Venture Capital News

VC Cafe

110

Image Credit: VC Cafe

Marketing While in Stealth Mode

- Startups in stealth mode can still market themselves strategically without revealing too much information to competitors or the public.

- Founders should focus on defining their unique narrative angle based on competitive intelligence, messaging patterns, customer pain points, and white spaces in the market.

- Creating a digital footprint through owning domain names, social media handles, and launching a simple landing page can help build intrigue without full disclosure.

- Establishing authority by championing the problem, sharing insights, and joining relevant communities can help build credibility and trust without divulging product specifics.

- Building a community of advisors, offering private access channels, and leveraging waiting lists can cultivate a group of early supporters eagerly awaiting your product launch.

- Stealth mode should be about controlled signaling, not complete silence, as it offers advantages in fundraising leverage, team alignment, and market preparation.

- Strategic disclosure and narrative building during stealth mode can set the stage for a successful launch that continues a conversation already initiated in the market.

- Israeli founders often reveal their stealth mode when raising a seed round, showcasing a strong team, a working product, and early revenue to attract investors.

- Many startups remain in stealth mode when seeking investments, highlighting the importance of effective marketing strategies even in a secretive phase.

- Startups should focus on building anticipation, authority, and credibility during stealth mode to create a strong foundation for a successful launch when the time is right.

Read Full Article

6 Likes

Medium

387

Image Credit: Medium

Why We Bet on Forethought to Redefine Customer Service with Agentic AI

- Customer service is evolving towards using agentic AI for autonomous and efficient outcomes.

- Forethought is leading this transformation with its AI-native platform, attracting customers like Airtable and Grammarly.

- Forethought's unique ability to automate complex workflows quickly without lengthy implementations sets it apart.

- The company's recent advancements in voice capabilities and omnichannel platform enhance customer engagement and resolution experience.

Read Full Article

23 Likes

Medium

105

Image Credit: Medium

Why Innovation Hubs Outside Silicon Valley Are the Future of VC

- Rising costs in Silicon Valley have resulted in startups looking for alternatives in cities like Lisbon, Warsaw, or Bangalore where operational costs are much lower.

- Innovation hubs are emerging outside of Silicon Valley, with cities like Miami, Austin, and Atlanta becoming attractive for tech startups due to talent pool, access to corporate headquarters, and lower operational costs.

- Remote work has redistributed innovation globally, enabling investors to fund startups beyond their local scenes, resulting in diversity in tech hubs and cross-border investments.

- The future of venture capital lies in exploring emerging markets, global talent, and diverse ecosystems rather than solely focusing on Silicon Valley, making geographic diversification a key factor for investors.

Read Full Article

6 Likes

Medium

377

Image Credit: Medium

Inside Kernel: How We Evaluate Startups Before Investing

- Kernel evaluates startups based on the problem they are solving and the timing of their solution, looking for products addressing urgent issues or creating new opportunities.

- The focus is on backing strong founders with domain knowledge who show progress and have signals of market traction and momentum.

- Kernel Equity is a collaborative partner that provides more than just capital, preferring to be actively involved post-investment and offering operator knowledge.

- The evaluation process is aimed at minimizing risks while embracing calculated ones, betting on builders and looking to support startups in building the future.

Read Full Article

22 Likes

Medium

211

Image Credit: Medium

Why Does So Much Capital Flow Into Crypto VC — and Not Into Liquid Strategies?

- Global venture capital firms invested approximately $11.5 billion into crypto and blockchain-focused startups in 2024, while crypto hedge fund assets under management (AUM) remained around $15.2 billion.

- Institutional allocators are primarily directing their capital into long-duration, illiquid VC strategies in the crypto space, despite the market correction in 2022.

- Unlike traditional finance where liquidity is rewarded, in the crypto space, early-stage crypto investments are favored due to being easier to understand and fitting into institutional 'Technology VC' buckets.

- Liquid crypto hedge funds have strategies that require deeper understanding and active oversight, which many allocators may not feel prepared for, leading to a preference for early-stage investments.

Read Full Article

12 Likes

Saastr

433

Why Marketing Should Almost Never Report to Sales

- Marketing reporting to sales may seem beneficial on paper due to sales being a top leader and the alignment between sales and marketing, but it often does not work well in practice.

- The main issues with having marketing report to sales include budget concerns, where sales prioritize hitting numbers over costs, and lack of patience for longer-term marketing initiatives.

- In tech companies, the CEO often serves as the primary marketer, making marketing's alignment with the CEO crucial. Trying to have marketing report to sales can be expensive and short-term focused, rarely yielding successful outcomes.

- In conclusion, it is advised to avoid having marketing report to sales unless there is unlimited capital and strong reasons for such an organizational structure.

Read Full Article

26 Likes

Alleywatch

423

Clarium Raises $27M to Help Hospitals Save Millions with AI-Powered Supply Chain Platform

- Clarium has raised $27M in funding to support hospitals in optimizing their supply chains using AI technology, aiming to address the annual overspending of $25B in the healthcare industry due to various inefficiencies and disruptions.

- Their platform, Astra OS, integrates real-time data from hospitals and suppliers, offering AI-powered workflow apps to enhance productivity, visibility, and resiliency within hospital supply chains.

- Clarium's solutions have led to significant cost savings for leading health systems like Yale New Haven Health and Geisinger, with faster disruption resolution and substitute approvals.

- The $27M Series A funding round was led by Northzone, with participation from existing investors General Catalyst, AlleyCorp, Kaiser Permanente Ventures, Texas Medical Center Ventures, and 1984 Ventures.

- Clarium differentiates itself by offering the only end-to-end platform for hospital supply chain management that leverages AI to automate tasks, predict outages, and optimize workflows.

- The company targets the hospital supply chain market in the U.S., which is estimated to be worth $2.76B in 2023 and projected to reach $9.72B by 2032.

- Clarium's business model involves direct sales to hospital systems, customizing features and apps to meet specific customer needs while aiming to reach all 5,000 hospitals in the U.S.

- The company plans to focus on further developing Astra OS, expanding functionalities and applications, scaling the team with tech and operational talent, and fostering relationships with new health system partners in the upcoming months.

- Clarium's investors recognized the market need for their solution, positioning the company as a pioneer in end-to-end hospital supply chain management, addressing significant gaps in the industry.

- Despite recent market uncertainty, Clarium's fundraising process was efficient, drawing interest from venture funds like Northzone, highlighting the company's potential and strategic relevance in the healthcare technology sector.

- The CEO of Clarium, Steve Liou, founded the company based on his extensive experience in healthcare investing and identified the critical need for efficient, data-driven solutions to revolutionize hospital supply chain management.

Read Full Article

25 Likes

Siliconangle

419

Image Credit: Siliconangle

AI biotech firm SpotitEarly raises $20.3M to scale noninvasive cancer detection in US

- Israeli AI biotech startup SpotitEarly has raised $20.3 million to scale its noninvasive breath test for cancer detection in the U.S.

- SpotitEarly uses AI and canines to analyze volatile organic compounds in exhaled breath to identify cancer biomarkers.

- The company's LUCID platform integrates AI to process breath samples and has shown 94% accuracy in a clinical trial of 1,200 people.

- SpotitEarly plans to make home testing kits available by 2026 in the U.S. and has appointed U.S.-based advisers to its scientific board.

Read Full Article

25 Likes

TechBullion

387

Image Credit: TechBullion

Why Luxembourg Is a Hotspot for Private Equity & Venture Capital

- Luxembourg has become a hotspot for private equity and venture capital investments, offering a conducive environment for fund managers and investors.

- The country's stable regulatory framework, strong legal system, and government support for financial services contribute to its appeal.

- Specialized investment vehicles like the RAIF and SIF enhance fund setup and management efficiency in Luxembourg.

- Tax advantages, including exemptions on certain types of income and a vast double taxation treaty network, attract investors seeking tax optimization.

- Luxembourg's strategic geographic positioning in Europe provides easy access to key financial hubs and facilitates cross-border transactions.

- Membership in the EU and adherence to EU regulations bolster investor trust and make Luxembourg an attractive investment destination.

- A multilingual workforce and initiatives like the LFF support the growth of venture capital alongside private equity in Luxembourg.

- The country's focus on innovative industries like fintech and clean energy attracts venture capitalists looking to fund disruptive technologies.

- Luxembourg's skilled workforce, sophisticated fund distribution capabilities, and industry events strengthen its position as a financial hub.

- With a AAA credit rating and stable political landscape, Luxembourg offers long-term consistency and predictability for investors.

Read Full Article

23 Likes

Medium

0

Image Credit: Medium

Savvy’s Thought of the Day:™ Betting on Yourself

- Todd Graves, founder of Raising Cane’s, faced rejections from banks, professors, and investors when pitching his idea of a chicken fingers restaurant.

- To fund his dream, Graves worked brutal 90-hour shifts at an oil refinery and fishing in Alaska, earning every dollar to open his first location.

- Raising Cane’s now boasts 800+ locations and billions in revenue, showcasing the success of Graves' bet on himself and hard work.

- Bootstrapping taught Graves invaluable lessons in grit, resourcefulness, and the power of sweat equity as a founder.

Read Full Article

Like

SiliconCanals

198

Image Credit: SiliconCanals

Finland’s Wave Ventures unveils €7M fund to invest in Gen Z founders across the Nordics and Baltics

- Helsinki-based Wave Ventures announces a third fund of €7M to invest in Gen Z founders in the Nordics and Baltics.

- The fund, supported by investors like the founders of Slack, Bolt, Skype, and others, aims to back the most exceptional Gen Z founders.

- Wave Ventures, founded in 2016, focuses on early-stage founders and has made over 50 initial investments through its first two funds, backing nearly 80% of Finnish startups led by young CEOs.

- With Fund III, the firm plans to expand its investment strategy, supporting 3 to 10 new teams per country annually, focusing on initial angel and pre-seed funding rounds of up to €100,000.

Read Full Article

11 Likes

Saastr

322

Dear SaaStr: I Don’t See Enough Activity in My SDRs. What Can I Do To Get More From Them?

- Increase accountability by having SDRs write detailed call notes with next steps and log them in CRM.

- Set clear activity metrics like daily or weekly goals for calls, emails, and LinkedIn touches focusing on quality and quantity.

- Encourage split-testing different messaging and outreach strategies to learn what works best.

- Host weekly webinars for prospects and customers to generate interest and improve lead routing and follow-up for better conversion rates.

Read Full Article

19 Likes

Insider

110

Image Credit: Insider

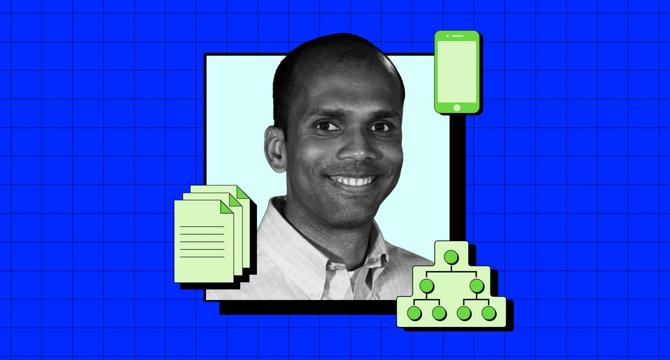

Gokul Rajaram believes seed investing is a 'marathon.' Here's how that's helped him notch top deals.

- Gokul Rajaram's experience at Alphabet, Meta, and DoorDash provides him with a strong network for his investment portfolio.

- Rajaram places high value on exceptional founding teams with product and market expertise that can adapt and succeed in the long run.

- He focuses on finding founders who can pivot effectively and change company trajectories, drawing from his deep expertise and network.

- Rajaram's approach to seed investing involves patience, grit, and endurance, emphasizing the importance of founding teams and first-principles thinking.

Read Full Article

6 Likes

Medium

285

Image Credit: Medium

Financing Africa’s Future: Why Evergreen Funds May Outperform Venture Capital

- The traditional venture capital model may not be suitable for Africa's long-term development needs.

- Evergreen funds allow for patient, value-building ownership aligned with Africa's timelines.

- By prioritizing domestic wealth retention and ownership, evergreen funds can boost equity localisation and national champions.

- This shift towards evergreen funding models could lead to sustainable dividends, real economic value, and a reorientation towards resilience in Africa's financing landscape.

Read Full Article

17 Likes

Medium

230

Image Credit: Medium

India’s VC and Startup Ecosystem: Punching above Its Economic Weight

- India's startup ecosystem, with over 140,000 startups and 100+ unicorns, exhibits significant growth and potential, despite a per capita GDP lower than Western nations.

- In 2024, India attracted $43 billion in private equity and VC investments, with strong performance in sectors like fintech, AI, healthtech, and social commerce.

- Transitioning from high-growth startups to listed companies like Zomato and Nykaa signals maturity and value creation in India's startup landscape.

- Government initiatives like Angel Tax Abolition and Startup India have fostered a supportive environment for startups and VCs.

- India's sectoral diversity, spanning fintech, AI, healthtech, and social commerce, offers varied opportunities for VCs with diverse interests.

- Returnees with foreign degrees face challenges securing MNC roles but find warm welcome and opportunities in India's startup ecosystem.

- VC careers in India offer promising prospects for returnees, leveraging their international background to drive innovation and wealth creation.

- India's startup ecosystem presents stability, growth, and a chance to contribute to a rising nation, making it an attractive career destination for returnees.

- Challenges faced by Indian students and professionals in countries like Canada and the UK highlight the importance of leveraging India's burgeoning startup ecosystem for career growth.

- The 'VC Academy' program provides returnees with the skills to excel in India's VC and startup landscape, offering opportunities for networking and career advancement.

Read Full Article

13 Likes

For uninterrupted reading, download the app