Venture Capital News

Medium

353

Image Credit: Medium

Navigating Modern Funding: Why Capital Efficiency Beats Capital Volume

- Capital efficiency is crucial for startups to generate maximum output per dollar spent, focusing on lean operations and measurable returns.

- Centralized financial oversight tools like AAK Tele-Science help founders make smarter financial decisions by tracking capital use, project progress, and team performance.

- Efficient use of initial funding showcased through real-time data can attract follow-on investments, emphasizing the importance of disciplined execution post-funding.

- Platforms integrating financial tracking with productivity tools optimize workforce management and continuous funding strategy, leading to sustainable business growth.

Read Full Article

21 Likes

Insider

369

Image Credit: Insider

Bat VC launches $100 million fund to back US and Indian AI startups

- Bat VC, founded by Indian tech veterans, has launched a $100 million fund to support AI startups in the US and India.

- The fund's focus is on early-stage startups in the AI, fintech, and enterprise sectors, with check sizes ranging from $3 million to $5 million.

- India's growing economy and US-China trade tensions are attracting tech investors, making it an appealing market for startups to scale.

- The VC firm aims to capitalize on the AI boom, Big Tech's expansion in India, and the shift in global trade dynamics to foster tech innovation in the country.

Read Full Article

22 Likes

Siliconangle

457

Image Credit: Siliconangle

ClearVector raises $13M to expand identity-driven threat detection platform

- ClearVector Inc. has secured $13 million in funding to expand its identity-driven threat detection platform that focuses on real-time detection of threats by monitoring identity behaviors across different environments.

- The cybersecurity startup aims to redefine cybersecurity by shifting from traditional threat detection to identity-driven security, addressing issues with existing security approaches that struggle to deal with identity-based attacks.

- ClearVector's platform utilizes identity graph technology to monitor behaviors of human, machine, third-party, and AI identities within an organization, allowing for visibility, attribution, and anomaly detection to indicate malicious activity.

- The Series A funding round was led by Scale Venture Partners LP, with participation from Okta Ventures, Inner Loop Capital, and Menlo Ventures LP, highlighting the industry's recognition of the value of ClearVector's approach to cybersecurity.

Read Full Article

27 Likes

Medium

337

Image Credit: Medium

AI for VC: Build vs Buy

- Develop custom AI only where no vendor solution exists, and switch to commercial tools as they catch up.

- Custom AI requires high upfront investment and ongoing maintenance, straining typical VC management fee structures.

- Reliance on key technical leaders makes custom tools vulnerable during leadership transitions.

- Focus internal resources on AI that enhances your unique investment edge; use vendor tools for everything else.

Read Full Article

20 Likes

Medium

447

Image Credit: Medium

Is The Existing VC Model Disappearing?

- AI's impact on optimizing processes and reducing resource requirements allows startups to achieve significant traction with less capital, leading to quicker time to market and decreased operational costs.

- Startups are shifting towards leaner approaches with smaller funding rounds or bootstrapping, giving them more control and ownership while presenting new challenges for venture capital firms.

- This trend may lead to a fundamental restructuring of the venture capital model, potentially resulting in fewer funding rounds, decreased check sizes, and increased competition for deals at earlier stages.

- Despite these changes, the traditional capital-raising model is not disappearing immediately, and raising smart money and proving value quickly will be crucial for founders to benefit from the evolving landscape.

Read Full Article

26 Likes

Medium

443

Image Credit: Medium

A founder’s market lens must zoom in, not out — what investors look for in your analysis

- In pitch decks, the market slide plays a crucial role in conveying a believable strategy to investors.

- A strong market narrative demonstrates understanding of the target customers, reach strategies, and timing.

- Starting with a Serviceable Obtainable Market (SOM) analysis, focusing on realistic reachable segments, is more effective.

- Sizing the market bottom-up with practical examples enhances credibility and understanding of entry points.

- Understanding market dynamics and conveying 'why now' is crucial for investors to see the timeliness of the opportunity.

- Emphasizing adoption friction considerations, such as decision-makers, budget ownership, and integration complexity, adds depth to the market analysis.

- Investors value how founders think about market challenges more than precise market numbers in early-stage pitches.

- A specific, bottom-up SOM analysis showcases customer understanding and growth strategies, earning investor trust.

- Market insight reflects commercial maturity and demonstrates the focus on building a viable business, not just technology.

- Building a credible market story is an essential step in preparing for a successful fundraising round.

Read Full Article

26 Likes

Insider

327

Image Credit: Insider

Some startups are using the label 'AI agent' to raise prices, says Andreessen Horowitz partner: 'There's a marketing angle to agents'

- Some startups are using the label 'AI agents' to raise prices, according to Andreessen Horowitz partner Guido Appenzeller.

- Andreessen Horowitz, a prominent venture capital firm, is discussing the marketing angle some startups are using with AI agents.

- Companies have been branding simple tools as AI agents to raise software prices.

- Andreessen Horowitz is a backer of OpenAI and xAI, seeking to raise a $20 billion fund to invest more heavily in AI.

Read Full Article

19 Likes

Saastr

281

Dear SaaStr: Our Biggest Potential Customers Are All Asking for Custom Features. When Do We Say Yes?

- Balancing the need to close big deals with the risk of overextending the team on custom work is a classic enterprise SaaS challenge.

- Agree to do custom work only if it can be reused and benefit other customers in the future, not just the current one.

- Set clear guardrails for evaluating custom requests to ensure they align with the roadmap and benefit multiple users.

- Consider charging for custom features or integrations as a premium service to offset costs and show customer commitment.

- Prioritize configurability over customization to make the product more scalable and reduce technical debt.

- Outsource custom work to trusted partners if resource-constrained to avoid overloading the internal team.

- Create a playbook for handling custom requests to define criteria, pricing guidelines, approval processes, and ensure consistency.

- Use custom work as a learning opportunity to identify product gaps and stay ahead of customer needs.

- Be willing to say no to extreme custom requirements to protect the team and product integrity in the long term.

- Communicate the value of the core offering to enterprise customers to show how it meets their needs without customization.

Read Full Article

16 Likes

Insider

406

Image Credit: Insider

How Rudina Seseri stays ahead of the investing curve by being on the 'bleeding edge' of all things AI

- Rudina Seseri, the cofounder of Glasswing Ventures, with over $270 million in assets, is known for her expertise in AI-native companies.

- She has been investing in machine-learning startups and has a sharp eye for identifying AI-native companies that are fundamentally designed around machine intelligence.

- Seseri's track record of backing fast-rising enterprise-tech plays has helped Glasswing Ventures grow its assets and secure investments in various innovative companies.

- Her ability to stay ahead of the curve in the AI space and provide unparalleled support to founders has positioned Glasswing Ventures as a go-to partner for disruptive startups.

Read Full Article

24 Likes

Medium

383

Image Credit: Medium

Fund Momentum – Fresh Funds Ready to Deploy #14

- Michael Schneider, a startup advisor, launched Seedraisr to support early stage startup founders and emerging VC fund managers.

- The latest edition of his newsletter highlights 30 VC & PE funds raised in late April & early May 2025.

- Some of the prominent funds featured include EWOR Founder Fellowship, Bosch Ventures Fund VI, AI Fund III, Revo Capital Fund III, and more.

- EWOR Founder Fellowship, based in Germany, focuses on visionary, technical, and serial entrepreneurs in various sectors at the pre-seed and seed stages.

- Bosch Ventures Fund VI, headquartered in the USA, targets deeptech companies in areas such as Energy Efficiency, AI, and Quantum Computing across different stages.

- AI Fund III, also in the USA, specializes in co-founding and building AI startups, operating as a venture studio.

- Revo Capital Fund III in Turkey focuses on technology sectors like Fintech, B2B SaaS, and Cybersecurity at the seed and early stages.

- Marathon Venture Capital Fund III in Greece concentrates on B2B IT infrastructure, cybersecurity, agriculture tech, and more at the seed stage.

- Aldea Ventures Fund II in Spain is a fund of funds investing in early-stage VC managers, particularly in deep tech.

- Various other funds like Adams Street European Venture Fund I, dao5 Fund II, FPV Ventures Fund II, and Earthling VC Fund I are also highlighted in the newsletter.

Read Full Article

23 Likes

Medium

411

Image Credit: Medium

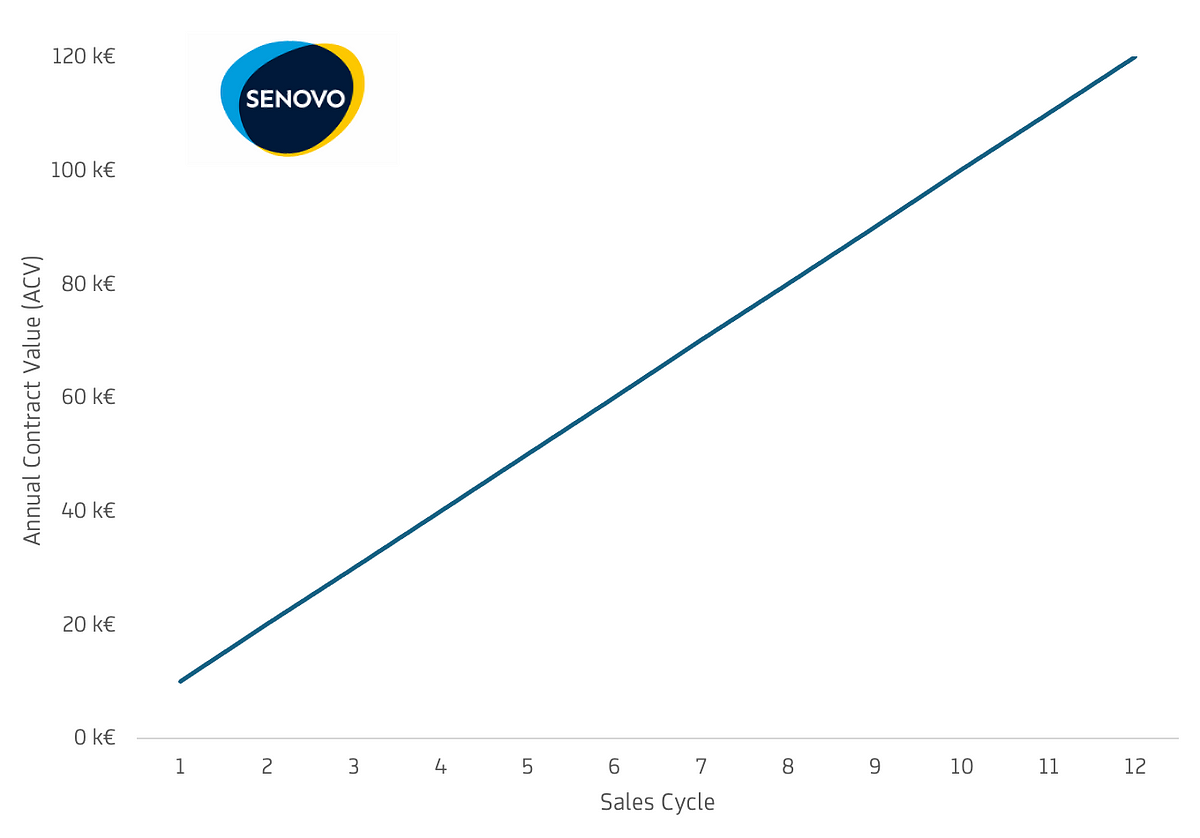

Why We’re All In on Enterprise Software (And How Founders Can Win)

- Enterprise software is essential for businesses and often becomes mission-critical, deeply integrated into workflows.

- Predictable revenue and cash flow are key benefits of selling to enterprises, with large deal sizes and upfront payments.

- Retaining enterprise customers is easier due to the stickiness of the software within workflows, leading to strong customer lifetime value.

- Efficient growth is achievable in enterprise software despite long sales cycles, as it generates better unit economics.

- There is a strong market pull for innovative enterprise solutions like AI-driven automation and cybersecurity tools.

- Enterprise software is built for scalability and can efficiently grow without high capital investments, leading to valuable exits.

- It is crucial for founders to understand their customers, invest in go-to-market strategies, and build with purpose in the enterprise software space.

- Success in enterprise is about solving real business problems with intention and addressing the complexities with a focus on long-term impact.

- Partnering with experienced teams and focusing on defining clear KPIs and scalable growth strategies are essential for building successful enterprise software companies.

- Senovo actively supports founders in developing their go-to-market strategies, scaling intentionally, and building defensible and impactful enterprise software.

Read Full Article

24 Likes

Medium

94

Image Credit: Medium

A Biography of Venture Capitalist Rajat Khare and His Investments in AI Technology

- Rajat Khare, a venture capitalist, is an alumnus of IIT Delhi and a renowned figure in the tech and investment sectors.

- He founded Boundary Holding, a venture capital firm in Luxembourg, focusing on deep-tech and AI-driven startups.

- Boundary Holding invests in early to growth-stage businesses with real-world problem-solving abilities, providing guidance and access to global technology networks.

- Khare's investment strategy involves identifying startups integrating AI into impactful applications, with a focus on sectors like cybersecurity, aerospace, and healthcare.

Read Full Article

5 Likes

Medium

129

Image Credit: Medium

That Kind of Holy: The Subtle Power of Everyday Wins

- Microscopic victories in daily life can feel disproportionately divine, like waking up naturally before your alarm.

- Experiencing satisfaction in finding out an ex-partner has downgraded, not out of revenge but as silent validation from the universe.

- The joy of seeing your skin glow even before applying skincare, feeling a sacred and cellular-level happiness.

- Empowerment and peace in setting boundaries without justification, finding power in saying no with confidence and firmness.

Read Full Article

7 Likes

Medium

101

Image Credit: Medium

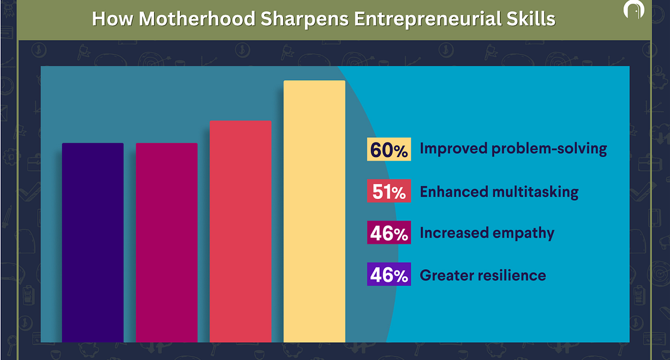

Indian Mompreneurs Who Inspire Us With Their Strength, Sacrifice, and Success

- Mompreneurs in India take on the role of both mothers and entrepreneurs, leveraging skills like time management and creativity to run successful businesses.

- Several inspiring women, such as the founders of Nykaa, Sugar Cosmetics, Mamaearth, and others, are leading the mompreneur movement in India.

- These mompreneurs have overcome obstacles like career changes and bias to build empowering businesses while balancing family and work responsibilities.

- The success stories of these mompreneurs offer valuable strategies for thriving in both personal and professional life, emphasizing the importance of vision, resilience, and support.

Read Full Article

6 Likes

Medium

101

Image Credit: Medium

10 Mind-Boggling Unsolved Mysteries from History That Still Baffle Experts

- Stonehenge in England, a big stone circle, remains a mystery with questions about how the rocks were moved and its purpose still unanswered.

- The tale of Atlantis, a mythical city that sank into the sea, has puzzled experts for centuries with doubts lingering over its existence.

- Easter Island's Giant Heads, known as moai, continue to baffle researchers as they ponder how these huge stone statues were created and transported without modern tools on the remote island in the Pacific Ocean.

Read Full Article

6 Likes

For uninterrupted reading, download the app