, for approximately $1 billion.

- Neon offers a managed cloud-based database platform with features like cloning databases, previewing changes, automatic scaling, branching, and point-in-time recovery.

- The acquisition will allow Databricks to combine Neon's technology with its own data intelligence services to enhance the deployment of AI agents for customers.

- Neon, founded in 2021, has raised $129.6 million in funding, and its investors include Microsoft's venture arm M12, General Catalyst, Menlo Ventures, and Notable Capital.

Read Full Article

15 Likes

Guardian

36

Image Credit: Guardian

UK watchdog launches investigation into Aviva’s £3.7bn takeover of Direct Line

- UK watchdog, Competition and Markets Authority, launches investigation into Aviva's £3.7bn takeover of Direct Line.

- The merger aims to create one of the largest car insurers in the UK as Aviva expands its business in the sector.

- The investigation will determine the impact on competition, with a deadline set for July 10 for a decision on proceeding to phase 2.

- Aviva, the largest UK insurer, and Direct Line, known for brands like Churchill, plan job cuts post-merger, following efforts to streamline operations.

Read Full Article

2 Likes

For uninterrupted reading, download the app